|

3. DISPOSITION OF 2011 TAX and rate SUPPORTED OPERATING Surplus/DEFICIT

RÈGLEMENT DE L’EXCÉDENT / DU DÉFICIT DE 2011 DES OPÉRATIONS FINANCÉES PAR LES RECETTES FISCALES ET LES REDEVANCES

|

COMMITTEE RECOMMENDATIONS

That Council approve:

1. That $5.7 million of the 2011 surplus be used to replace the debt financing for the Lifecycle and Baseball Development Improvements at Ottawa Stadium;

2. That the deficit of $3.656 million in transit be funded by a transfer from the Transit Capital Reserve Fund;

3. That the deficit of $0.279 million in Public Health be funded by the City from the 2011 surplus and that these funds be returned to the City should the Ottawa Board of Health be reimbursed by the Province for costs incurred in 2011;

4. That $1.0 million of the 2011 surplus land sales revenues from the Ottawa Community Lands Development Corporation be used to fund the contractual obligation to build a road as required per the sale of 655 Longfields Drive;

5. That the $0.217 million year-end surplus in the Committee of Adjustment be used during 2012 to undertake an operational review of their programs and to allow for work to proceed with making application materials available to the public on the City’s website;

6. That $15.148 million of the tax supported year-end surplus be contributed to the City Wide Capital Reserve Fund to eliminate the 2011 year-end deficit balance; and

7. That the remaining 2011 tax supported surplus of $2.650 million be contributed to the City Tax Stabilization Reserve.

RECOMMANDATIONS DU COMITÉ

Que le Conseil approuve :

1. que 5,7 millions de dollars du surplus de 2011 soient utilisés afin de remplacer le financement par emprunt pour les améliorations relatives à l’aménagement et au cycle de vie du stade de baseball d’Ottawa;

2. que le déficit de 3,656 millions de dollars dans le transport en commun soit financé au moyen d’un transfert à partir du fonds de réserve pour immobilisations du Service de transport en commun;

3. que le déficit de 0,279 million de dollars dans la santé publique soit financé par la Ville à partir du surplus de 2011, et que ces fonds soient rendus à la Ville quand la province remboursera le Conseil de santé d’Ottawa pour les coûts engagés en 2011;

4. que 1 million de dollars du surplus de 2011 des produits de vente de terrains de la Société d’aménagement des terrains communautaires d’Ottawa soient utilisés pour financer l’obligation contractuelle de construire une route découlant de la vente du 655, promenade Longfields;

5. que le surplus de fin d’exercice de 0,217 million de dollars du Comité de dérogation soit utilisé en 2012 pour mener un examen opérationnel de ses programmes et déployer les ressources nécessaires afin de rendre les documents de demande accessibles au public sur le site Web de la Ville;

6. que 15,148 millions de dollars du surplus de fin d’exercice financé par les taxes soient versés dans le Fonds de réserve pour immobilisations de la Ville pour éliminer le solde déficitaire de fin d’exercice de 2011; et

7. que le surplus financé par les taxes restant de 2011 de 2,650 millions de dollars soit versé dans le Fonds de stabilisation fiscale de la Ville.

DOCUMENTATION

1. City Treasurer’s report dated 28 February 2012 (ACS2012-CMR-FIN-0008).

Report to/Rapport au:

Finance and Economic Development Committee

Comité des finances et du développement économique

and / et au Conseil

28 February 2012 / le 28 février 2012

Submitted by/Soumis par : Marian Simulik, City Treasurer/Trésorière municipale

Contact Person/Personne ressource : Mona Monkman, Deputy City Treasurer- Corporate Finance/ Trésorière municipale adjoint - Finances municipales

Finance Department/Service des finances

613-580-2424 ext./poste 41723, Mona.Monkman@ottawa.ca

|

Ref N°: ACS2012-CMR-FIN-0008 |

REPORT RECOMMENDATIONS

That the Finance and Economic Development Committee recommend Council approve:

1. That $5.7 million of the 2011 surplus be used to replace the debt financing for the Lifecycle and Baseball Development Improvements at Ottawa Stadium;

2. That the deficit of $3.656 million in transit be funded by a transfer from the Transit Capital Reserve Fund;

3. That the deficit of $0.279 million in Public Health be funded by the City from the 2011 surplus and that these funds be returned to the City should the Ottawa Board of Health be reimbursed by the Province for costs incurred in 2011;

