|

3. RFO PROCESS – Lease or sale of Air Rights AT lANSDOWNE PARK Processus de demande d’offres – location ou vente des droits aériens au parc lANSDOWNE

|

COMMITTEE RECOMMENDATIONS

That Council:

1. Receive the findings of the Request for Expressions of Interest (REOI) Stage One for the lease or sale of the Air Rights at Lansdowne Park; and

2. Approve the release of the Request for Offers (RFO) Stage Two to select real estate builders/developers to either lease or purchase the air rights at Lansdowne Park as outlined in this report.

RECOMMANDATIONS DU COMITÉ

Que le Conseil :

1. reçoit les résultats de la première étape, la demande de déclarations d’intérêt, pour la location ou la vente des droits aériens au parc Lansdowne; et

2. approuve la mise en œuvre de la deuxième étape, la demande d’offres, afin de sélectionner les entrepreneurs ou promoteurs immobiliers qui loueront ou achèteront les droits aériens du parc Lansdowne, comme le présente ce rapport.

DOCUMENTATION

1. City Manager’s report dated 11 August 2011 (ACS2011-CMR-REP-0021).

2. Extract of Finance and Economic Development Committee Minutes dated 18 August 2011

Report to/Rapport au:

Council / et au Conseil

11 August 2011 / le 11 Août 2011

Submitted by/Soumis par: Kent Kirkpatrick, City Manager / Directeur municipal

Contact Person/Personne ressource : Gordon MacNair, Director, Real Estate Partnerships and Development Office/Directeur, Partenariats et Développement en immobilier

(613) 580-2424 x 21217, Gordon.MacNair@Ottawa.ca

|

Ref N°: ACS2011-CMR-REP-0021 |

SUBJECT: |

RFO PROCESS – Lease or sale of Air Rights AT lANSDOWNE PARK |

|

|

|

OBJET : |

Processus de demande d’offres – location ou vente des droits aériens au parc lANSDOWNE

|

REPORT RECOMMENDATIONS

That Finance and Economic Development Committee recommend that Council:

1. Receive the findings of the Request for Expressions of Interest (REOI) Stage One for the lease or sale of the Air Rights at Lansdowne Park; and

2. Approve the release of the Request for Offers (RFO) Stage Two to select real estate builders/developers to either lease or purchase the air rights at Lansdowne Park as outlined in this report.

RECOMMANDATIONS DU RAPPORT

Que le Comité des finances et du développement économique recommande au Conseil :

1. de recevoir les résultats de la première étape, la demande de déclarations d’intérêt, pour la location ou la vente des droits aériens au parc Lansdowne; et

2. d’approuver la mise en œuvre de la deuxième étape, la demande d’offres, afin de sélectionner les entrepreneurs ou promoteurs immobiliers qui loueront ou achèteront les droits aériens du parc Lansdowne, comme le présente ce rapport.

EXECUTIVE SUMMARY

This report responds to direction to staff on 7 September 2010 to move forward with a two-stage process for the lease or sale of the air rights for the residential and the lease of the air rights for the office above the proposed retail and parking structure at Lansdowne Park. It presents the results of the Request for Expressions of Interest (REOI), Stage One and seeks approval to continue with the Request for Offers (RFO), Stage Two to select real estate developers to either lease or purchase the air rights at Lansdowne Park.

The REOI, Stage One process, which began in late September 2010, was designed to gather industry feedback, measure market interest in the air rights, and identify development issues associated with the opportunity. This information will be used to ensure the RFO, Stage Two is responsive to the needs of the development community while maximizing the financial return to the City. A Fairness Commissioner was retained to ensure the REOI was open, transparent, and Respondents were treated equally.

This report details the results of the REOI, in which there was significant interest, with 26 requests for the REOI document. Commercial Confidential Meetings (CCMs) were arranged for Respondents requesting more detail and clarification. The purpose of these meetings was to anchor key elements of the RFO and provide an opportunity for Respondents to ask any questions that they may have related to the process as well as to partake in an open exchange of information with respect to issues associated with the air rights development.

Feedback indicated an interest in residential opportunities, with more limited interest in the office opportunity. A desire for clarity was identified with a need to provide further details regarding design, development costs, timing for payments, legal conditions, and the overall process when the RFO is issued.

The original schedule included a report on the findings of the REOI being tabled in January 2011. However, due to The Friends of Lansdowne legal challenge and OMB appeals to the zoning, the process was delayed. The negotiations with the OMB appellants did not take place until March 2011 with unresolved appeals extending into early May 2011. As a result, the design and technical specifications had not evolved by January 2011 to support moving forward with the RFO. Releasing the RFO without detailed technical specifications, greater clarity in legal agreements, and complete site plan and design guidelines, would have likely elicited few, if any, responses from the development industry.

As a result of the CCMs, together with the negotiated OMB Settlement, and through the advancement of the Integrated Site Plan, the scope of the air rights development opportunity has been refined with new terms of reference and timelines. The details of these are outlined in this report.

The business model and financial terms in the LPP Project Framework originally identified potential net value of $10.2 million from the lease or sale of all the residential air rights opportunities at Lansdowne Park exclusive of building area reserved for the Ottawa Art Gallery (OAG). The compensation for the air rights was based on the estimated density of development as per preliminary plans. The OMB settlement, which reduced the density of residential development, will have a negative impact on the estimate of value anticipated for the air rights. It is estimated that the loss of residential density will cause a reduction in value of approximately $3.4 million. This will be offset by the inclusion within the RFO of the building area that had been reserved for the OAG, together with refinements in the building design work based on the approved zoning. The revised net value estimate for the air rights is $10 million.

The RFO process includes the opportunity for both residential and office developers to bid for the air rights opportunities at Lansdowne. The City will seek the Best Offer for air rights, so the RFO will be an open and inclusive, flexible, and allow proposals to include offers on both the sale or lease of air rights so that the City can determine the Best Offer. Staff will report to Council on the outcome of the RFO and for final approval of the Preferred Developer(s).

SOMMAIRE EXECUTIF

Ce rapport répond aux directives données au personnel le 7 septembre 2010 concernant la mise en œuvre d’un processus en deux étapes en vue de la location ou de la vente des droits aériens des aménagements résidentiels et commerciaux ci-dessus et de la structure de vente au détail et de stationnement proposée au parc Lansdowne. Il présente les résultats de la première étape, la demande de déclarations d’intérêt, et attend l’autorisation de donner suite à la deuxième étape, la demande d’offres, afin de sélectionner les promoteurs immobiliers qui loueront ou achèteront les droits aériens du parc Lansdowne.

