|

2. RFO PROCESS – Lease And sale of Air Rights AT lANSDOWNE PARK

Processus de demande d’offres – location ET vente des DROITS RELATIFS A LA PROPRIETE DU DESSUS au parc lANSDOWNE

|

COMMITTEE RECOMMENDATIONS

That Council:

1. Receive the findings of the Request for Offers Stage Two;

2. Approve the selection of Minto Communities Inc. as the real estate developer to purchase the Residential Air Rights at Lansdowne Park and delegate authority to the City Manager to negotiate, finalize and execute applicable agreements with Minto Communities Inc. as outlined in this report;

3. Approve the selection of Minto Properties Inc. as the real estate developer to lease the Office Air Rights at Lansdowne Park and delegate authority to the City Manager to negotiate, finalize and execute applicable agreements with Minto Properties Inc. as outlined in this report;

4. Approve an increase in debt authority from $119.1 million to $124.2 million for the Lansdowne Park Project to fund the overall revenue shortfall from the sale of the Air Rights of $2.3 million and the contribution of $2.8 million to the Social Housing Reserves Fund as described in this report; and

5. Approve the establishment of a capital program for the allocated development costs in the amount of $21.09 million for the residential and office podiums and parking to be funded from the sale of the air rights as described in this report.

RECOMMANDATIONS DU COMITÉ

Que le Conseil:

1. reçoive les résultats de la deuxième étape, la demande d’offres;

2. approuve le choix de Minto Communities Inc. en tant que promoteur immobilier qui achètera les droits relatifs à la propriété du dessus résidentiels au parc Lansdowne, et de déléguer au directeur municipal les pouvoirs de négocier, de finaliser et de conclure les ententes pertinentes avec Minto Communities Inc., comme l’indique ce rapport;

3. approuve le choix de Minto Properties Inc. en tant que promoteur immobilier qui louera les droits relatifs à la propriété du dessus commerciaux au parc Lansdowne, et de déléguer au directeur municipal les pouvoirs de négocier, de finaliser et de conclure les ententes pertinentes avec Minto Communities Inc., comme l’indique ce rapport;

4. approuve et d’augmenter de 119,1 millions à 124,2 millions de dollars le total de la dette autorisée dans le but de financer un déficit global de produit de la vente de les droits relatifs à la propriété s’élevant à 2,3 millions de dollars ainsi qu’une contribution de 2,8 millions de dollars au fonds de réserve du logement social, comme l’indique ce rapport ; et

5. approuve l’établissement d’un projet d’immobilisation de 21,9 millions de dollars pour les coûts d’aménagement alloués relatifs aux structures résidentielles, commerciales et de stationnement, lesquelles seront financées par les produits bruts tirés de la vente des droits relatifs à la propriété du dessus.

DOCUMENTATION

1. City Manager’s report dated 9 February 2012 (ACS2012-CMR-REP-0006).

Report to/Rapport au:

Finance and Economic Development Committee

Comité des finances et du développement économique

and Council / et au Conseil

9 February 2012 / le 9 février 2012

Submitted by/Soukis par: Kent Kirkpatrick, City Manager / Director municipal

Contact Person/Personne ressource : Gordon MacNair, Director, Real Estate Partnerships and Development Office/Directeur, Partenariats et Développement en immobilier (613) 580-2424 x 21217, Gordon.MacNair@Ottawa.ca

|

Ref N°: ACS2012-CMR-REP-0006 |

SUBJECT: |

RFO PROCESS – Lease And sale of Air Rights AT lANSDOWNE PARK |

|

|

|

OBJET : |

Processus de demande d’offres – location ET vente des DROITS RELATIFS A LA PROPRIETE DU DESSUS au parc lANSDOWNE |

REPORT RECOMMENDATIONS

That the Finance and Economic Development Committee recommend Council:

1. Receive the findings of the Request for Offers Stage Two;

2. Approve the selection of Minto Communities Inc. as the real estate developer to purchase the Residential Air Rights at Lansdowne Park and delegate authority to the City Manager to negotiate, finalize and execute applicable agreements with Minto Communities Inc. as outlined in this report;

3. Approve the selection of Minto Properties Inc. as the real estate developer to lease the Office Air Rights at Lansdowne Park and delegate authority to the City Manager to negotiate, finalize and execute applicable agreements with Minto Properties Inc. as outlined in this report;

4. Approve an increase in debt authority from $119.1 million to $124.2 million for the Lansdowne Park Project to fund the overall revenue shortfall from the sale of the Air Rights of $2.3 million and the contribution of $2.8 million to the Social Housing Reserves Fund as described in this report; and

5. Approve the establishment of a capital program for the allocated development costs in the amount of $21.09 million for the residential and office podiums and parking to be funded from the sale of the air rights as described in this report.

RECOMMANDATIONS DU RAPPORT

Que le Comité des finances et du développement économique recommande au Conseil :

1. de recevoir les résultats de la deuxième étape, la demande d’offres;

2. d’approuver le choix de Minto Communities Inc. en tant que promoteur immobilier qui achètera les droits relatifs à la propriété du dessus résidentiels au parc Lansdowne, et de déléguer au directeur municipal les pouvoirs de négocier, de finaliser et de conclure les ententes pertinentes avec Minto Communities Inc., comme l’indique ce rapport;

3. d’approuver le choix de Minto Properties Inc. en tant que promoteur immobilier qui louera les droits relatifs à la propriété du dessus commerciaux au parc Lansdowne, et de déléguer au directeur municipal les pouvoirs de négocier, de finaliser et de conclure les ententes pertinentes avec Minto Communities Inc., comme l’indique ce rapport;

4. d’approuver et d’augmenter de 119,1 millions à 124,2 millions de dollars le total de la dette autorisée dans le but de financer un déficit global de produit de la vente de les droits relatifs à la propriété s’élevant à 2,3 millions de dollars ainsi qu’une contribution de 2,8 millions de dollars au fonds de réserve du logement social, comme l’indique ce rapport ; et

5. d’approuver l’établissement d’un projet d’immobilisation de 21,9 millions de dollars pour les coûts d’aménagement alloués relatifs aux structures résidentielles, commerciales et de stationnement, lesquelles seront financées par les produits bruts tirés de la vente des droits relatifs à la propriété du dessus.

This report responds to a direction from Council on 7 September 2010 to move forward with a two-stage process to lease or purchase the residential air rights and to lease the office air rights at Lansdowne Park above the proposed retail and parking structures to be built by the Ottawa Sports and Entertainment Group (OSEG). It presents the results of the Request for Offers (RFO) Stage Two and recommends the real estate developer(s) to construct the office and residential air rights components at Lansdowne Park.

Stage One of the process, which began in October 2010, was designed to gather industry feedback, measure market interest in the air rights, and identify development issues associated with the opportunity. This information was used to develop the RFO for Stage Two which was approved for release by Council on 25 August 2011 report (ACS2011-CMR-REP-0021).

