Report to / Rapport au:

Planning and Environment Committee/

Comité de l'urbanisme et

de l'environnement

and/ et au

Agriculture and Rural Affairs Committee /

Comité de l'agriculture

et des affaires rurales

and Council / et au

Conseil

6 April 2010 / le 6 avril 2010

Submitted by/Soumis par: Nancy Schepers, Deputy City Manager/Directrice

munipale adjointe, Infrastructure Services and

Community Sustainability/Services d’infrastructure et Viabilité des

collectivités

Contact Person/Personne ressource : Dixon Weir, General Manager/Directeur général

Environmental Services Department/Services environnementaux

(613) 580-2424 x22002, Dixon.Weir@ottawa.ca

SUBJECT:

|

REVIEW OF THE WATER,

SANITARY AND STORMWATER RATE STRUCTURE

|

|

|

|

OBJET:

|

EXAMEN DE LA STRUCTURE DE

REDEVANCES POUR L’EAU, LES EAUX-VANNES ET LES EAUX PLUVIALES

|

REPORT RECOMMENDATIONS

That the Planning and Environment

Committee recommend that Council approve:

2. Full

cost recovery by service area, specifically:

different rates for the provision of drinking water services, and

sanitary and stormwater services.

3.

That staff further examines options for the

recovery of stormwater and drainage costs in 2010, for report back to Council

in 2011.

4.

That staff further examine options for the

recovery of costs from Russell Township and report back in Q4, 2010.

RECOMMANDATIONS DU RAPPORT

Que le Comité de

l’urbanisme de l’environnement recommande au Conseil d’approuver :

1.

L’application d’une structure

tarifaire « de base et volumétrique » à partir de 2011, selon la

description de « l’option A » en page 12 du présent

rapport.

2.

Le recouvrement complet des coûts

par secteur de service, en particulier : différentes redevances pour la

prestation des services de l’eau potable, des eaux-vannes et des eaux

pluviales.

3.

L’examen plus approfondi des options

de recouvrement des coûts des services des eaux pluviales et de drainage en

2010 et le personnel fera rapport au Conseil en 2011.

4.

L’examen plus approfondi des options

de recouvrement des coûts au canton Russell et le personnel fera rapport au T4

en 2010.

EXECUTIVE SUMMARY

The City is carrying out a Cost, Revenue and Rate Study in order to meet provincial regulations requiring the submission of a Council-approved Financial Plan for Ottawa’s drinking water system by 01 July 2010. A key element of the study has been the examination of the existing “Water & Sewer” rate structure, and the review of alternative rate structures for opportunities to improve financial sustainability.[1]

Approximately 75 per cent of drinking water, sanitary and

stormwater/drainage costs are paid directly from rates.[2] The City’s heavy reliance on this revenue

source necessitates a rate structure designed to ensure fairness, transparency,

cost recovery and revenue stability.

Unfortunately, the existing rate structure has weaknesses that undermine

revenue stability.

Currently, the City uses a “volumetric” rate structure whereby users pay

by the cubic metre consumed, plus a small Fire Charge. This rate

structure is easy to understand and administer, however, many of the City’s

costs for delivery of these services are “fixed”, and do not vary significantly

with changes in the volume of water billed.

The City's water and wastewater infrastructure comprises one of the largest industrial complexes in Eastern Ontario with an estimated replacement value of roughly $17 billion. Costs for operating, maintaining and, in particular, renewing these systems are not so much a function of their output, but rather their size, age and complexity. These costs increase annually simply due to continual growth and aging of the systems, regardless of whether water sales increase. Despite this, the City’s water and sewer revenues are directly tied to water sales. The goal of changing the rate structure is to lessen the vulnerability of revenues to fluctuations in water sales.

“Water & Sewer” rates are established at the beginning of the year based upon a forecast of water sales (i.e. the examination of consumption trends and growth rates.) Actual sales are dependent upon rainfall patterns, the economy, actual growth and the degree to which water is used efficiency. Unfortunately, even small deviations between predicted and actual sales can have large financial consequences.

The current rate structure exacerbates the challenge of

dealing with this uncertainty, and was identified by the Auditor General as a

weakness in his 2008 Review of the Water

Rate, which recommends that the City consider adoption of “water rates

based on a fixed meter charge plus a consumption charge as this will provide…a

more predictable and stable cash flow.”

Adding

a “base” charge to the Water and Sewer Bill will help to ensure recovery of a portion of fixed costs

that do not vary according to the volume of water or wastewater managed, and

mitigate revenue shortfalls in years where actual sales are less than

forecasted.

That said, a change in the rate structure does not in itself increase

revenues - the proposed rate is revenue neutral - it only guarantees

that a certain amount will be collected each year regardless of the volume of

water sold. Rate increases will continue

to be required due to rising costs, regardless of whether the City changes the

rate structure. This will be the subject

of future reports.

Most customers will see modest changes in their water bills as a result

of the recommendations in this report, and will benefit from greater price

stability in response to fluctuations in their consumption.

Other commonly used rate structures were

examined that would better allow the City to meet key rate setting

objectives. Four options were tabled at

Planning and Environment Committee in June 2009 for public consultation. Staff met with several community

associations, attended ward meetings and hosted seven Open Houses in September

and October 2009 to inform the public of the potential changes, and to solicit

feedback. In general:

·

Participants understood the reasons for moving

to a “base plus volumetric” rate structure and were supportive of such.

·

Participants understood the reasons for moving

to separate accounting of water and sewer costs, and were supportive of

different rates for the two service areas.

·

Participants were not supportive of Options B and C that would

transfer roadside drainage costs from the Water and Sewer Bill to the Tax Bill.

