|

8. BROWNFIELDS PROPERTY TAX ASSISTANCE/ REHABILITATION GRANT APPLICATION – UNITRIN DEVELOPMENTS Inc. AND Triform DEVELOPMENTS INC. – 280 – 300 wEST HUNT CLUB ROAD (FILE NO. F18-04-11-UNIT)

demande d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles – Unitrin Developments Inc. et Triform Developments Inc. – 280–300, rue HUNT CLUB OUEST (dossier no F18-04-11-UNIT)

|

COMMITTEE RECOMMENDATIONS

That Council approve:

1. The Brownfields Property Tax Assistance/Rehabilitation Grant Application submitted by Unitrin Developments Inc. and Triform Developments Inc., owners of the property at 280-300 West Hunt Club Road, for a Brownfields Property Tax Assistance and Brownfields Rehabilitation Grant not to exceed $4,579,511.00 payable as a property tax rebate or equivalent to Unitrin Developments Inc. and Triform Developments Inc. over a maximum of eight years subject to the establishment of, and in accordance with, the terms and conditions of the Brownfields Property Tax Assistance/Rehabilitation Grant Agreement;

2. Delegation of authority to the Deputy City Manager, Planning and Infrastructure, to execute a Brownfields Property Tax Assistance/Rehabilitation Grant Agreement with Unitrin Developments Inc. and Triform Developments Inc. establishing the terms and conditions governing the payment of the Brownfields Property Tax Assistance/Rehabilitation Grant for 280-300 West Hunt Club Road to the satisfaction of the Deputy City Manager, Planning and Infrastructure, the City Clerk and Solicitor and the City Treasurer;

3. An exemption for the proposed redevelopment at 280-300 West Hunt Club Road from paying future Municipal development charges up to a maximum of $2,029,651.00 under Section 7 of the South Urban Centre Stormwater Development Charges By-law, 2009 in accordance with the Guideline for the Development Charge Reduction Program due to Site Contamination approved by Council March 28, 2007 and included in the $4,579,511.00 grant request as outlined in Recommendation 1 above;

4. The enactment of a property tax assistance by-law providing tax assistance for the property at 280-300 West Hunt Club Road in the form of conditional cancellation and/or deferral of the increase in the taxes levied on the property for municipal purposes under the provisions and requirements of Section 365.1, as amended, of the Municipal Act with the amount not to exceed $4,579,511.00 subject to the terms and conditions of the Brownfields Property Tax Assistance/Rehabilitation Grant Agreement; and

5. That staff apply for matching property education tax assistance for the property at 280-300 West Hunt Club Road under the Provincial Brownfields Financial Tax Incentive Program or through any other replacement program administered by the Ministry of Municipal Affairs and Housing.

RECOMMANDATIONS DU COMITÉ

Que le Conseil:

1. Approuve la demande d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles soumise par Unitrin Developments Inc. et Triform Developments Inc., qui possèdent la propriété située au 280-300, chemin Hunt Club Ouest, pour un montant maximal de 4 579 511 $, payable sous la forme d’un remboursement d’impôt foncier ou l’équivalent à Unitrin Developments Inc. et à Triform Developments Inc. sur une période maximale de huit ans, sous réserve des modalités actuelles et futures de l’entente d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles;

2. Délègue au personnel le pouvoir de conclure une entente d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles avec Unitrin Developments Inc. et Triform Developments Inc. Cette entente établira les modalités de paiement de l’entente visant la propriété située au 280-300, chemin Hunt Club Ouest et son réaménagement, à la satisfaction du directeur municipal adjoint, Urbanisme et Infrastructure, du greffier municipal et chef du contentieux et du trésorier municipal;

3. Exempte le réaménagement proposé au 280-300, chemin Hunt Club Ouest des redevances d’aménagement municipales futures jusqu’à concurrence de 2 029 651 $, conformément au paragraphe 7(t) du Règlement sur les redevances d’aménagement (no 216-2009) et aux lignes directrices en matière de réduction des redevances d’aménagement à cause de la contamination de l’emplacement, approuvées par le Conseil le 28 mars 2007;

4. Délègue au personnel le pouvoir de rédiger un règlement d’allègement de l’impôt foncier qui permettra au Conseil d’accorder un allègement d’impôt pour la propriété située au 280-300, chemin Hunt Club Ouest. Cet allègement consistera en une annulation conditionnelle ou un report de l’augmentation des impôts municipaux et scolaires prélevés relativement à cette propriété en vertu du paragraphe 365.1(2), dans sa forme modifiée, de la Loi sur les municipalités, et ce montant ne pourra excéder 4 579 511 $, sous réserve des modalités de l’entente d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles et de toute restriction ou condition précisée par le ministère des Affaires municipales et du Logement; et

5. Que le personnel fasse une demande en vue d’obtenir un allégement d’impôts fonciers scolaires équivalent pour la propriété située au 280-300, chemin Hunt Club Ouest dans le cadre du Programme d’encouragement fiscal et financier pour le nettoyage des friches contaminées ou de tout autre programme administré par le ministère des Affaires municipales et du Logement.