4. That $1.0 million of the 2011 surplus land sales revenues from the Ottawa Community Lands Development Corporation be used to fund the contractual obligation to build a road as required per the sale of 655 Longfields Drive;

5. That the $0.217 million year-end surplus in the Committee of Adjustment be used during 2012 to undertake an operational review of their programs and to allow for work to proceed with making application materials available to the public on the City’s website;

6. That $15.148 million of the tax supported year-end surplus be contributed to the City Wide Capital Reserve Fund to eliminate the 2011 year-end deficit balance; and

7. That the remaining 2011 tax supported surplus of $2.650 million be contributed to the City Tax Stabilization Reserve.

RECOMMANDATIONS DU RAPPORT

Que le Comité des finances et du développement économique recommande au Conseil d’approuver ce qui suit :

1. que 5,7 millions de dollars du surplus de 2011 soient utilisés afin de remplacer le financement par emprunt pour les améliorations relatives à l’aménagement et au cycle de vie du stade de baseball d’Ottawa;

2. que le déficit de 3,656 millions de dollars dans le transport en commun soit financé au moyen d’un transfert à partir du fonds de réserve pour immobilisations du Service de transport en commun;

3. que le déficit de 0,279 million de dollars dans la santé publique soit financé par la Ville à partir du surplus de 2011, et que ces fonds soient rendus à la Ville quand la province remboursera le Conseil de santé d’Ottawa pour les coûts engagés en 2011;

4. que 1 million de dollars du surplus de 2011 des produits de vente de terrains de la Société d’aménagement des terrains communautaires d’Ottawa soient utilisés pour financer l’obligation contractuelle de construire une route découlant de la vente du 655, promenade Longfields;

5. que le surplus de fin d’exercice de 0,217 million de dollars du Comité de dérogation soit utilisé en 2012 pour mener un examen opérationnel de ses programmes et déployer les ressources nécessaires afin de rendre les documents de demande accessibles au public sur le site Web de la Ville;

6. que 15,148 millions de dollars du surplus de fin d’exercice financé par les taxes soient versés dans le Fonds de réserve pour immobilisations de la Ville pour éliminer le solde déficitaire de fin d’exercice de 2011; et

7. que le surplus financé par les taxes restant de 2011 de 2,650 millions de dollars soit versé dans le Fonds de stabilisation fiscale de la Ville.

BACKGROUND

As part of the finalization of 2011 operations, and in conjunction with the preparation of the financial statements it is necessary to obtain Council approval of the disposition and funding of any operating surplus or deficit. This report provides an analysis of the final results of the 2011 operations for both tax and rate supported City programs.

Although reflected in this report, a separate 2011 Rate supported services and Transit services year-end report will also be submitted to the Environment Committee and Transit Commission respectively that will provide additional details on the year-end results.

DISCUSSION

Year-end Results

The City ended the year with an overall surplus of $35 million, which represents 1.3 percent of the $2.6 billion operating expenditure budget. The year-end position will vary from year to year. This surplus resulted primarily from additional revenues and expenditure savings of a one- time nature.

The surplus will be used as follows:

- $5.7 million will be used to provide cash financing for the City’s share of the Ottawa Stadium improvements instead of debt financing. This reduces the City’s debt load.

- The remainder will be contributed to reserves in order to provide some flexibility in addressing future needs.