Accordingly, this report recommends:

· Implementation of a new rate structure commencing in 2011 that will consist of the following:

o

A drinking

water Base Rate and Volumetric Rate.

o

A

wastewater and drainage Base Rate and Volumetric Rate.

·

Further study of how best to manage the

recovery of stormwater and roadside drainage costs in 2010, for report back to

Council with recommendations in Q1, 2011.

·

Further study of how best to recover costs for

bulk water sales to Russell Township.

Legal/Risk Management Implications

There are no legal/risk management impediments

to implementing any of the recommendations in this report.

Financial Implications

There are no current financial implications as a result of this

report. Impacts to ratepayers and the

total water bill that would have resulted in 2009 are outlined in Table 2. Rate structure changes do not unto themselves

increase revenues. Future rate increases will need to be set to

meet the revenue requirements of the City, regardless of the rate structure in place.

Assignments related to implementing changes to the billing system,

educating the public on the changes and to further investigate stormwater cost

recovery and cost recovery from Russell Township are scheduled in 2010. Funding from this work is currently available

in capital internal orders 904 174 Water Rate Review and 904 176 Sewer Rate

Review.

Public Consultation/Input

The following activities were carried out to

raise awareness of the study, and of the rate structure options under

consideration:

·

Public

Meeting Notices were published in the major daily newspapers and all community

papers, meetings.

·

The

options were presented to two Standing Committees of Council: Planning and Environment Committee and the

Agricultural and Rural Affairs Committee.

·

Rural

Councillors were invited to provide a list of groups they wished to be

contacted for one-on-one meetings regarding possible changes in the recovery of

roadside drainage costs.

·

E-notices

were sent to a list of over 200 stakeholder groups including all community and

business associations.

·

Meetings

were held with representatives from individual groups as follows:

o

July 21,

Rural Issues Advisory Committee (RIAC);

o

July 27,

North-West Goulbourn CA;

o

August 11,

Carlsbad Springs CA;

o

September

14, Glens CA, Orchard Estates CA and Merivale Gardens CA;

o

September

19, Cumberland Village Association; and,

o

September

28, Rideau Goulbourn Ward Meeting.

·

Open

Houses were held as follows:

o

September

15, Manotick;

o

September

22, Nepean Sportsplex and Kanata Recreation Complex;

o

September

23, Jim Durrell Arena and St. Laurent Complex;

o

September

30, Carp Fairgrounds and City Hall; and,

o

October 1,

Navan Arena.

·

Briefings

were provided to both the Environmental Advisory Committee and the Business

Advisory Committee.

·

Over 300

surveys were completed at the Open Houses or submitted thereafter.

·

There have

been over 2325 hits on the project web page Ottawa.ca/ratestudy.

·

Over 200

comments were received via the project email ratestudy@ottawa.ca.

RÉSUMÉ

La Ville fait une étude des coûts, des revenus

et des redevances en réponse aux règlements provinciaux exigeant la

présentation d’un plan financier approuvé au Conseil pour le réseau d’eau

potable d’ici le 1er juillet 2010. Un élément important de

l’étude a été l’examen de la structure tarifaire actuelle « de l’eau et

des égouts » et l’examen de structures tarifaires de rechange, afin de

trouver des occasions d’améliorer la viabilité financière[3].

Les redevances règlent directement environ

75 % des coûts des services d’eau potable, des eaux-vannes et des eaux

pluviales – du drainage[4]. Étant donné que la Ville compte énormément

sur cette source de revenus, il faut une structure tarifaire conçue pour

garantir l’équité, la transparence, le recouvrement des coûts et la stabilité

des revenus. La structure tarifaire actuelle a malheureusement des faiblesses

qui minent la stabilité des revenus.

La Ville utilise actuellement une structure

tarifaire « volumétrique » selon laquelle les utilisateurs paient au

mètre cube consommé, à laquelle on ajoute une petite redevance d’eau-incendies.

Cette structure tarifaire est facile à comprendre et à administrer, mais de

nombreux coûts engendrés par la Ville pour la prestation de ces services sont

« fixes » et ne varient pas énormément quand le volume d’eau facturée

change.

L’infrastructure des

services d’eau et d’égouts de la Ville constitue l’un des complexes industriels

les plus importants de l’Est de l’Ontario, dont la valeur de remplacement est

estimée à environ 17 milliards de dollars. Les coûts d’exploitation,

d’entretien et, plus particulièrement, de renouvellement de ces réseaux ne

tiennent pas tant à leur production qu’à leur taille, à leur âge et à leur

complexité. Ces coûts augmentent chaque année simplement en raison de

l’expansion et du vieillissement des réseaux de la ville, sans égard à

l’augmentation des ventes d’eau. Malgré ces facteurs, les revenus des services

d’eau et d’égouts de la Ville sont directement liés aux ventes d’eau. Le

changement de la structure tarifaire vise à réduire la vulnérabilité des

revenus aux fluctuations des ventes d’eau.

Les redevances d’eau et

d’égout, basées sur les prévisions des ventes d’eau, autrement dit, sur

l’examen du taux de croissance et des tendances constatées dans la

consommation, sont déterminées au début de l’année. Les ventes réelles

dépendent de la pluviosité, de l’économie, de la croissance réelle et de

l’efficacité avec laquelle l’eau est utilisée. Malheureusement, des variations

minimes entre les ventes prévues et les ventes réelles peuvent avoir

d’importantes répercussions sur le plan financier.