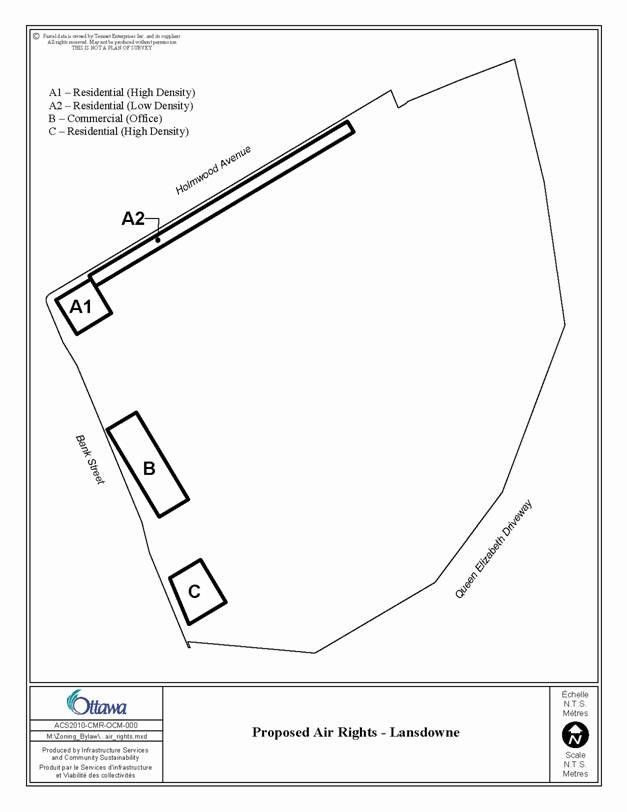

The business model and financial terms in the Lansdowne Partnership Plan (LPP) framework originally identified a potential net value of $10.2M for the residential air rights opportunities at Lansdowne Park exclusive of the building area originally reserved for the Ottawa Art Gallery (OAG). The compensation for the air rights was based on the estimated density of development as per the preliminary plans. However, the Ontario Municipal Board (OMB) settlement reduced the density of residential development and resulted in a reduction in value of approximately $3.4M. This was offset by the inclusion within the RFO of the building area that had been reserved for the OAG (Building “K” or Parcel C shown in the sketch attached as Document 1), together with refinements in the building design work based on the approved zoning.

The revised value for the residential air rights as referred to in the 25 August 2011 report to Council (ACS2011-CMR-REP-0021) was estimated at $10M, net of the hard and soft development costs to create the podiums and underground parking for the air rights. This amount was adjusted back to the original $10.2M to include the ground level of Building “K”. The office air rights were for lease net of the hard and soft costs. The estimated net annual income, based on the underlying land value of the office air rights was $198,000.

The RFO Stage Two was released on 7 September 2011; it was posted on MERX and administered by Supply Branch. A Fairness Commissioner was retained to ensure the RFO process was open and transparent and that respondents were treated fairly. There were twenty two (22) requests for the RFO document. Commercially Confidential Meetings (CCMs) were arranged for respondents that passed a viability test. A total of six (6) developers requested a CCM and all passed the viability test and participated in meetings. The CCMs provided a forum to clarify the RFO and to disseminate project information as it became available. Respondents had the opportunity to ask questions related to the process as well as to partake in an open exchange on the issues associated with the air rights development.

The RFO process was conducted concurrent with the development of the LPP Stage Two Site Plan and the advancement of the conceptual architecture for the commercial development. As a result, there was a need to provide further details outside of the CCMs pertaining to design, development costs, payment schedules, legal conditions, and the overall RFO process. A total of fourteen Addendums were issued to clarify and refine the air rights offer. As a result of the amount of information being released over October and November 2011, the closing date for submissions was extended to 5 December 2011.

During the RFO, adjustments and refinements were made to improve upon the process. Most of these adjustments were minor in nature with two exceptions:

1. The ground level of Building “K”, being the non-residential component of that building, was included in the residential air rights offer. The City had originally envisioned constructing and keeping control over a significant portion of the ground floor. There were concerns expressed by respondents over elevation changes, bridge impacts, stadium elements, surface access, lobby locations, loading and garbage and shared construction and operating costs that made the City’s retention of the ground floor impractical. The inclusion of the ground floor of Building “K” in the residential air rights package addressed respondent design issues, streamlined construction and removed cost implications for the City.

2. A further adjustment to the RFO process addressed the issue of the City’s reimbursement for certain amounts collectively referenced as the “Allocated Development Costs”. The City is responsible for those costs that are allocated against the air rights components and includes the hard and soft costs of the parking garage and of the site infrastructure. The LPP legal agreements, under negotiation with OSEG, commit the City to pay these costs up front.

In the initial RFO, respondents were to estimate an allowance for Allocated Development Costs within their financial offers. However, in order to treat all respondents fairly, the City amended the RFO to indicate the value of the Allocated Development Costs and required that bidders commit to pay them to the City. The Fairness Commissioner and Borden Ladner Gervais LLP (BLG) endorsed this change. The residential development opportunity had Allocated Development Costs in the amount of $19,135,000. The office development opportunity had Allocated Development Costs in the amount of $6,955,000. These amounts would be paid by the successful bidder(s) in addition to the financial offers provided for the respective air rights.

Upon closing of the RFO on 5 December 2011, the City received three (3) residential submissions and all the submissions were based on a purchase (as opposed to lease) of the air rights. Only two (2) of the submissions were qualified by the evaluation committee. The submission with best value to the City was in the amount of $30,500,000.

The City received one submission for the office component with the RFO closing on 5 December 2011. However, the one submission did not meet the City’s mandatory bid requirements and did not qualify as a responsive submission. In an effort to obtain compliant offers for the office air rights, the RFO was re-issued and required that offers be submitted by 21 December 2011. To encourage submissions, the requirement that bidders indicate a commitment to pay the Allocated Development Costs for the office was removed. On closing of the RFO extension for the office component, one (1) bid was received in the amount of $3,490,000. Subsequent negotiations included a potential future payment in the tenth year of the lease term based upon the success of the development.

SOMMAIRE EXÉCUTIF

Ce rapport répond aux directives données par le Conseil le 7 septembre 2010 concernant la mise en œuvre d’un processus en deux étapes pour la location ou la vente des droits relatifs à la propriété du dessus des aménagements résidentiels ainsi que la location des droits relatifs à la propriété du dessus des aménagements commerciaux au parc Lansdowne, au-dessus des structures de vente au détail et de stationnement proposées qui seront construites par l’Ottawa Sports and Entertainment Group (OSEG). Il présente les résultats de la deuxième étape, la demande d’offres, et recommande un ou des promoteur(s) immobilier(s) pour la construction des composantes commerciales et résidentielles des droits relatifs à la propriété du dessus au parc Lansdowne.

La première étape du processus, entamée en octobre 2010, visait à recueillir des renseignements auprès du secteur, à mesurer l’intérêt du marché envers les droits relatifs à la propriété du dessus et à relever les problèmes d’aménagement relatifs à cette possibilité. Ces données ont été utilisées pour mettre au point la demande d’offres, deuxième étape du processus, dont l’émission a été approuvée par le Conseil le 25 août 2011 (rapport ACS2011-CMR-REP-0021).

Le modèle opérationnel et les aspects financiers du cadre de partenariat pour le parc Lansdowne (PPL) prévoyaient à l’origine tirer une valeur nette potentielle de 10,2 millions de dollars de toutes les possibilités de location ou de vente des droits relatifs à la propriété du dessus résidentiels du parc Lansdowne, à l’exception de la superficie de l’immeuble initialement réservé à la Galerie d’art d’Ottawa (GAO). Le dédommagement relatif aux droits relatifs à la propriété du dessus a été calculé en fonction de la densité de l’aménagement prévu dans les plans préliminaires. Toutefois, le règlement négocié avec la Commission des affaires municipales de l'Ontario (CAMO) réduisait la densité d’aménagement résidentiel, entraînant une diminution de valeur d’environ 3,4 millions de dollars. Cet écart a été comblé par l’inclusion à la demande d’offres de l’aire commerciale réservée à la GAO (immeuble « K » ou parcelle C dans le plan ci-joint, au Document 1), et par des ajustements aux travaux de conception des bâtiments en fonction du zonage approuvé.

