|

9. 2011 ANNUAL REPORT PURSUANT TO

THE BUILDING CODE ACT RAPPORT ANNUEL DE 2011 PRESCRIT PAR LA LOI SUR LE CODE DU BÂTIMENT |

Committee

recommendation

That Council

approve the 2011 Annual Report pursuant to the Building Code Act.

Recommandation DU Comité

Que le Conseil approuve le Rapport

annuel de 2011 prescrit par la Loi sur le

code du bâtiment.

Documentation

1.

Deputy City

Manager's report, Planning and Infrastructure, dated 8 March 2012 (ACS2012-PAI-PGM-0069).

Report to/Rapport au:

Planning Committee

Comité de l’urbanisme

and Council / et au Conseil

08 March 2012 / le 08 mars 2012

Submitted by/Soumis par:

Submitted

by/Soumis par : Nancy Schepers, Deputy City Manager/Directrice

municipale adjointe, Planning and Infrastructure /

Urbanisme et Infrastructure

Contact Person/Personne-ressource: Arlene Grégoire, Director of Building Code

Services and Chief Building Official/Directrice des services du code du

bâtiment et chef du service du code de bâtiment, Planning and Growth

Management/Urbanisme et Gestion de la croissance (613) 580‑2424 x41425,

Arlene.Gregoire@ottawa.ca

|

SUBJECT: |

|

|

OBJET : |

RAPPORT ANNUEL DE 2011 PRESCRIT PAR LA LOI SUr LE CODE DU BÂTIMENT |

REPORT RECOMMENDATION

That the Planning Committee recommend that

Council approve the 2011 Annual Report pursuant to the Building Code Act.

Recommandation

du rapport

Que le Comité de l’urbanisme recommande au

Conseil d’approuver le Rapport annuel de 2011 prescrit par la Loi sur le code du bâtiment.

Background

Pursuant

to Section 7 (4) of the Building Code Act,

the City is required to prepare a report every 12 months containing information

on building permit fees collected as well as the cost of servicing building

permits and enforcing the Building Code

Act and Building Code. Regulation

Division C Part 1 (1.9.1.1) further directs the municipality to distinguish between

direct and indirect costs as well as to include in the report the balance of

the reserve(s) at year end where such have been established. Accordingly, the 2011 Annual Report pursuant

to the Building Code Act is provided

for the approval of Planning Committee and Council as follows.

|

The Cost of Servicing Building

Permits and Enforcing the Building Code

Act and Building Code |

Actual

2011 $000 |

||

|

|

|

||

|

Building Permit Revenues |

23,996 |

||

|

|

|

|

|

|

Expenditures – |

Direct Costs |

(14,564) |

|

|

|

Indirect Costs |

(4,374) |

|

|

|

|

||

|

Transfer to Building Code Enforcement Reserves |

5,058 |

||

|

|

|

||

|

Building Code Enforcement Reserve Funds |

||||

|

|

|

|

|

|

|

|

Revenue Stabilization $000 |

Insurance $000 |

Capital Contribution $000 |

|

|

Closing Balances |

|

|

|

|

|

December 31, 2011 |

27,929 |

6,388 |

8,071 |

|

DISCUSSION

Costs

The Building Code Act directs municipalities to set building permits fees to fully recover the costs of servicing building permits and of enforcing the Act and Building Code. These include both direct and indirect costs. Direct costs include such costs as the compensation costs for the Building Officials, staff involved in the processing of applications, training and development costs, computers and peripherals and vehicles and mileage costs to name a few. The approach for allocating indirect costs within the City is closely aligned with the Ontario Municipal Benchmarking Initiative (OMBI) recommended methodology. Indirect costs consist of expenditures by other departments incurred in support of Building Code Services’ Code-related activities, including legal assistance and representation from Legal Services, budget preparation and tracking by the Finance Department and accommodation expenses based on the actual square footage space that is occupied by the branch.