Le processus de demande de déclarations d’intérêt, entamé à la fin de septembre 2010, a été conçu afin de recueillir des renseignements du secteur, de mesurer l’intérêt du marché envers les droits aériens et de relever les problèmes d’aménagement relatifs à cette possibilité. Ces données feront en sorte que la demande d’offres réponde aux besoins des acteurs du secteur immobilier et maximise le rendement financier pour la Ville. Un commissaire à l’équité a été nommé afin de garantir que la demande de déclarations d’intérêt se déroule de manière ouverte et transparente et que les répondants soient traités équitablement.

Ce rapport explique en détail les résultats de ce processus qui a soulevé beaucoup d’intérêt, avec 26 demandes. Des réunions commerciales confidentielles ont été organisées afin de fournir plus de détails et d’explications aux dirigeants municipaux qui le souhaitaient. L’objectif de ces réunions était de bien définir les éléments clés de la demande d’offres, mais aussi de permettre aux proposants de poser des questions relatives aux processus et de prendre part à un échange d’information ouvert au sujet des problèmes relatifs à l’aménagement des droits aériens.

Les proposants ont manifesté plus d’intérêt envers le secteur résidentiel qu’envers le secteur commercial. Ils ont indiqué souhaiter en savoir plus au sujet de la conception, des coûts d’aménagement, de l’échéancier des paiements, des conditions légales et du processus global au moment de la diffusion de la demande d’offres.

L’échéancier d’origine incluait un rapport sur les résultats de la déclaration d’intérêts présentés en janvier 2011. Cependant, le processus a été retardé en raison de la bataille juridique avec les Amis de Lansdowne et des appels de la Commission des affaires municipales de l'Ontario (CAMO) relatifs au zonage. Les négociations avec les appelants de la CAMO n’ont eu lieu qu’en mars 2011 et les appels non résolus se sont prolongés jusqu’au début de mai 2011. Par conséquent, la conception et les spécifications techniques qui devaient appuyer la demande d’offres n’ont pas été élaborées avant janvier 2011. La publication de la demande d’offre sans spécifications techniques détaillées, sans explications supplémentaires quant aux ententes légales, sans plan de site complet et sans lignes directrices de conception aurait probablement réduit fortement le nombre de propositions des promoteurs, le cas échéant.

À la suite des réunions commerciales confidentielles, du règlement négocié avec la CAMO et de l’évolution du Plan d'implantation intégré, la portée de la possibilité d’aménagement des droits aériens a été précisée par de nouveaux paramètres et un nouvel échéancier. Les détails sont explicités dans ce rapport.

Le modèle opérationnel et les aspects financiers du cadre de partenariat pour le parc Lansdowne (PPL) prévoyaient à l’origine tirer une valeur nette potentielle de 10,2 millions de dollars de toutes les possibilités de location ou de vente des droits aériens résidentiels du parc Lansdowne, à l’exception de la superficie de l’immeuble réservé à la Galerie d’art d’Ottawa (GAO). Le dédommagement relatif aux droits aériens a été calculé en fonction de la densité de l’aménagement prévu dans les plans préliminaires. Le règlement négocié avec la CAMO, qui réduisait la densité d’aménagement résidentiel, aura des répercussions négatives sur la valeur anticipée des droits aériens. La perte de revenus des droits aériens liés à la baisse de la densité résidentielle est estimée à 3,4 millions de dollars. Cet écart sera en partie comblé par l’inclusion à la demande d’offres de l’aire commerciale réservée à la GAO et par des ajustements aux travaux de conception des bâtiments en fonction du zonage approuvé. Après révision, la valeur nette des droits aériens est estimée à 10 millions de dollars.

Le processus de demande d’offres permet aux promoteurs résidentiels et commerciaux de présenter des soumissions relatives aux droits aériens de Lansdowne. La demande d’offres, ouverte, inclusive et souple, permettra aux soumissionnaires d’inclure à la fois des offres de vente et de location pour que la Ville puisse déterminer quelle est la meilleure offre. Le personnel présentera les résultats de la demande d’offres au Conseil municipal, qui donnera l’approbation finale aux promoteurs privilégiés.

BACKGROUND

In June 2010, Council approved moving forward with developing the Lansdowne Park Partnership Plan (LPP) with the Ottawa Sports and Entertainment Group (OSEG). Within the LPP framework, revenue from the City lease/sale of the air rights at Lansdowne Park was to be used to offset the debenture cost associated with financing the stadium revitalization and the new parking garage. Council in November 2010 approved the Integrated Site Plan for Lansdowne Park that sets out directions for development on the entire site including the Urban Park Plan. As part of the site plan approval process, residential and office development is permitted above the retail and parking structure. Under the LPP, OSEG has the rights to the retail development and the City has retained the ownership of the residential and office air rights.

On September 7, 2010, the Corporate Services and Economic Development Committee (CSEDC) approved a report (ACS2010-CMR-REP-0045), to initiate a two-stage process to facilitate the lease/sale of the air rights over the proposed commercial development. The two stage approach included a Request For Expressions of Interest (REOI) stage followed by a Request For Offers (RFO) stage. The Terms of Reference were amended by CSEDC to indicate that the “preferred option for the City would be to lease the air rights at Lansdowne Park and that the sale of the air rights would be considered a secondary option.”

The REOI process began in late September 2010 and was administered by the Real Estate Partnerships and Development Office (REPDO) with assistance from Supply Branch. The services of PPI Consulting Limited were retained to help in defining the process and a Fairness Commissioner was retained to ensure the REOI was fair, open and transparent.

The purpose of the REOI Stage One process was to gather industry intelligence and to ascertain market interest in the air rights and identify development issues associated with the opportunity. The industry feedback obtained in the CCMs conducted in the REOI was used to craft the RFO, Stage Two document in order to be responsive to the needs of the development community while maximizing the financial return to the City. Industry engagement was critical to the process. Public notices of the REOI were placed with industry associations/trade publications (e.g. BOMA), local and national newspapers (e.g. Ottawa Citizen and Globe and Mail) and on MERX.

Staff prepared presentation boards and attended the Ottawa Real Estate Forum in October 2010 where representation from both the local and national development communities were present. Interested parties were directed to contact Supply Branch for a copy of the REOI document. During the REOI process a total of 26 inquiries were made to Supply Branch for REOI documents.

The original schedule had staff reporting the findings of the REOI to Council in January 2011. The Friends of Lansdowne legal challenge and OMB appeals to the zoning delayed the process. Preliminary negotiations with the OMB appellants did not take place until March 2011 with unresolved appeals extending into early May 2011. In addition, the design and technical specifications had not evolved by January 2011 to support moving forward with the RFO. Releasing the RFO for the lease/sale of the air rights, without detailed technical specifications, greater clarity in legal agreements, and assurances with the site plan and design guidelines, would have elicited few, if any, responses from the development industry.

In the interim, City staff together with outside agencies/stakeholders, and OSEG have been working on design details and the needed specifications for the podium and retail components. The legal documentation detailing the cost sharing and construction management, together with the technical specifications for the podium design over the retail, have reached a point to advance the RFO process. This report presents the results of REOI Stage One and seeks approval to continue with the RFO, Stage Two.