Après modification, la valeur des droits relatifs à la propriété du dessus résidentiels, en vertu du rapport au Conseil du 25 août 2011 (ACS2011-CMR-REP-0021), a été évaluée à 10 millions de dollars, déduction faite des coûts d’aménagement essentiels et accessoires liés à la création de structures et de stationnement sous-terrain pour les droits relatifs à la propriété du dessus. Ce montant a été ajusté par rapport à la somme initiale de 10,2 millions de dollars afin d’inclure le rez-de-chaussée de l’immeuble « K ». La valeur de location des droits relatifs à la propriété du dessus commerciaux ne comprenait pas les coûts essentiels et accessoires. Les produits annuels nets, estimés en fonction de la valeur sous-jacente du terrain rattaché aux droits relatifs à la propriété du dessus commerciaux, s’élèvent à 198 000 $.

La demande d’offres, deuxième étape du processus, a été lancée le 7 septembre 2011; elle a été affichée dans MERX et était administrée par la division de l’approvisionnement. Un commissaire à l’équité a été nommé pour veiller à ce que le processus de demande d’offres se déroule de manière ouverte et transparente et que les proposants soient traités équitablement. Vingt-deux (22) demandes ont été soumises pour le document de demande d’offres. Des réunions commerciales confidentielles ont été organisées avec les proposants qui avaient réussi l’évaluation de viabilité. Au total, six (6) promoteurs ont demandé une réunion commerciale confidentielle; ils ont tous réussi l’évaluation de viabilité et participé aux réunions. Ces réunions donnaient l’occasion de clarifier la demande d’offres, en plus de permettre aux proposants de poser des questions relatives aux processus et de prendre part à un échange d’information ouvert au sujet des problèmes relatifs à l’aménagement des droits relatifs à la propriété du dessus.

Le processus de demande d’offres a été mené parallèlement à l’élaboration du plan du site visé par la deuxième étape du PPL et à l’avancement de l’architecture conceptuelle relative à l’aménagement commercial. Par conséquent, les proposants ont manifesté, à l’extérieur des réunions commerciales confidentielles, le besoin d’en savoir davantage au sujet de la conception, des coûts d’aménagement, de l’échéancier des paiements, des conditions légales et du processus global de la demande d’offres. Quatorze addendas ont donc été publiés afin de clarifier et de préciser l’offre de droits relatifs à la propriété du dessus. En raison de la quantité d’information diffusée pendant les mois d’octobre et de novembre 2011, la période de soumission a été prolongée jusqu’au 5 décembre 2011.

Au cours de la demande d’offres, des modifications et des précisions ont été apportées en vue d’améliorer le processus. La plupart de ces ajustements étaient mineurs, à l’exception des deux modifications suivantes :

1. Le niveau du sol de l’immeuble « K », la composante non résidentielle de cet édifice, a été inclus dans l’offre de droits relatifs à la propriété du dessus résidentiels. À l’origine, la Ville avait envisagé de construire et de gérer une partie importante du rez-de-chaussée. Les proposants ont exprimé certaines préoccupations à l’égard des aspects qui rendaient la conservation du rez-de-chaussée par la Ville impossible, notamment les changements de niveau, les répercussions sur le pont, les éléments du stade, l’accès à la surface, les emplacements des entrées, le chargement et les ordures ainsi que des coûts partagés de construction et d’exploitation. L’intégration du rez-de-chaussée de l’immeuble « K » à l’ensemble des droits relatifs à la propriété du dessus résidentiels a permis de résoudre les problèmes de conception soulevés par les proposants, de simplifier la construction et d’éliminer les répercussions sur les finances de la Ville.

2. Un autre ajustement apporté au processus de demande d’offres abordait la question du remboursement, par la Ville, de certains montants collectivement appelés « coûts d’aménagement alloués ». La Ville est responsable des coûts imputés aux composantes de droits relatifs à la propriété du dessus, y compris les coûts essentiels et accessoires du garage de stationnement et de l’infrastructure du site. Les ententes légales du PPL, en cours de négociation avec l’OSEG, obligent la Ville à acquitter ces coûts à l’avance.

Dans la demande d’offres initiale, les proposants devaient estimer une somme pour les coûts d’aménagement alloués dans l’ensemble de leurs offres financières. Cependant, afin de traiter tous les proposants équitablement, la Ville a modifié la demande d’offres de manière à ce que la valeur des coûts d’aménagement alloués soit indiquée, et que les soumissionnaires s’engagent à payer ces coûts à la Ville. Le commissaire à l’équité et Borden Ladner Gervais LLP (BLG) ont appuyé cette modification. En ce qui concerne la composante d’aménagement résidentiel, les coûts d’aménagement alloués s’élevaient à 19 135 000 $. En ce qui a trait à la composante d’aménagement commercial, le montant des coûts d’aménagement alloués s’établissait à 6 955 000 $. Ces montants seraient donc acquittés par le ou les soumissionnaire(s) retenu(s), en plus des offres financières proposées pour leurs droits relatifs à la propriété du dessus respectifs.

À la clôture de la demande d’offres, le 5 décembre 2011, la Ville a reçu trois (3) soumissions résidentielles et toutes ces offres visaient l’achat (plutôt que la location) des droits relatifs à la propriété du dessus. Seulement deux (2) des soumissions ont été approuvées par le comité d’évaluation. La soumission la plus favorable pour la Ville s’élevait à 30 500 000 $.

La Ville a reçu une soumission pour la composante commerciale au terme de la demande d’offres, le 5 décembre 2011. Toutefois, cette soumission n’a pas satisfait aux exigences d’offre obligatoire et n’a donc pas été jugée conforme. Afin de tenter d’obtenir des offres adéquates pour les droits relatifs à la propriété du dessus commerciaux, la demande d’offres a été réémise pour une période de soumission se terminant le 21 décembre 2011. Cette fois, par mesure incitative, les soumissionnaires n’étaient plus tenus de s’engager à acquitter les coûts d’aménagement alloués. Au terme de ce prolongement de la période de demande d’offres pour la composante commerciale, une (1) offre a été soumise, au montant de 3 490 000 $ plus un éventuel paiement à la dixième année du bail, selon le succès de l’aménagement.

BACKGROUND

In June 2010, Council approved moving forward with the development of the LPP with OSEG. Within the LPP framework, the net revenue from the City lease or sale of the air rights at Lansdowne Park was to be used to offset the debenture cost associated with financing the stadium revitalization and the new underground parking garage. In November 2010, Council approved the Integrated Site Plan for Lansdowne Park that sets out directions for development on the entire site. The site plan permits residential and office development above the retail and parking structures. Under the LPP, OSEG has the rights to the retail development and the City retained the ownership of the residential and office air rights.

On 7 September 2010, the Corporate Services and Economic Development Committee (CSEDC) approved report (ACS2010-CMR-REP-0045), that initiated a two-stage process to facilitate the lease or sale of the air rights over the proposed commercial development. The two-stage approach included a Request for Expressions of Interest (REOI) stage followed by a Request for Offers (RFO) stage. The Terms of Reference were amended by CSEDC to indicate that the “preferred option for the City would be to lease the air rights at Lansdowne Park and that the sale of the air rights would be considered a secondary option.”

The REOI process began 1 October 2010 and was administered by the Real Estate Partnerships and Development Office (REPDO) with assistance from the Supply Branch. The purpose of the REOI Stage One process was to gather industry information, ascertain market interest in the air rights and identify development issues associated with the opportunity. The industry feedback obtained in the CCMs was used to craft the RFO Stage Two document in order to be responsive to the needs of the development community and the City. The services of PPI Consulting Limited were retained to help define the process and a Fairness Commissioner was retained to ensure the entire process was fair, open and transparent.