DOCUMENTATION

1. Deputy City Manager, Planning and Infrastructure report dated 19 March 2012 (ACS2012-PAI-PGM-0066).

Report to/Rapport au :

Finance and Economic Development Committee

Comité des finances et du développement économique

and Council / et au Conseil

19 March 2012 / le 19 mars 2012

Submitted by/Soumis par : Nancy Schepers, Deputy City Manager/Directrice municipale adjointe, Planning and Infrastructure / Urbanisme et Infrastructure

Contact Person/Personne-ressource : John Smit, Manager/Gestionnaire, Development Review-Urban Services/Examen des projets d'aménagement-Services urbains, Planning and Growth Management/Urbanisme et Gestion de la croissance

(613) 580-2424, 13866 John.Smit@ottawa.ca

REPORT RECOMMENDATIONS

That the Finance and Economic Development Committee recommend Council approve:

1. The Brownfields Property Tax Assistance/Rehabilitation Grant Application submitted by Unitrin Developments Inc. and Triform Developments Inc., owners of the property at 280-300 West Hunt Club Road, for a Brownfields Property Tax Assistance and Brownfields Rehabilitation Grant not to exceed $4,579,511.00 payable as a property tax rebate or equivalent to Unitrin Developments Inc. and Triform Developments Inc. over a maximum of eight years subject to the establishment of, and in accordance with, the terms and conditions of the Brownfields Property Tax Assistance/Rehabilitation Grant Agreement;

2. Delegation of authority to the Deputy City Manager, Planning and Infrastructure, to execute a Brownfields Property Tax Assistance/Rehabilitation Grant Agreement with Unitrin Developments Inc. and Triform Developments Inc. establishing the terms and conditions governing the payment of the Brownfields Property Tax Assistance/Rehabilitation Grant for 280-300 West Hunt Club Road to the satisfaction of the Deputy City Manager, Planning and Infrastructure, the City Clerk and Solicitor and the City Treasurer;

3. An exemption for the proposed redevelopment at 280-300 West Hunt Club Road from paying future Municipal development charges up to a maximum of $2,029,651.00 under Section 7 of the South Urban Centre Stormwater Development Charges By-law, 2009 in accordance with the Guideline for the Development Charge Reduction Program due to Site Contamination approved by Council March 28, 2007 and included in the $4,579,511.00 grant request as outlined in Recommendation 1 above;

4. The enactment of a property tax assistance by-law providing tax assistance for the property at 280-300 West Hunt Club Road in the form of conditional cancellation and/or deferral of the increase in the taxes levied on the property for municipal purposes under the provisions and requirements of Section 365.1, as amended, of the Municipal Act with the amount not to exceed $4,579,511.00 subject to the terms and conditions of the Brownfields Property Tax Assistance/Rehabilitation Grant Agreement; and

5. Staff to apply for matching property education tax assistance for the property at 280-300 West Hunt Club Road under the Provincial Brownfields Financial Tax Incentive Program or through any other replacement program administered by the Ministry of Municipal Affairs and Housing.

RECOMMANDATIONS DU RAPPORT

Que le Comité des finances et du développement économique fasse les recommandations suivantes au Conseil :

1. Approuver la demande d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles soumise par Unitrin Developments Inc. et Triform Developments Inc., qui possèdent la propriété située au 280-300, chemin Hunt Club Ouest, pour un montant maximal de 4 579 511 $, payable sous la forme d’un remboursement d’impôt foncier ou l’équivalent à Unitrin Developments Inc. et à Triform Developments Inc. sur une période maximale de huit ans, sous réserve des modalités actuelles et futures de l’entente d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles;

2. Déléguer au personnel le pouvoir de conclure une entente d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles avec Unitrin Developments Inc. et Triform Developments Inc. Cette entente établira les modalités de paiement de l’entente visant la propriété située au 280-300, chemin Hunt Club Ouest et son réaménagement, à la satisfaction du directeur municipal adjoint, Urbanisme et Infrastructure, du greffier municipal et chef du contentieux et du trésorier municipal;

3. Exempter le réaménagement proposé au 280-300, chemin Hunt Club Ouest des redevances d’aménagement municipales futures jusqu’à concurrence de 2 029 651 $, conformément au paragraphe 7(t) du Règlement sur les redevances d’aménagement (no 216-2009) et aux lignes directrices en matière de réduction des redevances d’aménagement à cause de la contamination de l’emplacement, approuvées par le Conseil le 28 mars 2007;

