|

12. ST. JOSEPH BOULEVARD COMMUNITY IMPROVEMENT

PLAN grant application – JARDIN ROYAL GARDEN INC. – 2802‑2810 ST.

JOSEPH BOULEVARD (File no. D03-01-07

STJOG 1) Demande de subvention du Plan

d’amélioration communautaire du boulevard St-Joseph – Jardin royal garden

inc. – 2802-2810, boulevard St-Joseph |

COMMITTEE RECOMMENDATIONS

That Council:

1.

Approve the St. Joseph Boulevard Community Improvement Plan Grant

Application submitted by Jardin Royal Garden Inc., owner of the property at

2802‑2810 St. Joseph Boulevard, for a Development Incentive Grant not to

exceed $735,060, payable

to Jardin Royal Garden Inc. over a maximum of 10 years subject to the Owner

entering into an Agreement, as provided for in the approved St. Joseph

Boulevard Community Improvement Plan; and

2.

Authorise staff to negotiate a Development Assistance Agreement with

Jardin Royal Garden Inc. establishing the terms and conditions governing the

payment of the Development Incentive Grant for the redevelopment of 2802-2810

St. Joseph Boulevard satisfactory to the Deputy City Manager, Infrastructure

Services and Community Sustainability, the City Solicitor and the City

Treasurer.

RecommandationS du Comité

Que le Conseil :

1.

approuve la demande de subvention du Plan d’amélioration communautaire

du boulevard St-Joseph présentée par Jardin Royal Garden Inc., propriétaire du

terrain situé au 2802‑2810, boulevard St-Joseph, en accordant une

subvention au développement d’un montant n’excédant pas 735 060 $,

payable à Jardin Royal Garden Inc. sur une période maximale de 10 ans,

sous réserve de l’établissement des conditions d’un Accord d’aide au

développement, et en conformité avec celles-ci;

2.

informe le personnel de conclure un Accord d’aide au développement avec

Jardin Royal Garden Inc. en établissant les conditions régissant le versement

de la subvention au développement pour le réaménagement du 2802-2810, boulevard

St‑Joseph qui répond aux attentes de la directrice municipale adjointe,

Services d’infrastructure et Viabilité des collectivités, du chef du

contentieux et de la trésorière municipale.

DOCUMENTATION

1. Deputy City

Manager of Infrastructure Services and Community Sustainability report dated 15

May 2009 (ACS2008-ICS-PGM-0092)

Report to/Rapport au :

Corporate Services and

Economic Development Committee

Comité des services

organisationnels et du développement économique

and Council / et au Conseil

15 May 2009 / le 15 mai 2009

Submitted by/Soumis par : Nancy Schepers, Deputy City Manager

Directrice municipale adjointe,

Infrastructure Services and Community

Sustainability

Services d’infrastructure et Viabilité des collectivités

Contact

Person/Personne-ressource : Richard Kilstrom, Manager/Gestionnaire, Policy

Development and Urban Design/Élaboration de la politique et conception urbaine,

Planning and Growth Management/Urbanisme et Gestion de la croissance

Élaboration de la politique et conception urbaine

(613) 580-2424 x22653, Richard.Kilstrom@ottawa.ca

|

Ref N°: ACS2009-ICS-PGM-0092 |

|

SUBJECT: |

ST. JOSEPH BOULEVARD COMMUNITY IMPROVEMENT PLAN grant application

– JARDIN ROYAL GARDEN INC. – 2802‑2810 ST. JOSEPH BOULEVARD (File

no. D03-01-07 STJOG 1) |

|

|

|

|

OBJET : |

Demande de subvention du

Plan d’amélioration communautaire du boulevard St-Joseph – Jardin royal

garden inc. – 2802-2810, boulevard St-Joseph |

REPORT RECOMMENDATIONS

That the Corporate Services and Economic Development

Committee recommend Council:

1.