The original schedule included staff reporting the findings of the REOI to Council in January 2011. However, the Friends of Lansdowne legal challenge and OMB appeals to the zoning delayed the process. Preliminary negotiations with the OMB appellants did not take place until March 2011, with unresolved appeals extending into early May 2011. In addition, the design and technical specifications were delayed and had not been fully evolved by January 2011. Releasing the RFO for the lease or sale of the air rights, without detailed technical specifications, greater clarity in legal agreements and assurances with the site plan and design guidelines, would have elicited few, if any, responses from the development industry.

In the interim, City staff, together with outside stakeholders and OSEG, worked on design details and the specifications for the podium infrastructure and residential components. The legal documentation detailing cost sharing and construction management, together with the technical specifications for the podium designs over the retail, reached a point to advance the RFO process. On 25 August 2011, the results of the REOI and the terms of reference for the final stage of the RFO were approved by Council (ACS2011-CMR-REP-0021).

The RFO document was released by Supply Branch and posted on MERX on 7 September 2011. All parties that requested the original REOI document were contacted by Supply Branch and informed of the posting of the RFO document. The RFO end date was set for 15 November 2011 and the intent was to have Preferred Respondents selected for both the office and residential air rights to be brought to Council for approval in mid-December 2011. As in the REOI, the services of BLG, PPI Consulting Limited, and a Fairness Commissioner were retained to ensure the entire process was fair, open, and transparent.

In constructing the RFO document, the lessons learned in the REOI were applied. An important refinement was made to the RFO process in that only those that requested a CCM, passed a viability test, and attended a CCM would be eligible to submit offers on the air rights. Attendance at a CCM to discuss the nuances of the proposed build program within the LPP was viewed as a necessity and therefore a mandatory requirement.

There were twenty-two (22) requests for the RFO document with six (6) developers requesting a CCM and passing the viability test. The six qualified respondents were a mix of local development firms and firms based outside of the City but with experience in building within the Ottawa market. The CCMs were held in October 2011 with respondents having the opportunity to ask any questions related to the process as well as to partake in an open exchange of information with respect to issues associated with the air rights development.

During the RFO process, the technical specifications underlying the development of the air rights and the legal agreements were further refined. The RFO process was conducted concurrent with the development of the LPP Stage Two Site Plan and with the OSEG conceptual architecture for the commercial development. As a result there was a need to provide further details pertaining to design, schedule and development costs. To clarify and refine the air rights offer, a series of addendums were issued. Addendum numbers 1 to 4 were issued on the MERX system and made available to the twenty-two parties that requested the RFO documentation. The final date to request a CCM was 25 October 2011. After this date, only the six qualified respondents that had participated in a CCM were sent the subsequent addendum numbers 5 to 14.

During the RFO process, respondents were permitted to submit questions resulting in over 100 inquiries being made to staff. The questions and answers, updated plans and drawings, legal agreements and report clarifications were assembled and released through the RFO addendums. As a result of the volume of information being released over October and November 2011, the closing date for submissions was extended to 5 December 2011 to ensure enough time was provided to each respondent to assimulate the information presented and, if necessary, seek additional clarification.

The Addenda made refinements and clarifications to the RFO process with most being minor in nature. Two refinements made during the RFO process did have a material influence on how a respondent would calculate an offer price. The first dealt with the non-residential component of Building “K” and the second with requiring bidders to indicate a commitment to pay the Allocated Development Costs to the City. The Allocated Development Cost are certain soft and hard costs for which the City is responsible, including the proportionate share of the cost of the parking structure, infrastructure upgrades and the additional structural costs required for the respective air rights developments, as described in greater detail in the RFO.

Building “K” is the largest of the planned structures being sixty (60) meters in height and located beside the Bank Street Bridge over the Rideau Canal. The grade level non-residential component of Building “K” was not originally included in the air rights offer. The City envisioned constructing the ground floor at its cost and retaining ownership of approximately 13,000 sq. ft. being the net area after deducting the lobby, service and passageways required for the residential building. The cost to create the space was estimated at $2M and was to be carried as a separate project cost by the City. The space was to be leased and the revenue generated used to offset the cost. The permitted uses on the ground floor are restricted under the zoning and by the LPP Site Plan. The permitted uses have minimal commercial value and it was considered high risk that the City would recover in rent the amortized cost to construct the ground level.

To estimate a value for the air rights, a potential respondent would need to determine the saleable area. This process includes the preparation of blocking or massing plans. Respondents, in completing their schematic for Building “K”, expressed concerns over the ground floor design, layout, construction and future operations. Without certainty on design, the influences of elevation changes, Bank Street bridge grades, OSEG stadium elements, surface access points, lobby locations, storage, loading, and garbage all impacted the blocking plans.

Respondent concerns over who would design and construct the ground floor, the integration of the non-residential component into the building above, the sharing of the construction costs, the tenancies and the allocation of future operating costs were having a negative influence on the RFO process. To address these concerns, the practical solution was to let the successful residential air rights developer design from the base of the podium and construct the entire building. By including the ground floor of Building “K” in the residential air rights, significant design concerns of the respondents were eliminated, construction processes were streamlined and the risk to the City of not recovering construction costs was avoided. The ground floor area adds value and its inclusion in the air rights increases the estimated value for the residential air rights back to the original estimate of $10.2M (rounded).

The RFO was revised to address questions on the Allocated Development Costs. Respondents were originally asked to propose an amount as an allowance for the Allocated Development Costs within their financial offers. However, to ensure that all respondents were treated fairly, the City decided to indicate a specific amount for the Allocated Development Costs. Consequently, the City amended the RFO to require bidders to commit to pay the Allocated Development Costs. This enabled respondents to make a financial offer with certainty as to these costs. The Fairness Commissioner and BLG endorsed this change to the RFO process.

The City, working with the project cost consultants and in consultation with the Fairness Commissioner, determined the amount of the Allocated Development Costs. The residential air rights opportunity had Allocated Development Costs in the amount of $19,135,000. The office air rights opportunity had Allocated Development Costs in the amount of $6,955,000. These amounts would be paid by the successful bidder(s) in addition to the financial offers provided for the respective air rights.

The RFO closed on 5 December 2011, with the City receiving three submission packages for the residential air rights and one submission for the office air rights. The only submission received for the office air rights did not meet the minimum bid requirements. As a result, the City re-issued the RFO for the office air rights and required that bids be submitted by 21 December 2011. The re-issued RFO was sent to all qualified Respondents. To address some of the developer risk, and elicit more interest, the requirement that bidders indicate a commitment to pay the Allocated Development Costs attributable to the office was removed. The response at the end of the extension remained at one submission.

As a result of the extension, the report to Council was delayed approximately six (6) weeks. The revised LPP development schedule as of November 2011 contemplates OSEG commencing construction of the parking garage in June 2012 with completion by end of July 2013. The base podium (parking garage) for Building “K” is scheduled to be completed by March 2013 and ready for the air rights developer to commence construction. The retail shell and base podium for Building A1 (or Parcel A1 in the sketch attached) is scheduled to be completed and ready for the residential air rights developer by May 2013. Construction of the Holmwood Townhouse components (or Parcel A2 in the sketch attached) can commence when the underlying parking garage and retail structures are completed in June 2014. The podium for Building “I” (or Parcel B in the sketch attached), the office, will be completed by June 2013 permitting the office development to commence at that time.