4. Déléguer au personnel le pouvoir de rédiger un règlement d’allègement de l’impôt foncier qui permettra au Conseil d’accorder un allègement d’impôt pour la propriété située au 280-300, chemin Hunt Club Ouest. Cet allègement consistera en une annulation conditionnelle ou un report de l’augmentation des impôts municipaux et scolaires prélevés relativement à cette propriété en vertu du paragraphe 365.1(2), dans sa forme modifiée, de la Loi sur les municipalités, et ce montant ne pourra excéder 4 579 511 $, sous réserve des modalités de l’entente d’allègement de l’impôt foncier et de subvention pour la remise en valeur des friches industrielles et de toute restriction ou condition précisée par le ministère des Affaires municipales et du Logement; et

5. Demander au personnel de faire une demande en vue d’obtenir un allégement d’impôts fonciers scolaires équivalent pour la propriété située au 280-300, chemin Hunt Club Ouest dans le cadre du Programme d’encouragement fiscal et financier pour le nettoyage des friches contaminées ou de tout autre programme administré par le ministère des Affaires municipales et du Logement.

BACKGROUND

Brownfields are properties where past actions have resulted in actual or perceived environmental contamination and/or derelict or deteriorated buildings. They may be vacant, abandoned or underutilized. They are usually, but not exclusively, former industrial or commercial properties.

The Brownfields Redevelopment Community Improvement Plan (BRCIP) was adopted by Council on April 27, 2007 and amended by Council on May 12, 2010.

The BRCIP presents the rationale behind the redevelopment of brownfields in Ottawa, and the actions and strategies that will promote brownfields redevelopment. The BRCIP contains a comprehensive framework of incentive programs which include the Brownfields Property Tax Assistance Program and the Rehabilitation Grant Program.

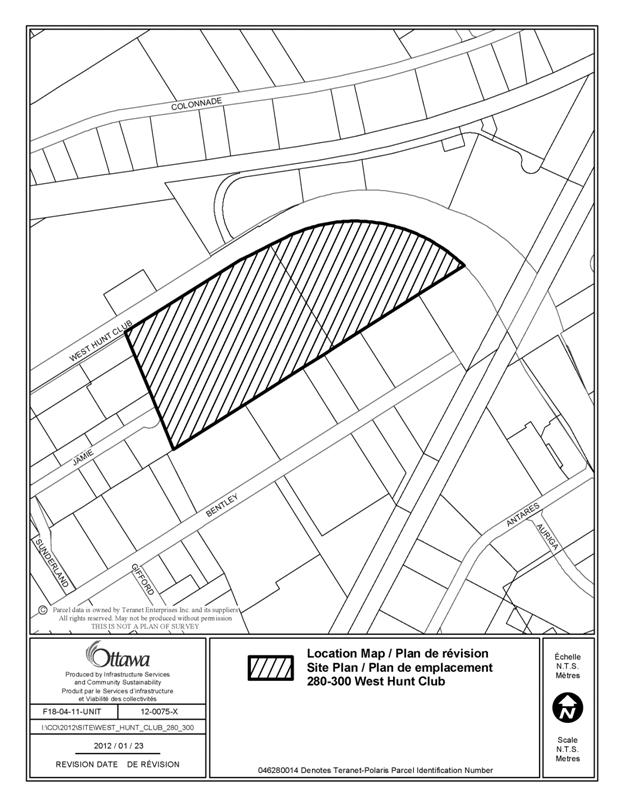

Unitrin Developments Inc. and Triform Developments Inc. have filed an application for both programs under BRCIP for the demolition, clean-up and redevelopment of 280 – 300 West Hunt Club Road, an 11.61 hectares property with frontages on West Hunt Club Road and James Avenue (see Documents 1, 2 and 3). The site was previously used for industrial purposes (petroleum storage facilities) and it has one vacant building located in the northwest corner of the property. The remainder of the lands are relatively flat, cleared of any significant trees and are paved in some areas. The property has been purchased for redevelopment and is presently undergoing remedial works to address environmental contamination issues.

The Phase I and II Environmental Site Assessments prepared by Paterson Group Inc. in 2008 identified a number of environmental impacts from petroleum-based products under the property, likely stemming from the long-term use of the property as a bulk fuel storage facility on the north-west portion the site from 1953 to 2001. This contamination had been previously identified and has been monitored by various companies since 1990. Paterson Group Inc. conducted a supplemental program in 2009 to delineate the contaminated plumes and prepared a site remediation plan.