Approve the St. Joseph Boulevard Community Improvement Plan Grant

Application submitted by Jardin Royal Garden Inc., owner of the property at

2802‑2810 St. Joseph Boulevard, for a Development Incentive Grant not to

exceed $735,060, payable

to Jardin Royal Garden Inc. over a maximum of 10 years subject to the Owner

entering into an Agreement, as provided for in the approved St. Joseph

Boulevard Community Improvement Plan; and

2.

Authorise staff to negotiate a Development Assistance Agreement with

Jardin Royal Garden Inc. establishing the terms and conditions governing the

payment of the Development Incentive Grant for the redevelopment of 2802-2810

St. Joseph Boulevard satisfactory to the Deputy City Manager, Infrastructure

Services and Community Sustainability, the City Solicitor and the City

Treasurer.

RECOMMANDATIONS DU RAPPORT

Que le Comité des services organisationnels et du développement économique recommande au Conseil :

1.

d’approuver la demande de subvention du Plan d’amélioration

communautaire du boulevard St-Joseph présentée par Jardin Royal Garden Inc.,

propriétaire du terrain situé au 2802‑2810, boulevard St-Joseph, en

accordant une subvention au développement d’un montant n’excédant pas

735 060 $, payable à Jardin Royal Garden Inc. sur une période

maximale de 10 ans, sous réserve de l’établissement des conditions d’un

Accord d’aide au développement, et en conformité avec celles-ci;

1.

d’informer le personnel de conclure un Accord d’aide au développement

avec Jardin Royal Garden Inc. en établissant les conditions régissant le

versement de la subvention au développement pour le réaménagement du 2802-2810,

boulevard St‑Joseph qui répond aux attentes de la directrice municipale

adjointe, Services d’infrastructure et Viabilité des collectivités, du chef du

contentieux et de la trésorière municipale.

BACKGROUND

On

January 28, 2009 City Council adopted the St. Joseph Boulevard Community

Improvement Plan (CIP). The goal of the CIP is to bolster the economic

viability of the St. Joseph Boulevard area by stimulating the development and

redevelopment of privately held property, encouraging land use intensification

and the provision of affordable housing, supporting the establishment of

mixed-use development, and improving site and built-form aesthetics. This is achieved in the CIP through a

comprehensive framework of incentive programs including the Project Feasibility

Study Grant, Planning Fee Grant, Development Incentive Grant and the Building

Permit Fee Grant that partially offset a range of typical development costs.

J.P.

Taillefer on behalf of Jardin Royal Garden Inc. has filed an application for a

Development Incentive Grant for the one-hectare property located at 2802-2810

St. Joseph Boulevard (Document 1). The property is located within the St.

Joseph Boulevard Community Improvement Plan Project Area. The 1397 square metre commercial building

that existed on the property was demolished, by permit, in 2008.

The

purpose of this report is to bring the Development Incentive Grant application

for 2802‑2810 St. Joseph Boulevard before Committee and Council for

approval.

DISCUSSION

The

Development Incentive Grant Program provides financial assistance to partially

offset the cost of site and building development. Eligible costs under this program include, for example, building

demolition, construction, energy efficiency (LEED), building permit fees, hard

and soft site landscaping components and signage. The annual grant amount is equal to 70 per cent of the increase

in the municipal portion of property taxes (tax increment) resulting from

constructed projects. This grant is

paid once annually over a maximum 10-year period to a total overall maximum

grant amount of 70 per cent of the eligible on/off site construction costs or

$1,000,000 whichever is lower.

The

Building Permit Fee Grant Program provides financial assistance to partially

offset the cost of building permit fees.

The grant amount is equivalent to 30 per cent of building permit

fees. This Building Permit Fee Grant is

automatically included as an eligible cost within, and is paid as a component

of an approved Development Incentive Grant (a separate application is not

required). Through the Development

Incentive Grant, up to 70 per cent of the 30 per cent (maximum 21 per cent of

permit cost) may be reimbursed.

The

Development Incentive Grant amount is increased to 85 per cent of the eligible

on/off site construction costs or $1,000,000.00 whichever is lower, if three or

more new affordable housing units are constructed. This grant bonus does not apply to this application.