La

structure tarifaire actuelle accentue le défi que constitue cette incertitude

et le vérificateur général a constaté que c’est une faiblesse dans sa Vérification

de la redevance d’eau en 2008. Il recommande que la Ville considère adopter

« des redevances d’eau basées sur une facturation fixe au compteur et une

facturation à la consommation, ce qui fournirait […] un flux de trésorerie plus

prévisible et plus stable ». L’ajout d’une redevance « de base »

à la facture de l’eau et des égouts aidera à garantir le recouvrement d’un

pourcentage des coûts fixes qui ne varie pas selon le volume d’eau et d’eaux

usées gérées, et à atténuer le manque de revenus pendant les années où les

ventes réelles sont inférieures à celles prévues.

Cela dit, un changement de structure tarifaire n’augmente pas les

revenus en soi, puisque le tarif proposé n’engendre aucun revenu. Il garantit

seulement qu’une somme relative sera perçue chaque année, peu importe le volume

d’eau vendue. Des augmentations des redevances continueront d’être nécessaires

à cause des coûts à la hausse, peu importe si la Ville change la structure

tarifaire. Cela fera l’objet de rapports ultérieurs.

La plupart des clients ne verront qu’un léger changement dans leur

facturation d’eau et ils profiteront d’une certaine régularité dans le montant

à débourser malgré la fluctuation de leur consommation en eau.

D’autres

structures tarifaires habituellement appliquées ont été examinées et elles

aideraient la Ville à mieux atteindre ses principaux objectifs pour établir les

redevances. Quatre options ont été déposées au Comité de l’urbanisme et de

l’environnement en juin 2009 pour consultation publique. Des membres du

personnel ont rencontré plusieurs associations communautaires, ils ont assisté

à des réunions de quartier et ont organisé sept réunions publiques en septembre

et octobre 2009 pour informer les citoyens des changements éventuels et

obtenir leur réaction. En général :

·

Les participants

comprennent pourquoi nous voulons adopter une structure tarifaire « de

base et volumétrique », et nous avons leur accord.

·

Les participants

comprennent pourquoi nous voulons adopter une comptabilité distincte pour les

coûts de l’eau et des égouts, et ils soutiennent les redevances différentes

pour les deux secteurs de service.

·

Les participants ne

soutiennent pas les options B et C qui transféreraient les coûts de

drainage en bordure de route de la facture d’eau et d’égouts à la facture de

taxe foncière.

Ce rapport recommande

donc :

·

L’application

d’une nouvelle structure tarifaire à partir de 2011 qui comprendra les points

suivants :

o

Une

redevance fixe pour l’eau potable et une redevance volumétrique.

o

Une

redevance fixe pour les eaux usées et le drainage et une redevance

volumétrique.

·

Une étude plus poussée pour

déterminer comment gérer au mieux le recouvrement des coûts des eaux pluviales

et du drainage en bordure de route en 2010 pour faire rapport au Conseil et

présenter des recommandations au T1 en 2011.

·

Une étude plus

approfondie pour déterminer comment recouvrer au mieux les coûts pour les

ventes d’eau au volume au canton Russell.

Répercussions

juridiques – sur la gestion des risques

L’application des recommandations du

présent rapport ne pose pas d’embuches juridiques –à la gestion des

risques.

Répercussions financières

Aucune répercussion financière ne découle

actuellement du présent rapport. Les répercussions sur les contribuables et la

facture d’eau totale éventuelles en 2009 sont décrites au tableau 2.

Les changements de structure tarifaire n’augmentent

pas les revenus en soi. Il faudra déterminer les augmentations tarifaires à

l’avenir pour obtenir les revenus dont la Ville a besoin, peu importe la

structure tarifaire appliquée.

Une somme de 150 000 $ est nécessaire

en 2010 pour apporter les changements au système de facturation, informer le

public sur les changements et faire une enquête plus approfondie sur le

recouvrement des coûts des eaux pluviales et le recouvrement des coûts au

canton Russell. Le financement est actuellement disponible dans les ordres

internes d’immobilisations 904 174 de la Vérification de la redevance

d’eau et 904 176 de la Vérification de la redevance des égouts.

Consultation publique – réactions

Les activités suivantes ont été

faites pour sensibiliser les citoyens à l’étude et aux options de structure

tarifaire considérées :

·

Des

avis de réunion publique ont été publiés dans les principaux quotidiens, aux

réunions et dans les journaux communautaires.

·

Les

options ont été présentées à deux comités permanents du Conseil : Le

Comité de l’urbanisme et de l’environnement et le Comité de l’agriculture et

des affaires rurales.

·

Les

conseillers en milieu rural ont été invités à dresser une liste des groupes qui

veulent qu’on les invite à des réunions en personne sur les changements

éventuels du recouvrement des coûts de drainage en bordure de route.

·

Des

messages électroniques ont été envoyés à plus de 200 groupes

d’intervenants, y compris tous les syndicats professionnels et les associations

communautaires.

·

Il

y a eu des réunions avec les représentants des groupes suivants :

o

Le

21 juillet, Comité consultatif sur les questions rurales (CCQR)

o

Le

27 juillet, AC de Goulbourn Nord-Ouest

o

Le

11 août, AC de Carlsbad Springs

o

Le

14 septembre, AC de Glens, AC d’Orchard Estates et AC de Merivale Gardens

o

Le

19 septembre, Association du village de Cumberland

o

Le

28 septembre, réunion du quartier Rideau Goulbourn

·

Il

y a eu les réunions publiques suivantes :

o

Le

15 septembre, Manotick

o

Le

22 septembre, Sportsplex de Nepean et complexe récréatif de Kanata

o

Le

23 septembre, aréna Jim Durrell et complexe Saint-Laurent

o

Le

30 septembre, champ de foire et hôtel de ville de Carp

o

Le

1er octobre, aréna de Navan.