The closings of the air rights transactions will be staggered to coincide with these start dates. It is anticipated that the shell structures of Building “I” will be enclosed by the end of June 2014. For stadium operational requirements, it is preferred that all exterior construction be substantially complete by June 2014 so that access to the site will not be impeded by construction equipment. Despite the delay in selecting the preferred respondent(s), the residential and the office components are expected to keep to the LPP schedule with construction to commence in July 2013 and the base buildings (excluding townhomes) to be completed by July 2014.

DISCUSSION

The sale revenue income from the residential air rights is to be used to partially offset the City’s capital contribution to the stadium refurbishment as per the Lansdowne Partnership Plan Implementation Report approved by Council on 28 June 2010 (ACS2010-CMR-REP-0034).

As the LPP designs have advanced, the building envelopes have been refined. The successful respondents will have flexibility to design their buildings within the zoning and site plan regulations and the technical limitations of the podium structures. The Table present in the RFO document in September 2011 provided general guidelines on the available density for each air rights element. The figures presented in the original offering were refined during the RFO process.

Design revisions were made in line with the Lansdowne Design Review Panel (LDRP) guidelines which readjusted the proportions of use within Building A1 and increased the massing of Building “K”. The overall height of Building A1 remained at 42 meters with the apportionment adjusted from 12 to 15 meters to encompass two levels of commercial uses and from 30 to 27 meters to accommodate nine storeys of residential development. The LDRP guidelines also increased the podium base of Building “K” with the permitted height remaining at 60 meters. The revised air rights being offered by the City are outlined below in Table 1: RFO Available Air Right Densities.

|

Table 1. RFO AVAILABLE AIR RIGHT DENSITIES |

||

|

Residential Air Rights |

||

|

Parcel

|

Building Type |

Area Estimated for RFO[1] |

|

A1

(Building A1) |

Residential – High Density (42 metres max. Building height) – 9 storey (27 meters) residential over a 2 storey (15 meters) commercial podium at Bank/Holmwood.

|

61,000 sq. ft. |

|

A2 (Townhouse Blocks) |

Residential – Low Density (12 metres max. Building height) along Holmwood Ave. (4 storey residential at grade to be built over parking structure).

|

49,000 sq. ft.

|

|

C

(Building “K”) |

Residential – High density (60 metres max. height) ground level non residential space included with air rights development.

|

250,000 sq. ft. including amenity space

13,000 sq. ft. non residential ground level |

|

|

Subtotal Residential Density |

373,000 sq. ft. |

|

|

Maximum Number of Residential Units Permitted |

280 units |

|

Non Residential – Office Air Rights |

||

|

B

(Building I) |

Commercial Office (38 metres max. height ) 7 storey office over 1 storey ground floor retail podium to be built by OSEG)

|

100,000 sq. ft.

|

|

|

Subtotal Non Residential |

100,000 sq. ft. |

|

|

Total Available Development Density (Sq. Ft.) |

473,000 sq .ft. |

The City’s objective was to maximize the financial offers for the air rights by creating a competitive environment within the development community. The anticipated value for the air rights is based on the density of development as per zoning criteria and design guidelines. The business model and financial terms previously reported to Council identified a potential value of $10.2M from the lease or sale of the residential air rights at Lansdowne Park. This estimate was revised to $6.8M based on the OMB Minutes of Settlement. The impact of the OMB settlement was offset by the inclusion within the RFO of the building area that had been reserved for the OAG, together with refinements in the building design work based on the approved zoning. The revised estimate of value for the air rights in the RFO was back to the original estimate of $10.2M when all of the residential and non residential components of Building “K” are included.

The business model and financial terms in the LPP Project Framework originally identified the office air rights as having a market rental value of $198,000 per annum. The anticipated rent was to be included in the closed, financial waterfall system and shared by the City and OSEG.

There was no mandatory requirement in the RFO to place offers on both the residential and office components. Residential developers could submit an offer on the residential air rights only, without a requirement to submit an offer on the office air rights. Conversely, an office developer could submit an offer solely on the office air rights without a requirement to submit an offer for the residential air rights. The opportunity remained to place offers to construct on both the residential and office air rights.

The mandatory submission requirements focused on the respondents acknowledging the following key areas:

- Project Schedule

Acknowledge the LPP schedule (as of September 2011) and the key delivery dates and milestones that have an impact on the construction of the air right components;

- Compliance with Design Guidelines

Acknowledge the overarching principles contained in the general architectural guidelines for the Lansdowne site including the LEED requirements and the role of the LDRP in the oversight of the development plan;

- Bid Security

Provide the required deposit funds and acknowledge the payment schedule;

- Financial Capacity

Demonstrate the financial capacity to complete the purchase of the air rights and the construction of the building(s) without the requirement to complete presales/leasing.

The RFO proposal included key requirements that respondents were required to accept. These pertained to the overall development scheme for the LPP and the City obligations and conditions. Key elements were:

- Residential Air Rights as One Package

The complexities of multiple residential projects being constructed simultaneously on a single site by multiple developers would be problematic to manage and control. The residential air rights were bundled under one contract for a single residential developer;

· Leasing/Acquisition of the Designated Parking Stalls

The leasing or acquisition of the 280 designated underground parking spaces was a mandatory requirement for the successful residential developer. The leasing of the 90 underground parking spaces was a mandatory requirement for the successful office developer;

- Commitment to pay Allocated Development Costs

The offers received for the residential air rights were, in addition to their financial offer for the value of the residential air rights, to include a commitment to pay the Allocated Development Costs attributed to the residential development. The Allocated Development costs are specific hard and soft costs that the City is responsible for, including the proportionate share of the cost of the parking structure, infrastructure upgrades and the additional structural costs required for the development of the residential air rights.

In the final amended RFO there was no such requirement for the office air rights developer to pay for the Allocated Development Costs.

Evaluation of proposals received under the RFO process required a team having expertise in real estate development, economic development, development approvals and finance. The evaluation committee for this RFO process consisted of:

· Manager, Realty Initiatives and Development;

· Manager, Realty Services Branch;

· Manager, Development Review (Urban); and

· Representative from the Finance Department.

In order to ensure that all activities associated with the RFO process were carried out with fairness, openness, transparency, and compliance, a Fairness Commissioner oversaw the RFO process together with staff from Supply Branch.

Residential Component of RFO

Upon closing of the RFO on 5 December 2011, the City received three residential air rights submissions. Of the three, only two were qualified by the evaluation committee as being compliant. One submission was disqualified because that proposal only dealt with a portion of the residential air rights and not the entire bundle. The highest qualified offer providing best value to the City is shown below in Table 2: Residential Air Rights.

Table 2. Residential Air Rights

|

|||

|

Respondent

|

Financial Offer |

Allocated Development Costs |

Net Value to the City (Less Allocated Development Costs) |

|

Minto Communities Inc.

|

$30,500,000

|

$19,135,000 |

$11,365,000 |

It was the consensus of the evaluation committee that the purchase proposal submitted by Minto Communities Inc. (Minto Communities) met all the mandatory requirements of the RFO to acquire the air rights for the residential component. Minto Communities submitted the highest responsive financial offer in the amount of $30,500,000. This offer includes the Allocated Development Costs attributable to the residential development of $19,135,000. The total residential air rights financial offer net to the City is $11,365,000.

The residential submissions were based on a purchase of the air rights with no offers to lease. Residential development under a leasehold interest is not common and the ability of the developer to finance construction is more restrictive under a lease scenario. A common theme in the CCMs in both the REOI and the RFO was that the Ottawa housing market was not accustomed to development in leased air rights. The respondents felt there would be potential for market resistance to a residential development on the basis of a leasehold interest for seventy (70) years term of the lease. All respondents felt that a leased project would have a longer sell-out period creating additional risk. The potential for a long sales period, coupled with the requirement to commence construction as early as May 2013 with the building’s shell complete by July 2014 (regardless of pre-sales), created significant financial risk, and precluded an offer under a lease scenario.

