|

1.

DEVELOPMENT CHARGES POLICY REPORT

RAPPORT SUR LA POLITIQUE DES REDEVANCES

D’AMÉNAGEMENT

|

Committee recommendations as

amended

That Council

approve:

1. The revised City of Ottawa Development Charge Background Study

dated June 8, 2009 and the City of Ottawa Area-Specific Development Charge

Background Study dated June 8, 2009, issued separately, with the following

amendments:

a. That the three large area

Single Dwelling Unit (SDU) residential rates as described in the City of Ottawa

Development Charges Background Study, dated June 8, 2009 be amended, based on

anticipated funding from the Stimulus Program, as follows: Inside the Greenbelt

SDU charge of $15,536 (was $16,111), Outside the Greenbelt SDU charge of

$22,071 (was $22,546) and Rural SDU charge of $14,769 (was $15,244);

b. That the Non-residential General development

charge be amended, based on anticipated funding from the Stimulus Program, as

follows: $16.06 per square foot for full service rate (was $16.63),

Non-residential Commercial/Institutional/Industrial rate be capped at $13.01

(was $13.47) and that the (full service) rate for Limited Industrial uses be

set at $7.39 (was $7.65);

2. That the current list of non-statutory

exemptions, subject to the proposed transitional provisions, be modified as

follows:

a. That

the development charge exemptions for non-profit health care facilities be

limited to the portion that is not reimbursed or subsidized by either the

Provincial or Federal government;

b.

The

types of non-profit uses that will be exempt by resolution of Council was

narrowed to include child care and long term care facilities, which are both

municipally mandated services;

c.

The

residential Development Charges exemption within

the designated areas fronting lsabella Street and Chamberlain Avenue, was

removed;

d. The

area-based exemption for residential properties in downtown Ottawa will be

discontinued after two years, as of August 1, 2011, and no transitional

provisions will apply;

3. That

rates be indexed on an annual basis, commencing on August 1, 2010 in accordance

with the Statistics Canada Infrastructure Development Charges Price Index;

4. That

the current Development Charges

By-laws be repealed and that the successor general development charge by-law

and the area-specific stormwater by-laws, substantially in the form and content

included in the City of Ottawa Development

Charges Background Study, dated June 8, 2009 and the City of Ottawa

Area-specific Development

Charges Background Study for Individual Stormwater Management Ponds and

Drainage Systems, dated June 8, 2009 be enacted;

5. The

policy regarding front-ending agreements as detailed in Document 3 be approved

including the provision for the award of contracts for front-ended works upon

certification by an independent engineer that the contract provides for a

competitive price;

6. Subject to 2(d), that owners who have filed a building

permit application prior to September 15, 2009 and obtain a building permit

prior to December 31, 2009 be subject to the lesser of the total rates in place

as of June 23, 2009 and June 25, 2009;

7. That

the requirement for being eligible for current provisions within the exemption

zone be based on entering into an approved site plan agreement with the City

before the end of the 24-month transition time frame;

8. That

the requirement for being eligible for current provisions provided to the

application of redevelopment

credits applied to the demolition of buildings that are statutorily exempt be

based on entering into an approved site plan agreement with the City before the

end of the 24-month transition time frame;

9. That

the proposed increase in the development charge rates be phased in, according

to the following schedule:

a. From

the time of by-law enforce date to January 15, 2010 the rates in the current

by-law will be in effect;

b. January

16, 2010 to January 15, 2011 - current rates plus 25 per cent of difference

between current and calculated charges;

c. January

16, 2011 to January 15, 2012 - current rates plus 50 per cent of difference

between current and calculated charges;

d. January

16, 2012 to January 15, 2013 - current rates plus 75 per cent of difference

between current and calculated charges;

e. January

16, 2013 to by-law expiry - full calculated rates;

10. That

the timing of payment of non-residential development charges be calculated in

two instalments - the non-discounted portion of the charge shall be paid at the

time of issuance of the building permit and the discounted portion of the

charge shall be payable at a maximum of two years from the date of issuance of

the initial building permit subject to certain conditions. This option will not be available to

institutional developments;

11. That

the development in the vicinity of transit stations reduction due to the

proximity to rapid transit networks are consistent with the zoning by-law;

12. That the

redevelopment of land credits be amended so that any demolitions of

pre-existing residential and non-residential buildings that have taken place

prior to the passage of the new by-law, excluding a type of use exempt from

paying development charges, be subject to redevelopment credit expiry period

ending January 1, 2019;

13. That

as part of the passage of the main by-law a mid-term review will be undertaken

to determine if sufficient revenue is being contributed to meet

development-related cost requirements;

14. That

pursuant to the Development Charges Act, subsection 12(3), no further

notice or meeting is required.

RecommandationS MODIFIÉES DU Comité

Que le Conseil :

1. approuve la version révisée de l’étude

préliminaire sur les redevances d’aménagement de la Ville d’Ottawa du

8 juin 2009 et l’étude préliminaire sur les redevances d’aménagement

d’application particulière de la Ville d’Ottawa du 8 juin 2009, études

qui ont été publiées séparément, sous réserve des modifications

suivantes :

a. modification des trois taux résidentiels pour

les unités d’habitation individuelles des grands secteurs décrits dans l’étude

préliminaire sur les redevances d’aménagement de la Ville d’Ottawa du

8 juin 2009, en fonction du financement prévu dans le cadre du programme

d’incitation, soit : redevances de 15 536 $ pour les unités à

l’intérieur de la Ceinture de verdure (au lieu de 16 111 $), de 22 071 $

pour les unités à l’extérieur de la Ceinture de verdure (au lieu de

22 546 $) et de 14 769 $ pour les unités en milieu rural

(au lieu de 15 244 $);

b. modification des redevances d’aménagement

générales pour les unités non résidentielles en fonction du financement prévu

dans le cadre du programme d’incitation, soit : établissement du taux

tous services compris à 16,06 $ le pied carré (au lieu de 16,63 $),

plafonnement du taux pour les unités non résidentielles des secteurs

commercial, institutionnel et industriel à 13,01 $ (au lieu de

13,47 $) et établissement du taux (tous services compris) pour les unités

à usage industriel limité à 7,39 $ (au lieu de 7,65 $);

2. modifie

la liste actuelle des exemptions non prescrites, sous réserve des dispositions

transitoires proposées, à savoir :

a. que

les exonérations de redevances d’aménagement pour les installations de soins de

santé sans but lucratif soient limitées à la portion qui n’est pas remboursée

ou qui est subventionnée soit par le gouvernement fédéral ou le gouvernement

provincial;

b. les types d’utilisations à but non lucratif

qui seront exemptés par résolution du Conseil ont été mieux définis pour

inclure les services de garde d’enfants et les établissements de soins de

longue durée, lesquels sont des services mandatés par la municipalité;

c. l’exemption de redevances d’aménagement

résidentiel dans les zones désignées donnant sur la rue Isabella et l’avenue

Chamberlain a été supprimée;

d. exonération

pour les propriétés résidentielles du centreville d’Ottawa sera supprimée après

deux ans, au 1er août 2011, et aucune disposition

transitoire ne s’appliquera;

3. indexe les taux sur une base annuelle à

partir du 1er août 2010, conformément à l’indice des prix de

Statistique Canada pour les redevances d’aménagement d’infrastructures;

4. abroge les règlements actuels sur les

redevances d’aménagement et adopter le nouveau règlement général sur les

redevances d’aménagement et les règlements sur les eaux pluviales propres à

certains emplacements, essentiellement selon la forme et le contenu de l’étude

préliminaire sur les redevances d’aménagement de la Ville d’Ottawa, en date du

8 juin 2009, et de l’étude préliminaire sur les redevances

d’aménagement d’application particulière de la Ville d’Ottawa relativement aux

systèmes individuels de gestion des eaux pluviales et de drainage, en date du

8 juin 2009;