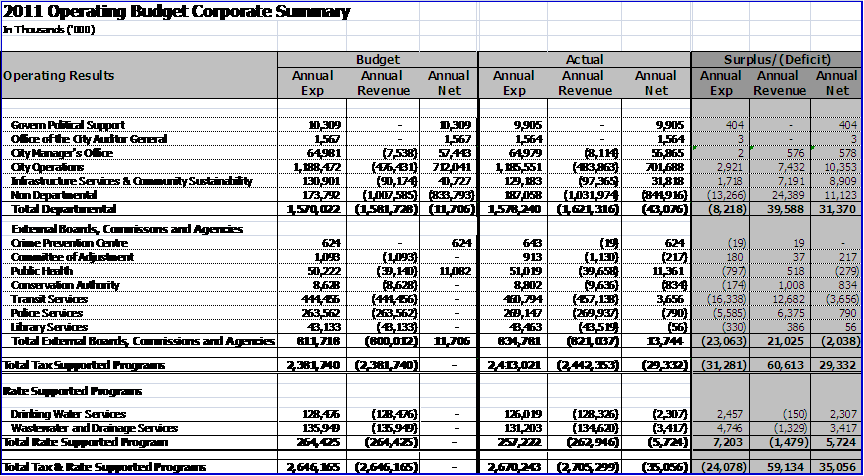

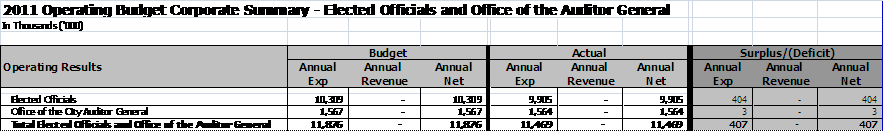

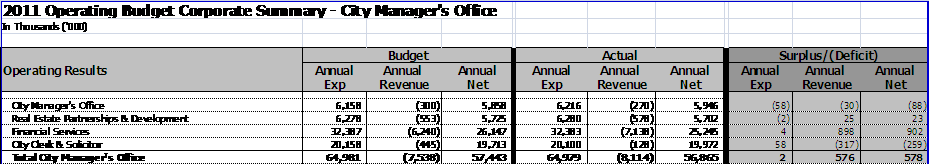

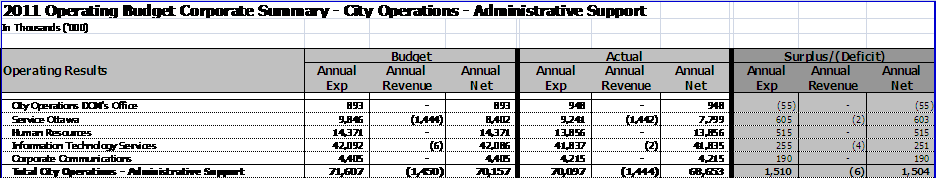

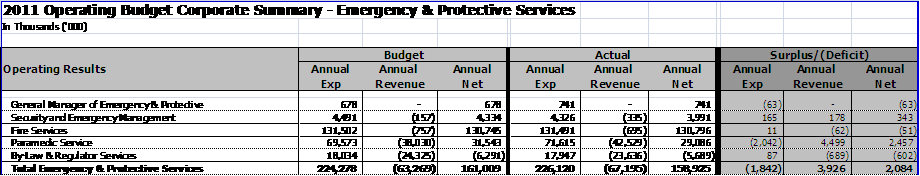

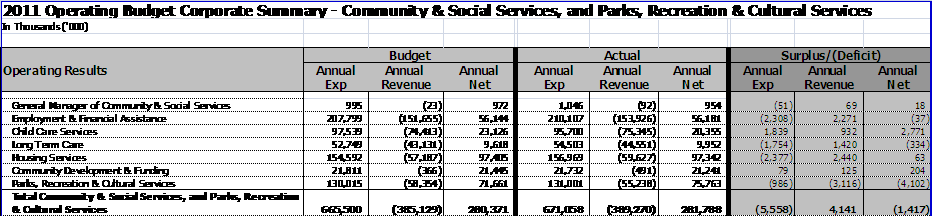

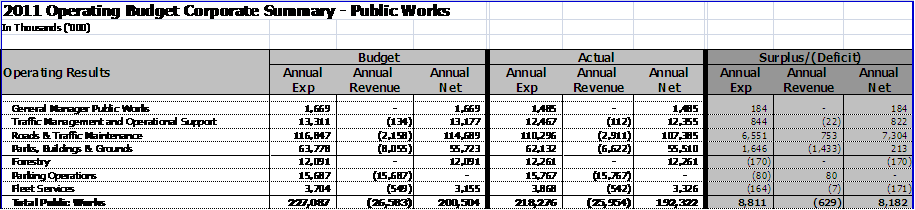

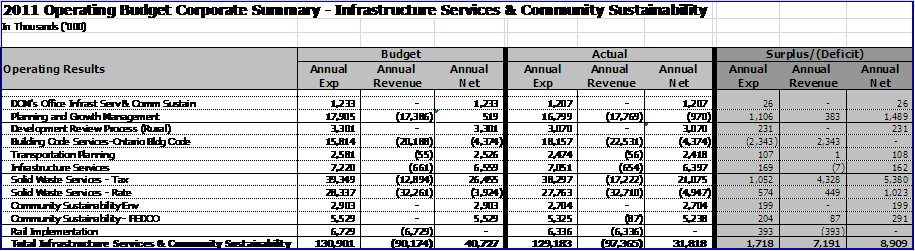

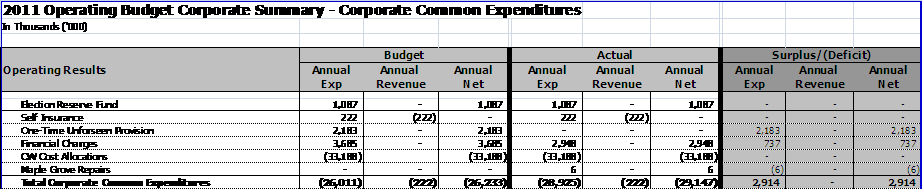

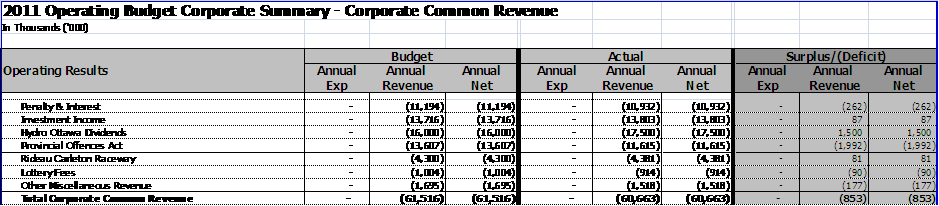

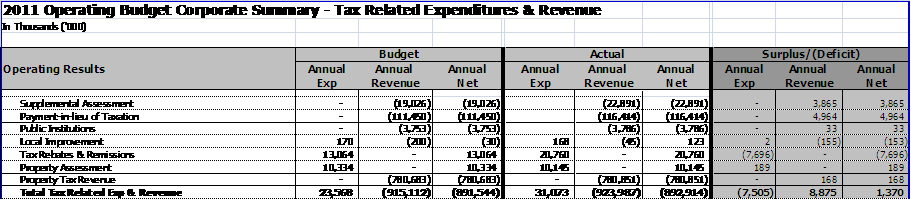

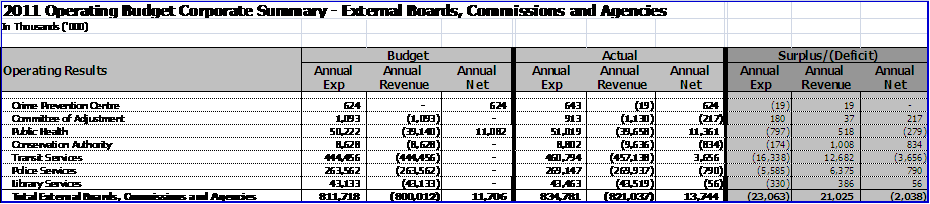

Document 1 presents a summary of the year-end operating results by “business area”. For some services such as transit and police the final year-end position includes both operating results and the impacts of changes in certain taxation related revenues and expenditures that are allocated to those services as they have their own tax rate. These are referred to as the results by “business area”.

The following provides a brief overview of the major areas that contributed to the 2011 year-end position. Additional information is provided in Document 2.

Departmental Accounts

Paramedic Services $2.5 million surplus:

Increased funding was received from the Province in 2011 to maintain the 50/50 funding ratio. The 2012 Budget reflects the increased provincial revenue.

Child Care $2.8 million surplus:

Decreased cost from lower utilization of subsidized child care as a result of the implementation of Full Day Kindergarten and increased revenue from parental fees were the major factors contributing to the surplus. The 2012 Budget reflects the increased parental fees.

Public Works $8.2 million surplus:

The surplus results primarily from savings in winter control costs, non-winter roads & traffic operations, one-time expenditure savings along with increased capital recoveries as a result of capital works activity associated with the Federal Economic Stimulus Program.

Solid Waste Services $6.4 million surplus:

Surplus was due mainly higher revenues reflecting higher commodity market prices for recycled materials. These prices will vary from year to year.

Parks and Recreation $4.1 million deficit:

Revenues were not achieved due to delays in implementation of the Service Ottawa Sponsorship & Advertising initiative (it is anticipated that in 2012, a fully staffed Corporate Partnership Office will generate the budgeted revenues in sponsorship and advertising), adverse market conditions affecting Hall Rentals and Fitness Memberships, along with a decrease in Admissions / Registrations as a result of facility closures and construction.