·

Le

Comité consultatif de l’environnement et le Comité consultatif sur les affaires

ont obtenu des comptes rendus.

·

Plus

de 300 questionnaires ont été remplis aux réunions publiques ou présentés

par la suite.

·

Il

y a eu plus de 2 325 visites à la page Web du projet

Ottawa.ca/résidents/water/cost_revenue/index_fr.html.

·

Plus

de 200 commentaires ont été envoyés au courrier électronique du projet redevanceseau@ottawa.ca.

BACKGROUND

Ontario Regulation

453/07 requires municipalities to

submit a Council-approved Financial Plan for their drinking water systems no later

than July 2010. In preparing the Plan,

municipalities must demonstrate that funds collected through rates and other

revenue sources will allow for the sustainable planning, design, operation,

maintenance and renewal of their drinking water system(s) over time.

In the 2008 report, Review of the City’s Water Rate, the City’s

Auditor General makes several recommendations regarding the existing “Water

& Sewer” rate structure.

Specifically, that the City:

·

Establish “water rates based on a fixed meter

charge plus a consumption charge as this will provide…a more predictable and

stable cash flow”;

·

Review

“the method for establishing fire protection costs”; and,

·

Revise

“the water rate to ensure full cost recovery”.

Figures 1 and 2 illustrate two key facts about existing cost recovery:

·

In recent

years, drinking water and wastewater/drainage costs have been steadily

increasing while water sales have declined.

Over the 2008-2009 period, actual water sales were approximately

six per cent (6%) less than projected.

While this is not a significant deviation given the uncertainty in

consumption variables (such as weather and the economy), it represented a $16

million loss in revenues.

·

In 2009,

approximately $240M or 75 per cent of total service delivery costs were directly

derived from rates (i.e. the Water & Sewer Bill).

For these reasons a review of the rate

structure was essential, not just for drinking water services, but also for

wastewater and drainage services, as these service areas are subject to the

same vagaries in water sales and revenue shortfalls. Accordingly, the same cost of service

analysis and financial planning activities were carried out for wastewater and

drainage services as were done for drinking water services.

FIGURE 1:

Annual Costs versus Volumes Sold[5]

FIGURE 2: Drinking Water & Wastewater Funding

Sources

In carrying out a review of the rate structure, consideration was given

to relevant directives contained in the City’s 2007 Fiscal Framework:

·

Capital

and operating costs for water and sewer must be 100 per cent recovered;

·

Sufficient

revenues must be raised to fund operations, while maintaining appropriate

levels of debt and equity;

·

Changes in

user fees should be transparent; and,

·

Recovery

rates for services should consider the extent of private, commercial and

community benefit (including environmental considerations).

On this basis, four rate structures were tabled

in June 2009 at Planning and Environment Committee for public consultation. The following section presents the four

options and public feedback to them.

DISCUSSION

Development of the Options

The following

rate setting priorities were considered during development and assessment of

alternative rate structures, and reflect policies contained in the 2007 Fiscal Framework:

·

Revenue stability;

·

Improved transparency and defensibility;

·

Long-term

financial flexibility and resiliency;

·

Stable rates; and,

·

Simple to

understand and update.

Other important

principles that were considered included the following:

·

Adverse financial impacts to each customer group should be minimized;

·

Rates should be affordable within the Ottawa economic climate; and,

·

Rates should discourage wasteful consumption and discharge practices.

The Options

Under the Current Rate Structure, listed as Option D in Table 1

below, the City applies a “volumetric” charge whereby customers pay a fixed

rate for every cubic metre of drinking water purchased ($1.264 m3 in 2009)[6], plus a fire service

charge. Wastewater costs are also

recovered using a volumetric rate on the assumption that discharges roughly

equal the amount of water purchased (100 per cent surcharge in 2009).[7] Stormwater management costs are recovered via

the sewer rate, however, there is no correlation between water consumption and

stormwater management requirements.

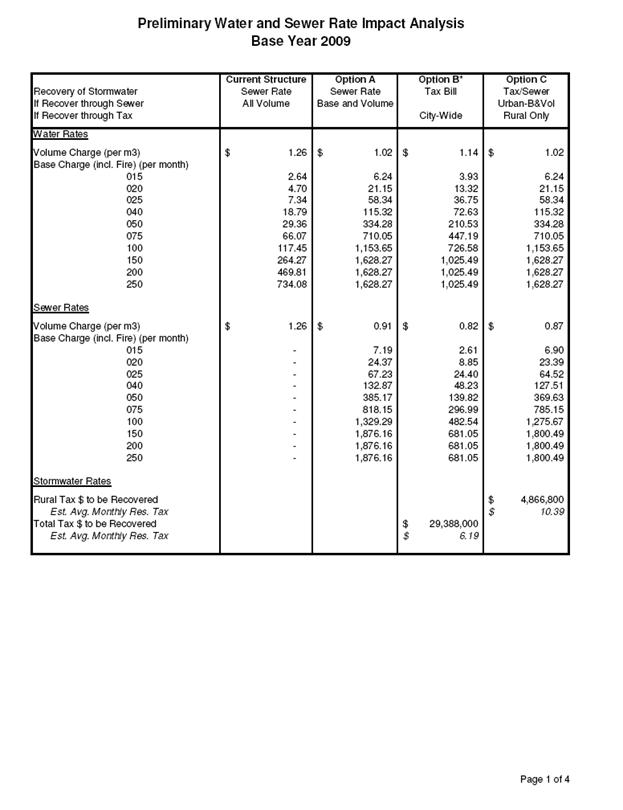

Table 1 illustrates this, and compares the current rate structure

against the three other options (A, B and C) that underwent public

consultation. Note that Options A, B and

C only differ in how they recover stormwater costs.