Of total costs in 2011, 77 per cent were direct costs while 23 per cent were indirect. The direct and indirect costs, excluding the contribution to the reserve funds, were:

|

Direct Costs |

$14,563,877 |

|

Indirect Costs |

$ 4,373,766 |

|

|

|

|

2011 Totals |

$18,937,643 |

Permit Fees and Activity

The Building Code Act stipulates that revenues must not exceed the anticipated reasonable costs required to administer and enforce the Act and Code. Accordingly, the building permit fee rate and other fees for services are set to generate sufficient revenues to ensure full cost recovery and ensure the program is revenue neutral. The 2011 budget year anticipated a 2.5 per cent increase in costs and in view of the previous year’s surplus results, the branch did not raise the building permit fee rate and preserved the rates of $12.00 per $1000 construction and $8.40 per $1000 construction for farm buildings.

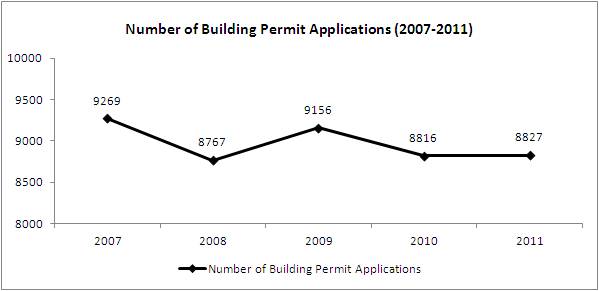

Since 2007, Ottawa has experienced consistently higher numbers of building permit applications than in previous years. In fact, the number of applications received yearly from 2007 through 2011 has been on average 15.7 per cent higher than in 2006. In 2011, 8827 building permit applications were submitted, roughly the same number as were submitted in 2010. This is not an indication of a trend of decreased construction activity or reduction in workloads because the number of permit applications received for more complex projects, residential and institutional, has increased in proportion to other types of projects. For example, a shift from constructing single dwelling units to multi-residential projects has resulted in a drop in total residential permits as one permit application for a multi-residential project will bundle many units per permit.

Ottawa is also experiencing a heightened demand for inspections. The number of inspections performed by Building Officials in 2011 (over 103,000) represents a 17-per-cent increase in the number of inspections completed five years ago in 2006. With the additional mandatory inspections related to the new energy conservation standards, it is anticipated that the number of inspections for similar construction activity will rise. New resources, including technologies, will be necessary to offset the increase in workloads, meet the legislated timeframes and mandate while providing excellent service to the permit holders.

Reserve Funds

The Building Code Act provides for the establishment of reserve

funds to ensure municipalities are able to fulfill their legislative mandate

despite downturns in construction activity and to cover capital investments

(growth vehicles, computers and software development, etc.) and special

costs/liabilities. In 2006, the branch

established the following reserve accounts to which any surplus building permit

revenues are allocated at year-end: 1) a revenue stabilization fund, which

safeguards the City’s ability to enforce the Building Code despite a

significant drops in construction activity and a declines in revenues; 2) a

capital contribution fund, which covers capital expenditures in support of the

activities related to servicing and enforcing building permits and enforcing

the Act and Code; and, 3) an

insurance fund, which covers costs associated with appeals and lawsuits.

As of December 31, 2011, the following fund balances were as follows.

|

Building Code

Enforcement Reserve Funds |

||||

|

|

||||

|

|

Revenue Stabilization |

Insurance |

Capital Contribution |

Total |

|

Opening Balance

January 1, 2011 |

25,229,358 |

6,388,089 |

6,445,573 |

38,063,020 |

|

2011 Transfers to Operating |

|

(733,713) |

|

(733,713) |

|

2011 Year-end Contributions |

2,700,000 |

733,713 |

1,625,000 |

5,058,713 |

|

Opening Balance

January 1, 2012 |

27,929,358 |

6,388,089 |

8,070,573 |

42,388,020 |

2011 Highlights

- Risk Review – In 2011, the City of Ottawa’s

insurer, the Frank Cowan Company, finalized a risk review of the building

regulatory activities of Building Code Services branch as part of its

insurance and risk management services.

The intent of the

Review was to identify opportunities to reduce risk, and better defend

claims. Typically a risk review

involves an examination of the City’s policies, practices and procedures

and an analysis of the claims.

Cowan was provided a 10 year claims history

specific to the Building Code Services branch as well as an overview of its

policies and procedures. The outcome of

the risk review was positive with no significant concerns or recommendations

for action.