All

grant programs are structured such that payment occurs following construction

of a project, property reassessment by the Municipal Property Assessment

Corporation has occurred and the first year of post-reassessment taxes has been

paid. This grant payment timing ensures

that the City through its investment in the four grant programs has facilitated

an actual constructed project and allows time for project-related tax increment

revenues to be received.

The

CIP requires that all grant applications exceeding a total amount of $250,000

be brought before Committee for consideration and Council for approval.

The Royal Garden Grant

Application

Staff

has reviewed the required documents that are to be submitted to the City as

part of a Development Incentive Grant application and the grant application is

deemed to be complete. The proposed

redevelopment is the conversion of an existing single storey commercial

building to an expanded three-storey, 95-unit retirement residence (Document

2). The project is subject to an

application for site plan control.

Approval of the site plan application is expected to be finalized by

early summer 2009 with construction scheduled to begin shortly thereafter. The

project should be completed and occupied in 2010.

Development

Incentive Grant Eligible Costs and Estimated Grant Amount

Under

the St. Joseph Boulevard Community Improvement Plan, the applicant is required

to submit an estimate of project construction costs and an estimate of the

post-construction assessed value and tax payment amount to determine grant

eligibility, eligible project costs and projected grant payment amount. Staff

has reviewed the submissions and has determined that the total eligible costs

for the Development Incentive Grant are $8,300,000. The CIP requires that total upset amount for all grants combined

per property will be the lesser of 70 per cent of the eligible costs,

$1,000,000, or until 10 annual grant payments at 70 per cent of the municipal

tax increment amount have been made.

The

detailed calculations based on the formulas contained within the approved CIP

are shown in Document 4. In summary,

the total Development Incentive Grant amount is estimated to be $735,060. The

grant will be paid post-development in annual payments of approximately $73,506

over a 10-year period. The actual total

amount of the grant and the actual annual grant payments will be recalculated

annually based on actual taxes paid.

The total grant however will not exceed $735,060.

The

actual grant payment timing will depend on the pace at which development

occurs, the property is reassessed and the first year of post-development taxes

is paid in full. Since the total estimated grant amount is less than $1,000,000

and is less than 70 per cent of the eligible project costs, the grant program

period will be 10 years from the date of first grant payment.

For

the purposes of estimating the highest future municipal tax increment and the

earliest estimated grant pay-out period it has been assumed for illustrative

purposes that the development will be completed in 2010. The detailed

assumptions and the calculations are shown in Document 4. If the building program proceeds at this

pace the first grant payment could occur in 2012 and the grant pay-out could

end in 2021.

Economic

Benefits

The

overall economic impact of the proposed development is estimated at $8,300,000

in construction value for the 95-unit retirement residence. Both significant direct and indirect

economic benefits to the local economy will be realized during the construction

period through payroll, purchased material supplies and services and equipment

rentals for the development project.

Approximately

$11,000,000 in new residential assessment would be added to the property tax

assessment roll at full development. The tax consultant for the Owner estimates

approximately $121,265 per year in municipal property taxes can be expected at

full development. This is a significant increase over the estimated 2009

(post-appeal) municipal taxes of $16,256.

City Strategic Directions

One of

the City’s priorities, as a strategic direction, is in planning and growth

management. An important objective is to integrate

new growth seamlessly with established communities.

In

general, residential intensification assists the City’s overall smart-growth

urban management objectives by placing less of an emphasis on the expansion of

service boundary (into greenfields) and more of an emphasis on the utilization

of existing municipal infrastructure investments. The current approved site plan for this property incorporates

many sustainable development principles such as the creation of compact built

form, the strengthening of the link between higher density residential

development and public transit, and providing additional housing opportunities

within an existing urban community.

CONSULTATION

Public

consultation is not required for grant approval under the St. Joseph Boulevard

Community Improvement Plan. The Heart

of Orleans Business Improvement Area and Orleans Chamber of Commerce have been

advised of this grant application.

LEGAL/RISK MANAGEMENT IMPLICATIONS

There

are no legal/risk management impediments to implementing any of the

recommendations in this report.

This

application will be subject to a legal agreement setting out the details of the

responsibilities of the Owner and of the City in providing the grant

program. The agreement will be

registered on the title of the property to which it applies.