Table

1: Rate Structure Options

|

|||||

|

Service |

Rate Structure |

Option

A Base

+ Volumetric |

Option

B Base

+ Volumetric |

Option C

Base + Volumetric |

Option D

Current

Rate Structure |

|

Drinking Water |

Base Charge |

ü

|

ü

|

ü |

Fire Charge |

|

Volumetric Charge |

ü

|

ü

|

ü |

ü |

|

|

Sanitary |

Base Charge |

ü |

ü |

ü |

|

|

Volumetric Charge |

ü |

ü |

ü |

100% surcharge on the

water volumetric charge |

|

|

Stormwater |

Incl. in Water and Sewer Bill |

Those on central

services |

|

Those

on central services |

Incl. in the above

surcharge |

|

Tax Bill |

|

Applied City-wide |

Those on private

services |

|

|

|

Total

Revenue |

$240.9 M |

$240.9 M |

$240.9 M |

$240.9 M |

|

Option A differs from the current Rate Structure in that it introduces a “base” charge, which would recover a portion of the fixed costs incurred by the City that have no relationship to the volume of water purchased (e.g. customer and billing service costs.) Customers would be charged a fixed amount based upon the size of their water service line, and then an additional amount per cubic metre purchased (i.e. metered.) This “Base plus Volumetric” approach provides for greater revenue stability by guaranteeing minimum revenues per customer.

Like Option A, Option B also introduces a base

charge, but differs by moving stormwater costs off of the Water and Sewer Bill and

onto the Tax Bill. This would result in

all landowners in the City sharing in stormwater costs. The rationale for this is that all landowners

benefit from stormwater services.

Option C is the same as Option B except that

stormwater costs would be divided between those on central water and sewer

services, and those who are on private services. Generally, those on central water and sewer

receive a higher level of stormwater service than those on private services;

and under this option would be responsible for paying a greater proportion of

stormwater costs.

Other rate structures and features that were considered and eventually

eliminated, included the following:

Flat Fees – A fixed

rate is charged, independent of usage (e.g. City of Gatineau). Although a flat fee

for all customers would provide revenue and rate stability, this type of

structure is not as defensible from a cost of service perspective and does not

encourage or reward conservation

Inclining/Declining Block Rates – Volumetric charges can also vary according to the amount, or

“blocks”, of usage. Under declining

block rates, the charge per unit consumed ($/m3) would decrease as

the volume consumed increases (e.g. City of Toronto). As economic

development was not a key rate setting objective and would threaten revenues,

declining block rates do not fit the City’s objectives. While an inclining block rate (where the

water rate increases at certain thresholds) would meet the City’s objective for

conservation/demand management, it is also less revenue and rate stable and

more complex and difficult to implement.

Fees and Charges per Customer Class – Several rate structures can be refined to allocate specific costs

among different customer classes to allow for greater “user pay.” Customer classes can be defined along

different lines, for example: a)

residential, commercial, industrial; b) inside the Greenbelt, outside the

Greenbelt; c) by water pressure zones or sewer catchment areas. With the exception of

establishing different rates by service type (i.e. water and wastewater), rate

differentiation per other customer distinction adds complexity to the rate

structure and can decrease revenue and rate stability. Furthermore, a base charge per meter size,

combined with the volumetric charge, inherently provides a level of

equitability by customer type.

Stormwater Specific Rates

– Other methods for recovering stormwater costs were considered including:

·

Property

tax through the surface operations budgets; and,

·

Property-based

fees based on an assessment of the impervious area or property size.

Greater investigation is required before implementing a stormwater

specific rate, which is discussed in greater detail further on in this report.

Public Consultation

The following activities were carried out to

raise awareness of the study, and of the rate structure options under

consideration:

·

Public

Meeting Notices were published in the major daily newspapers and all community

papers.

·

The

options were presented to two Standing Committees of Council: Planning and Environment Committee and the

Agricultural and Rural Affairs Committee.

·

Rural

Councillors were invited to provide a list of groups they wished to be

contacted for one-on-one meetings regarding possible changes in the recovery of

roadside drainage costs.

·

E-notices

were sent to a list of over 200 stakeholder groups including all community and

business associations.

·

Meetings

were held with representatives from individual groups as follows:

o

July 21,

Rural Issues Advisory Committee (RIAC);

o

July 27, North-West

Goulbourn CA;

o

August 11,

Carlsbad Springs CA;

o

September

14, Glens CA, Orchard Estates CA, and Merivale Gardens CA;

o

September

19, Cumberland Village Association; and,

o

September

28, Rideau Goulbourn Ward Meeting.

·

Open

Houses were held as follows:

o

September

15, Manotick;

o

September

22, Nepean Sportsplex and Kanata Recreation Complex;

o

September

23, Jim Durrell Arena and St. Laurent Complex;

o

September

30, Carp Fairgrounds and City Hall; and,

o

October 1,

Navan Arena.

·

Briefings

were provided to both the Environmental Advisory Committee and the Business

Advisory Committee.

·

Over 300

surveys were completed at the Open Houses or submitted thereafter.

·

There have

been over 2325 hits on the project web page Ottawa.ca/ratestudy.

·

Over 200

comments were received at the project email ratestudy@ottawa.ca.

Public

Feedback

Most public feedback was from the rural

community. Less than 5 per cent of those

who phoned or responded to the survey or to ratestudy@ottawa.ca were from the urban/sub-urban area.