DISCUSSION

Project Schedule Update

The revised LPP development schedule contemplates OSEG commencing construction of the parking garage in the second quarter of 2012, with the retail shell structures completed by June 2013 and the final interior fit-up by mid to late 2014. OSEG is planning for the stadium to be ready by June 2014 for the Canadian Football League season and to possibly host a FIFA Soccer Event. For stadium operational requirements, it is preferred that all OSEG construction be substantially complete by June 2014 so that access to the site will not be impeded by construction equipment. The construction schedule for the residential and office components must work back from these dates to ensure the site in unencumbered by construction equipment by June 2014.

The issuance of the RFO is proposed to commence in late August 2011. The procurement process will run until early November 2011. The evaluation and selection process will be concluded by the end of November 2011 with Council confirming the outcome in early December 2011.

Concerns were raised over the original schedule given the various unknown factors. The development of the LPP has helped in clarifying some of the ambiguities in the original schedule as refinements and updates are ongoing. The original schedule had approximately 4 weeks allocated for contract development/coordination and finalizing the project agreements for the successful developer(s). In the CCMs, all the Respondents indicated that due to the complexities of this project a period of 2 to 3 months was more appropriate to finalize the project agreements. To address this issue, the schedule for the RFO has been adjusted to include a period of approximately 3 months to coordinate with OSEG and complete the project agreements by mid March 2012.

The finalization of the residential and office planning approvals and issuance of building permits are to be completed over a 12-13 month period. The residential pre-construction sales and office leasing would be completed concurrent to the planning and building permit approvals. The residential and the office components are expected to be tendered in April 2013 with construction to commence in June 2013 with substantial completion by July 2014. The response in the CCMs was that this timeframe (duration) from permit to substantial completion was aggressive. However, given the two stage site plan approval process for the Lansdowne revitalization provides for Site Plan Approval to accommodate the air rights development in advance of the RFO process being concluded, the timeframe for construction was possible.

The revised timeframe and the Project Gantt Chart for the RFO is shown in Document 1, RFO - Anticipated Project Schedule. A summary of the Document is presented below in Chart #1.

|

Chart #1 Anticipated Project Schedule for Residential and Office Air Rights Development

|

||

|

Task/Event Pre-Selection |

Start Date |

End Date |

|

1. Issue RFO - Stage 2 on MERX |

Late Aug. 2011 |

Early Nov. 2011 |

|

2. Conduct CCMs |

Mid Sept. 2011 |

Late Oct. 2011 |

|

3. Evaluate Submissions |

Early Nov. 2011 |

Mid Nov. 2011 |

|

4. Prepare Report to Committee & Council |

Early Nov. 2011 |

Early Dec. 2011 |

|

5. Council Meeting/Select Preferred Offeror |

|

|

|

6. Contract Coordination Preferred Offeror/City/OSEG |

Mid Dec. 2011 |

Mid Mar. 2012 |

|

7. OSEG Tenders for Construction of Garage/Podium |

Mid Jan. 2012 |

Late Mar. 2012 |

|

8. Production of Final LPP and Air Rights Agreements |

Late Mar. 2012 |

Mid May 2012 |

|

9. Office/Residential Design Work and Presales/leasing |

Late May 2012 |

April 2013 |

|

10. OSEG Construction of Garage/Podiums |

Late May 2012 |

June 2013 |

|

11. Building Permits for Residential and Office |

Late Oct. 2012 |

Late Jan. 2013 |

|

12. Tender& Construct Residential & Office Components |

Early Apr. 2013 |

July 2014 |

Results of the REOI Commercial Confidential Meetings

An integral part of the REOI process was to refine the technical specifications underlying the development of the air rights in combination with the legal partnership agreements. The cornerstone of the REOI process was the CCMs with interested Builders/Developers. Requesting a CCM was not a mandatory requirement for a Potential Offeror in Stage One, but highly recommended. In order to qualify for a CCM, a Viability Test was used to screen those Respondents capable of constructing a project of the size and scope envisioned for the air rights component was part of the REOI. The Respondents requesting a CCM all passed the Viability Test and were granted a meeting. The Respondents were a mix of local development firms and firms based outside of the City but with experience in building within the Ottawa market. The CCM component of the REOI process began on November 2, 2010 and concluded on December 9, 2010.

The CCMs were an opportunity for both the City and the Respondent to partake in an open exchange of information. The focus was to ensure that new and emerging issues associated with the air rights development were brought to the table during the REOI, Stage One. The Respondents signed a “Non-Disclosure Agreement” before undertaking the CCM. To manage the complexity and variety of pertinent information in the CCMs, the City established a panel of subject matter experts assembled from Finance, REPDO, Supply Branch, and Planning and Growth Management. In addition, the City engaged a commercial banking consultant to address the commercial financing component of developing air rights and an architect to assist in integrating the OSEG proposed commercial development and the air rights proposal. In attendance at all the meetings was a Fairness Commissioner to ensure impartial and confidential meetings.

During the CCMs, staff presented the development opportunity, the proposed schedule and special considerations. There was a free flow of questions and exchange of dialogue between Respondents and the City’s experts. The CCMs ranged in length from 2.5 to 3 hours and the information collected was aggregated and synthesized. Apart from scheduling concerns that were addressed above, there were ten key elements that surfaced in the CCMs. Each element below is identified and evaluated to assist in determining the Terms of Reference for the RFO, Stage Two document.

1. An interest in the residential opportunities (although primarily on a purchase basis as opposed to a lease basis).

CCM Respondents felt there was value in the air rights and that a market for residential product existed. Consistent in the CCMs was that each Respondent anticipated market resistance to a condominium development on the basis of a lease fee interest. A common theme was that the Ottawa market was not accustomed to this type of development on leased land. Furthermore, the notion of air rights, under a lease or purchase option has the potential for a longer sell out period creating additional risk for the developer. This would have a negative impact on the air rights value in a lease scenario. However, all CCM Respondents were amenable to price the air rights opportunity and place a bid under both a lease and purchase option.

The complexities of multiple residential projects being constructed simultaneously on a single site by multiple developers would be problematic to manage and control. In discussions with the CCM Respondents, OSEG, and with the City’s consultants, staff concluded that in the RFO, Stage Two the residential air rights be bundled under one contract for a single residential developer. One residential developer managing construction and having a single encompassing marketing strategy would be cost effective and likely generate best value for the residential air rights.

2. Cautious interest for the office opportunity.

All but one of the CCM Respondents felt that speculative office space development of 90,000 to 100,000 sq. ft. held significant risk. Without a lease agreement for an office tenant in place prior to construction, little interest was expressed in this component of the air rights. Requiring a mandatory office component in the bundle of residential air rights could limit the number of offers.