The soil and groundwater analytical test results are in excess of the applicable Ministry of the Environment (MOE) site standards for commercial development. The recommendations of the Paterson report, in conjunction with further analyses undertaken in 2011, indicated that the contaminated soil and groundwater must be removed from the site during redevelopment.

The site qualifies as an eligible "brownfield" under the City's Brownfields CIP.

The purpose of this report is to bring the application for 280 – 300 West Hunt Club Road before Committee and Council for consideration and approval.

DISCUSSION

The Ottawa Brownfields Redevelopment Community Improvement Plan specifies that, the total of all grants, property tax assistance and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings.

The purpose of the Property Tax Assistance Program is to encourage the remediation and rehabilitation of brownfields sites by providing a cancellation of the property tax increase on a property that is undergoing or has undergone remediation and development to assist with payments of the costs of environmental remediation. This program applies only to properties requiring environmental remediation and/or risk assessment/management. Section 365.1 of the Municipal Act, 2001 authorizes Council to pass a by-law providing for the cancellation of all or a portion of the taxes for municipal and school purposes levied on an eligible property, such as the subject site, subject to such conditions as the City may determine. Any cancellation of the education portion of the taxes requires a prior-approved application to the Ministry of Municipal Affairs and Housing (MMAH) to consider matching educational tax assistance under the Provincial Brownfields Financial Tax Incentive Program (BFTIP). The application for education tax assistance is made by the City directly to the MMAH in Kingston. The matching education property tax assistance may be provided on a different schedule from the municipal property tax assistance provided by the City.

The Rehabilitation Grant Program is a tax-increment based grant funded through the tax increase that results from redevelopment of the property. The tax-increment grant is not paid in advance but is directly tied to the amount of development actually completed on the property. If the development does not proceed then no grants are paid.

The Property Tax Assistance would commence first and will equal 100 per cent of the City portion and any matching education portion of the increase in property taxes that results from the redevelopment for up to three years, or up to the time when the total tax assistance equals the total eligible costs, whichever comes first.

The Rehabilitation Grant will equal 50 per cent of the City portion of the increase in property taxes that results from the redevelopment, commencing after the Property Tax Assistance Program benefits end and is payable annually for up to five years, or up to the time when the total grant payments equal the balance of the total eligible costs, whichever comes first. The City will only pay the annual grant after property taxes have been paid in full each year.

The owners are also eligible for the “Development Charge Reduction Due to Site Contamination” Program which allows a maximum reduction of municipal development charges up to 25 per cent of eligible cost items for Property Tax Assistance. The amount credited is reduced from the eligible cost cap under the combined Property Tax Assistance and Rehabilitation Grant Programs. This program allows the owner to receive a development charge credit at the time of application for building permits.

The Unitrin Developments Inc. and Triform Developments Inc. Grant Application

The required documents that are to be submitted to the City as part of a Property Tax Assistance/Rehabilitation Grant application are described in Document 3. Staff reviewed the submissions and deemed the application to be complete as of April 12, 2011. An addendum to the application was submitted November 21, 2011 to revise anticipated cost estimates of remedial works and eligible grant requests.

Proposed Remediation

The remediation program will consist of a generic approach. An excavation and segregation program will be carried out. Paterson Group Inc. estimates that 80,000 metric tonnes of heavily hydrocarbon impacted soil will be excavated from the site for off-site disposal at an MOE licensed landfill facility. Approximately 5,000,000 litres of hydrocarbon impacted groundwater will be pumped and treated on-site by special units during the excavation program, which is expected to last three months.

Any potentially hazardous building materials (such as asbestos and lead) will be removed and managed as part of the building decommissioning and demolition.

The applicant advised staff in April 12, 2011 that they would be commencing demolition of the existing building and then proceeding with site remediation activities. These activities were undertaken on the full understanding and written acknowledgment by the applicant that under the General Program Requirements, as stated in Section 6.2 (b) of the BRCIP that: “The City is not responsible for any costs incurred by an applicant in relation to any of the programs, including without limitation, costs incurred in anticipation of a grant and/or tax assistance”.

However, while these rehabilitation works have been completed it is important to note that these works are still eligible costs under the provisions of the Brownfields Redevelopment Community Improvement Plan as the works were undertaken after the submission of a completed application. Section 6.6.3. (a), of the Rehabilitation Grant Program requirements states that: “A grant application must be submitted to the City prior to the start of any rehabilitation works to which the grant will apply."

Proposed Redevelopment Scheme

This property is being developed through two site plan applications.

The developer is proposing four retail areas with approximately 31,181 m2 of combined retail/Restaurant uses. (for elevations of a portion of one site, see Document 9).

The project has received site plan control approval from the Department and is in the process of finalizing their agreements.