5. approuve la politique concernant les

ententes de financement préalable décrite dans le document 3, y compris la

disposition prévoyant l’octroi d’un contrat pour les travaux financés au

préalable dès qu’on obtient la confirmation d’un ingénieur indépendant que le

contrat prévoit un prix concurrentiel;

6. sous

réserve de 2d), applique les taux les plus bas entrant en vigueur le 23

juin 2009 et le 25 juin 2009 aux propriétaires qui présentent des

demandes de permis de construire avant le 15 septembre 2009 et

obtiennent un permis de construire avant le 31 décembre 2009;

7. approuve l’exigence voulant que

l’admissibilité aux dispositions actuelles dans la zone d’exemption soit fondée

sur la conclusion d’un accord de plan d’implantation approuvé par la Ville

avant la fin de la période de transition de 24 mois;

8. approuve l’exigence voulant que

l’admissibilité aux dispositions actuelles concernant l’application de crédits

de réaménagement lors de la démolition d’édifices dont l’exemption est

prescrite soit fondée sur la conclusion d’un accord de plan d’implantation

approuvé par la Ville avant la fin de la période de transition de 24 mois;

9. que l’augmentation proposée du taux des redevances

d’aménagement se fasse par étape, selon le calendrier suivant :

a. de

la date d’entrée en vigueur du règlement municipal jusqu’au

15 janvier 2010 – les taux du règlement actuel s’appliqueront;

b. du

16 janvier 2010 au 15 janvier 2011 – les taux actuels plus

25 p. 100 de la différence entre les redevances actuelles et les

redevances calculées;

c. du

16 janvier 2011 au 15 janvier 2012 – les taux actuels plus

50 p. 100 de la différence entre les redevances actuelles et les

redevances calculées;

d. du

16 ja nvier 2012 au

15 janvier 2013 – les taux actuels plus 75 p. 100 de la

différence entre les redevances actuelles et les redevances calculées;

e. du

16 janvier 2013 à l’expiration du règlement –

100 p. 100 des taux calculés;

10. que le moment du paiement des

redevances d’aménagement non résidentiel soit calculé en deux versements, la

partie non escomptée de la redevance étant payée au moment de la délivrance du

permis de construction et la partie escomptée de la redevance étant payable

dans les deux ans de la date de délivrance du permis de construction initial,

sous réserve de certaines conditions. Les aménagements institutionnels ne

pourront se prévaloir de cette option;

11. que

la réduction des aménagements au voisinage des stations des couloirs de

transport en commun due à la proximité de réseaux de transport en commun rapide

soit conforme au règlement de zonage;

12. que

le réaménagement des crédits fonciers soit modifié de telle sorte que toutes

les démolitions d’édifices résidentiels et non résidentiels existant déjà qui

ont eu lieu avant l’adoption du nouveau règlement, à l’exclusion d’un type

d’utilisation exempté du versement de redevances d’aménagement, soient

assujetties à la période d’expiration des crédits de réaménagement se terminant

le 1er janvier 2019;

13. qu’un examen à miparcours visant à

déterminer s’il y a suffisamment de revenus pour régler les dépenses associées

à l’aménagement soit effectué dans le cadre de l’adoption du règlement

principal;

14. que conformément à la

Loi de sur les redevances d’aménagement, paragraphe

12(3), aucun autre avis ne soit donné.

Documentation

1.

Transmittal

letter to Planning and Environment Committee and City Council, from the

Development Charges Council Sponsors.

2.

Deputy

City Manager’s report, Infrastructure Services and Community Sustainability

dated 15 June 2009 (ACS2009-ICS-PGM-0134).

Transmittal Letter to Planning

and Environment Committee and City Council

From the Development Charges

Sponsors

Dear Members of Council,

Since being designated as

Sponsors for this policy initiative we have worked diligently with City staff

and met with a number of stakeholders throughout the development of the staff

recommendations.

As Sponsors we support and

endorse the staff recommendations for development charges in the three

development charge areas. The charges proposed are in keeping with City

Council’s principle that growth must pay for growth and the recommendations

respect the economic crisis that our community is experiencing.

Staff and the Sponsors have taken

every opportunity to meet with stakeholders and understand how development

charges affect the development industry. This consultation has allowed the City

to make positive refinements to the proposed development charges.

We are asking Planning and

Environment Committee and City Council to consider seven additional refinements

that have come to light during consultations after the report was made public.

These recommendations are:

- That the timing of payment of non-residential

development charges be calculated in two installments - the non-discounted

portion of the charge shall be paid at the time of issuance of the

building permit and the discounted portion of the charge shall be payable

at a maximum of two years from the date of issuance of the initial

building permit subject to certain conditions. This option will not be available to institutional

developments.

- That the development in the vicinity of transit

stations reduction due to the proximity to rapid transit networks are

consistent with the zoning bylaw.

- That the redevelopment of land credits be amended

so that any demolitions of pre-existing residential and non-residential

buildings that have taken place prior to the passage of the new by-law,

excluding a type of use exempt from paying development charges, be subject

to redevelopment credit expiry period ending January 1 2019.

- That the development charge exemptions for

non-profit health care facilities be limited to the portion that is not

reimbursed or subsidized by either the Provincial or Federal government.

- That as part of the passage of the main by-law a

mid-term review will be undertaken to determine if sufficient revenue is

being contributed to meet development-related cost requirements.

6. That

the proposed increase in the development charge rates be phased in, according

to the following schedule:

a. From

the time of By-law enforce date to January 15, 2010 the rates in the current

by-law will be in effect;

- January 16, 2010 to January 15, 2011 - current

rates plus 25 per cent of difference between current and calculated

charges;

- January 16, 2011 to January 15, 2012 - current

rates plus 50 per cent of difference between current and calculated

charges;

- January 16, 2012 to January 15, 2013 - current

rates plus 75 per cent of difference between current and calculated

charges;

- January 16, 2013 to by-law expiry -full

calculated rates.

- The area-based exemption for residential

properties in downtown Ottawa will be discontinued after two years as of

August 1, 2011 and no transitional provisions will apply.

The first recommendation was the

result of discussions with BOMA related to the financing and working capital

constraints of commercial building projects. The intent of the policy is to

provide greater flexibility relating to DC payments by balancing the needs of

the City to fund growth-related infrastructure costs and the ability of a

non-residential developer to bridge finance the entire fee before revenue

streams from construction materialize.

The portion payable at a later phase will be subject certain

requirements and conditions such as no reductions in the security provided for

works until full development charges paid and indexing at the development

charge rate.

The second recommendation adjusts

the Road component reduction related to apartment dwellings within 600 metres

of the primary transit network to include an 800-metre exemption where the lot

is separated from the rapid transit station by a highway, grade-separated

arterial roadway, railway yard, watercourse, private lands or any other major

obstacle such that the actual walking distance to the rapid transit station is

increased. This adjustment makes the discount consistent with the provisions of

the zoning by-law.

The third recommendation relates

to the February report outlining the DC By-law Review Framework. Redevelopment credits are provided in

recognition that a pre-existing residential and non-residential building or

structure, that has been demolished, had an existing demand on services

allocated to the property. Staff are

recommending the imposition of an extended grandparenting clause, ending

January 1 2019, for preserving the redevelopment credit for pre-existing

demolitions. After the passage of the

new by-law any demolitions that occur will be subject to the five-year

redevelopment credit expiry period.