To maximize the number of offers the RFO, Stage Two will be divided into separate office and residential air right components. There will be no mandatory requirement to place offers on both the residential and office components in order to qualify. This latitude in the process will permit a residential developer to submit an offer only on the residential air rights and not be required to submit an offer on the office air rights. Conversely, an office developer will have the opportunity to submit an offer solely on the office air rights and not be required to submit a bid for the residential air rights. The opportunity remains for developers to place offers to construct on both the residential and office air rights. It is anticipated that this flexibility will increase the number of offers from across the development community.

3. A need to understand the design constraints to be imposed by the Lansdowne Design Review Panel (LDRP).

There was uncertainty at the time of the REOI over the design constraints and the level of influence/control of the Lansdowne Design Review Panel. Since that time, through the process of finalizing the Site Plan approval and consistent with the conditions imposed by Council, the process for the design review of the air rights elements has become more defined. This process mirrors and is consistent with the normal design review process that all development subject to design review and approval would follow. In the case of the air rights development however, because the site plan approval will have been concluded, the design review will focus on architecture and ensuring integration with the overall architectural design for the base buildings and ensure responsiveness to the Architectural and Building Design Guidelines set out in the Integrated Site Plan Implementation Design Manual. The LDRP will be involved in setting the broad design directions to augment the broad guidelines noted and that would be specific to realizing the integration objectives of the air rights architecture with the podium designs. The LDRP would also review and approve conceptual architectural designs. This would be considered the pre-consultation stage under the normal design review process. The city wide Urban Design Review Panel (UDRP) would review and provide comments on the final architectural plans prior to permits being issued.

Details related to expectations and requirements for the air rights development with respect to design and review process will be clearly documented in the RFO. The UDRP will be consulted in the development of the RFO design criteria in order to provide Respondents with clarity and consistency in the review process. It is not anticipated that the design constraints will impact on the City’s ability to obtain best value for the air rights development.

4. A need to understand the limitations imposed by the podium design being constructed by OSEG.

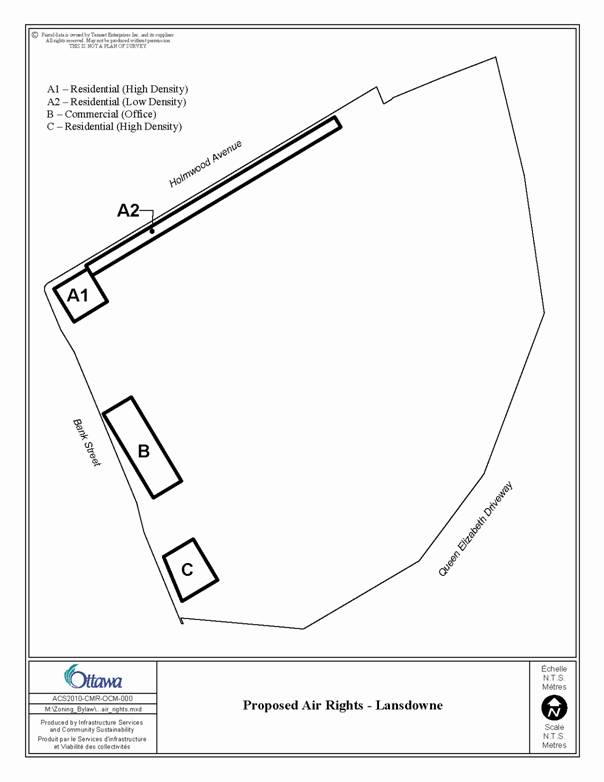

At the time of the REOI, there were no plans or drawings produced by OSEG that detailed the podium and the constraints created by the retail uses and underground parking structure. For the residential towers (Blocks A and C as shown on Document 2 - Proposed Air Rights Development) the current option is to construct a transfer slab over the retail that will permit unfettered spacing of the retail columns at grade while giving the greatest flexibility to the residential column grid on the upper floors. It is anticipated that a design based on a transfer slab will be sufficiently advanced by mid August 2011, with a retail plan outlining uses, to be included in the RFO as an addenda to address these concerns. The additional cost of the transfer slab will be based on the incremental costs to the retail and parking garage components associated with the slab construction. The design for the office podium (Block B as shown on Document 2) can be accommodated over the retail design without incurring cost for a transfer slab.

5. A need to understand the hard and soft development costs that they will have to bear if they are the Preferred Developer.

Issues were raised in the CCMs relating to the office and residential construction and how the hard and soft costs are to be assigned and any costs for alterations to the proposed plans. In response, staff and OSEG developed cost formulas to determine fair and reasonable proportionate allocations of the soft and hard development costs.

The Site Plan has now been signed off/approved by the LDRP. Sign off/approval by the LDRP on the conceptual architectural plans for the OSEG development is expected in September 2011. This will then allow for the Stage 2 site plan approval to be finalized. As a result, the Offerors will not have to incur any of the soft costs related to the development of the Site Plan and will benefit from the advance planning work. The successful developer(s) will only be responsible for obtaining the necessary building permits and remittance of the development fees and charges associated to their specific plans. The approved Site Plan will create an element of certainty in the RFO process and staff anticipate that the advanced planning work completed by OSEG and the City will be reflected in higher offers to lease or buy the air rights.

The RFO will require the Offeror(s) to bid for the air rights in November 2011. The LPP Project costs will not be known until after the tender is completed in March 2012. For the air rights developer(s) to commit prior to the tender creates uncertainty/risk that would place downward pressure on the value of the air rights. To counter balance for the uncertainty and risk, the City will assume the responsibility for the hard costs attributable to the air right components. The successful air rights developer(s) will not be involved in the cost allocation with OSEG and are free to submit a straightforward offer for the air rights inclusive of the podium base and associated hard costs. The offers received for the air rights will represent a “gross” amount and include a value for the real estate components together with a value attributable to the hard cost to account for the:

- Underground parking garage , inclusive of access stairs, elevators, service areas for mechanical and electrical, garbage and storage areas provided within the parking structure;

- Production of basic building services for power, water, gas, storm and sanitary sewers to accommodate the anticipated development;

- Incremental costs to create the supporting podium structures, including transfer slabs (if applicable);

- Common elements outside of the air rights envelope such as lobby areas, stairwells, and loading bays within the ground floor retail components; and

- Common landscaping elements.

The lease or sale of the residential air rights opportunities was estimated to have a net value of $10.2M. The value calculation for the air rights was based on the estimated density of development - the gross developable area established for each building envelope as per the OSEG design concept. The $10.2M was the estimated net amount anticipated to be received by the City after the soft and hard costs to create the air rights opportunity were deducted. The face value of the offers for the air rights will in fact be higher but the offer price will consider a gross amount to account for both the hard and the soft costs incurred by the City on behalf of the developer.