Calculating the Property Tax Assistance/Rehabilitation Grant

Under the Brownfields Property Tax Assistance/Rehabilitation Grant program guide, the applicant is required to submit various technical documents to determine eligibility as well as the costs eligible for the rehabilitation grant and property tax assistance. Staff reviewed the submissions and has determined that the total costs eligible for a Brownfields Property Tax Assistance/Rehabilitation Grant under the program are $9,159,022.

The Brownfields Redevelopment Community Improvement Plan specifies that the total eligible costs (Document 5) be capped at 50 per cent of the total costs. Applying this cap, results in a final eligible cost for the calculation of the Property Tax Assistance/Rehabilitation Grant to be $4,579,511. A breakdown of the eligible costs is shown in Document 5.

The ability to receive the Property Tax Assistance/Rehabilitation Grant can occur over a number of venues and timing for the payouts of the grants.

Property Tax Assistance Program

The Property Tax Assistance program portion cancels the City and, if approved by the Minister, education property tax increase that would normally occur on a Brownfield property that has undergone environmental remediation/risk management and redevelopment in order to assist with paying for remediation costs. This program provides a cancellation of the City and education property tax increase on a redeveloped Brownfield property for up to three years.

The cancellation of the property tax increase is specified in a by-law. The application for education tax assistance would be made by the City to the Province via the Brownfields Financial Tax Incentive Program (BFTIP). It is not an automatic approval. If the Province does not approve of the education tax assistance then the balance would be included in the City’s approved Rehabilitation Grant, payable up to five years from the end of the Property Tax Assistance period. Given the timing for processing these provincial applications, it was determined to proceed, at this time, with the remainder of the application and to bring forward any recommendation with respect to the education tax component in a later report.

The present municipal tax portion on the property is $73,289 and the education portion is $56,039 while the Post Construction estimated maximum for the municipal tax portion is $1,085,688 and the education tax portion is $ 830,119.

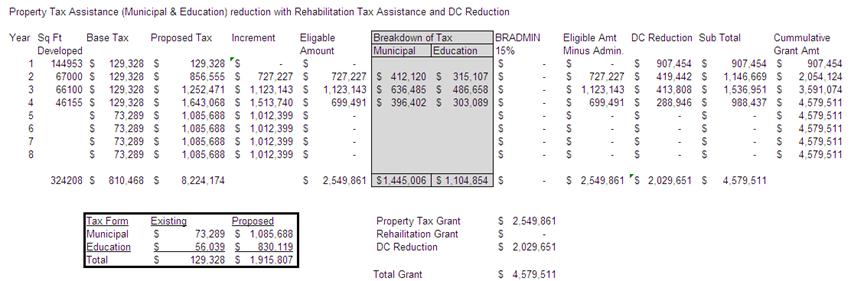

Based on the Municipal and Education Tax Assistance on full build-out of this development (Document 8, Table 1), this could translate into the full amount of the eligible costs of $2,549,861 being attained within the first three year period and no Rehabilitation Grant portion would be required. There would be a Development Charge reduction payment in the fourth year.

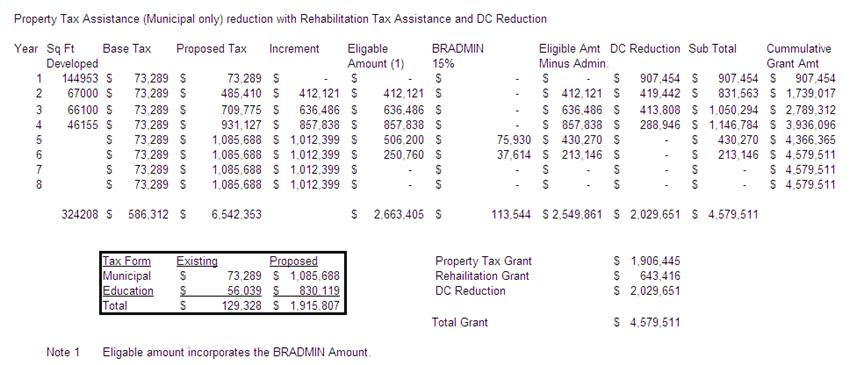

Based on the Municipal Tax Assistance (not considering the education tax portion) on full build-out of this development (Document 8, Table 2), this could translate into the full amount of the eligible costs of $1,906,445 being attained within the first three year period and the Rehabilitation Grant portion of $ 643,416 would be given in the next two year period.

Actual Payments of the Property Tax Assistance/Rehabilitation Grant is reviewed at the end of each tax year to confirm the actual tax benefit of the development to calculate the payment to the developer to reflect the principals of the agreement.

At the actual time of payment at the end of each year, the annual tax benefit would be based on the actual property tax increase calculated for that year and what would have been paid through this program in the year this agreement was entered into.

