|

3. OC Transpo

Pension Plan alternative payment arrangements Autres modalités de

paiement liées au Régime de pension d’OC Transpo |

Commission recommendationS

That

Council:

1. Approve the issuance of

letter(s) of credit to offset some or all of the special payments required to

fund a Solvency Deficit on the OC Transpo Pension Plan in accordance with the

Regulations Amending Certain Regulations Made under the Pension Standards Act.

1985 (Regulations); and

2. Authorize the Treasurer

to apply to the Royal Bank of Canada to provide the letter(s) of credit in an

amount determined by the Treasurer, to enter into a Trust agreement with RBC

Dexia and to do all things necessary to issue such letter(s) of credit.

RecommandationS de la commission

Que le Conseil :

1. approuve

l’émission de lettre(s) de crédit afin de décaler certains ou l’ensemble des

paiements spéciaux requis pour financer

un déficit de solvabilité du Régime de pension d’OC Transpo conformément au

Règlement correctif visant certains règlements pris en vertu de la Loi de 1985 sur les normes de prestation de

pension (le Règlement);

2. autorise

la trésorière à faire une demande auprès de la Banque royale du Canada en vue

d’obtenir la(les) lettre(s) de crédit d’un montant déterminé par la trésorière,

pour conclure une convention de fiducie avec RBC Dexia et de prendre toutes les

mesures nécessaires pour assurer l’émission de cette(ces) lettre(s) de crédit.

DOCUMENTATION

1.

City

Treasurer’s report, dated 5 August 2011 (ACS2011-CMR-FIN-0043).

Report

to/Rapport au :

Transit Commission

Commission du transport en commun

and Council / et au Conseil

5 August 2011 / le 5 août 2011

Submitted by/Soumis par: Marian Simulik,

City Treasurer/Trésorière municipale

Contact

Person/Personne ressource : Mona Monkman, Deputy Treasurer, Corporate Finance/ Trésorière

municipale adjointe-Finances municipales

Finance Department/Service

des finances

613-580-2424

ext./poste 41723,Mona.Monkman@ottawa.ca

|

Ref N°: ACS2011-CMR-FIN-0043 |

SUBJECT:

|

|

|

|

|

OBJET:

|

Autres modalités de paiement liées au

Régime de pension d’OC Transpo |

REPORT RECOMMENDATIONS

That Transit Commission recommend Council:

1. Approve the issuance of letter(s) of

credit[1]

to offset some or all of the special payments required to fund a Solvency

Deficit on the OC Transpo Pension Plan in accordance with the Regulations

Amending Certain Regulations Made under the Pension Standards Act. 1985

(Regulations); and

2. Authorize the Treasurer to apply to the

Royal Bank of Canada to provide the letter(s) of credit in an amount determined

by the Treasurer, to enter into a Trust agreement with RBC Dexia and to do all

things necessary to issue such letter(s) of credit.

RECOMMANDATIONS DU RAPPORT

Que la Commission du transport en commun recommande au Conseil :

1. d’approuver

l’émission de lettre(s) de crédit1 afin

de décaler certains ou l’ensemble des paiements spéciaux requis pour financer un déficit de solvabilité du Régime de

pension d’OC Transpo conformément au Règlement correctif visant

certains règlements pris en vertu de la Loi

de 1985 sur les normes de prestation de pension (le Règlement);

2. d’autoriser

la trésorière à faire une demande auprès de la Banque royale du Canada en vue

d’obtenir la(les) lettre(s) de crédit d’un montant déterminé par la trésorière,

pour conclure une convention de fiducie avec RBC Dexia et de prendre toutes les

mesures nécessaires pour assurer l’émission de cette(ces) lettre(s) de crédit.

BACKGROUND

The OC Transpo Pension Plan was established in 1951 and employees and the employer made contributions to the plan up to January 1, 1999 when OC Transpo staff joined OMERS. As a result the OC Transpo Pension Plan is now a closed pension plan, subject to federal pension plan regulations which continues to be administered by the City. In accordance the Pension Benefits Standards Act 1985, an actuarial valuation is carried out by the plan’s actuaries every three years and is submitted to the Office of Superintendent of Financial Institutions (OSFI). As required by the governing legislation when a plan has a solvency deficit and/or going-concern deficits, special payments (cash contributions) are required in order to return the plan to a solvent position.

Largely as a result of the financial crisis of 2008, declines in equity markets and the prevailing low interest rate environment, the actuarial valuations for the last two years indicate that the OC Plan has both a going concern and a solvency deficit. Since the OC Transpo pension plan is a closed plan there are no contributions being made from employees so any special contributions required to fund plan deficits are to be made by the City. The 2010 and 2011 budgets include $13 million to fund the required special payment.

Pension plans generally have been impacted by prevailing low interest rates which form the basis of the discount rate used to determine the present value of future pension payment obligations. For example, OMERS reported a plan deficit of $4,467 million based on an actuarial valuation of plan net assets. [2] OMERS implemented employee and employer contribution rate increases as a strategy to return the plan to a surplus position. Contribution rate increases were 1% in 2011 and a further planned increase averaging 1% in 2012 and 0.9% in 2013.