The successful air rights developer(s) will be required to enter into reciprocal agreements with the City and OSEG to deal with shared facility operating costs and other similar matters of mutual interest or requirements in the “go forward”. The business terms will be presented in the RFO, however, the actual costs and proportionate shares will not be known until all construction is near completion.

6. The office air rights will only be offered under a lease scenario. The City would also like to examine a lease option for the residential air rights. What would be the term of the residential and office lease agreements?

Residential development under a lease fee interest is not common. The ability of the developer to finance construction is more restrictive under a lease scenario. Critical to the project financing is the term of the lease. Based on the industry feedback, advice from experts retained to advise staff, and the business terms of the LPP, the recommended length of term for the residential air rights is 70 years with the recommended length of term for the office air rights set at 50 years.

The lease commencement would be on the signing of the project agreements by the City, OSEG and the successful air rights developer(s). The general lease terms would be net to the City with an annual payment. The air rights developers will be required to state the annual payments over the term of the lease which would include the hard and soft development costs and escalations for inflation. For the RFO evaluation the lease income will be converted to an equivalent onetime payment applying a present value formula using a market discount rate.

7. A need to understand the timing for payments for the air rights under either a lease or purchase and for the shared development costs.

The CCMs revealed that the Respondents all wanted to delay payments for the air rights and development costs for as long as possible. The developer of the air rights is required to construct regardless of the performance of presales and there is the possibility that standard commercial construction financing may not be available due to the contracted schedule to build. The desire to delay payment is balanced against the City’s need to ensure that the successful developer(s) has the financial capacity to close on the agreements and begin construction without presales. The RFO will mitigate some of the financial risk to the City by requesting letters from the bank or lending institution commenting on the financial strength of the developer(s).

A progress payment schedule will be developed for both a lease and a purchase of the air rights. The situation is quite novel as the successful developer(s) will be required to start construction regardless of the presales or preleasing levels. To ensure that construction of the office and residential components is undertaken in the timeframes set out on the LPP Schedule, a deposit representing 15% of the value of the purchase offer, or the present value of the lease offer, will be required on signing. Both scenarios of lease or purchase will require progressive payments by the successful developer(s) linked to the construction schedule and it is anticipated that the City will receive its gross payment for the air rights, inclusive of soft and hard costs, at the time residential and office construction begins in second quarter of 2013.

The most significant development cost to be included with the air rights is for the underground parking. A total of 370 spaces were originally reserved within the LPP for the air rights component. The parking was apportioned with 90 spaces attributed to the office at one space per 1,000 sq. ft. and 280 spaces attributed to the residential uses. There is no requirement to use all the assigned parking and the zoning permits 0.5 parking spaces per residential dwelling unit. The final parking requirement, and total cost, was impacted by the OMB and is discussed later in this report.

The construction of the parking garage will be funded by the City. A proportionate share of the parking garage will be recovered from OSEG under the LPP Cost Sharing Agreement. Through the lease or sale of the air rights the City will receive additional compensation from the office and residential developer(s) towards the parking garage.

8. A need to understand the legal terms and conditions of the opportunity.

The Legal Agreement negotiations for the LPP are ongoing with an anticipated completion date of August 2011. The project agreements are anticipated to close once all costs are known in May 2012. In preparation of the RFO, staff are working with the City’s legal team to produce a set of business terms and governing legal principles. These will form part of the RFO document. During the RFO, before the final project agreements are signed, the successful developer(s) will have some limited opportunity for input into the development of the Tri-party agreements (early December 2011 to the end of January 2012).

It is important to note that the Stage Two Site Plan Approval will impose constraints and guidelines that will form part of the legal agreements. The site plan has been crafted to accommodate minor adjustments/modifications to the building footprint. Input will be limited and will deal with refining the schedule and certain detailing of the design.

9. A desire to have the podium and air rights projects achieve architectural consistency.

In Council’s Stage 1 approval of the integrated site plan, specific directions and requirements related to building design and architecture to be reflected through conceptual architectural plans, and in the final architectural plans for all new development have been set out. The conditions included in the site plan approval further requires that both conceptual architectural plans and final architectural plans for the exterior design treatment and elements for all new development be reviewed by the City’s Urban Design Review Panel (UDRP) and be approved prior to permits being issued. This matter relates to the item previous discussed dealing with the LDRP process and will be set out in the RFO documents. The UDRP will be consulted in the development of the RFO document.

10. A desire to understand the overall RFO process including:

a. A preference for having the City evaluate the quality of design, even if the overall objectives for the City are to maximize the financial contribution.

Some Respondents expressed a desire to have their designs evaluated during the RFO process. The City has communicated during the CCMs that there will be a suite of technical pass/fail hurdles and that the design requirements are to meet the requirements of Council as expressed in its approval of the Integrated Site Plan. Further clarification on expectations, as previously noted will be set out in the RFO document.

b. The LEED requirements in the process.

Respondents asked if the City will be seeking LEED certification and how it will be incorporated into the process. Staff confirmed to the Respondents that buildings are to be designed to achieve the LEED New Construction sustainability targets set for new development through the site plan approval given by Council. In responding to conditions set out in the Stage 1 approval of the site plan, the City’s sustainability consultant has developed a document to achieve the sustainability directions set by Council for both the site and for buildings. These directions require that buildings incorporate sustainability features that will support the Site LEED ND certification that is required to strive for the Gold designation. To support this, the RFO will require that the air rights elements to be developed over the OSEG podiums along Bank Street be designed to LEED NC Gold and that they be certified under LEED. The approach and strategy to incorporate sustainability requirements in the buildings will involve the City’s sustainability consultant who would work with the building design teams of the successful air rights developer(s) as they begin to develop concept designs to identify key elements that will need to be included to achieve the required LEED NC Gold certification. Air rights developers would also have the option of retaining their own LEED consultants to work with their design teams to achieve the LEED requirements for the air rights elements. This could include the air rights developers retaining the City’s consultant. The objective is to provide flexibility to the air rights developers towards achieving the required sustainability certification for the air rights elements.

The street level Holmwood Avenue residential will not require certification under LEED or be developed to a LEED target given that LEED is not well geared to low rise ground oriented residential projects. Rather, this element will be required to be constructed to a residential sustainability standard such as R2000 or Energy Star.

Impact of the Ontario Municipal Board Settlement

There were fourteen OMB appeals to the LPP zoning. Two appeals where withdrawn and the City reached a settlement with three plaintiff groups representing nine appellants that resulted in a reduction in the developable area and minor site adjustments. A hearing was held in May 2011 to address the three remaining appeals. On June 15th 2011, the OMB dismissed the appeals and accepted the amended zoning by-law proposed by the City that resulted from the settlement process with the three appellant groups.