Rural interest in this issue was largely due to the potential

consequences of shifting roadside drainage costs from the Water and Sewer Bill

to the Tax Bill.

Several issues were raised within the rural

community that either directly or indirectly related to the Cost, Rate and

Revenue Study, and how costs should be apportioned and recovered. Specifically, the following issues were

raised by the rural community:

·

Rural landowners pay for the installation, maintenance and renewal of

driveway culverts, which are felt to be more costly than the proportion of

taxes and development charges paid by urban landowners for the same or better

service.

·

Rural

landowners pay the same proportion of taxes as urban landowners for road and

snow removal service but receive a lower level of service.

·

Roads and

roadside ditch levels of service dropped post amalgamation.

·

Most felt

that roadside drainage costs should never have moved off of the Tax Bill at

amalgamation.

·

There appears to be limited coordination of maintenance and renewal of

driveway culverts and roadside ditches, which results in system failure.

·

Urban expansion is believed to be causing increased frequency and

duration of flooding of downstream rural drains and properties, which is a

problem in agricultural areas in particular.

·

Less care appears to be taken to notify the rural community of planned

works and to mitigate impacts than is done in urban communities.

·

Concerns were expressed regarding the quality of road works in the rural

community, including roadside drains.

·

Landowners

do not want to be double charged for Municipal Drains.

·

Some

landowners object to paying for the optional enclosure of roadside ditches

(i.e. for the installation of culverts along road frontage on either side of a

driveway.)

·

Some

landowners objected that they are responsible for the aesthetic maintenance of

the roadside ditch.

In the absence of resolving several or all of the above issues, most

rural landowners felt that Option A was preferable.

In discussing the relative merits of Options B and C, many felt that

Option B was preferable because it would have less of an impact on Tax

Bills. However, others expressed concern

that if roadside drainage costs remained pooled with urban stormwater costs,

that there would be greater likelihood of cost escalation over time, therefore

Option C was preferable in the long-term.

In a limited number of cases, rural landowners identified Option D as the

preferred alternative.

From the urban area, concern was expressed that moving from a

“volumetric” charge to a “base plus volumetric” rate structure would penalize

those with low consumption rates, i.e. small households, “snow birds” or those

who are water efficient. Furthermore,

those with high consumption rates could see a drop in their total bill.

NEW - Option E

Several rural landowners suggested another option that entails

reclassifying roadside drainage as a “road” service instead of a “stormwater”

service. This would achieve four things:

·

It would

put these service costs where rural residents thought they were, and most felt

they should be, that is, on the tax levy.

·

It would

allocate the costs on the City-wide basis as is the case with all other road

services, and mitigate significant tax increases to rural property owners.

·

It would

improve the linkage between those paying for the service and those delivering

it.

·

It would

allow for fuller debate of roadside drainage services at budget.

Based upon the range of comments received in response to Options A, B, C

and D, it is reasonable to believe that many residents would view Option E as a

good compromise, with the qualifying statement that the aforementioned concerns

regarding roadside drainage need to be addressed in some manner to improve

public confidence in the service.

Russell Township

In 2010, the 400mm feedermain to Russell

Township will be commissioned and the Township will be billed on a volumetric

basis. Russell Township has requested

that it be given a wholesale rate under the new rate structure, as it will not

receive some of the services currently recovered through the City’s water

rate. Staff is reviewing the matter to

determine if a wholesale rate is warranted, and if so, what that rate might be

and whether it should be aligned to any changes to the rate structure, or

managed separately. Staff will report

back with a recommendation on this matter in Q1, 2011.

Recommended Approach

Based upon analysis of the alternatives and consideration of public

feedback, staff recommend the following:

1. That the current rate structure remain in place

in 2010. Changing the rate structure requires changes

to the City’s billing system that will take six to eight months to

complete. Furthermore, the public will

require adequate notice of the change.

2. That separate rates be established for drinking

water and wastewater services. Full cost accounting has been carried out for

both service areas and wastewater costs (including stormwater) are not 100%

of drinking water costs; nor are they likely to be over time. Furthermore, several areas of the City have

only one of two services. Tracking and

recovering them as a separate fee from drinking water would achieve greater

transparency of wastewater and drainage charges. A separate “sewer” rate would address all

three of these matters.

3. That a “base plus volumetric” rate structure be

introduced in 2011. The current rate structure does not yield

stable revenues, and causes significant operating losses in both the drinking

water and wastewater and drainage service areas when “projected” sales do not

meet “actual”. A “base plus volumetric”

charge will provide greater revenue stability by guaranteeing recovery of

20-30% of annual projected rate

revenues, regardless of actual

water sales. This stabilization in

revenues is illustrated in Figure 3, and is explained in greater detail in

Document 2, attached.)

4. Options for recovering stormwater and roadside

drainage costs should be studied further; and in the meantime remain embedded

in the “sewer rate”. Those on private services, largely in the

rural area, raised several issues regarding roadside drainage that warrant

further investigation. The City needs to

better demonstrate value for money to unserviced landowners before transferring

any or all roadside drainage costs back to the Tax Bill. Most jurisdictions in Canada and the United

States recover stormwater costs separately from taxes, and recover roadside

drainage costs as part of the Tax Bill.

However, many are experimenting with alternative cost recovery

mechanisms, including reduced charges for those with properties that have

higher infiltration rates. Further

examination of the options, and of existing challenges in the rural area are

needed before implementing any change.