The fourth recommendation refers

to the current non-statutory exemption, which allows for non-profit health care

facilities to receive a full development charge waiver. The funding circumstances surrounding the

initial imposition of the exemption have changed. This amendment will, therefore, limit the threshold of the amount

of the waiver to the portion that is not reimbursed by other levels of

government. The full charge will be

payable at the building permit stage and, subsequently, only the portion not

reimbursed by either the Provincial or Federal governments will be refunded to

the applicant.

The next item is a proposal to

have staff undertake a mid-term review, which is not a statutory requirement,

prior to the full study update in 2014 in order to revisit the calculation of

various rates. One of the Guiding

Principles passed as part of the Fiscal Framework-2007 is that growth should

pay for itself to the full extent allowed by legislation and not be subsidized

by property taxes and utility rates. The review would focus on whether the

imposition of the charges has provided the City with the revenue streams needed

to offset development-related costs for each service.

The transition and phase-in dates

have been extended by fifteen days to allow planning staff additional time to

process applications post the holiday season.

Finally, the

staff report has recommended the phase-out of the downtown residential

exemption. However, there are unique challenges to developing a downtown

project. The timelines in urban areas

are often longer and involve additional requirements in terms of information to

be supplied. Therefore, the criteria

for being eligible for current provisions within the exemption zone would be

based on entering into an approved site plan agreement with the City before the

end of the 24-month transition time frame. After the 24- month period the

development charge applicable at the time will be payable. None of the transitional provisions of the

proposed development charges by-law will apply.

During the course of the

consultation a number of issues were raised unrelated specifically to the DC

Background Study but involving development. The Sponsors have agreed to further

investigate these tangential issues with staff and the stakeholders and report

back to Planning and Environment Committee. These issues are:

- The impact of regulatory restrictions and cost of

electrical relocation and provision on development inside the greenbelt

including the issue of provision of underground electrical service. A

preliminary meeting with Hydro Ottawa has taken place.

- The management of front ending agreements.

- The cost of development and building permits on

Ottawa’s health care facilities. This review is consistent with Corporate

Services and Economic Development direction of March 3, 2009.

- The costs of development inside the greenbelt and

potential incentives to meet the goals of the City’s Official Plan.

In closing, we Sponsors have

found this initiative as an extremely positive experience and the feedback from

staff and stakeholders has been uniformly positive. We recommend that Planning

and Environment Committee continue the practice of policy sponsors for major

policy initiatives within the mandate of the Committee.

Respectfully submitted,

Peter Hume Peggy Feltmate Jan

Harder Christine Leadman

Report to/Rapport au :

Planning and

Environment Committee

Comité de l'urbanisme et de l'environnement

and Council/et au Conseil

15 June 2009 / le 15 juin 2009

Submitted by/Soumis par : Nancy Schepers, Deputy City Manager/Directrice

municipale adjointe,

Infrastructure Services and

Community Sustainability/Services d’infrastructure et Viabilité des

collectivités

Contact Person/Personne ressource : John L. Moser, General

Manager/Directeur général, Planning and Growth Management/Urbanisme et Gestion

de la croissance

(613)

580-2424 x 28869, john.moser@ottawa.ca

SUBJECT:

|

DEVELOPMENT CHARGES POLICY REPORT

|

|

|

|

OBJET :

|

RAPPORT SUR LA POLITIQUE DES REDEVANCES

D’AMÉNAGEMENT

|

REPORT RECOMMENDATIONS

That the Planning and

Environment Committee recommend Council approve:

1. The revised City of Ottawa Development

Charge Background Study dated June 8, 2009 and the City of Ottawa Area-Specific

Development Charge Background Study dated June 8, 2009, issued separately, with

the following amendments:

a. That the three

large area Single Dwelling Unit (SDU) residential rates as described in the

City of Ottawa Development Charges Background Study, dated June 8, 2009 be

amended, based on anticipated funding from the Stimulus Program, as follows:

Inside the Greenbelt SDU charge of $15,536 (was $16,111), Outside the Greenbelt

SDU charge of $22,071 (was $22,546) and Rural SDU charge of $14,769 (was

$15,244);

b. That the Non-residential General development

charge be amended, based on anticipated funding from the Stimulus Program, as

follows: $16.06 per square foot for full service rate (was $16.63),

Non-residential Commercial/Institutional/Industrial rate be capped at $13.01

(was $13.47) and that the (full service) rate for Limited Industrial uses be

set at $7.39 (was $7.65);

2.

That the current list of non-statutory exemptions, subject to the

proposed transitional provisions, be modified as follows:

a.

Development

Charges exemptions for non-profit health care facilities are to be limited to

the capital cost that must be raised locally by the community;

b.

The

types of non-profit uses that will be exempt by resolution of Council was

narrowed to include child care and long term care facilities, which are both

municipally mandated services;

c.

The

residential Development Charges exemption within

the designated areas fronting lsabella Street and Chamberlain Avenue, was

removed;

d. The

area-based exemption for residential properties in downtown Ottawa will be

discontinued after two years as of August 1, 2011.

3. That

rates be indexed on an annual basis, commencing on August 1, 2010 in accordance

with the Statistics Canada Infrastructure Development Charges Price Index;

4.

That the current Development Charges By-laws be

repealed and that the successor general development charge by-law and the

area-specific stormwater by-laws, substantially in the form and content

included in the City of Ottawa Development

Charges Background Study, dated June 8, 2009 and the City of Ottawa

Area-specific Development

Charges Background Study for Individual Stormwater Management Ponds and

Drainage Systems, dated June 8, 2009 be enacted;

5.

The policy regarding front-ending

agreements as detailed in Document 3 be approved including the provision for

the award of contracts for front-ended works upon certification by an independent

engineer that the contract provides for a competitive price;

6. That

owners who have filed a building permit application prior to September 15, 2009

and obtain a building permit prior to December 31, 2009 be subject to the

lesser of the total rates in place as of June 23, 2009 and June 25, 2009;

7.

That the requirement for being

eligible for current provisions within the exemption zone be based on entering

into an approved site plan agreement with the City before the end of the

24-month transition time frame;

8.

That the requirement for being

eligible for current provisions provided to the application of redevelopment credits applied to the

demolition of buildings that are statutorily exempt be based on entering

into an approved site plan agreement with the City before the end of the

24-month transition time frame;

9. That

the proposed increase in the development charge rates be phased in, according

to the following schedule:

·

From the

time of By-law enforce date to December 31, 2009 the rates in the current

by-law will be in effect;

·

January 1

to December 31, 2010 - current rates plus 25 per cent of difference between

current and calculated charges;

·

January 1

to December 31, 2011 - current rates plus 50 per cent of difference between

current and calculated charges;

·

January 1

to December 31, 2012 - current rates plus 75 per cent of difference between

current and calculated charges;

·

January 1, 2013

to by-law expiry - full calculated rates.