On March 25, 2011 the Federal Minister of Finance issued regulations for federally regulated pension plans which among other items, provided details on the use of letters of credit by pension plan sponsors in lieu of making cash contributions for solvency special payments.

There are only a few municipalities in Ontario that have federally regulated pension plans. Generally these are pension plans for transit operations that cross a provincial or national border. The City of Windsor is responsible for the Windsor Transit pension plan which is a federally regulated pension and is subject to the same regulations as the OC Transpo plan. Windsor has recently taken a decision to provide a letter of credit in the amount of $729,000 in lieu of making the full solvency payment in respect of the Windsor Transit pension plan.

The new legislation allows the City the opportunity to reduce its yearly budget expense with respect to this pension plan.

DISCUSSION

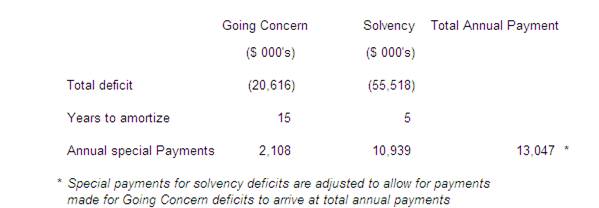

The most recent actuarial valuation of the OC Transpo Pension Plan indicates that special payments are required annually in the amount of $2.1 million to fund a going concern deficit and $10.9 million to fund a solvency deficit, for a total of $13 million. As the OC Transpo Pension Plan is a “closed” plan with no employee contributions, there is no opportunity to change contribution rates, as OMERS did in order to fund plan deficits. The City as plan sponsor and administrator is responsible for funding any deficits. The following table outlines the deficit position and required City of Ottawa contributions.

Amending regulations to the Pension Benefits Standards Act, 1985 took effect on April 1, 2011. These regulations provide for the use of letters of credit in lieu of making special payments to the pension plan to fund solvency deficits. Letters of credit may be issued on behalf of plan sponsors to a trustee for the benefit of the pension plan. The value of all letters of credit issued to reduce solvency payments is limited to 15% of the market value of the plan assets. The letter of credit is payable on demand if there is a default such as the bankruptcy of the employer, the letter of credit is not renewed or notice is provided to cancel the letter of credit or the plan is terminated either voluntary or involuntarily by OSFI.

The use of letter(s) of credit permit plan sponsors to reduce the amount of a special payment. This allows the City to manage the additional contributions to the plan to ensure that the plan is sufficiently funded while avoiding unanticipated increases in payments as a result of an actuarial valuation. Contributions to the plan which result in actuarial surpluses in future years cannot be returned to the City and are retained in the plan.

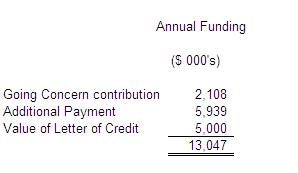

The 2011 adopted budget provided for $13 million for special payments to be made to the OC Transpo Pension Plan to fund actuarial deficits. Of the $13 million, $4.9 million was funded from the Transit Reserve. It is recommended that the letter of credit option be used to reduce the amount of the annual contribution to $8 million. This level of contribution provides the special payments required to fund the going concern deficit and provides for a contribution to fund the solvency deficit. It is anticipated that additional annual contributions of $8 million will be required for the next several years to reduce and eliminate plan deficits. The following is a summary of the annual funding for the plan:

Investment returns, the level of interest rates, the rate of inflation, the number of retirees and life expectancy are some of the factors which will vary and have a direct impact on the actuarial valuation of the plan making it difficult to predict when the plan will return to a solvent basis.

An actuarial valuation will be prepared annually to determine if the plan is returning to a solvent basis and to assess if any adjustments are required to the annual contribution to the fund.

Authority is requested for the Treasurer to arrange for additional letters of credit or increases to issued letters of credit in lieu of special payments to fund solvency deficits up to the limit of 15% of the plan assets as set out in the amending pension plan regulations. With plan assets of $511.8 million as at December 31, 2010 the maximum amount of letters of credit is $76.7 million.

RBC Dexia acts as the plan’s custodian and holds all plan investments. The Regulations require a trustee to hold any letters of credit which are provided by plan sponsors. RBC Dexia is agreeable to act as trustee for this purpose and has provided a draft agreement for signature by the City.

RURAL IMPLICATIONS

There are no rural implications to implementing the proposed recommendations in this report.

CONSULTATION

The public consultation process is not applicable.

COMMENTS BY WARD COUNCILLOR(S)

This is a City Wide item.

LEGAL/RISK MANAGEMENT IMPLICATIONS

There are no legal impediments to implementing the recommendations in this report.

TECHNICAL IMPLICATIONS

There are no technical implications.

FINANCIAL IMPLICATIONS

The use of letters of credit as provided in the amending regulations reduces the amount of the annual contribution to the OC Transpo Pension Plan while leaving the annual payment at a level which is expected to eliminate the plan deficits over time.

The adopted budget provides for $12.927 million in pension contributions; with $4.858 million funded from a contribution from the Transit Reserve. The recommendations in this report will reduce the budgeted expenditure to $8 million and the elimination of the contribution from the Transit Reserve.

SUPPORTING DOCUMENTATION

N/A

DISPOSITION

If the recommendations are approved, this report will be submitted to City Council for its consideration at the next available Council meeting.