Rehabilitation Grant program

Grants, paid in the form of property tax rebates, would be capped at 50 per cent of the municipal share of the increase in property taxes that result from the redevelopment, payable annually for up to five years after the three year period of the Property Tax Assistance; or, up to the time when the total grant payments equal the total eligible costs, whichever comes first. The City will only pay the annual grant after the property taxes have been paid in full each year and all terms and conditions specified in the registered legal agreement between the City and the applicant have been met. It is possible that the pay-out could occur within four to eight years (depending if the Education Tax portion is applied) of the first payment at which time the annual municipal payment would end.

Development Charge Reduction to Site Contamination Program

The owners are eligible for the “Development Charge Reduction Due to Site Contamination” Program which allows a maximum reduction of development charges up to 25 per cent of eligible cost items for Property Tax Assistance but the amount credited will be reduced from eligible grants under the Rehabilitation Grants Program. This program allows the owners to receive a credit at the time of application for building permits. The anticipated total development charges for full build-out for this development, is $4,262,000. The eligible development charge credit of 25 per cent is calculated as $2,029,651.

For the purposes of estimating the possible future municipal tax increment and the estimated pay-out period it has been assumed for illustrative purposes that the project would be completed by 2015. The detailed assumptions and the calculations are shown in Document 6.

Economic Benefits to the Community

The overall economic impact of the proposed retail/service commercial development is estimated at $33 million in direct construction value. During the development of the site, direct and indirect economic benefits to the local economy will be experienced as a result of building demolition, site remediation and the construction period through payroll, purchased material supplies and services and equipment rentals. It is estimated that during the construction period approximately 264 person years of direct employment and 462 person years of indirect employment would be created by the project.

The economic benefits would span over a period of up to four years. After completion a number of new retail/service jobs would also be created. Commercial businesses along West Hunt Club and Merivale Roads will also benefit from a larger number of consumers traveling to this area of the city.

Over $63.5 million in new commercial assessment would be added to the property tax assessment roll at full development. Staff estimates that over $1,000,000 per year, in increased municipal property taxes can be expected at the completion of the project, after the property tax assistance and rehabilitation grant end, which would subsequently go to the City's general revenues.

The project will earn the City over $2.8 million in present value dollars in development charges, building permit fees and other development fees.

ENVIRONMENTAL IMPLICATIONS

The approval of this property tax assistance/rehabilitation grant will assist with the redevelopment of this brownfield property and ensure that this contaminated site is properly remediated prior to development. A Record of Site Condition (RSC) will be required as per the funding agreement. Brownfield redevelopment is identified as a key strategy for promoting reinvestment in existing urban areas and for reducing the need to expand into greenfield sites. The remediation and redevelopment of brownfield sites assists in meeting the Environmental Strategy’s goal of “clean air, water and earth.”

RURAL IMPLICATIONS

There are no rural implications with associated with this report.

CONSULTATION

There was no consultation – not applicable.

COMMENTS BY THE WARD COUNCILLOR

The Ward Councillor is aware of this application and the staff recommendations.

LEGAL IMPLICATIONS:

The recommendations in this report are consistent with the policies of the Brownfields Community Improvement Plan (section 6.5 Property Tax Assistance Program, section 6.6 Rehabilitation Grant Program and section 7 Development Charge Reduction Program) and section 365.1 of the Municipal Act, 2001. There are no legal impediments to approving the recommendations in this report.

RISK MANAGEMENT IMPLICATIONS

There are no risk management implications associated with this report.

CITY STRATEGIC PLAN

One of the City’s priorities, as a strategic direction, is planning and growth management. An important objective is to respect the existing urban fabric, neighbourhood form and the limits of existing hard services, so that new growth is integrated seamlessly with established communities (Code F2). The proposed commercial use of this underutilized site, made possible through rehabilitation, intensifies development within the City’s current urban boundary. This will result in the more efficient use of existing infrastructure in a manner that enhances and complements the desirable characteristics of the area. The proposed development generally complies with the intent and targets of the Urban Design Guidelines for Large-Format Retail.

TECHNICAL IMPLICATIONS

There are no technical implications associated with this report.

FINANCIAL IMPLICATIONS

The total eligible costs for a Brownfields Property Tax Assistance/Rehabilitation Grant are $9,159,022, as detailed in Document 4. The Brownfields Redevelopment Community Improvement Plan caps assistance/grant at 50% of eligible costs, or $4,579,511, as detailed in Document 5.

Of the $4,579,511, $2,029,651 will be funded through reductions to Development Charges, and $2,549,861 will be funded through incremental taxes resulting from the increased assessments. In addition, $113,544 will be contributed to the Municipal Leadership Revolving Fund, which will be funded through incremental taxes resulting from the increased assessments. Details are in Document 8, Table 2.

