bjbjàà

|

9. ST. JOSEPH BOULEVARD

COMMUNITY IMPROVEMENT PLAN Plan

d'amélioration communautaire du boulevard St-Joseph |

Committee

RecommendationS

That Council:

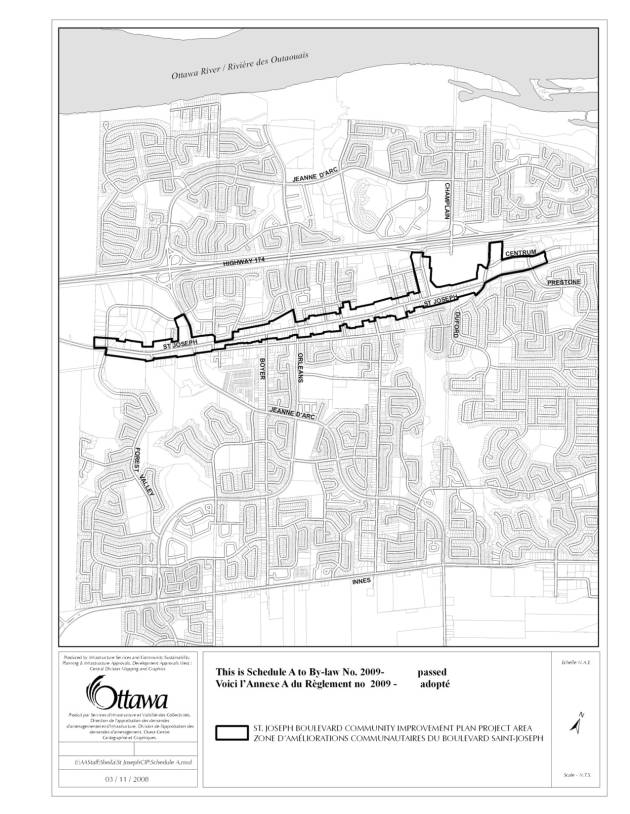

1. Enact

a by-law to designate the area shown as Schedule “A” on Document 1 as the St.

Joseph Boulevard Community Improvement Plan Project Area;

2. Enact

a by-law to adopt the St. Joseph Boulevard Community Improvement Plan as

detailed in Document 2 and 3; and

3. Delegate to the General Manager,

Planning and Growth Management the authority to approve Community Improvement

Plan grant applications for which the total combined grant amount does not

exceed $250,000.00, subject to an annual financial reporting to Council.

RECOMMENDATIONS DU COMITÉ

Que le Conseil :

1. adopte

un règlement municipal visant à désigner la zone illustrée à l’annexe A du

document 1 comme Zone de projet d’amélioration communautaire du boulevard St‑Joseph;

2.

adopte un règlement municipal visant

à adopter le Plan d’aménagement communautaire du boulevard St-Joseph comme il

est défini dans les documents 2 et 3; et

3. délègue au directeur général, Urbanisme et Gestion de la

croissance, le pouvoir d’approuver les demandes de subvention relatives au Plan

d’amélioration communautaire pour lesquelles le montant total combiné ne

dépassera pas 250 000 $, et qui devront faire l’objet d’un rapport financier

annuel déposé devant le Conseil.

DOCUMENTATION

1. Deputy City Manager of Infrastructure

Services and Community Sustainability report dated 19 December 2009

(ACS2008-ICS-PLA-0003).

Report to/Rapport au :

Planning and Environment Committee

Comité de l'urbanisme et de l'environnement

and / et

Corporate Services and Economic Development Committee

Comité des services organisationnels et du développement économique

and Council / et au Conseil

19 December 2008 / le 19 décembre 2008

Submitted by/Soumis par : Nancy

Schepers, Deputy City Manager

Directrice municipale adjointe,

Infrastructure Services and

Community Sustainability

Services d’infrastructure et

Viabilité des collectivités

Contact Person/Personne-ressource :

Richard Kilstrom, Manager/Gestionnaire, Community Planning and

Design/Aménagement et conception communautaire, Planning and Growth

Management/Urbanisme et Gestion de la croissance

(613) 580-2424 x22653,

Richard.Kilstrom@ottawa.ca

SUBJECT:

|

|

|

|

|

OBJET :

|

REPORT RECOMMENDATIONS

That the Planning and

Environment Committee and the Corporate Services and Economic Development

Committee recommend Council:

1.

Enact a by-law to designate the area shown as Schedule

“A” on Document 1 as the St. Joseph Boulevard Community Improvement Plan

Project Area;

2.