The OMB Minutes of Settlement required that the mid-rise residential development that fronted on Holmwood Avenue (102,000 sq.ft.) be removed from the overall development program. In addition, the high rise residential building at the corner of Bank Street and Holmwood Avenue (Parcel A1) was reduced in building height from 12 to 10 storeys above the 2 storey retail podium. The Minutes of Settlement also capped the overall development of residential dwelling units at a maximum of 280. The new development scheme is shown in Document 2 – Proposed Air Rights Development. By reducing the density of residential development the OMB settlement had a negative impact on the estimate of value anticipated for the residential air rights. The loss of residential density along Holmwood Avenue corresponds to an unadjusted decrease in value for the air rights of approximately $3.4 million.

It is important to note that the original REOI Stage One estimate for developable area of 308,000 sq. ft. (218,000 sq. ft. residential and 90,000 sq. ft. non residential) was provided as a guideline. The volume of the air rights was based on preliminary work completed by the OSEG design team based on a set of design assumptions. In the CCMs it was made clear that these figures could be adjusted to reflect a Respondent’s specific design provided it was compliant with the final zoning regulation, specific requirements set out in the conditions included as part of the Stage 1 Site Plan Approval and be responsive to the City’s design guideline documents. Council approval of the zoning in November 2010, changes to the Site Plan based on OMB decisions, and further advances in the residential design, have refined the building area (volume) of the air rights for the RFO, Stage Two. Under the current design guidelines the RFO revised building areas are 278,000 sq. ft. residential and 90,000 sq. ft. office for a total of 368,000 sq. ft. The modifications to the air rights offering as a result of both refinements to the design and the Minutes of Settlement are shown in Chart 2 - Revised Air Rights Development Densities. The chart outlines the amount of development density reported in the REOI, Stage One and the revised estimates for the RFO, Stage Two.

|

Chart #2 REVISED AIR RIGHTS DEVELOPMENT DENSITIES

|

|||

|

Parcel |

Building Type |

Areas Estimated in REOI |

Areas Estimated for RFO * |

|

A |

Residential – High Density (52 metres max. Height – 12 storey residential over a 2 storey commercial podium to be built by OSEG.

Design Refined & OMB Adjusted Revised building envelope with reduction in building height by two storeys to 10. |

67,000 sq. ft..

--- |

---

66,000 sq. ft. |

|

A |

Residential – Medium Density (30 metres max. Height – 4 - 5 storey residential over a 2 storey commercial/retail podium to be built by OSEG)

Design Refined & OMB Adjusted Elimination of this component |

102,000 sq. ft.

--- |

---

0 |

|

A |

Residential – Low Density (12 metres max. Height) along Holmwood Ave. (4 storey residential at grade) Design Refined & OMB Adjusted Unchanged |

49,000 sq. ft.

--- |

---

49,000 sq. ft. |

|

C (Building K) |

Under a separate RFO tied to OAG Residential – High density (66 metres max height)

Design Refined Residential – High density (66 metres max height) One level amenity space & 14 storeys residential)

|

60,000 sq. ft. Residential

--- |

---

150,000 sq. ft. Residential 13,000 sq. ft. amenity |

|

|

Subtotal Residential Density |

278,000 sq. ft. |

278,000 sq. ft. |

|

|

Maximum Number of Residential Units Permitted |

None Specified |

280 units |

|

|

|

|

|

|

B |

Commercial Office (38 metres max. Height ) 7 storey office over 1 storey ground floor retail podium to be built by OSEG)

Design Refined & OMB Adjusted Unchanged |

90,000

---

|

---

90,000 |

|

C (Building K)

|

Under a separate RFO tied to OAG

Design Refined Commercial space (One storey of 13,000 sq. ft) at Bank Street at bridge over canal over parking garage that is to be built by OSEG |

45,000 sq. ft. OAG

--- |

---

13,000** |

|

|

Subtotal Commercial Space (Air Rights) |

135,000 sq. ft. |

90,000 sq. ft. |

|

|

Total Development Density (Sq. Ft.) |

413,000 sq. ft. |

368,000 sq .ft. |

* As per OMB Minutes of Settlement and advanced design work

**The ground level commercial/retail space (13,000 sq. ft.) is to be retained by the City and is not included in the air rights RFO.

The design work for Parcel A1, the Holmwood Avenue residential tower, has advanced with the approval of the Site Plan. The RFO will present this element of the air rights as having an estimated building area of 66,000 sq. ft. to be constructed over ten storeys. The reduction in building height, as set out in the OMB settlement, will not impact on the anticipated value for the air rights as the revised gross building size is similar to the original estimate of 67,000 sq. ft. Similarly, the townhouse development (Parcel A2) opportunity remains unchanged and represents a buildable area of approximately 49,000 square feet in the RFO.

The original buildable area cited in the REOI, Stage One excluded Parcel C, the site at Rideau Canal and Bank Street quadrant (also referenced on the OSEG Plan as Building K). The City had intended to issue a separate RFO for Parcel C (Building K). This element of the air rights was envisioned for a separate mixed-use development with the Ottawa Art Gallery (OAG) occupying 45,000 sq. ft. and a residential tower above the gallery of 60,000 sq. ft. The option to relocate the OAG has been withdrawn and Parcel C can be offered for lease or sale as part of the RFO air rights package.

The residential tower footprint for Building K has been analyzed and the estimated building area for the residential air rights component is 150,000 sq. ft. This buildable area is above the original design estimate of 60,000 sq. ft. and offsets much of the lost density from the OMB Minutes of Settlement with the deletion of the Holmwood Avenue mid rise elements.

The City holds separately from the LPP the development rights for two levels of non residential use over the parking structure within Building K. The RFO will include the upper level of this space as part of the residential air rights package thereby increasing the air rights opportunity. The successful residential developer would benefit by including this space (estimated at 13,000 sq. ft.) into their development scheme. The second floor will function as a separation between the retail/commercial use on the ground level and the residential use that commence at the third level. Staff anticipate that this space will be used for residential amenities such as private gymnasium, building management office, party room etc. Accordingly, the offers for the residential air rights will be positively impacted with the ability to incorporate this additional space into the development.

The City has reserved for the exclusive use of the residential developer a total of 280 underground parking spaces. To reflect the changes in density brought on as a result of the OMB Settlement, and to manage construction costs by keeping the underground parking on one level, the City has elected to reduce the number of parking stalls reserved for the residential air rights. The design of the parking structure is under development with a completion date in September 2011. The anticipated number of underground parking spaces to be included in the residential air rights is 250-280 spaces. The assumption is that not all residential units will require a parking space. The lease/purchase of the designated underground parking spaces will be a mandatory requirement for the successful residential developer.