Customer Impact Analysis

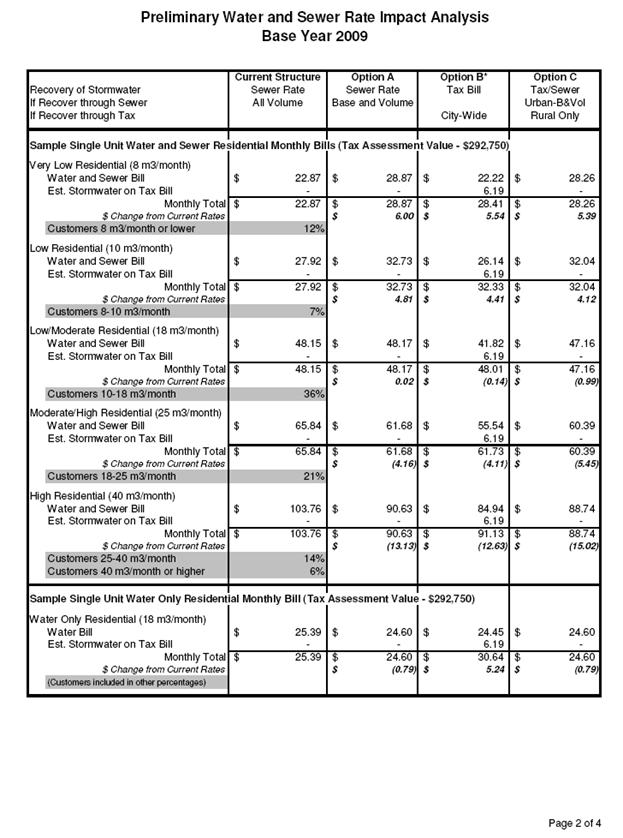

The cost implications of implementing Option A were analyzed for key

user groups using the 2009 water and wastewater rates, as presented in Table 2.

In most cases, this will mean that the larger portion of the bi-monthly

“Water and Sewer” Bill will be attributable to volumetric charges, thus

providing average consumers with ample opportunity to influence their Water and

Sewer Bills through conservation, while reducing the vulnerability of the City

to fluctuations in water sales.[9]

Table 2:

Comparison of Average Monthly Charges

Option A (Recommended) versus Existing

Rate Structure

(Theoretical impacts

using 2009 revenue requirements[10])

|

||

|

Service |

Option A Base + Volumetric |

Option D

Existing Rate

Structure |

|

RESIDENTIAL - LOW CONSUMPTION (<10m3/month;

~20% of customer accts.) |

||

|

Drinking Water |

$16.44 |

$15.28 |

|

Sanitary |

$16.29 |

$12.64 |

Stormwater

|

Incl. in Sanitary |

Incl. in Sanitary |

|

Monthly

Total |

$32.73 |

$27.92 |

|

RESIDENTIAL - AVERAGE CONSUMPTION (18m3/month; >30% of customer accts.) |

||

|

Drinking Water |

$24.60 |

$25.39 |

|

Sanitary |

$23.57 |

$22.75 |

Stormwater

|

Incl. in Sanitary |

Incl. in Sanitary |

|

Monthly Total |

$48.17 |

$48.14 |

|

HIGH DENSITY RESIDENTIAL - AVERAGE (625m3/month) |

||

|

Drinking Water |

$723.92 |

$808.79 |

|

Sanitary |

701.62 |

$790.00 |

Stormwater

|

Incl. in Sanitary |

Incl. in Sanitary |

|

Monthly Total |

$1,454. |

$1,598.79 |

|

COMMERCIAL - AVERAGE LOW (65m3/month;

< 2% of customers) |

||

|

Drinking Water |

$87.45 |

$86.85 |

|

Sanitary |

$83.52 |

$82.16 |

Stormwater

|

Incl. in Sanitary |

Incl. in Sanitary |

|

Monthly Total |

$170.98 |

$169.01 |

|

COMMERCIAL – AVERAGE HIGH (3,500m3/month;

< 1% of customers) |

||

|

Drinking Water |

$4,723.65 |

$4,541.45 |

|

Sanitary |

$4,514.29 |

$4,424.00 |

Stormwater

|

Incl. in Sanitary |

Incl. in Sanitary |

|

Monthly Total |

$9,237.94 |

$8,965.45 |

|

UNSERVICED PROPERTIES (private well

and/or private septic) |

||

|

Drinking Water |

$0 |

$0 |

|

Sanitary |

$0 |

$0 |

Stormwater

|

$0 |

$0 |

|

Monthly Total |

$0 |

$0 |

Refer to

Attachment B for theoretical rates and impacts to other customer groups.

The

fire service fee is included in the new base rate.

As shown in Table 2, most ratepayers would experience a change in their

monthly charges. Residential customers

with very low average monthly water consumption would experience an increase in

their total Water and Sewer Bill of approximately $4.12 - $6.00 per month

(depending upon their actual usage.)[11] This reflects the additional cost they would

pay to cover their share of the fixed costs for providing drinking water and

sanitary sewer services. Increases in

this range would be experienced by up to 20 per cent of residential water and

sewer customers.

All customers would experience stabilization of their Water & Sewer

Bills over time. As illustrated in

Figure 3, not only would the City’s revenues stabilize under the new rate

structure, so too would costs to consumers.

For example, if an industry experienced a spike in demand for process

water, only the volumetric portion of its Water & Sewer Bill would

increase.

As is shown in

figure three below, the recommended rate structure change will stabilize both

revenue for the City and total costs billed to customers. The figure shows that if the City projected

revenues of $255 million based on estimated volume consumed, and actual

consumption was 10 per cent lower than expected, revenue would drop to $230

million under the current rate structure, but only $236 million under the

recommended new structure. Conversely,

if actual consumption was 10 per cent higher than projected, customers would

pay $281 million under the current structure, but only $274 million under the

recommended new structure.