Enact a by-law to adopt the St. Joseph Boulevard

Community Improvement Plan as detailed in Document 2 and 3; and

3.

Delegate

to the General Manager, Planning and Growth Management the authority to approve

Community Improvement Plan grant applications for which the total combined

grant amount does not exceed $250,000.00, subject to an annual financial

reporting to Council.

RECOMMANDATIONS DU

RAPPORT

Que le Comité de

l’urbanisme et de l’environnement et le Comité des services organisationnels et

du développement économique recommandent au Conseil :

1. d’adopter un règlement

municipal visant à désigner la zone illustrée à l’annexe A du document 1 comme

Zone de projet d’amélioration communautaire du boulevard St‑Joseph;

2. d’adopter un règlement

municipal visant à adopter le Plan d’aménagement communautaire du boulevard

St-Joseph comme il est défini dans les documents 2 et 3; et

3. de déléguer au directeur

général, Urbanisme et Gestion de la croissance, le pouvoir d’approuver les

demandes de subvention relatives au Plan d’amélioration communautaire pour

lesquelles le montant total combiné ne dépassera pas 250 000 $, et

qui devront faire l’objet d’un rapport financier annuel déposé devant le

Conseil.

BACKGROUND

In 2003, the City approved the St. Joseph Boulevard Corridor Study. This study established a framework to guide the form of development adjacent to the street and suggested improvements to the streetscape. The goal of the Corridor Study was to set the stage for future intensification and beautification enhancing the area as a live/work/shop destination and thereby supporting the economy of the area. It led to a comprehensive change to the zoning for the St. Joseph Boulevard corridor that implements the design recommendations in the study. The Corridor Study recommended a series of strategic initiatives including the preparation of a Community Improvement Plan for the area.

The City commenced preparation of the St. Joseph Boulevard Community Improvement Plan in December 2007. The CIP was drafted under the guidance of a Project Advisory Committee comprised of representatives from the Heart of Orleans Business Improvement Area, the Chamber of Commerce, Action Ottawa-Orleans and representatives from the Councillors offices from Wards 1 and 2. The property owners within the study area and the community-at-large were consulted through two public open house meetings.

The goal of the St. Joseph

Boulevard Community Improvement Plan (CIP) is to bolster the economic viability

of the St. Joseph Boulevard area by stimulating development and redevelopment

of privately held property, encouraging land use intensification and the

provision of affordable housing, supporting the establishment of mixed-use

development, and improving site and built-form aesthetics. This is achieved in the CIP through a program

of grant-based financial incentives to landowners that will partially offset a

range of typical development costs. The

CIP does not contain direction for streetscape (public street right-of-way)

improvements.

Other goals of the CIP include:

a)

Reinforcing the St. Joseph

Boulevard area as a central focus for the community;

b)

Strengthening the St. Joseph

Boulevard area as a live / work / play destination;

c)

Encouraging a range of

higher-density housing types including affordable housing units;

d)

Providing employment

opportunities through intensification of commercial and office uses;

e)

Encouraging infill and

mixed-use development;

f)

Assisting in achieving

improved building architecture, site design and site landscaping; and

g)

Helping to provide for an

attractive, safe and pedestrian friendly environment.

The CIP Project Area covers a length of about 4.0

kilometres along St. Joseph Boulevard, extending approximately from Youville

Drive in the west to Prestone Drive in the east. It is comprised of approximately 75 hectares of land and affects

approximately 150 commercial and residential properties fronting on both the

north and south sides of St. Joseph Boulevard as well as properties fronting on

Jeanne D’Arc Boulevard, Place D’Orleans Drive and within portions of the

Cumberland Town Centre area (see Document 1).

The Planning Act requires that Council approve the

Community Improvement Plan Project Area and the Community Improvement Plan

document at a formal public meeting. A

by-law must first be passed that enacts a Community Improvement Plan Project

Area then immediately following the Community Improvement Plan document can be

adopted by by-law. A statutory appeal

period applies after by-law approval.

Best Practices Review

The Planning Act provides for municipalities to

offer financial incentives in the form of loans and grants within approved

Community Improvement Plan project areas.

Staff contacted several other municipalities in Ontario to determine

successes and failures of their respective CIP’s and to identify emerging

trends and best practices. The cities

of Windsor, London, Hamilton, Oshawa, Barrie, Owen Sound, Quinte West, Sudbury,

Gananoque, Brockville and Kingston were contacted.