Grant payments will only be made following construction and

payment in full of the first year of post-development taxes. Grant payments will also not be made unless

the minimum specified increase in assessed value of the property has

occurred. These requirements reduce

interim financial pressure on the City, help to ensure that substantive work

has been undertaken on the property and eliminate the risk of grant payments

being made that have not led to actual project construction.

FINANCIAL IMPLICATIONS

As per the CIP, if this grant application is approved the City would

provide the Owner with an annual grant equivalent to 70 per cent of the

increase in municipal taxes, to the lesser of a maximum of 70 per cent of site

eligible development costs and $1,000,000.

For this grant the total maximum grant is $735,060 as calculated based

on the information submitted in support of the application. Note that the tax consultant for the Owner

has estimated the 2009 taxes based on successful appeal to the Assessment

Review Board. If the appeal is successful, the annual grant payment is

estimated to be $73,506. The grant

payment would be calculated annually based on actual taxes paid. The grant would be paid once per year for up

to 10 years until the total maximum grant amount is reached. After that time, the City will begin to

collect and retain the full municipal portion of the tax increment.

The City

will retain the balance (30 per cent) of the municipal tax increment per year

coinciding with the grant period. This

money will be deposited into the CIP Revolving Fund account. This account functions as a revolving fund

(capital account) to be used to offset the cost of future grants under the

Feasibility Study Grant program and the Planning Fee Grant program.

The

capital requirement for the Development Incentive Grant Program (and the

Building Permit Fee Grant Program) is funded from the citywide capital reserve

fund. All grant program capital

requirements will be identified individually at annual budget time as strategic

initiatives and as such will be subject to approval by Council as part of the

usual City budget process. Since the

first grant payment for this application is projected to be made in 2012, the

grant payment amount will be brought to Council for consideration as part of

the 2012 budget process. Note that if

the first grant payment is approved and an agreement is entered into between

the City and the applicant, the City is obliged to continue annual grant

payments in subsequent years.