Recommendation for Residential Air Rights

The financial offer of the Minto Communities submission exceeds the original expectation of a $10.2M by $1.16M. The Minto Communities proposal for the residential structure provides the City with an opportunity to realize the project objectives of the redevelopment of Lansdowne Park and maximize the financial compensation, while promoting urban intensification, and achieving the sustainability directions set by Council for the residential buildings. Based on the foregoing, staff recommends Minto Communities’ submission to purchase the residential air rights.

Office Component of RFO

The Site Plan proposes a gross office development of approximately 100,000 sq. ft. (or Parcel B, in the sketch attached). At the time of the first closing of the RFO on 5 December 2011, the RFO included a requirement that bidders indicate a commitment to pay the Allocated Development Costs attributed to the office development ($6.95M) in addition to their financial offers for the leasehold interest in the office air rights.

The expectation identified in the LPP Financial Pro Forma estimated the market value of the air rights lease of $198,000 per annum. This anticipated rent for the office air rights was to be included into the closed, financial waterfall system and shared by the City and OSEG.

Two (2) potential bidders indicated an interest in the office air rights during the RFO process. Without a lease agreement in place with a major tenant prior to construction, both parties expressed concerns over the speculative nature of the development. The requirement to commit to pay the Allocated Development Costs attributed to the office development ($6.95M), and the requirement to build as per the LPP schedule, regardless of the status of pre-leasing, placed risk into the business model pro forma. Similar reservations by potential respondents had been reported in the REOI Stage One report (ACS2011-CMR-REP-0021) approved by Council on 25 August 2011, outlined under ‘Results of the REOI Commercial Confidential Meetings’ under “Cautious Interest for the Office Opportunity”.

The RFO closed 5 December 2011 with the City receiving one submission for the office air rights component. The evaluation committee rejected the offer as not meeting the mandatory bid requirements as it failed to include a commitment to pay the full Allocated Development Costs attributed to the office development ($6.95M).

The single submission received on the original closing date was not unexpected. The CCM’s held during the REOI in the fall of 2010 revealed no firm interest for the office air rights. During the CCMs for the RFO, respondents reported that nothing had changed in the market place over the past year to support office development. Staff also discussed the marketability with external real estate consultants which resulted in a number of key observations:

· There is potential risk on the level of rental rates that can be achieved at this location since Lansdowne is not located in the central business district and the level of rents may be more in line with what could be achieved in suburban locations. Since typical suburban office buildings do not have to provide underground parking, this creates significant costs to this development. Whether these additional costs can be captured back through the anticipated rental rates was unknown;

· The size of the office building, at 100,000 sq. ft., is small by downtown core standards. As a result, the cost per square foot to construct at Lansdowne is higher than a similar LEED Gold standard downtown core office building which is typically 300,000 sq. ft. plus in size;

· The leasehold interest, rather than fee simple ownership interest, complicates the mortgage financing;

· The proposed construction schedule and short time frame for a lease marketing campaign, compounds developer risk owing to the potential for vacancy in the immediate post construction period; and

· Market conditions play a factor in the low level of interest in the office air rights. The ability to finance and construct a speculative office building in the current economic climate requires significant equity which not all developers have, or are willing, to invest given the potential risk or reward. Ottawa does not have a large private sector office market and the prospects for tenants are challenging at this time. The current Ottawa office market is somewhat soft with a city wide vacancy of 7% (Cushman Wakefield Office Report 3rd Quarter 2011). The federal government as a potential major tenant is remote as Public Works Government Services (PWGSC) requirements for new office space are typically in blocks greater than 300,000 square feet. In early 2011, PWGSC announced an intention to decrease their Central Business District profile by approximately one million square feet. If implemented this would lead to a more competitive rental market in favour of tenants. Given the current office market condition respondents were concerned that there could be an extended lease-up period for an office development at Lansdowne impacting the project’s profitability.

From a market perspective, these are key factors that need to be considered in determining what the City can expect to earn for the office air rights and therefore what a respondent would offer for the rights at Lansdowne.

Having an office built at Lansdowne is an important element to the LPP project. An office component would help animate the development during the daytime. The construction of an office will also enable the City to recapture part of the overall development cost and provide additional tax revenue.

With no qualified office submissions, staff re-issued the RFO through a final Addendum to the six (6) respondents who had participated in the CCMs. The Addenda contained an extension of the date for bids for the office RFO component to 21 December 2011 and to elicit more interest, the requirement that bidders include a commitment to pay the Allocated Development Costs attributable to the office was removed.

On 21 December 2011, the City received one submission for the office air rights. The evaluation committee reviewed the submission in accordance with the stated project objectives. The Fairness Commissioner scrutinized the evaluation process to ensure that it followed the process stipulated in the RFO document. The result of the re-issued office RFO was a submission from Minto Properties Inc. (Minto Properties) in the amount of $3.49M.

The Minto Properties offer reflects the perceived risk and reward in moving forward with an office development at this point in time. REPDO staff under the guidance of Supply Branch entered into discussions with Minto Properties primarily related to the draft contractual terms being used to create the LPP legal agreements, and timing issues related to how the City and OSEG will address delays in the project and their implications on the office air rights developer. The offer requires certain items to be resolved in further negotiations, including:

1. Finalization of terms acceptable to the respondent within the required agreements governing the LPP including, but not limited to, the following:

(i) Agreement to Lease, in respect of the sublease on the office Air Right Parcel;

(ii) Sublease of the office Air Rights;

(iii) Construction Management Agreement;

(iv) Construction Procedures Agreement;

(v) Reciprocal Agreements;

(vi) Cost Sharing Agreement;

(vii) Lender’s Agreement; and

(viii) Parking Management Agreement.

2. The offer is based on an office construction start date within 100 days of the current scheduled start date for the office of 24 June 2013.

3. Confirmation that the infrastructure is appropriate to support the respondent’s proposed office building.

4. If the LPP is cancelled, or the respondent’s offer is accepted but an Agreement to Lease is not executed by the City of Ottawa by 1 September 2012, then the respondent may withdraw and receive a refund of all deposits (including, without limitation, its bid deposit) paid to date.

During these discussions, the City requested that Minto Properties agree to include an opportunity for the City to receive a further financial benefit in the future if the development exceeds its expected returns that are based on today’s market assumptions. Minto Properties agreed to a participation formula, based on a 10-year horizon that will enable the developer to construct and stabilize the occupancy and revenue of the office development. If specific financial goals are met, the City will participate by receiving a one-time payment at the end of year 10. The financial results are shown in Table 3: Office Air Rights.

Table 3. Office Air Rights

|

|||

|

Respondent

|

Financial Offer |

Allocated Development Costs |

Net Value to the City (Less Allocated Development Costs) |

|

Minto Properties Inc.

|

a) $3,490,000 b) One-time payment in year 10 of stabilized operations based on a 50% share of profit over an internal rate of return of 11% |

$6,955,000 |

($3,465,000) May be reduced in magnitude should an amount described as (b) under the financial offer to be obtained

|

In reviewing the submissions, the City considered three options: 1) reject the submission and not have an office built at Lansdowne; 2) reject the submission and complete the necessary infrastructure in order to support an office sometime in the future when the market conditions warrant; and 3) accept the offer. To assess the financial implications of each option, the LPP project construction budgets were reviewed by the City and outside consultants to determine an order of magnitude in pursuing each option.

Option One - Reject Offer

The rejection of the offer has both qualitative and quantitative impacts. The overall quality of the Lansdowne Project would suffer without the development of an office building to animate the site during regular business hours. Having a multi-use development following the live, work, play planning objectives has always been a desired outcome of the LPP. Excluding an office element would go against these core objectives.