RECOMMANDATIONS DU RAPPORT

Que le Comité de l’urbanisme et de

l’environnement recommande au Conseil de prendre les mesures suivantes :

1. approuver

la version révisée de l’étude préliminaire sur les redevances d’aménagement de

la Ville d’Ottawa du 8 juin 2009 et l’étude préliminaire sur les

redevances d’aménagement d’application particulière de la Ville d’Ottawa du

8 juin 2009, études qui ont été publiées séparément, sous réserve des

modifications suivantes :

a. modification des trois taux résidentiels pour

les unités d’habitation individuelles des grands secteurs décrits dans l’étude

préliminaire sur les redevances d’aménagement de la Ville d’Ottawa du

8 juin 2009, en fonction du financement prévu dans le cadre du programme

d’incitation, soit : redevances de 15 536 $ pour les unités à

l’intérieur de la Ceinture de verdure (au lieu de 16 111 $), de

22 071 $ pour les unités à l’extérieur de la Ceinture de verdure (au

lieu de 22 546 $) et de 14 769 $ pour les unités en milieu

rural (au lieu de 15 244 $);

b. modification des redevances d’aménagement

générales pour les unités non résidentielles en fonction du financement prévu

dans le cadre du programme d’incitation, soit : établissement du taux

tous services compris à 16,06 $ le pied carré (au lieu de 16,63 $),

plafonnement du taux pour les unités non résidentielles des secteurs

commercial, institutionnel et industriel à 13,01 $ (au lieu de

13,47 $) et établissement du taux (tous services compris) pour les unités

à usage industriel limité à 7,39 $ (au lieu de 7,65 $);

2. modifier

la liste actuelle des exemptions non prescrites, sous réserve des dispositions

transitoires proposées, à savoir :

a. les exemptions de redevances d’aménagement

pour les établissements de soins de santé à but non lucratif devront se limiter

aux coûts en capital qui doivent être financés à l’échelle locale par la

collectivité;

b. les types d’utilisations à but non lucratif

qui seront exemptés par résolution du Conseil ont été mieux définis pour

inclure les services de garde d’enfants et les établissements de soins de

longue durée, lesquels sont des services mandatés par la municipalité;

c. l’exemption de redevances d’aménagement

résidentiel dans les zones désignées donnant sur la rue Isabella et l’avenue

Chamberlain a été supprimée;

d. l’exemption propre au secteur s’appliquant

aux propriétés résidentielles dans le centre-ville d’Ottawa sera supprimée dans

deux ans, soit le 1er août 2011.

3. indexer

les taux sur une base annuelle à partir du 1er août 2010,

conformément à l’indice des prix de Statistique Canada pour les redevances

d’aménagement d’infrastructures;

4. abroger

les règlements actuels sur les redevances d’aménagement et adopter le nouveau

règlement général sur les redevances d’aménagement et les règlements sur les

eaux pluviales propres à certains emplacements, essentiellement selon la forme

et le contenu de l’étude préliminaire sur les redevances d’aménagement de la

Ville d’Ottawa, en date du 8 juin 2009, et de l’étude préliminaire

sur les redevances d’aménagement d’application particulière de la Ville

d’Ottawa relativement aux systèmes individuels de gestion des eaux pluviales et

de drainage, en date du 8 juin 2009;

5. approuver

la politique concernant les ententes de financement préalable décrite dans le

document 3, y compris la disposition prévoyant l’octroi d’un contrat pour

les travaux financés au préalable dès qu’on obtient la confirmation d’un

ingénieur indépendant que le contrat prévoit un prix concurrentiel;

6. appliquer

les taux les plus bas entrant en vigueur le 23 juin 2009 et le

25 juin 2009 aux propriétaires qui présentent des demandes de permis

de construire avant le 15 septembre 2009 et obtiennent un permis de

construire avant le 31 décembre 2009;

7. approuver

l’exigence voulant que l’admissibilité aux dispositions actuelles dans la zone

d’exemption soit fondée sur la conclusion d’un accord de plan d’implantation

approuvé par la Ville avant la fin de la période de transition de 24 mois;

8. approuver

l’exigence voulant que l’admissibilité aux dispositions actuelles concernant

l’application de crédits de réaménagement lors de la démolition d’édifices dont

l’exemption est prescrite soit fondée sur la conclusion d’un accord de plan

d’implantation approuvé par la Ville avant la fin de la période de transition

de 24 mois;

9. adopter

progressivement l’augmentation proposée des redevances d’aménagement en

fonction du calendrier suivant :

· de

la date d’entrée en vigueur du règlement jusqu’au

31 décembre 2009 : application des taux du règlement actuel;

· du

1er janvier au 31 décembre 2010 : application des taux actuels

plus 25 p. 100 de la différence entre les redevances actuelles et les

redevances établies;

· du

1er janvier au 31 décembre 2011 : application des taux

actuels plus 50 p. 100 de la différence entre les redevances

actuelles et les redevances établies;

· du

1er janvier au 31 décembre 2012 : application des taux

actuels plus 75 p. 100 de la différence entre les redevances actuelles et les

redevances établies;

· du

1er janvier 2013 jusqu’à la date d’expiration du règlement :

taux établis.

BACKGROUND

A Background Study must be prepared pursuant to Section 10 of the Development Charges Act, 1997 (DCA) and, together with the proposed by-law, must be made available

to the public, as required by Section 12 of the Act, more than two weeks prior to the public meeting of Council,

which is to be held June 23, 2009.

The charges calculated represent those which can be recovered under the

DCA based on the City's capital spending plans and other assumptions which

are responsive to the requirements of the DCA.

A decision is required by Council, after receiving input at the public meeting,

as to the magnitude of the charge it wishes to establish, for residential,

commercial, industrial and/or institutional development. Property tax, user

rates or other funding sources will be required to finance any potentially Development Charges-recoverable capital costs which are not

included in the charge that is adopted.

Other decisions involve

finalizing development charge policy and the by-law, including exemptions,

phasing-in, indexing, applicability to the redevelopment of land, and the

schedule of charges by type of land use. The purpose of the public meeting is

to obtain additional input concerning these matters.

As part of the February

report to Planning and Environment Committee a four-member Development Charges By‑law

Sponsor Committee was established. The

mandate of the Committee was to guide the update of the by-law by advising and

assisting staff and by reviewing options to amend the Development Charges rates. The Committee was composed of the following

members: Councillor Hume, Councillor

Feltmate, Councillor Harder and Councillor Leadman.

Several meetings took place

between staff, the Committee and stakeholders to review the proposed

growth-related program. The sessions

resulted in numerous recalculations of the various components of the

residential and non-residential charges. The acceptance of the recommendations

in this report, championed by the Committee, represent the accumulation of discussions that would ensure

that both adequate infrastructure is available to meet the needs of planned

growth, while at the same time, provide stable funding for growth-driven

infrastructure.

DISCUSSION

Development

Charge Background Studies

The DCA sets out the essential steps necessary to create successor Development Charges

By‑laws. Most importantly, the DCA requires that a Development Charges Background Study be

completed. Staff has undertaken the afore-mentioned studies and the resulting

reports are important companion documents to this policy report. Copies of the

main study, entitled City of Ottawa Development Charges Background Study Report

(dated April 9, 2009) were made available to the public. Revised copies of the main study, City of Ottawa Development Charges Background

Study Report (dated June 8, 2009) and the City of Ottawa Area – specific

Development Charges Background Study for Individual Stormwater Management Ponds

and Drainage Systems (dated June 8, 2009) were made available prior to the

public meeting.

In March, 2009, Council approved the report, “The New Development

Charge By-law – Approach and Timetable”, which set out for departments the

basic way in which growth-related municipal services should be assessed in

relation to the charges and the timing of the preparation work for the by-law

and background study.

The preliminary development charge analysis was subsequently tabled at

the Planning and Environment Committee on May 11. This analysis summarized the rate information contained in the

April 9 draft Development Charges Background Study and outlined some of the

cost implications of growth-related services.

Following an extensive consultation process, the Background Study and

proposed Development Charges By-law

are being provided for information purposes as part of that consultation

process. Through this report, final development charges

recommendations are being

made to Committee and Council for approval of the 2009 Development Charges

By-law and the amended

Background Study.