Most municipalities have incentive programs tailored to

specific circumstances of their particular CIP project area. Certain of them have grant or loan programs

in order to implement require detailed design guidelines. An example of this would be façade

improvement grants that are paid at specified rates depending on the level of

aesthetic improvement achieved. The St.

Joseph Boulevard Corridor Study (2003) does not provide sufficient design

detail to allow the City to offer such performance-based incentive

programs. Also, loan programs were

reported to be costly to administer in terms of staff time compared to the

benefit received from the program and therefore are not recommended for this

CIP.

City staff also consulted extensively with the Ministry of

Municipal Affairs and Housing, Kingston office, on draft versions of the

document to draw from their collective experience in reviewing and approving

municipal CIP’s. As a result of the

best practices review, and based on input received from Municipal Affairs and

Housing as well as through public consultation, a set of four grant programs

are recommended for inclusion in the St. Joseph Boulevard CIP.

Recommended Financial Incentive Programs

Four grant programs are recommended for the St. Joseph Boulevard Community Improvement Plan (Document 3). The recommended grant programs have been structured to cover the progression of typical development projects from inception to completion. The financial incentive amounts within each of the grants have been increased slightly to support the construction of new affordable housing units. Affordable housing is defined as housing, either rental or ownership, for which a low or moderate income household pays no more than 30 per cent of its gross annual income. All grants are paid only after site development is completed, the Municipal Property Assessment Corporation (MPAC) has reassessed the property and the first year of taxes have been paid in full.

Grant program duration under the CIP is an initial period of five years with an option to extend for up to another five years. Council can extend or cancel the CIP programs at any time (except any approved grant program payments to owners must continue). Changing the CIP by adding new grant programs or by increasing the grant payment amounts must be approved through a formal amendment to the CIP under the Planning Act.

The recommended CIP grant programs are summarized as follows:

1.

Project Feasibility

Study Grant Program

This grant program provides financial

assistance to partially offset the cost of studies that are undertaken to help

determine if a development project is feasible. Studies in this program include, for example, servicing analysis,

market studies, site design and architectural concept designs. This grant would be beneficial to all types

of development from small projects such as façade and site improvement up to

larger projects such as building demolition and site intensification through

redevelopment.

The total overall grant amount for all eligible feasibility studies combined is 25 per cent up to a total overall maximum grant amount of $2,500. The grant amount is increased to 50 per cent of study costs up to $5,000 combined maximum if three or more new affordable housing units are constructed.

3. Development Incentive

Grant Program

This

grant program provides financial assistance to partially offset the cost of

site and building development. Eligible

costs under this program include, for example, building demolition,

construction, energy efficiency (LEED), building permit fees, hard and soft site

landscaping components and signage.

This grant is paid once annually over a maximum 10-year period to a

total overall maximum grant amount of 70 per cent of the eligible on/off site

construction costs or $1,000,000.00 whichever is lower.

The

annual grant amount is equal to 70 per cent of the increase in the municipal

portion of property taxes (tax increment) resulting from constructed

projects. The annual grant amount is

increased to 85 per cent of eligible on/off site construction costs if three or

more new affordable housing units are to be constructed.

4. Building Permit Fee

Grant Program

This

grant program provides financial assistance to partially offset the cost of

building permit fees. The grant amount

is equivalent to 30 per cent of building permit fees. This cost is then included as an “eligible cost” within an

approved Development Incentive Grant.

Through the Development Incentive Grant up to 70 per cent of the 30 per

cent (maximum 21 per cent of permit cost) may be reimbursed.

The grant maximum percentage is increased to 40 per cent of building permit fees if three or more new affordable housing units are constructed. Through the Development Incentive Grant up to 85 per cent of the 40 per cent (maximum 34 per cent of permit cost) may be reimbursed.

The total combined grant maximum amount per property, for all CIP grants combined, is 70 per cent of the eligible on/off site construction costs or $1,000,000.00, whichever is lower. The total combined maximum grant amount is increased to 85 per cent of the eligible on/off site construction costs or $1,000,000.00 whichever is lower, if three or more new affordable housing units are constructed.

All grant programs are structured such that payment occurs following construction of a project, property reassessment by the Municipal Property Assessment Corporation has occurred and the first year of post-reassessment taxes have been paid. Issuing payments after construction ensures that the City, through its investment in the four grant programs, has resulted in an actual project that benefits the community and allows time for project-related tax increment revenues to be received by the City.