The Site Plan will enable an office developer to construct 90,000 square feet of rentable space (Parcel B). There are 90 parking spaces reserved for the office air rights as per the zoning requirements. This figure remains unchanged and will be a mandatory acquisition under a lease arrangement for the successful office developer. The business model and financial terms in the LPP Project Framework originally identified the office space air rights as having a market rental value of $198,000 per annum. This potential revenue stream is not impacted by the OMB settlement, nor have market conditions changed to deviated from this forecast. The anticipated rent, in the range of $198,000 per annum, will be included in the closed, financial waterfall system and shared by the City and OSEG.

By not locating the OAG at Lansdowne Park, the City now has under its control approximately 13,000 sq. ft. of rentable ground level space in Building K. This space was not included in the original value estimate of the air rights. It will be located on Bank Street, but below the grade of the bridge that extends over the Rideau Canal. It will have inferior retail/commercial attributes and the permitted uses may be constrained in the context of the zoning limits placed on total allowable gross leasable area for retail type uses. Potential uses for the ground floor could be uses accessory or ancillary to the stadium (such as a team sports store for the CFL and/or soccer franchises, offices for these franchises), a place of assembly with additional community type uses, some minor retail provided that the area fits within the overall gross leasable area limit for retail type uses. A determination on the use of the ground floor will be made prior the RFO process being concluded and would be reported to bidders for the air rights through an addendum to the RFO documents. The cost to create the space is estimated at $2M and will be carried as a separate project cost by the City. The ground level unit will be leased and the revenue generated will either be incorporated into the LPP, or maintained as a separate City asset and held externally to the LPP.

Purpose and Objectives of the RFO Process

The City’s Official Plan promotes urban intensification. In keeping with these policies and principles, Council approved a rezoning for the Lansdowne site to permit retail uses as well as the low, medium and high rise residential and office uses which are the subject of the REOI, Stage One process. Within the LPP Project Agreements, the City retains the air rights above the OSEG retail development and parking structure. The estimated density of the air rights is 278,000 square feet of residential and amenity space and 90,000 square feet of office space. The total estimate of gross developable area to be offered for lease or sale is 368,000 square feet.

The City anticipates that compensation for the air rights will be based on the density of development as per zoning criteria and design guidelines. The business model and financial terms in the LPP project framework identified potential value of $10.2M from the lease or sale of the residential air rights at Lansdowne Park. This estimate was revised based on the OMB Minutes of Settlement to $6.8 million. The impact of the OMB is offset by the inclusion within the RFO of the building area that had been reserved for the OAG, together with refinements in the building design work based on the approved zoning. The revised estimate of value for the air rights in the RFO is $10M.

The lease/sale income is to be used to partially offset the City’s capital contribution to the stadium refurbishment. In the course of Council’s consideration and, subsequently, approval of the Lansdowne Partnership Plan Implementation Report on June 28, 2010 a number of Motions were passed which refined or amended a number of the original recommendations in the Report. One such Motion, being Motion NO. 92/42, provided, in part, for “…the sale or lease, at the sole option of the City, of air rights…for residential development”.

Nevertheless, the LPP Project Agreement Framework (Document 18 of the Report) that was approved by Council on the same date provided that one of the deductions in the formula to calculate the City’s “Funding Equity” would be the “net proceeds received by the City for the sale of residential air rights”. Consequently, although the City has complete discretion to choose whether it will lease or sell the air rights for residential development, the amount of the highest responsive bid received for the sale of the air rights is the figure that will be inserted into the formula for calculating the City’s “Funding Equity”. This amount may thus be different from the actual amount of money received by the City should it elect to enter into a long-term lease of the air rights with a bidder but not to sell them outright.

RFO Methodology

The City’s objective is to maximize its financial offers for the air rights subject to an offer meeting its needs. The RFO methodology is simple in design and process. The intent is to solicit a wide market appeal and create a competitive environment within the development community. As a result, staff recommends that the City proceed directly with a RFO on the basis that:

- The timing of the process will be based on the milestone schedule set out in this report;

- It proceed on the basis of mandatory requirement phases as set out in Document 3 of this report;

- The financial proposals identify the maximum value to the City.

Evaluation Team

Evaluation of proposals received under the RFO process described in this report will require a team having expertise in real estate development, economic development, development approvals and finance.

As a result, it is proposed that the evaluation committee for this RFO process consist of:

· Manager, Realty Initiatives and Development;

· Manager, Realty Services Branch

· Manager, Development Review (Urban); and

· Representative from the Finance Department.

Fairness Commissioner

In order to ensure that all activities associated with the RFO process are carried out with fairness, openness, transparency, and compliance, a Fairness Commissioner will oversee the RFO process.

CONSULTATION

The process will include a media announcement in September as an opportunity overview for potential Offerors followed by the scheduling of CCMs to ensure an informed development community prior to release of the RFO.

COMMENTS BY THE WARD COUNCILLOR(S)

Staff meet with Councillor Chernushenko on June 27 to provide an overview of the report.

LEGAL IMPLICATIONS

There are no legal impediments to implementing the recommendations in this report. Commercial Confidential Meetings are permissible in a competitive process when structured appropriately. Legal Services has been consulted throughout the progress of this matter.

CITY STRATEGIC PLAN

The proposed development of air rights with the LPP aligns with the City Strategic Plan. The development program respects the existing urban fabric, neighbourhood form, and the limits of existing hard services, so that the revitalized Lansdowne is integrated seamlessly with both the local community and larger city fabric.

TECHNICAL IMPLICATIONS

Many key technical issues and considerations associated with the Lansdowne development related to matters such as transportation, adequacy of services, and stormwater management have been addressed through the work undertaken to develop the LPP and to respond to Council’s November 2009 directions. Other technical issues, more specific to determining development details and conditions for development, will be addressed through the process to finalize the Site Plan Approval and Building Permit approval process.

FINANCIAL IMPLICATIONS

There will be no financial implications subject to achieving the lease or sale of the residential air rights at the forecast net amount $10.2M. In the event that this forecast amount is not received the City will be obliged to find other sources to finance the shortfall of the residential component under its contribution requirements to the LPP agreement.

There will be no financial implications subject to achieving the lease of the office air rights at the forecast annual net rental of $198,000. Should there be no submission to lease the office air rights there will be a short fall in the revenue assigned to the closed system of this amount.

ENVIRONMENTAL IMPLICATIONS

There are no environmental implications associated with the recommendations in this report.

DISPOSITION

Subject to Committee and Council approval, staff will implement the recommendations as outlined in the report.