Development Charge Rates

In summary, the gross capital cost of the entire program is $6.67

billion. Of this amount, $2.65 billion has been deemed to be development

charge-recoverable ($1.77 billion from residential development and $0.88

billion from industrial, commercial and institutional development

(non-residential)). The difference between the gross and development

charge-recoverable amounts is comprised of the following deductions, pursuant

to the Development Charges

Act:

- $250 million Beyond

10-year Service Level Cap

- $1,383 million Benefit

to Existing Development

- $372 million Post

Period Capacity

- $2,014 million Subsidies, Other Contributions, and 10 per cent Statutory Deduction

Total - $4,019 million

The sole purpose of development charges is to fund the servicing costs

of growth, thereby enabling growth to pay for growth and to proceed in a timely

and efficient manner. It reflects the

City's desire to establish a development charge schedule, which reasonably

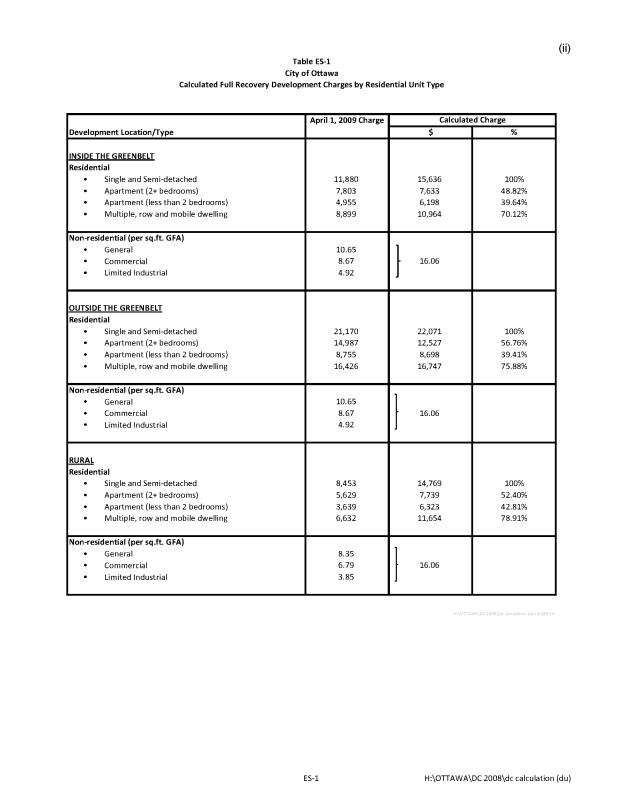

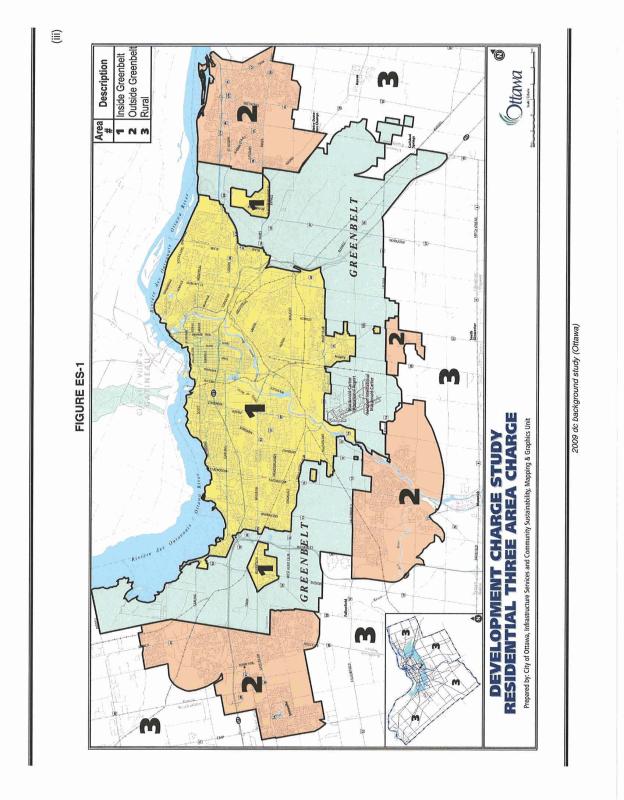

reflects servicing benefits received in the broad areas of the city. As a

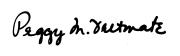

result, the single detached dwelling charge for fully serviced development

lnside the Greenbelt is marginally above the Rural area charges and

approximately 28 per cent below the Outside the Greenbelt charge (see Document

1).

The proposed charge for a single detached unit is greater than the

current development charge in all three cases, but the increase varies

significantly. The increase is highest for Rural development for two main

reasons:

(i)

Rural cost

allocation has increased significantly to reflect the City-wide attribution of

arterial road costs which are designed to move commuters, shoppers and other

traffic throughout the City;

(ii)

Rural cost

allocation of a portion (one-third) of transit costs.

Increase in the charge Inside the Greenbelt reflect the same

road-related circumstances, as well as an increase in water and sanitary sewer

charges based on assigning a growth component to replacement of existing sewers

located in intensification areas.

It is important to note that the development charge for semi-detached

and large apartment units located Outside the Greenbelt decreased as a result

of a significant decline in the updated occupancy statistics for those unit

types. The large apartment unit rate

located Inside the Greenbelt is also lower than the current charge (see Document 2).

The DCA also requires that the capital costs must be reduced or

adjusted for capital grants, subsidies and other contributions made to a

municipality. A number of the projects identified in the background study have

been included in the City's application to Federal and Provincial governments

for two-thirds funding under the Infrastructure Stimulus Program. All of the Public Transit projects that have

been included in the application are identified in the Development Charges

Background study with two-thirds funding coming from Grants, Subsidies and

Contributions. The road projects that

have been included in the funding application that are growth related have been

shown in the Background Study without any outside funding, thereby increasing

the amount of development charges that are projected to be collected.

On June 5, 2009 the Federal and

Provincial governments announced they would fund two-thirds of various

growth-related road projects. This will reduce the required amount of

development charges to be collected on the city-wide roads component by $79

million. This will result in a

reduction of $475 per single-family household.

As the timing of the printing of the background study did not allow these

changes to be included, they will be included in the final document and the

development charges will be amended accordingly.

Inside Greenbelt - Single

Dwelling Unit

Revised $15,636 (was $16,111 as

of June 8)

Outside Greenbelt - Single

Dwelling Unit

Revised $22,071 (was $22,546 as

of June 8)

Rural – Serviced - Single

Dwelling Unit

Revised $14,769 (was $15,244 as

of June 8)

Rural – Unserviced - Single

Dwelling Unit

Revised $12,756 (was $13,231 as of June 8)

Non-residential charges have been calculated using one uniform,

City-wide charge. This was done to reflect current policy, industry input and

to support employment growth to the fullest extent possible throughout the

city.

The non-residential charge has increased by 51 per cent, as compared to

the April 1, 2009 "Non‑Residential General" charge (from $10.65

per square foot of GFA to $16.06

per square foot). This is largely due to an increase in the development

charge-recoverable cost of Roads, Transit and Sanitary Sewers, which comprise

the bulk of the non-residential charges.

A fully calculated non-residential charge is proposed for development

within the non-residential general category (e.g. retail and hotels). For other

categories of non-residential development, the following reductions are

proposed:

- Commercial/Industrial/lnstitutional

- reduced to 81 per cent of

full-calculated charge;

- Limited

Industrial - reduced to 46 per cent of the

full-calculated charge.

These reductions are consistent with the adjustments made in the 2004

Development Charges By-law for these categories of uses.