The grants are not a direct

rebate of taxes paid. However, in the

case of the Development Incentive Grant, the maximum annual grant amount is

based on a percentage of the increase in the municipal portion of tax payment

(increment) post-development as compared to pre-development. Using

the tax increment amount as a guide provides a reasonably consistent mechanism

of determining grant payment amounts that reflect actual improvements carried

out on a property. This approach also

has the advantage of providing a sliding scale for grant calculations - smaller

projects typically have a lower increase in assessed value, a smaller tax

increment amount, and generally would receive smaller grants. Larger projects have a higher increase in

assessed value, a larger tax increment amount, and would generally receive

larger grants. Sample grant payment

calculations for residential and commercial development projects are set out in

Document 4.

The following summarises the general requirements of the CIP:

· All owners of private properties in the CIP Project Area can apply for grant programs for all types of land use. Only one grant per grant type, per property (including coordinated development projects) is permitted.

· CIP grants may be given for projects resulting in one or more of:

- a building addition,

- façade improvement facing a public road,

- construction of a new building, and

- site works including landscaping and signage.

· All CIP grants are only paid after project construction, property reassessment by MPAC has occurred, and the first year of tax payment is made in full.

· Maximum combined total grant payment amount resulting from all CIP grant programs, including applicable Brownfields CIP grants, cannot exceed 70 per cent (85 per cent if three or more affordable housing units are constructed) of eligible project costs, or $1,000,000.00, whichever is lower.

· In order for a CIP application to be processed and a grant payment made, the projected total overall grant amount per grant type must be at least $1,000.00.

· In order for a CIP grant payment to be made there must be a minimum $10,000.00 increase in post-construction assessed property value. An estimate of the increase in assessed property value must be provided as part of an application for a Development Incentive Grant.

· All CIP grants are subject to an agreement signed by the owner and registered on the title of the property to which they apply. If an applicant has received approval for a Project Feasibility Study Grant and/or a Planning Application Fee Grant, the related requirements and grant payment amounts would form part of the legal agreement prepared for a Development Incentive Grant and Building Permit Fee Grant.

To streamline the approvals process, it is recommended that Council delegate to the General Manager, Planning and Growth Management, approval of grant applications with a total payment amount equal to or less than $250,000.00. All grant applications with a total payment amount greater than $250,000.00 would be brought to Committee and Council for consideration. Final approval of all new grants would be contingent on Council approving the first year of grant payment at the time of annual City budget approval. Note however that once a grant application is approved and an agreement is entered into between the City and the applicant, the City is obliged to continue annual grant payments as set out in the agreement.

As part of the grant capital budget approval process, staff will prepare and bring forward to Council for information an annual monitoring report on the performance of the CIP setting out, for example:

· The number and type of grant applications,

· The increase in assessed value and taxes paid for participating properties,

· Projected and actual grant payment amounts,

· Number of residential units / area of commercial space constructed,

· Estimate of jobs created / maintained.

Ottawa Brownfields Community

Improvement Plan

Council approved the

Brownfields CIP on April 22, 2007. The

Brownfields CIP provides financial assistance for the redevelopment of

contaminated sites. Since approval,

several applications have been processed under this program. The proposed St. Joseph Boulevard CIP is

modelled on the Brownfields CIP in terms of general content and structure, but

its grant programs have been tailored to meet needs specific to the St Joseph

Boulevard community context. Highlights

of the key differences between the Brownfields CIP and the proposed St. Joseph

Boulevard CIP are as follows:

· For the Development Incentive Grant (Rehabilitation Grant in the Brownfields CIP) the annual grant payment amount is 70 per cent rather than 50 per cent of the municipal tax increment (85 per cent where three or more affordable housing units are constructed).

·

The overall combined maximum payment for all grants per

property is 70 per cent rather than 50 per cent of eligible project costs

(85 per cent where three or more affordable housing units are constructed) and

is capped at $1,000,000.00 maximum (including any Brownfields CIP grant

amounts).

· The property must have a minimum increase of $10,000.00 in post-construction assessed value in order for grant payments to be made.

· The projected overall grant payment per grant type must be greater than $1,000.00 in order for a grant application to be processed and paid.

CONSULTATION

A public open house meeting was held on May 27, 2008 to introduce the proposed project composition and schedule and to present the preliminary Community Improvement Plan project area boundary and preliminary financial incentive programs. A second public open house meeting was held on September 24, 2008 to present a full draft copy of the CIP document including the proposed CIP project area boundary and four financial incentive programs. The meetings were generally well attended and a very positive response to the proposed CIP was received from residents and business owners.