Transit Services $3.7 million deficit:

Due primarily to increased fuel consumption and compensation costs.

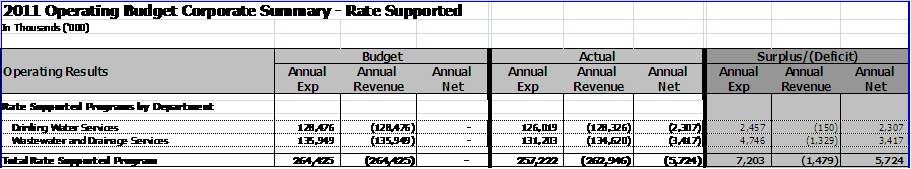

Water and Sewer Operations $5.7 million surplus:

Compensation costs were lower than budget reflecting staffing vacancies early in the year.

Police Services $0.8 million surplus:

The budget for Police operations under the jurisdiction of the Ottawa Police Services Board were on budget. The year-end surplus resulted from higher revenues in the property tax related accounts, primarily in payments-in-lieu and supplementary assessment offset by higher remission costs. As per past practice, the surplus is included in the overall City surplus position.

Non Departmental Accounts

Sale of Surplus Lands $4.962 million surplus:

Revenues derived from the sale of surplus City lands are not budgeted for on an annual basis since the amount of land available for sale will vary significantly from year to year.

Ottawa Community Lands Development $1.3 million surplus:

Several properties were sold during the past year, allowing the Land Development Corporation to exceed Council’s 2011 target return of $5.5 million.

Hydro Ottawa Dividends $1.5 million surplus:

Based on the City’s dividend policy, Hydro Ottawa is required to remit to the City an annual dividend payment equal to the greater of $14 million or 40% of Hydro Ottawa’s net income. The 2011 payment is reflective of the higher Hydro Ottawa earnings.

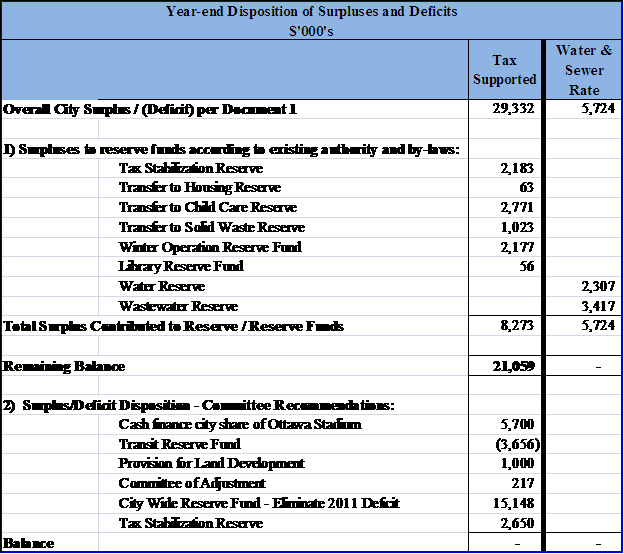

Disposition of Surplus and Deficits

As outlined in Table 1, the total year-end surplus for the tax supported programs, external boards and agencies is $29.3 million and $5.724 million for the water and sewer rate supported programs. Through the recommendations in this report, $28 million of the $35 million year end surplus will be transferred to various reserves.

Table 1 - Year-end Disposition

Disposition per existing authority and by-laws

In accordance with existing Council approved direction and by-laws, $8.273 million and $5.724 million of the respective tax and rate supported surpluses will be contributed to the reserve / reserve funds.

Council has approved criteria recommending that any surplus in the Provision for Unforeseen and One-Time Expenditures be transferred to the Tax Stabilization Reserve. The annual Council approved budget for this provision was $2.8 million.

Recommended disposition of Remaining Surplus / Deficit Positions

The Transit Services business area ended the year with a $3.656 million deficit. The Transit Reserve by-law states that the Transit Capital Reserve Fund may be used “to reduce or eliminate any operating deficits related to ongoing transit activities and programs as may be approved by Council of the City of Ottawa”. It is recommended that a transfer of $3.656 million be made from the Transit Capital Reserve Fund to fund the transit deficit.

The Ottawa Board of Health accounts were in a $0.279 million deficit at year end. The Board has not yet been reimbursed by the Province for the $0.752 million of costs incurred in dealing with the Infection Control Lapse. It is recommended that the City fund the $0.279 million deficit and that the Board repay the City when reimbursed by the Province for these costs.