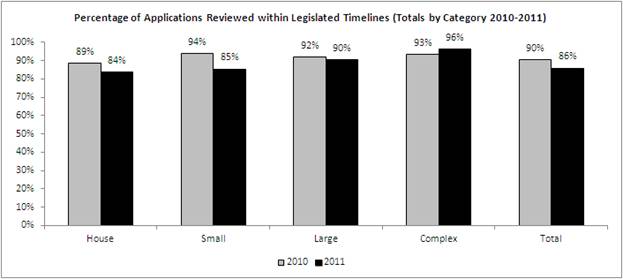

- Legislated Timelines - The branch's

performance in meeting legislated timeframes in 2011 reflects heightened

volume of work as well as the type of construction taking place within the

industry. This performance is

reflective of peak workloads during the summer months when staff numbers

are at its lowest, as well as a shift from single dwelling units to

multi-residential dwelling units which require a higher degree of reviews

and more complex building code issues.

The number of building permits issued reflects this shift from

single dwelling units to multi-residential dwelling units where one permit

may potentially be issued for four to six units.

The percentage of applications determined within legislative timeframes for 2011 by building type is as follows:

On the 2012 Workplan

- Building By-law – Building Permit Fee Methodology Conversion report to be presented in 2012 will outline the implementation details for changing how permit fees will be calculated – from calculating based on value of the proposed construction to calculating based on the area of new construction. This change in methodology will bring Ottawa in line with most municipalities in Ontario which already use the area/occupancy format based fee structure. The new methodology will improve fairness, transparency of costs for builders and residents, and improve the City’s ability to benchmark its program with other municipalities. A decrease in revenue may occur for a short term while transitioning to the new methodology; however it is proposed that any shortfall in 2012 be covered by the Building Code Revenue Stabilization Reserve.

- As of January 1, 2012, the Province of Ontario implemented new Building Code requirements regarding energy efficiency. In terms of workloads, the new standards will require a higher level of scrutiny by Building Officials, prior to issuing a permit and during inspections.

- New Technology Solutions – In 2011, the Building Code Services branch developed a longer-term strategic business technology framework of the branch’s technology initiatives. The aim is to develop and deliver major business technology solutions resulting in increased productivity, transparency, and greater satisfaction to our clients. In 2012, through the guidance of the Service Ottawa Department, Building Code Services branch will be equipping Building Inspectors with mobile devices. Further advances to complement the use of devices in the field will include the introduction of new software functionalities for implementation in 2013. Work is also underway to modify processes to take advantage of technology being made available corporately in the areas such as scanning and electronic document storage.

RURAL IMPLICATIONS

There are no rural implications associated with this report.

CONSULTATION

The City is required to report annually on the status of building permit revenues, costs of servicing building permits and enforcing the Building Code Act and Building Code and the reserve funds and to make the report available upon request. Accordingly, consultation was not undertaken.

Comments by the Ward Councillor(s)

Not applicable City-Wide report.

LEGAL IMPLICATIONS

There

are no legal implications associated with this report.

FINANCIAL IMPLICATIONS

Financials associated with building permit fees/revenues, costs of servicing building permits, and deferred revenues are discussed within the report.

RISK MANAGEMENT

IMPLICATIONS

There are no risk management implications associated with this report.

ACCESSIBILITY IMPACT

There are no accessibility implications associated with this report.

Environmental Implications

There are no environment implications associated with this report.

Technology Implications

This report refers to the delivery of major business technology solutions including, mobile workforce solutions via Service Ottawa, scanning and electronic document storage, and the introduction of new software functionalities for implementation in 2013. Further discussion will be required in order to determine the level of impact this will have on IT resources as well as assessing associated costs. A detailed business case may need to be evaluated through the City of Ottawa’s Portfolio Value Management process for IT investments, in advance of any planned implementation. ITS cannot commit to the potential work identified in this report at this time, however ITS will work with Planning and Growth Management during the development phase of the program to further determine potential needs.

City

Strategic Plan

SE1 Provide consistent and high-quality information and services to residents, visitors and enterprises and improve clients’ interactions with the City by ensuring services are timely and coordinated, easy to find and access, and delivered in a way that respects residents’ needs.

SE2 Improve the effectiveness and efficiency of service delivery to reach targets that have been approved by Council and communicated to residents and staff.

DISPOSITION

The “Background” portion of this report outlines the legislative requirement for an Annual Report as per the Building Code Act. This portion of the report will be published on the City’s website and distributed upon request