SUPPORTING

DOCUMENTATION

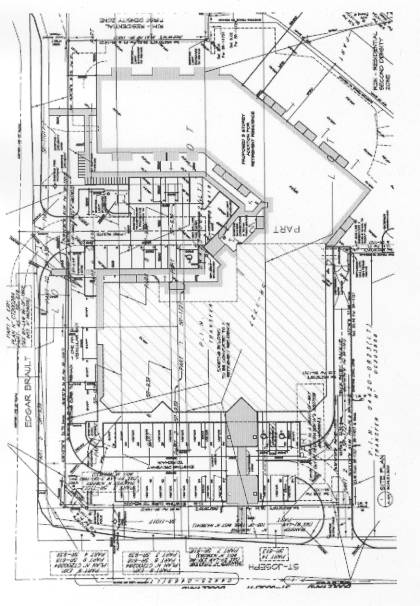

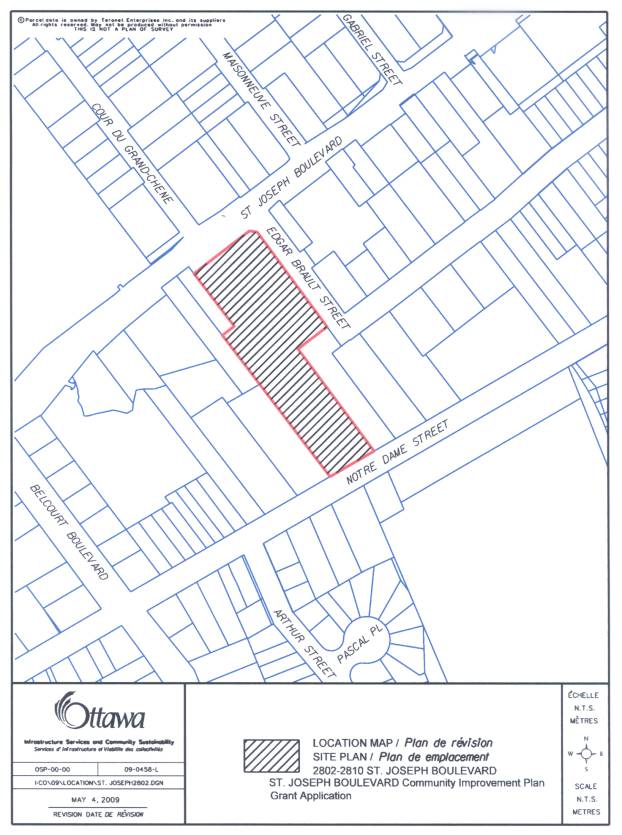

Document

1 Location Map

Document

2 Site Plan

Document

3 Eligible Costs

Document

4 Estimated Future City Property Tax

Increment and Annual Grant Payable

Document

5 Estimated Development Incentive

Grant

DISPOSITION

Legal

Services to prepare the Development Assistance Grant Agreement.

Planning

and Growth Management Department to monitor the performance of this grant

application and prepare a status report on this application as part of an

annual CIP monitoring report to Council.

Planning

and Growth Management Department to notify the applicant of Council’s decision.

LOCATION MAP DOCUMENT

1

SITE PLAN DOCUMENT

2

|

|

Item

|

Estimated Cost |

|

1 |

Building demolition: |

$ |

|

2 |

Construction of new building(s): |

$7,975,000 |

|

3 |

Construction of addition(s): |

$ |

|

4 |

Façade upgrade(s) in front yard or external side yard: |

$ |

|

5 |

On-site infrastructure construction / upgrade including water services, sanitary sewers burial of hydro service and stormwater management facilities: |

$100,000 |

|

6 |

Off-site infrastructure construction / upgrade including roads, water services, sanitary sewers, stormwater management facilities, electrical and gas utilities: |

$ |

|

7 |

On-site features construction / upgrade including hard and soft landscaping, parking areas, walkways, decorative lighting and signage: |

$200,000 |

|

8 |

Off-site features construction / upgrade including walkways, pedestrian amenities, hard and soft landscaping: |

$25,000 |

|

9 |

30% (40% if 3 or more affordable housing units) of the estimated Building Permit Fee to be paid: |

$ |

|

10 |

The following Leadership in Energy and Environmental Design (LEED) Program Components: a) base plan review by a certified LEED consultant; b) preparing new working drawings to the LEED standard c) submitting and administering the constructed element testing and certification used to determine the LEED designation |

$ |

|

|

Total Eligible Project Costs: Eligible Project Costs x Maximum 70% grant amount: |

$8,300,000 $5,810,000 |

The above-noted costs are

estimates only and Eligible Costs shall be based on actual paid Project Cost

amounts except that the maximum that the City will pay will be based on the

lesser of actual paid amounts or estimated costs, which may be audited by the

City.

ESTIMATED FUTURE CITY PROPERTY TAX INCREMENT

AND ANNUAL GRANT PAYABLE DOCUMENT

4

This Schedule is intended as an example of how the Development Incentive

Grant is calculated.

Pre-Project Property Tax Rates and Property Taxes

Current Value Assessment (2009) on the property

located at 2802-2810 St. Joseph Boulevard is $1,858,750, classed as

Commercial. Current annualized property taxes are approximately $30,000 broken

down as follows:

Table 1

Pre-Project Property Taxes*

|

Municipal Property Tax portion |

$16,256 |

|

Education Property Tax Portion |

$13,744 |

Total Pre-Project Property Taxes(In

the year the CIP grant application was made) |

$30,000 |

* Based on successful appeal currently before

the Assessment Review Board.

Based on the post-project assessment valuation

prepared by Cushman & Wakefield LePage, as submitted as part of the

application, it has been estimated that once the entire project is complete,

the property including all buildings will have a post-project assessment value

(in 2011) of approximately $12,500,000 in the residential tax class.