The quantitative impacts start with construction costs and include future operating costs. In the absence of an office building, that portion of the common elements that would have been the responsibility of the office developer will default to the City. The most significant of these costs relate to the parking garage.

The parking garage design is set at 1,370 spaces and the office share to construct 90 spaces is estimated at $4.55M. There would be significant redesign costs to reconfigure the garage plan and delays that could impact on the overall LPP schedule. Furthermore, the Transportation Master Plan prepared and approved is premised on the inclusion of the 90 spaces associated with the office parking being available to support overall parking needs for day-to-day activity and for events. With respect to events, the transportation plan (including off-site parking and associated shuttle services to support various event sizes) is premised on approximately 600 spaces of the total parking being available for event patrons. The remaining parking, which would include the parking for the office and retail elements, would be used to support event periods. Not providing the ninety (90) spaces would put increased pressure for off-site parking, increase demands for shuttles services, and increase potential on-going operational costs that would be carried by the City. As such, staff recommends that the City carry the additional cost to build the ninety (90) spaces as they are necessary for good operations of the integrated site with the retail, stadium, farmer’s market and urban park elements.

By eliminating an office component, some minor reductions to the parking garage costs would occur related to removing access stairs, garbage chute, elevator pit, incremental costs for the shear wall in garage and retail space, office services (storm and water sewer risers) and service vaults. However, the City would be required to pay for most of the parking and other project costs allocated to the office air rights development. The net total amount for the parking and the City’s share of site servicing and other operating items is estimated at $5.65M.

In summary, to reject the Minto Properties office submission would reduce the overall quality of the development at Lansdowne. The City would have less property tax revenue without an office development in the project. To ensure good operations of an integrated site, the City would incur the cost of constructing ninety (90) parking spaces and other LPP development costs that would have been allocated to the office developer in the net amount of $5.65M. The incremental cost of moving forward with the Lansdowne revitalization, without an office component, is $2.19M when compared to accepting the Minto Properties submission.

Option Two - Reject Offer and Build Infrastructure to Permit Future Office Development

As with Option One, the overall quality of the Lansdowne Project would suffer without the development of an office building to animate the site during regular business hours. The delay, until market conditions would support office development, is difficult to forecast. During the interim, the City would not receive any offsetting realty tax revenue and carry all the Allocated Development Costs for the office infrastructure. The risk would be to the City that the value of the lost tax revenue and Allocated Development Costs may not be recovered at a later date.

The quantitative impacts are similar to Option One in that the portion of the common elements that would have been allocated to the office development will default to the City. In addition to the parking garage component for ninety (90) spaces, all the site servicing, public realm landscaping, retail podium and other expenses would apply. Some minor savings would be had in the short term with regard to construction management. However these costs, and more, would be expended at a later date to deal with pedestrian access, vehicle movement during construction and on event days. To prepare the site for future office development would require the City to fund the full $6.95M cost associated with the office air rights.

There would be other sunk costs associated with a delay in constructing the office. Examples of these costs items include:

· The expense for a temporary roof over the ground floor retail plus the cost to remove the roof when the future office structure is built;

· The costs associated with installing the temporary roof top mechanical systems and later redesigning and integrating these into the office development;

· Temporary enclosures to be built and maintained for the elevator shaft and stairwell openings, as well as all slab penetrations for mechanical and electrical;

· The cost to protect the structural elements above the retail and modifications to the structural elements to allow for future connections; and,

· To avoid having to vacate the retail areas and parking garage below, while providing for shoring for the office construction in the future, a transfer slab would need to be built to be able to support the additional loading from the formwork and uncured concrete from above.

The City’s costs would increase to account for the sunk cost elements required to stabilize the OSEG retail development situated below the future office. The additional costs to delay and build at a later date have been assessed by the cost consultants at approximately $1.15M.

In summary, should the City reject the Minto Properties office submission and postpone development, the overall quality of the development at Lansdowne will suffer in the mid- to short-term. Financially, the City would lose tax revenue for the hold period, incur interest carrying costs and be responsible for the total office development costs and the additional sunk costs, for an estimated total amount of $8.1M.

In delaying the office the total aggregate cost to the City is $8.1M as of today. This amount would have to be offset against the value of the office air rights at some future point in time. The longer the hold period, the shorter the term of the air rights lease which reduces the value of the office air rights. There is significant risk to the City that it will not receive a future bid to recover its Allocated Development Costs, sunk costs, interest and lost tax revenue during the hold period.

Option Three – Accept the Minto Properties Inc. Submission

The Minto Properties financial offer has two components. The first component is a guaranteed cash payment in the amount of $3.49M. The second component is a future potential payment based on the success of the office project.

The cash payment is due in a series of instalments with the final payment when the podium is turned over to Minto Properties in July 2013. The second component potentially could be a source of future revenue for the City. The offer includes a provision for a future one-time payment at year 10 and is premised on achieving a set pre-tax investment rate of return. A benchmark internal rate of return (IRR) reflective of the risk/reward for constructing an office on speculation under the terms outlined in the RFO was estimated at 11%. Current reported average rates of return for fully occupied Downtown Class AA office space, with high quality tenants and similar investment horizons, is 7.1% (Altus Group “Valuation Parameters Q4, 2011 Ottawa”). The spread in the submission rate and the current market rates of return corresponds to Minto Properties assuming the risk of building an office on speculation in an untested market location. Should the office development under-perform, there is no recourse against the City as all the financial risk is on Minto Properties. Should the project perform beyond the 11% IRR threshold, the City will participate in the profits on an equal basis (after the 11% threshold) with Minto Properties.

It is difficult to determine what the City could anticipate as a one-time payment in the tenth year. There are many variables that are not known at this time such as the: final cost of construction, net rental rates, lease-up period, interest rates, loan and equity amounts, and the estimate of market value at the end of year ten. The key elements in determining how this profit sharing structure will operate are being defined but will be based upon principles that would be reasonably expected in the private commercial environment. Minto Properties has accepted an open book policy that will let the City determine that the factors in establishing the IRR reflective of normal market conditions. Should the office be a success the City will benefit.

The acceptance of the Minto offer would improve the overall quality of the Lansdowne project by providing animation to the site during regular business hours. There would be no delay in receiving tax revenue and the City would have reduced interest costs. In accepting this offer, the financial impact will be a requirement to increase debt for the project in the amount of $3.46M to cover the shortfall in the office air rights Allocated Development Costs.

The $3.46M will be reduced by the surplus from the sale of the residential air rights of $1.16M. The net financial impact is a requirement to increase debt in the amount of $2.3M.

Recommendation for Office Air Rights

Minto Properties’ submission for the office structure provides the City with an opportunity to realize the project objectives, create better functionality, promote urban intensification, and achieve the sustainability directions set by Council. The cost to the City of $3.46M is less than Option One of $5.65M with no property tax revenue. The Minto submission is less than Option Two which is estimated today at $8.1M for the hard and soft costs together with the sunk costs. There is significant risk in pursuing Option Two as the future rental income (over a shorter lease term) may not cover the $8.1M plus the costs during the hold and construction periods. As a result, staff is recommending that Minto Properties’ proposal to lease the air rights for the office component be approved as set out in this report.

RURAL IMPLICATIONS

N/A

CONSULTATION

The consultation for this project was consistent with the guidelines and best practices established by the Supply Branch and in accordance with the City’s procurement process.

COMMENTS BY THE WARD COUNCILLOR

The implications of this report are city-wide. The ward councillor has been apprised of the recommendations contained in this report.