According to the Development Charge Act, 1997, c.27 s.5(6)3) “An exemption may not be offset through an increase in fees for other categories.” Therefore a reduction in the DC collections arising from an exemption may result in a shortfall in funding to support growth-related projects. This shortfall will be addressed in the five-year review of the development charge by-law as required by legislation.

Maximum potential provincial funding under the Provincial Brownfield Financial Tax Incentive Program is $1,104,854. In the event that the application is approved, the City’s assistance/grant funding requirement would be reduced accordingly, as detailed in Document 8, Table 1.

The expenditure authority for the grant payments and revolving fund contributions will be brought forward by Planning and Growth Management through the annual budget process. Actual payments of the Property Tax Assistance/Rehabilitation Grant will be reviewed at the end of each tax year to confirm the actual tax benefit of the development and to calculate the actual payment to the developer.

SUPPORTING DOCUMENTATION

Document 1 Location Map

Document 2 Aerial View

Document 3 Property Tax Assistance/Rehabilitation Grant Application Requirements

Document 4 Property Tax Assistance/Rehabilitation Grant-Eligible Costs

Document 5 Calculating the Property Tax Assistance/Rehabilitation Grant

Document 6 Estimated Future City Property Tax Increment and Annual Municipal/Education Grant Payable

Document 7 Calculating the Tax Assistance\Rehabilitation Grant and Development Charge Reduction

Document 8 Payment Option Scenarios

Document 9 Elevation

DISPOSITION

City Clerk and Solicitor Department, Legal Services to prepare the Property Tax Assistance/Brownfields Rehabilitation Grant Agreement.

City Clerk and Solicitor Department, in consultation with Finance Department, to draft property tax assistance by-law (municipal component only) and forward for enactment by Council. A copy of the by-law will be forwarded to the Minister of Finance and Minister of MAH, as required by section 365.1 Municipal Act, 2001.

Planning and Growth Management Department, City Clerk and Solicitor Department and Finance to prepare BRCIP application and forward to the MMAH for education tax assistance under the Brownfields Tax Incentive Program.

Planning and Growth Management Department and Finance Department, Revenue Branch to develop a general administrative approach to implement the Brownfields Redevelopment Financial Incentive Program and more specifically for this application.

Planning and Growth Management Department to notify the applicant of Council’s decision.

PROPERTY TAX ASSISTANCE\REHABILITATION

GRANT APPLICATION REQUIREMENTS DOCUMENT 3

A Brownfields Property Tax Assistance\Rehabilitation Grant program guide was prepared as part of the administration of the Brownfields financial incentives program. This program guide provides the detailed requirements to an applicant in order to file a complete application with the City for consideration of financial assistance under this grant program. The applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. The following documents are required:

- All environmental studies (Phase I ESA, Phase II ESA and Remedial Action Plan);

- Detailed work plan and cost estimate prepared by a qualified person (as defined by the Environmental Protection Act and Ontario Regulation 153/04, as amended), for all eligible environmental remediation and risk assessment/risk management works;

- A cost estimate provided by a bona fide contractor for eligible rehabilitation/redevelopment and demolition costs;

- A set of detailed architectural/design and/or construction drawings; and

- An estimated post-project assessment value prepared by a private sector property tax consultant.

The applicant (registered owner) or agent acting on behalf of the registered owner is required to fully complete the application including all required signatures and complete the sworn declaration.

The costs eligible for a Brownfields Property Tax Assistance/Rehabilitation Grant for 280 – 300 West Hunt Club Road are estimated as follows:

|

|

Eligible Costs |

Estimated Cost |

|

1 |

Environmental studies, Remedial Work Plan and Risk Assessment not covered by Environmental Site Assessment Grant Program |

$56,900 |

|

2 |

Environmental Remediation including the cost of preparing a Record of Site Condition |

$6,237,150 |

|

3 |

Placing clean fill and grading |

$1,405,350 |

|

4 |

Installing environmental and/or engineering controls/works as specified in the Remedial Work Plan and/or Risk Assessment |

$248,000 |

|

5 |

Monitoring, maintaining and operating environmental and engineering controls/works as specified in the Remedial Work Plan and/or Risk Assessment |

$100,000 |

|

6 |

Environmental Insurance Premiums |

$71,202 |

|

|

Total Costs Eligible for Property Tax Assistance (Sum Costs 1 – 6 above) |

$8,118,602 |

|

|

|

|

|

7 |

Building demolition |

$19,000 |

|

8 |

50% of the upgrading costs for on-site infrastructure including water services, sanitary sewers and stormwater management facilities |