For the purposes of estimating the future municipal

tax increment and the estimated pay-out period it has been assumed that all of

the above components would be completed by mid-2010. It is important to note that the tax increment is an estimate and

provides guidance on the order of magnitude of the possible payment under the

assumption of all buildings being completed, reassessed and taxes levied and

paid at the full rate in 2011. The tax

rate (2011) and assessed values (2011) are held constant for illustration

purposes. In practice, the assessed

value of the units would likely increase reflecting increasing property values

to reflect the existing MPAC reassessment term. As well, there would likely be

some increase in annual municipal taxes during the projection period.

The administration of the grant program would

require that any grants to be paid be based on actual Municipal Property

Assessment Corporation (MPAC) property assessment (including any resolution of

appeals) of improved properties. The

prevailing tax rate would be applied and only after taxes are paid in full for

one year and only when the City is satisfied that all terms and conditions have

been met as specified in this agreement between the City and the applicant

would a grant be issued. The CIP

directs that the annual grant payment is capped at 70 per cent (85 per cent if

three or more affordable housing units have been constructed) of the municipal

share of the increase in property taxes over the pre-project municipal property

taxes paid.

The program period is a maximum of 10 years from the Development

Assistance Effective Date, until 70 per cent of the total project Eligible

Costs (85 per cent if three or more affordable housing units have been

constructed) have been paid by the annual grants or until $1,000,000 has been

paid, whichever comes first.

For this application, the estimated future Municipal

Tax Increment is the estimated future municipal tax minus the pre-project

municipal share of taxes. That is $121,265 minus $16,256 (from Table 1) =

$105,009.

The future municipal tax increment has been

estimated and the annual grant is based on the 70 per cent grant

factor. The possible grant payment

schedule is shown in Table 2 below. In

the administration of this grant the line item for each year would be

calculated in the corresponding year based on the new assessment, tax rate,

taxes paid and actual municipal tax increment paid in that year to establish

the actual grant payment.

Table 2 - Estimated Grant Amount

|

Year |

Existing Municipal Taxes (Base Rate) |

Projected

New Municipal Taxes |

Municipal Tax Increment |

Development Incentive Grant at 70% of

increment |

Feasibility & Planning Fee Grants

(1/10 of Total amounts) |

Est. Annual Development Assistance* |

Balance

to CIPRF** |

|

1 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

2 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

3 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

4 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

5 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

6 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

7 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

8 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

9 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

10 |

$16,256 |

$121,265 |

$105,009 |

$73,506 |

N/a |

$73,506 |

$31,503 |

|

TOT. |

$162,560 |

$1,212,650 |

$1,050,090 |

$735,060 |

N/a |

$735,060 |

$315,030 |

*The cumulative total of

annual Development Assistance paid shall not exceed the total from line 8 in

Document 5 (as may be reduced based on actual eligible project costs, assessed

values and tax increments paid).

**CIPRF = St. Joseph Boulevard Community

Improvement Plan Revolving Fund

DEVELOPMENT INCENTIVE GRANT

UPSET AMOUNT DOCUMENT 5

The St. Joseph Boulevard CIP

specifies that, the total of all grants combined with any Brownfield’s CIP

grant shall not exceed 70 per cent of eligible project costs, 85 per cent if

three or more affordable housing units have been constructed, to a total of

$1,000,000, whichever is lower.

|

1 |

Total Eligible Project Costs*: (from Document 3) |

$8,300,000 |

|

2 |

Total capping equal to the lesser of 70 per cent of Total Project Costs (85% if 3 or more affordable housing units constructed) and $1,000,000: |

$5,810,000 |

|

|

|

|

|

3 |

Project Feasibility Study Grant approved amount: (from Schedule “C”) |

N/A |

|

4 |

Planning Fee Grant approved amount: (from Schedule “D”) |

N/A |

|

5 |

Development Incentive Grant estimated amount: (from Table 2 – Document 4) |

$735,060 |

|

6 |

Brownfield’s CIP grant amount: (from existing or pending agreement, if any) |

N/A |

|

7 |

Sub-total: (lines 3 to 6 inclusive) |

$735,060 |

|

|

|

|

|

8 |

Total estimated Development Assistance upset

amount: (the

lower of lines 2, 7 and $1,000,000) |

$735,060 |

*Eligible

Costs are based on the lesser of the estimated and actual costs