LEGAL IMPLICATIONS

There are no legal impediments to implementing any of the recommendations in this report.

RISK MANAGEMENT IMPLICATIONS

There are risk implications identified and explained in the report, which are being managed by the appropriate staff.

The actual hard and soft costs elements detailed in the Allocated Development Costs for the residential and office components will not be known until the LPP has been tendered in March 2012. Should these costs be in excess of the estimated Allocated Development Costs ($26.1M), a budget pressure for the City will be created as the City will be responsible for the costs over budget. Should the costs be less, the City will benefit by that amount.

The successful respondents (Minto Communities Inc and Minto Properties Inc.) will be providing down payments for the air rights and for the infrastructure. These amounts will total approximately $7.8M against the City commitment to complete approximately $26.1M worth of Allocated Development Costs. Should both the selected respondents not close on the agreements to purchase and to lease by July 2013, the difference of $18.3M will incur to the City plus miscellaneous costs to temporarily cap the site services. By not closing the City would retain ownership of the 370 parking spaces reserved for the residential and office air rights.

The successful Respondents are expected to negotiate the final terms and conditions in the Legal Agreements for the air rights opportunities. Although the winning bidders and the City are expected to negotiate in good faith, it is possible that the negotiations will not be successful. If that is the case, the City may have to undertake a new process for the sale or lease of those air rights opportunities or consider entering into negotiations with the other Respondent for the Residential air rights parcel.

FINANCIAL IMPLICATIONS

With the approval of the recommendations in this report the City’s debt authority for the Lansdowne Partnership Plan has increased from the original report 9 June 2010 to $124.2M, the City has lost its share of the annual income of $198K on the office lease and the City will incur a short-term carrying cost as a result of front-ending the cost of residential and office podiums and parking. The financial implications are detailed below;

Debt Authority Impact

Residential Air Rights

The original financing plan had debt in the amount of $119.1M and revenue from residential air rights of $10.2M. The revenue from the Minto Coomunities Inc. air rights submission is $11.3M. Staff are recommending that the $1.1M excess from the residential air rights offset the shortfall in the office air rights detailed below. As a result of Motion No. 92/24 Moved by Holmes and seconded by Deans deleting Recommendation 22 of the June 2010 Council Report to waive the Affordable Housing Policy, twenty five percent of air rights proceeds goes to Affordable Housing. This effectively raises the debt authority by $2.8M ($11.3M x 25%) to $121.9M.

Office Air Rights

The recommended submission received from Minto Properties Inc. was $3.5M against the Allocated Development Costs associated with the office podium and parking. This results in a $3.4M shortfall which is partially offset by the excess revenue of $1.1M on residential air rights thereby increasing debt authority by $2.3M. However, the City and Minto are negotiating a future one-time payment dependant on whether or not the Office Project generates an equity internal rate of return greater than 11% at the end of the 12 year construction/holding period. As there is no ability to forecast this amount, it has not been included in the analysis.

The combined impact of the office and residential air rights RFO is to increase the debt authority to $124.2 M. The Council approved 18 August 2011 LLP Financial Pro Forma used an interest rate of 5.0%. The 16 Feb 2012 Lansdowne Partnership Plan Status Update Report ACS2012-CMR-REP-0004 adjusts the City’s interest rate to 4.63%. The increased cost of borrowing due to the increased debt can be absorbed through this rate differential.

Waterfall Payment Impact

The expectation identified in the LPP Financial Pro Forma estimated the market value of the office air rights lease of $198,000 per annum. This anticipated rent for the office air rights was to be included into the closed, financial waterfall system and shared by the City and OSEG. This results in an aggregate net decrease in cash flow to the waterfall of approximately $9.6 million over the 30 year operating term relative to the August 2011 estimate as discussed in Lansdowne Partnership Plan Status Update Report ACS2012-CMR-REP-0004.

Allocated Development Costs (Podium & Parking)

Under the LPP the City is responsible for the Allocated Develoment Costs supporting infrastructure of the air rights. As identified in this report the RFO process has estimated these costs at $26.1M. The residential cost is $19.1M the office cost is $7.0M. The cost is to be recovered from Minto Communities and Minto Properties through a series of deposits with the 1st due upon confirmation as preferred developer, the second upon execution of LPP agreements and the final payment at a close.

The estimated carrying costs to the City for the project during the construction period are $208K. This is calculated using the City’s short-term borrowing cost and assuming any loans would be repaid when revenues are received. The 2012 carrying cost is estimated to be $44K with the remainder falling into 2013. The 2012 budget can absorb the $44K and the 2013 Draft Estimates will reflect investment return using 2013 rates.

In addition it should be noted that the Allocated Development Costs are estimates and final costs will not be known until the procurement process is complete this spring. Final costs, determined though the tender process for this work, will be brought forward to City Council in late spring 2012 for approval prior to construction work commencing at Lansdowne.

ACCESSIBILITY IMPACTS

There are no accessibility impacts to implementing the recommendations in this report.

TECHNOLOGY IMPLICATIONS

Many key technical issues and considerations associated with the Lansdowne development related to matters such as transportation, adequacy of services, and storm water management have been addressed through the work undertaken to develop the LPP and to respond to Council’s November 2009 directions. Other technical issues, more specific to determining development details and conditions for development, will be addressed through the process to finalize the Site Plan Approval and Building Permit approval process.

CITY STRATEGIC PLAN

The Lansdowne Partnership Plan and revitalization initiative which includes the air rights development relate to the following Strategic priorities of Council:

Economic Prosperity

Objective: Promote Ottawa Globally – Revitalizing Lansdowne provides an Ottawa venue for hosting major sporting and cultural events;

Transportation and Mobility

Objective: Promote alternative mobility choices - A key element of the Lansdowne revitalization is putting in place a comprehensive and aggressive TDM program directed to providing facilities to support use of alternative travel options and promotional initiatives to encourage and promote use of sustainable transportation for day to day activities and for events;

Environmental Stewardship

Objective: Improve storm water management - The Lansdowne revitalization will provide for significantly improving the manner in which storm water over the past hundred plus years so as to control flows into the City system to address issues of potential surcharging, decrease storm run off and improve the quality of storm flow to the canal and provide for use of storm water for site irrigation;

Objective: Reduce environmental impact - The Lansdowne revitalization will make effective use of an existing urban site to accommodate a mix of uses, increase greenspace and revitalize a major city facility to contribute to achieving the City's urban sustainability objectives and reduce the environmental impacts of urban growth outside the urban area;

Healthy and Caring Community

Objective: Improve parks, recreation, arts and heritage - The revitalization program provides for re-establishing Lansdowne as a significant urban place that is grounded in the site's history and provides for improving opportunities for sporting and cultural endeavours with a re-purposed stadium and a significant urban park to accommodate events and for day-to- day community use;

Governance, Planning and Decision Making

Objective: Make sustainable choices - the decision to revitalize Lansdowne in a way that recaptures its sense of place and positions it to once again become a dynamic urban place supports and is consistent with making sustainable choices that will improve economic health, cultural virility, and environmental responsibility.

ENVIRONMENTAL IMPLICATIONS

There are no environmental implications associated with the recommendations in this report.

SUPPORTING DOCUMENTATION

Document 1 – Air Rights Development Schematic

DISPOSITION

That following Council approval of the recommendations in this report the City Manager complete the negotiations, finalize and execute the applicable agreements to transfer the residential air rights to Minto Communities Inc. and to lease the office air rights to Minto Properties Inc. and that Finance increase the debt authority for the LPP and create a capital account for the Allocated Development Costs associated with the air rights development.

DOCUMENT 1: Air Rights Development Schematic