Non-residential – General –

Gross Floor Area

$16.06 (was $16.63 as of June 8)

Non-residential –

Commercial/Industrial/Institutional – Gross Floor Area

$13.01 (was $13.47 as of June 8)

Non

residential – Limited Industrial – Gross Floor Area

$7.39 (was $7.65 as of June 8)

Exemption Policy

It is recommended that most

non-statutory exemptions and discounts be maintained. However, the following policies pertaining to

exemptions, credits and related matters are proposed as changes to the existing

by-law:

e.

Development

Charges exemptions for non-profit health care facilities are to be limited to

the capital cost that must be raised locally by the community;

f.

The types of

non-profit uses that will be exempt by resolution of Council was narrowed to

include child care and long term care facilities, which are both

municipally-mandated services;

g.

The residential

development charges exemption within the designated areas fronting lsabella

Street and Chamberlain Avenue, was removed;

h.

Redevelopment

credit provisions were narrowed to reduce the time between demolition and new

construction to a maximum of five years, starting August 1, 2009;

i.

As of August 1, 2011, redevelopment credits are not applicable in cases of demolition

of development that is exempt from charges under the by-law (for example former

school sites);

j.

The required distance from a light rail or transitway station

was increased from 500 metres to 600 metres for apartment dwellings to

qualify for the 50 per cent reduction in the Roads and Related Services

component of the charge.

The following would continue to be exempt from development

charges: a place of worship, churchyard, cemetery or burying ground,

agricultural buildings, farm retirement lots, non-profit housing, temporary and

seasonal buildings. Non-statutory

exemptions such as for places of worship or temporary buildings result in

little revenue to the City and a removal of the exemption would create greater

hardship to individuals that would be justified by the small increase in

revenue.

The area-based exemption for

residential properties in downtown Ottawa will be discontinued after two years

as of August 1, 2011. Staff have,

however, recognized the unique challenges of developing a downtown project. The

timelines in urban areas often involve more complicated matters and have

additional requirements in terms of information to be supplied. Therefore, the requirement for being

eligible for current provisions within the exemption zone would be based on entering

into an approved site plan agreement with the City before the end of the

24-month transition time frame. The

same transition provision, based on receiving site plan approval before August

1, 2011, will be provided to the application of redevelopment credits applied to the demolition of buildings that are

statutorily exempt from paying development charges.

Given that there has been ‘take

up’ of the reduction for residential apartment dwelling units in the vicinity

of transitway and light-rail stations due to the qualifying requirement for

parking space limits, it is proposed that the reduction be continued in the new

by-law. Location in proximity to the stations is an attractive feature for

providing more intensive residential redevelopment. The qualifying distance from a station has been increased to 600

metres from 500 to be eligible for the 50 per cent reduction in the Roads and

Related Services component of the charge.

Parking spaces allocated for visitors are not considered in the parking

space calculations.

Deduction for Post Period Capacity

Although there is no requirement

under the Act, staff has made an

additional deduction on road projects programmed in the 2020 to 2031 time frame

to account for the fact that development occurring after 2019 will receive some

benefit from these works. A number of

Water, Sanitary Sewer, and Road projects are forecasted to be constructed

during the end of the 22-year planning horizon (approaching 2031). Therefore a portion

of the cost of these projects (20 per cent for Roads and 25 per cent for Water

and Sanitary Sewer) will be assigned to post 2031, therefore decreasing the

residential and non-residential development charge rates.

Indexing of the Charges

It is important that the quantum,

of the development charges collected, increases over time in accordance with

the change in construction prices so that its purchasing power is preserved. It

is, therefore, recommended that the indexing of the charge continue on an

annual basis but on August 1 each year starting in 2010. As of April 22, the indexing was rescinded

and rates rolled back to their 2008 levels.

Historically, over the past five years, the yearly inflation percentage

has been lower than the factors used in other municipalities. However, the index is considered to better

reflect the increased development related costs incurred in Ottawa.

Transition Measures

Staff have recommended a

transition period, for the main by-law, for implementing the new rates. Development for which a complete building

permit application has to be filed by September 15, 2009 and for which a

building permit has to be obtained before January 1, 2010 shall be subject to

the lower of the total rate in effect as of June 23, 2009.

Phasing of the Development Charge

Rates

It is recommended that the new

charges be phased in, starting January 1, 2010, over a four-year period with

the only exception to this phase-in is the residential charge for the area

Outside the Greenbelt. The Inside the

Greenbelt and Rural charges will be phased in starting January 1,

2010. The phase-in schedule is proposed

as follows:

- From the time

of By-law enactment to December 31, 2009 the rates in the current by‑law

will be in effect;

- January 1 to December 31, 2010 - current rates plus 25 per cent of difference between current and

calculated charges (revised to reflect the discounted non-residential

charges, as discussed above);

- January 1 to

December 31, 2011 - current

rates plus 50 per cent of difference between current and calculated

charges;

- January 1 to

December 31, 2012 - current

rates plus 75 per cent of difference between current and calculated

charges;

- January 1,

2013 to by-law expiry -full calculated rates (including discounting as

discussed above).

Front-ending Agreements

Development Charge legislation

permits municipalities to enter into front-ending agreements with developers

whose need accelerates a capital work by undertaking it themselves and having

the City pay them back over time. The City currently has a number of these

agreements in place. The adoption of

such a policy also sets the parameters for discussion for what can often be

lengthy discussions with the developers (see Document 3).

City policy generally requires that contracts only be awarded after

being tendered or having obtained quotations from at least three different

firms. As front-ending agreements

provided for the expenditure of City funds by developers, developers are

encouraged to follow this policy.

However, staff are advised that developers often cause front-ended

works to be constructed by the developer's general contractor for the overall

development, as opposed to awarding a specific contract for the works in

question. It is possible in such

circumstance that the best price will be achieved by awarding the work to the

contractor who will already be on the site.

However, to ensure that such is the case, the front-ending policy will

require that an independent engineer certify to the City that a competitive

price has been achieved. Further, to

provide for transparent review of such contracts, the developer must ensure

that the contract that includes the front-ended works can be provided by the

City to any member of the public who wishes to see it.

The Parks Development capital

program was established in recognition of projected cash flow and affordability

over the required 10-year timeframe (2010-2019). Recently, the City has agreed to various park crediting

agreements, where ownership and development charge contributions are received

from one landowner. Repayment under the

agreements is directly related to the pace at which development occurs within

the benefiting lands based on the growth-related park fees collected at

building permit issuance. To help

assist with the overall construction schedule an agreement was reached with the

homebuilders, through the Council Sponsors’ review process, to maximize the

capital project funding allocations based on level of service measurements, for

both Parks Development and Recreation Facilities.

Area-specific Stormwater Charges

Stormwater management is being addressed separately from the City's

overall Background Study, given its unique features, i.e. a wide range of

development and area specific SWM requirements and solutions with widely

varying costs. Also, some developments outside of these areas provide fully for

their own SWM needs, pursuant to individual development agreements or use

existing previously funded capacity and are therefore exempt from these

area-specific by laws. In addition

to these two sets of circumstances, there are a number of stormwater drainage

works, which are city-wide or large-area in nature (i.e. storm sewer rehab

program and trunk storm sewer oversizing), which provide broad benefits to

development in the City and are included separately in the City-wide

Development Charge Background Study and by-law.

A separate stormwater charge has been calculated for each project area,

based on the recoverable costs.