FIGURE

3: Comparison of revenue impacts using

the Existing and Option A rate structures, assuming actual sales 10% +/-

from projected

It is important to assess this proposed change in rate structure from an

affordability perspective. Assuming an

average income of approximately $20,000[12]

for low-income households, those consuming less than 10m3 per month

would pay less than 2 per cent of their annual income on the combined services

of drinking water, sanitary and stormwater.

Industry benchmarks suggest that Municipal Water and Sewer Bills are

affordable if they constitute less than 4 per cent of the average household

income of a community. The average

after-tax household income in the City of Ottawa in 2005 was $68,288 (Source:

2006 Census). In short, projected increases

are considered to be reasonable, and would not unfairly affect low-income

households.

A number of industrial, commercial and

institutional (IC&I) accounts, determined to be less than 1% of all water

customers, would see an increase in their water bill greater than 10% because

they have large water meters but low water consumption. An investigation of those accounts has

commenced, and will be completed between now and implementation of the rate

structure changes in 2011. In many

cases, this impact can be mitigated through ‘right sizing’ of the water meter.

ENVIRONMENTAL IMPLICATIONS

The purpose of carrying out this study is to ensure sustainable funding

for essential infrastructure that is designed, operated and replaced over time

to protect natural resources and public health.

So, to the extent that stable revenues will allow the drinking water,

wastewater, stormwater and drainage services to be delivered in an

environmentally sustainable manner, the proposed changes to the rate structure

will assist in protecting our environment.

The existing “volumetric” rate structure encourages water conservation

because consumers pay for every cubic meter purchased—the more that is used,

the more that is paid. Under the

recommended “base plus volumetric” rate structure, people will continue to pay

for every cubic meter purchased, thereby maintaining the Waterwise emphasis and

consumer benefit.

Currently, the

Fire Charge is the only cost recovered via a service fee on the Water and Sewer

Bill. The new “base” drinking water fee

will recover not only fire service costs but also other costs, which combined

would constitute 20-30 % [13]

of annual rate revenues. Accordingly,

these fixed costs will be deducted from the “volumetric” rate, and lower the

portion of the bill tied to consumption.

However, on average,

between 70-80% of revenues will still be recovered through the volumetric rate,

therefore, the new rate structure will continue to encourage water

conservation, particularly amongst high volume users.

RURAL IMPLICATIONS

Based upon the results of consultation, additional work is required to

determine the most appropriate means of recovering stormwater quantity and

quality control costs versus roadside drainage costs. Furthermore, the City needs to assess the

various quality and level of service issues raised by the rural community

during consultations on this matter.

Accordingly, details regarding the issues raised were forwarded to the

General Manager of Public Works, the Director of Infrastructure Services and

the General Manager of Planning and Growth Management.

CONSULTATION

As described above.

LEGAL/RISK MANAGEMENT IMPLICATIONS

There are no

legal/risk management impediments to implementing any of the recommendations in

this report.

CITY STRATEGIC DIRECTIONS

Infrastructure Renewal Objective 5 of the City’s 2007-2010 Strategic Plan is to “Close the gap on sanitary and storm sewer and water line replacement by 2015.”

The City’s 2007 Fiscal Framework sets out the following strategic objectives and guiding principles for financial planning.

·

Capital assets are maintained

and/or replaced using models of best economy;

· Capital and operating costs for water and sewer to be 100 per cent recovered;

· Sufficient revenues are raised to fund operations, while maintaining appropriate levels of debt and equity;

· Equity (reserves) provides flexibility to respond to economic cycles and manage financial risk;

· Financial decisions based on a multi-year forecast;

· Changes in user fees to be transparent; and

· Recovery rates for services to consider…extent of private, commercial and community benefit (including environmental considerations).

The recommendations of this report will help the City to achieve the renewal objective, and to ensure long-term financial stability.

FINANCIAL IMPLICATIONS

As this rate structure was developed on a “revenue neutral” basis, there

are no current financial implications as a result of this report. However, over time, these charges will

improve rate transparency and revenue stability as prescribed by the City’s

2007 Fiscal Framework and as recommended by the City’s Auditor General.

Impacts to ratepayers and the total water bill that would have resulted

in 2009 are outlined in Table 2. Rate

structure changes do not unto themselves increase revenues, but rather provide

a guaranteed cash flow.

*Future rate increases will need to be set to meet the revenue

requirements of the City, regardless of the rate structure in place. Projected increases will be identified in the

draft Water and Wastewater Financial Plan to be tabled in Q2 2010, and that

must be submitted to the province by July 1, 2010.

In 2010, $150,000 is needed to implement changes to the billing system,

educate the public on the changes, and to further investigate stormwater cost

recovery and cost recovery from Russell Township. Funding is currently available in capital

internal orders 904 174 Water Rate Review and 904 176 Sewer Rate Review.

SUPPORTING DOCUMENTATION

Document 1 – Details of Theoretical Rate

Changes, 2009

Document 2 – Cost Allocation Discussion

DISPOSITION

1.

That

Environmental Services Department and Financial Services carry out the

activities required to implement rate structures for drinking water and for

wastewater and drainage services in 2011, with communications to the public to

commence in Q4 2010.

2.

That

Environmental Services and Financial Services carry out the investigation of

stormwater and drainage cost recovery; and the investigation of potential

alternative rate structure or rate for Russell Township and report back with

findings in Q1 2011.

Document 1

Details of Theoretical

Rate Changes, 2009