$1,021,420

|

|

|

|

|

|

|

Total Costs Eligible for Property Tax Assistance/Rehabilitation Grant (Sum Costs 1 – 8 above) |

$9,159,022 |

CALCULATING THE PROPERTY TAX

ASSISTANCE/REHABILITATION GRANT DOCUMENT 5

The Ottawa Brownfields Community Improvement Plan (CIP) specifies that, the total of all grants, property tax assistance and development charge reductions shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings.*

The owner is also eligible for the “Development Charge Reduction Due to Site Contamination” Program which allows a maximum reduction of development charges up to 25 per cent of eligible cost items for Property Tax Assistance but the amount received will be deleted from eligible grants for the Rehabilitation Grants Program. This program allows the owner to receive a credit at the time of application for building permits. The anticipated total development charges for full build-out for this development are $4,262,000. Eligible Development Charges of 25 per cent is equal to a credit of $1,402,000. Actual Development Charge Reductions are applied at the time of building permit applications.

|

1 |

Total eligible Costs- from Document 4 |

$9,159,022 |

|

2 |

Total capping at 50 per cent of line 1 |

$4,579,511 |

|

3 |

Total of Property Tax Assistance/ Rehabilitation Grant Payable and development charge credit |

* The site is located at 280-300 West Hunt Club Road. The subject lands are not located within the programs “priority area” therefore the Rehabilitation Grant portion is therefore eligible for a grant equivalent to 50 per cent of the municipal property tax increase that results from the redevelopment, payable annually for up to five years, or until the time when the total grant payments equal the total eligible costs whichever comes first.

The total Brownfields Property Tax Assistance/Rehabilitation Grant payable is $4,579,511 (line 3 above). The Development Charge Reduction program amount of $2,029,651 applied for is included in this amount. The total maximum tax assistance and rehabilitation grant is therefore $2,549,861.

ESTIMATED FUTURE CITY PROPERTY TAX INCREMENT AND

ANNUAL MUNICIPAL\EDUCATION GRANT PAYABLE DOCUMENT 6

Pre-Project Property Tax Rates and Property Taxes

Current Value Assessment on the property at 280-300 West Hunt Club Road is $5,079,000, classified as Commercial (CT), Commercial Excess Land (CU) and Industrial (IT). Current (2011) property taxes are approximately $129,328 broken down as follows:

Table 1

|

Municipal Property Tax portion |

$73,289 |

|

Education Property Tax Portion |

$56,039 |

Total Pre-Project Property Taxes |

$129,328 |

Based on a post-project assessment valuation prepared by Altus Group , as submitted as part of the application, and modified by staff to reflect a likely phase-in of assessment values, it is estimated that once the entire project is complete, the proposed commercial complex could have a post-project assessment value in excess of $68,539,774 (2011$). The estimated taxes to be generated from full build-out is $1,915,807 (2011$), see Table 2.

Estimated Annual Post-Project Municipal\Education Property Taxes

|

Tax Class*

|

Estimated assessment |

Estimated Municipal Tax |

Estimated Education Tax |

Estimated Total Tax |

|

Commercial |

$68,539,774 |

$1,085,688 |

$830,119 |

$1,915,807 |

* Tax Class Commercial

CALCULATING THE TAX

ASSISTANCE\ REHABILITATION

GRANT AND DEVELOPMENT CHARGE REDUCTION DOCUMENT 7

|

1 |

Total eligible Costs from application |

$9,159,022 |

|

2 |

Total capping at 50 per cent of line 1 |

$4,579,511 |

|

3 |

Estimated Development Charges |

$4,262,000 |

|

4 |

Total cost eligible for DC reduction from application – total items 1 to 6 (Document 4) |

$8,118,602 |

|

5 |

Capping at 25 per cent of line 4 – development charge reduction |

$2,029,651 |

|

6 |

Development charge is reduced by the amount in line 5 (line 3 – line 5) |

$2,232,350 payable as DCs |

|

7 |

Eligible cost cap is reduced by DC reduction (line 2 – line5) |

$2,549,861 |

|

8 |

Total potential grant and tax assistance |

$2,549,861 |

|

9 |

Eligible cost for tax assistance (line 7) |

$2,549,861 |

*The maximum reduction of development charges is 25 percent of the cost components of line 4 if the site is located in the non-priority area. This location would qualify as being in the non-priority area under the Brownfields CIP and therefore is eligible for the 25 per cent maximum reduction.

**The environmental site assessment, remediation and grading costs and environmental insurance premiums cost component of an approved Rehabilitation Grant may be applied against development charges payable, subject to Council approval.

The development charge is reduced to $2,232,350 (line 6 above) payable after the DC credit of $2,029,651.

The total potential rehab grant and tax assistance payable is $2,549,861 (line 8 above).