Approximately $233 million in costs are involved, split

approximately 61 per cent/39 per cent between residential and non-residential

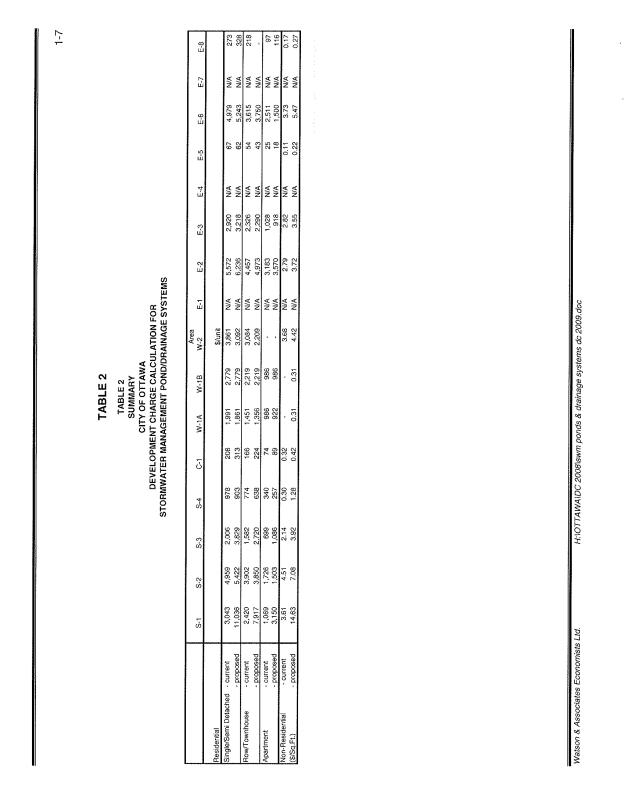

benefit, overall (see Document 4).

Conclusion

The charges calculated represent

those which can be recovered under the DCA,

based on the City’s capital spending plans and other assumptions which are

responsive to the requirements of the DCA. It is hoped that after weighing the various

options and receiving input at the public meeting, that the charges outlined in

this report will be adopted.

The aim of the Council Sponsors

was to provide for a setting in which an open and frank dialogue between staff

and stakeholders could be take place.

Overall, the various meetings have assisted all groups in obtaining a

better understanding and analysis of the complex set of information presented

during the review process. Therefore,

the proposed framework represents a balanced approach to the calculation of

capital costs for development charge purposes.

This has lead to the ultimate

goal of having all the groups directly involved in ensuring that the various

provisions in the study represent a fair methodology in implementing the

overall policy of having them pay their fair share of infrastructure, while at

the same time, distribute eligible capital costs fairly between residential

areas and non-residential development.

CONSULTATION

Various meetings were held with stakeholders

and groups, over the last nine months, to obtain feedback at various stages of

the study process. A preliminary

development charge analysis was tabled at Planning and Environment Committee on

May 11. A notice to inform the public

of this process was placed in newspapers on May 22, 2009. The background studies were made available

on June 8, 2009. The Development

Charges By-law Sponsor Committee has met several times with staff and

stakeholders, since the February 24 Planning and Environment Committee meeting,

to make recommendations and to advance additional options.

LEGAL/RISK

MANAGEMENT IMPLICATIONS

The appeal provisions

are as set forth in the disposition.

The current development charge by‑laws expire on 14 July

2009. Therefore the new by-laws must be

enacted before that date.

FINANCIAL IMPLICATIONS

The background study identifies capital projects with a growth

component of $6.67 billion over the next 22 years. Of this amount, $2.65 billion

has been determined to be recoverable from residential and non-residential

development. The City’s share of these

projects is $1.44 billion. An additional $1.96 billion is recoverable through

subsidies and $623 million is identified as being above the service level cap

or benefiting future development beyond 2031.

The timing of capital works is initially established by the background

study. Subsequently, the capital budget

process is the mechanism by which the City establishes its future expenditures

of development charge revenues.

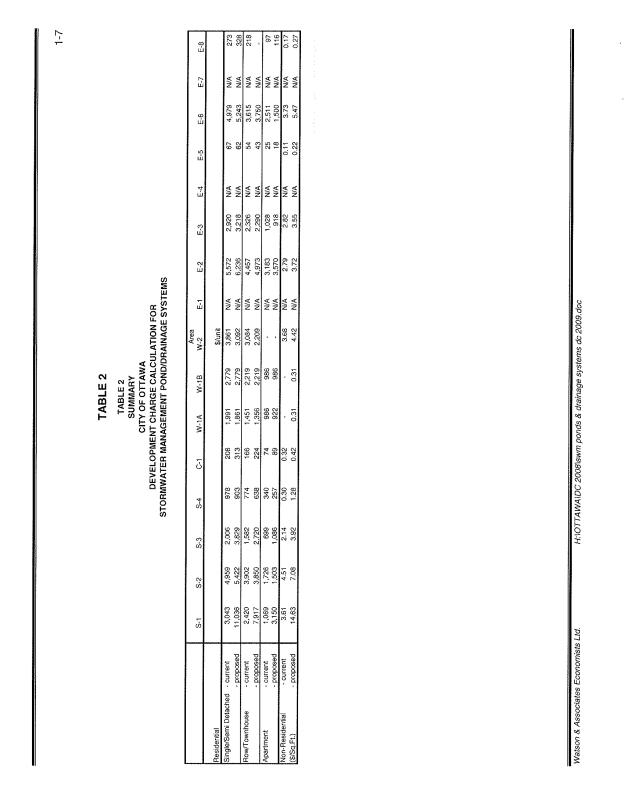

SUPPORTING DOCUMENTATION

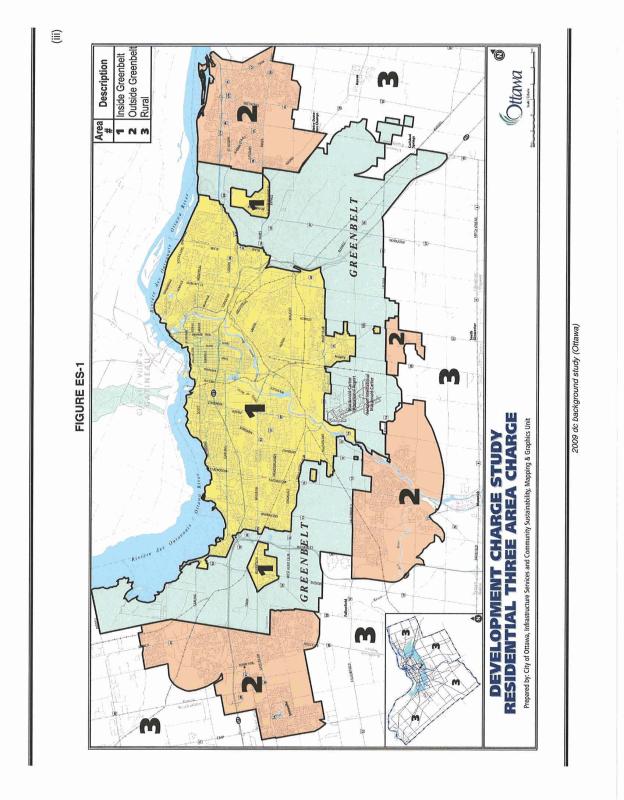

Document 1 – Comparison of

Development Charge Rates by Type

Document 2 – Map of Residential Charge Areas

Document 3 – Copy of Revised

Front-ending Policy

Document 4 – Summary of

Area-specific Stormwater Management Rates by Area

DISPOSITION

Planning and Growth Management

will make any changes to the City of Ottawa Development Charges Background

Report and the Area-Specific Development Charges Background Report as a result

of the direction of Planning and Environment Committee and Council.

Legal Services will prepare the required

by-laws and submit them to Council.

Within 20 clear days of the

passage of the by-law, Planning and Growth Management to ensure that there is a

notice of the passage of the By-laws and appeal deadline placed in the Citizen

and Le Droit.