SUPPORTING DOCUMENTATION

Document 1: RFO Anticipated Project Schedule

Document 2: Proposed Air Rights Development

Document 3: RFO Evaluation Criteria

DOCUMENT 1: RFO - Anticipated Project Schedule

|

Chart #1 RFO Anticipated Project Schedule Air Rights Development |

||

|

Task/Event |

Start Date |

End Date |

|

1. Finalize RFO Document |

Aug 11 2011 |

Aug 24 2011 |

|

2. Issue RFO Stage 2 on MERX |

Aug 29 2011 |

|

|

3. Open Period of RFO |

Aug 30 2011 |

Nov 04 2011 |

|

4. Conduct CCMs |

Sept 07 2011 |

Oct 21 2011 |

|

5. Receive and Evaluate Submissions |

Nov 7 2011 |

Nov 18 2011 |

|

6. Draft Report to Committee & Council |

Nov 14 2011 |

Nov 25 2011 |

|

7. Release Report |

Nov 29 2011 |

|

|

8. FEDCO Meeting |

Dec 06 2011 |

|

|

9. Council Meeting |

Dec 14 2011 |

|

|

10. Notify Selected Proponent |

Dec 15 2011 |

|

|

11. Contract Coordination and Development of Management Documents with OSEG |

Dec 19 2011 |

Mar 09 2012 |

|

12. Conduct Preliminary Design- Residential/ Office |

Dec 19 2011 |

June 29 2012 |

|

13. OSEG- Tender and Evaluation of Documents for LPP Pricing |

Jan 26 2012 |

Apr 23 2012 |

|

14. Production and Approval of all Final LPP Legal Agreements |

Apr 24 2012 |

June 29 2012 |

|

15. OSEG- Commence Parking Construction |

July 03 2012 |

Jan 16 2014 |

|

16. OSEG- Commence Retail Construction forming platforms for Residential & Office (Buildings A, I &K) |

June 10 2013 |

|

|

17. Complete Design Residential/Office |

May 07 2012 |

Aug 31 2012 |

|

18. Residential Presales/Leasing by Selected Offeror |

May 17 2012 |

June 2013 |

|

19. Building Permit Application Process Residential/Office |

Mar 01 2013 |

Mar 29 2013 |

|

20. Tender Residential and Office Components |

Apr 01 2013 |

May 30 2013 |

|

21. OSEG- Completion of Residential and Office Platforms |

June 10 2013 |

Sept 12 2013 |

|

22. Residential & Office Construction- Selected Proponent(s) |

Sept 13 2013 |

Feb 10 2015 |

|

23. Construction of Holmwood Townhomes |

May 26 2014 |

Feb 10 2015 |

|

24. Post Construction Sales |

Sept 29 2014 |

Feb 10 2015 |

DOCUMENT 2: Proposed Air Rights Development

DOCUMENT 3: RFO Evaluation Criteria

Selection Process for the Air Rights Project

1.0 INTRODUCTION

The purpose of this document is to present a draft selection process for the Request for Offer (RFO) for the lease or sale of the air rights associated with the Lansdowne Partnership Plan (LPP).

2.0 SELECTION METHODOLOGY

The selection of the Preferred Offeror consists of three (3) stages, as outlined below. Stage I, will be evaluated on a Qualify / Not Qualify basis for each response requirement. This is to ensure the City receives Offers from competent and experienced Offerors. The three (3) stages are as follows:

1. Stage I – Mandatory Submission Requirements and Mandatory Project Requirements

2. Stage II – Financial Offer

3. Stage III – Due Diligence

Stage I – Mandatory Submission Requirements and Mandatory Project Requirements

Stage I will consist of a review to determine which Offers comply with all of the Mandatory Submission Requirements and Mandatory Project Requirements. Offers that do not comply with all of the Mandatory Submission Requirements and Mandatory Project Requirements will be disqualified and not evaluated further. Offerors must pass all of the Mandatory Submission Requirements and Mandatory Project Requirements in order to proceed to Stage II, evaluation of Financial Offers.

The Mandatory Submission Requirements and Mandatory Project Requirements apply to offers pertaining to the residential development and/or office development opportunity and may include but not limited to the following:

Mandatory Submission Requirements

- Residential developers pertaining to the residential development must identify the two (2) most relevant design build projects the company has completed in the last six (6) years, having a total construction cost of $15 million or more, including illustrative materials.

- Office developers pertaining to the office development must identify the two (2) most relevant office design-build projects the company has completed in the last six (6) years, having at least 50,000 square feet or have a contract value in excess of $7,000,000 million. In the event that the developer and constructor are separate legal entities, sample projects are required of each entity.

· Developers must include a timeline for the development of the air rights indicating completion of construction no later than June 2014.

· Developers must provide a statement of design and development Intent indicating its overall strategy for implementing its design and development vision for the site.

· Developers must provide a security in the amount of Fifty Thousand Canadian Dollars ($50,000.00).

Mandatory Project Requirements

· The development proposal for the air rights is reviewed in conjunction with the underlying OSEG development and must receive final Stage 2 Site Plan Approval.

· The development proposal for the air rights must be reviewed and approved in accordance with the policies and procedures of the City’s Urban Design Review Panel (DRP).

- The high-rise components along Bank Street must be built and certified to LEED NC Gold standards.

- The developer must provide Project references for the Architect and the LEED consultant.

Stage II – Financial Offer

Offerors who meet all of the Mandatory Submission Requirements and Mandatory Project Requirements in Stage I will be considered for Stage II. A Financial Offer may be made for the development of the residential air rights and/or the development of the office air rights. Offerors have the option of leasing or purchasing the air rights on the residential component and/or the option of leasing the air rights on the office component. Offerors may submit on both options.

The maximum Offer that includes the lease of the air rights for the residential component will be identified. Then, the maximum Offer that includes the sale of the air rights for the residential component will be identified. As per City Council direction, the preferred option is to lease the air rights on the residential component. The sale of air rights for the residential component would only be considered as a secondary option.

Under the Basis of Selection, Offerors can submit a Financial Offer as follows:

Option 1 – Lease or Sale of the Air Rights for the Residential Component

- All lease offer(s) will be compared in determining the Highest Financial Lease Offer.

- All sale offer(s) will be compared in determining the Highest Financial Sale Offer.

The City will apply a Net Present Value (NPV) on the lease offer(s). The NPV of the lease offer(s) will then be compared to the sale offer(s) in determining the Highest Financial Overall Offer. The City retains the right to select either lease or sale it deems in the best interest of the City irrespective of the outcome of the NPV.

Option 2 – Lease of the Air Rights for the Office Component

- All lease offer(s) will be compared in determining the Highest Financial Lease Offer.

Stage III – Due Diligence (Optional, at discretion of the City)

Stage III is optional at the sole discretion of the City. Stage III will consist of a Due Diligence phase to review the certainty, reasonableness and comprehensiveness of each Offeror’ Financial Proposal. The City reserves the right to seek clarification of any of the elements contained in the Offer and to contact the people named in the project references in order to confirm the information provided. Offerors are expected to cooperate in providing clarification on any of the components of their Offer. Offerors that fail to satisfy the due diligence phase will not be given any further consideration.

Subject to the satisfactory completion of the Due Diligence stage, staff will recommend to Committee and Council a Preferred Offeror. The acceptance of the Offer is subject to Council approval.