At the City Council meeting of February 22, Council adopted the report “Ottawa Stadium (300 Coventry Road) – Results of the Request for Offers to Lease Process” which approved debt authority in the amount of $5,700,000 for Lifecycle and Baseball Development Improvements at Ottawa Stadium. The report also indicated that depending on the amount of the 2011 surplus, it would be recommended that this project be refinanced to remove the debt and that funding from the City-wide reserve be used for the capital improvements.

The lands sales associated with the Ottawa Community Lands Development Corporation were greater than was budgeted by $1.3 million. Staff is recommending that $1.0 million of the surplus in the land sales account be used to fund a commitment to build a road which is associated with the sale of 655 Longfields Drive to Jock River Farms.

The Committee of Adjustment ended 2011 with a surplus of $0.217 million. The Committee has requested that the Finance and Economic Development Committee and Council allow these funds to be used during 2012 to undertake an operational review of their programs and to allow for work to proceed with making application materials available to the public on the City’s website.

The 2011 year-end balance of the City Wide Capital Reserve Fund as shown in Document 3, is in a deficit of $15.148 million. Staff is recommending that funds from the 2011 surplus be used to eliminate this deficit in the City Wide Capital Reserve Fund.

Staff is recommending that the remaining 2011 operating surplus of $2.650 million be contributed to the Tax Rate Stabilization Reserve. This reserve was established to maintain stable tax rates and protect the City against unforeseen operating costs.

Continuity of Reserves and Reserve Funds

Document 3 presents a continuity schedule of the City’s reserves and reserve funds. The schedule shows the impact on reserve balances of the recommendations for surplus disposition that are included in this report.

The transfer of surplus fund to reserves improves the tax supported reserve positions for 2012. As a result, the forecast 2012 reserve position will be comparable to the year-end 2011 position even though the water and sewer rate supported program is using reserves extensively in 2012 to support the capital program.

As part of the 2009 disposition of tax supported operating deficit, the City wide deficit was partially funded from an $11.9 million loan from the Corporate Fleet Reserve Fund as there were insufficient funds at that time in the City Wide capital reserve fund. Council approved the transfer of $11.9 million from the Corporate Fleet reserve fund with the stipulation that the transfer be repaid over a 3 year term starting in 2011. To date, the City Wide Capital Reserve Fund has repaid $2.7 million of this loan. Of the remaining $9.2 million, $8.7 million will be repaid during 2012 and is reflected in the projected 2012 year end balances of both the City Wide Capital Reserve Fund and the Corporate Fleet Reserve Fund. The balance will be repaid in 2013.

The Environmental Lands reserve fund is projected to have a balance of $5.395 million at the end of 2012. This reflects an additional contribution of approximately $1.67 million from the disposition of the projected sinking fund surplus representing the amount of funds that are in excess of the debenture principle commitment. The report on the sinking fund surplus will be submitted to Committee and Council in June. In accordance with Council direction as adopted in March 2011, any sinking fund surpluses will be contributed to the Environmental Lands reserve fund.

Budget Adjustments

During the year, adjustments to budgets are made to better reflect the alignment of budget authority with spending needs. These transfers are made either through the delegated authority given to the City Treasurer or through Council-approved reports. Document 4 and 5 shows the changes in budgets processed since the June 30 2011 Quarterly Status Report. Council policy requires the reporting of these transactions for information purposes.

CONSULTATION

The purpose of this report is administrative in nature and therefore no public consultation is required.

LEGAL IMPLICATIONS

The transfers outlined in the recommendations require Council approval. There are no legal impediments to implementing the recommendations in this Report.

RISK MANAGEMENT IMPLICATIONS

There are no risk management impediments to implementing the recommendations in this Report.

FINANCIAL IMPLICATIONS

Financial implications are outlined in this report.

RURAL IMPLICATIONS

Not applicable.

Accessibility Impacts

Not applicable.

Environmental Implications

Not applicable.

Technology Implications

Not applicable.

SUPPORTING DOCUMENTATION

Document 1 – 2011 Operating Results Summary

Document 2 – Variance Analysis – 2011 Operating Results

Document 3 – 2012 Continuity of Reserves and Reserve Funds

Document 4 – Budget Adjustments under Delegated Authority

Document 5 - Inter & Intra-departmental Budget Adjustments & Transfers

DISPOSITION

The Finance Department will make the

necessary accounting adjustments.