Within 20 days, the City Clerk’s

Office to notify everyone, who has provided a written request for notice and a

return address and the secretary of every school board within the City of

Ottawa, of the passage of the By-laws and appeal deadline.

The public has 40 days after the

adoption of the by-law to file an appeal with the City Clerk. If appeals are

made, the City Clerk’s Office to compile a formal record of appeals including:

a certified copy of the by-law; a copy of the two development charge background

studies; certification that the notice of passage and last day of appeal was

given in accordance with the Act; and an original or true copy of all written

submissions and materials received in respect of the by-law before it was

passed. The City Clerk’s Office to forward a notice of appeal and record to the

Ontario Municipal Board secretary within 30 days of the last day of the appeal

period and provide such information and material as the Board may require.

The Planning and Growth

Management to prepare a pamphlet for each development charge by‑law that

has been adopted and is in force within 60 days after the by-law comes into

force if the by-laws are not appealed to the Ontario Municipal Board. If the

by-laws are appealed, the pamphlets are to be prepared within 60 days of the

Board’s decision or amendment order. The pamphlets are to be made available to

the public upon request.

COMPARISON OF DEVELOPMENT CHARGE RATES BY TYPE DOCUMENT 1

MAP

OF RESIDENTIAL CHARGE AREAS DOCUMENT

2

COPY OF REVISED FRONT-ENDING POLICY DOCUMENT

3

Front-ending agreements are

requested by developers who wish to have specific growth-related capital works

in place in advance of the City’s capital project plans for emplacement of

these same works: developers agree to finance the works at the “front end” and

recover their costs from the City at a later date. The following conditions must be met in order for the City to

enter into a front-ending agreement:

1.

All front-ending agreements with the City will be for

growth-related capital works that have been included in a development charge

study.

2.

The

contract for Front-Ended works shall be awarded by the Front-Ender in

accordance with the City’s Purchasing Policy of a competitive procurement

process and subject to the review and satisfaction of the General Manager,

Planning and Growth Management Department.

Where the front-ender does not award the work in accordance with the

City’s purchasing policy, they must demonstrate that competitive pricing has

been obtained, through independent analysis of their engineer, to the

satisfaction of the General Manager, Planning and Growth Management

Department. The contract for the work

must be made available to the City to provide to the public.

3.

Storm water ponds and related sewer works that are 100%

development charge funded in the recommended by-laws will be paid back to the

developer based on revenues as they are collected from the designated

area. This means that at no time are

the repayments to exceed the revenues received. Each front-ending agreement will define the geographic area

involved and a separate and specific deferred revenue account may be set up to

keep track of the revenues collected and payments made. Crediting will also be allowed for the

front-ending agreements related to storm water ponds. Indexing

shall apply to the outstanding balance in accordance with the rate of

indexation pursuant to the Development Charge By-Laws.

4.

For all other capital projects, a lump sum payment, both the

development charge portion and the City portion, will be made to the developer

in the year the project is identified in the City’s ten year capital plan at

the time the front-ending agreement is approved. Should growth occur earlier than forecasted, then repayment would

be accelerated to reflect the revised timing the City would have budgeted for

the project. If growth occurs more

slowly than forecasted, then the City will have an additional one to three years (one to three years from

the year the project was identified in the ten year plan) to make

repayments. Only in this latter case

will the City’s portion of the payment be indexed beginning with the year the

project was identified in the ten-year plan.

5.

The development charge portion that will be reimbursed will be

indexed yearly in accordance with the rate of indexation pursuant to the

Development Charge By-Laws up

to the year the capital project has been budgeted. (City Council approved February 7, 2005.)

6.

Given that the City will be assuming operating costs earlier

than anticipated through the front-ending agreement process, the City is not to

pay any carrying costs to the developer.

7.

All development charges payable by developers must be paid up

front in accordance with the City’s by-law.

With the exception of the storm water ponds and related sewer works,

there will not be any crediting allowed as a result of entering into a

front-ending agreement. On December 8,

2004, City Council approved, “That staff be directed to work with the industry

to develop the details of a credit policy to be incorporated into the

front-ending policy”.

8.

In the case where a developer(s) has front-ended a project

that at the discretion of the City benefits other developers, those developers

who were not part of the front-ending agreement shall pay all of their

development charges owed either at the time of registration of a plan of

subdivision or upon the issuance of the first conditional building permit,

whichever comes first. (City Council

approved July 14, 2004 Motion 16/5)

9.

In

the case where multiple Front-Ending Agreements are in force in the same

area-specific development charge By-Law, and the City has approved the

Front-Ended works for development charge reimbursements, the Front-Enders will

share in the distribution of development charge revenues on a pro-rata basis

with other storm water drainage projects.

The pro-rated works shall be based on the balance of the outstanding amount

owing on the date the repayment is due.

Existing Front-Enders will be advised of new Front-Ending Agreements for

storm water works within the same benefiting area and area-specific development

charge By-Law.

10.

The

capital project upset limits for engineering, project management, and contingency

shall be the established rates set in accordance with the City’s Development

Charge By‑Laws and accompanying background studies, as amended.

11.

Land

remuneration shall be subject to an appraisal by a professional land appraiser

and the appraisal shall be conducted in accordance with the terms of reference

as established in the City’s Development Charge By-Laws and accompanying

background studies, as amended. The

upset limit for land remuneration shall be the lesser of the appraised value

and the upset limit in accordance with the City’s Development Charge By-Laws

and accompanying background studies.

12.

Indexing

shall apply to the total project costs if the Front-Ended works have been

delayed over a period of time, the Front-Ender provides justification for the

delay, and with the written concurrence of the City.

13.

Where

a Front-Ender is eligible for development charge reimbursement, documentation

is required to support the reimbursement in accordance with the City’s

Purchasing Policy. The Front-Ending

Agreement shall identify at which stage the documentation shall be

required. The following documentation

shall be forwarded to the City before payment is issued:

·

An invoice summarizing the Front-Ended works, and

separate cost items, if applicable, for land, construction costs, engineering

fees, project management fees, contingency fees, and applicable taxes.

·

Payment Certificates, including the final certificate, signed by the developer’s

civil engineer.

·

All

invoices supporting re-payment for the Front-Ended works.

·

Statutory

Declaration.

·

Certificate

of Substantial Performance.

·

Workplace

Safety & Insurance Board Clearance Certificate (WSIB).

·

Certificate

of Publication.

14.

A report to Council is required to authorize staff to enter

into a front-ending agreement. The

recommendation will include the financial commitment of the City, specify the

funding source(s), the project timeline and where necessary, request that a

specific deferred revenue account be established. The financial comment in the report will specify the timelines

for the repayment, an operating budget impact and an estimate of the year in

which the operating budget impact will begin.

It should also indicate the year in which the project was originally

identified in the City’s ten-year capital plan. A capital project will be established upon Council approval to

enter into a front-ending agreement. The status of these projects will be

provided to Council on a yearly basis.

15.

No

capital project identified outside of the Council approved ten year long range

capital plan, shown in the Development Charge Background Study is eligible to

be Front-ended unless another item(s) of comparable value, funding allocation,

and timing is delayed. A capital project identified with a post-period deduction applied to

the gross cost will only have the development charge portion reimbursed if

front-ended over the term of the by‑law. Indexing would not be

applicable to the repayment of the post-period component of the project

cost. If growth occurs more slowly than forecasted, then the City

Treasurer will have the authority to add an additional three years, without

interest, to the repayment of the post-period component of the front-ended

project from development charges.

SUMMARY OF AREA-SPECIFIC STORMWATER

MANAGEMENT

RATES BY AREA DOCUMENT

4