LEGAL/RISK MANAGEMENT IMPLICATIONS:

Staff will prepare application guidelines and application forms for each of the CIP grants subject to Council approving them by adopting the St. Joseph Boulevard CIP by by-law. A standard agreement will be prepared with the assistance of Legal Services staff. If Council approves the CIP early in 2009 it is anticipated that the first agreements would be registered in 2010 and the first grant payments would be made in 2011 or 2012 (after site development and tax payment).

Grant payments are to be made

following construction and payment in full of the first year of taxes. Grant payments will also not be made unless

the minimum specified increase in assessed value of the property has occurred. These requirements reduce interim financial

pressure on the City, help to ensure that substantive work has been undertaken

on the property and eliminate the risk of grant payments being made that have

not led to actual project construction.

FINANCIAL IMPLICATIONS

The capital requirement for both the

Development Incentive Grant Program and the Building Permit Fee Grant Program

is to be funded from the city-wide capital reserve fund, calculated at the

rates for each grant program as approved in the CIP (based on the municipal tax

increment resulting from properties participating in the program). The Project Feasibility Study Grant Program

and the Planning Fee Grant Program are also to be funded from the city-wide

capital reserve fund, calculated based on retaining the remaining amount of

the municipal tax increment amount resulting from properties participating in

the Development Incentive Grant Program.

A “St. Joseph Boulevard Community Improvement Plan Revolving Fund”

capital account (CIP Revolving Fund) will be established as the operating

account for the life of CIP grant programs.

If approved, grant applications equal to

or less than $250,000.00 are to be approved by the General Manager, Planning

and Growth Management. Grant

applications that exceed $250,000.00 will be brought forward to Council for

approval through a staff report to Committee.

All grant program capital requirements will be identified individually

at annual budget time as strategic initiatives and as such will be subject to approval

by Council as part of the usual City budget process. Note

however that once a grant application is approved and an agreement is entered

into between the City and the applicant, the City is obliged to continue annual

grant payments as set out in the agreement.

All approved CIP grants are to be paid

only after project construction, reassessment by the Municipal Property

Assessment Corporation, and the first year post-reassessment taxes are paid in

full. This will ensure that the funds

transferred into the CIP Revolving Fund are directly as a result of the

incremental tax dollars realized from constructed CIP projects. Money transferred to the Revolving Fund

resulting from an approved CIP project may however be used to provide grant

payments to another approved CIP project.

Grant programs may also be funded from seed funding and subsequent

top-up funding as may be brought forward by staff for consideration of

Council.

There are no direct financial

implications as a result of this report.

Requests for funding will be included in the annual budget process or as

separate reports as required. There is

no requirement for additional staff in the Planning and Growth Management

Branch to implement the CIP. However, the Financial

Services Branch has advised that it may require additional staff resources to

respond to increased workload related to community improvement plans as well as

to other project initiatives that are being brought forward by the

Infrastructure Services and Community Sustainability Department.

Motion 26/37

passed by Council in December 2007 requires that $500,000.00 be allocated to

streetscape corridor improvements identified in the St. Joseph Boulevard CIP

(once approved). Motion 26/38 requires

that Motion 26/37 be referred to Planning and Environment Committee at the time

the CIP comes forward to that Committee.

The CIP now before Committee cannot be used as a basis to implement

Motion 26/37 since the recommended CIP affects only private property and does

not contain provisions for streetscape design improvements.

FINANCIAL ADMINISTRATION

Planning and Growth Management staff will receive and administer grant applications and take the lead role in liaison with applicants through the grant review and approval process. Staff will also identify for consideration by Council through a CIP monitoring report, the annual budget requirement for each anticipated CIP grant and will identify the overall anticipated CIP grant amounts in the Long Range Financial Plan.

For the first year of each approved grant, the budget pressure amount will be based on the approved percentage of the estimated tax increment amount as provided by the applicant at the time of initial grant application. The actual grant payment amount in the first year will be based on the lower of the estimated or actual tax increment amounts. In all subsequent years grant amounts will be calculated based on the actual municipal incremental tax amount. The Revenue Division of the Financial Services Branch will take the lead role in reviewing estimates of increase in assessment, calculating annual grant payment amounts and for transferring appropriate funds into the CIP Revolving Fund. Financial Services Unit staff will be responsible for issuing grant payments and for tracking totals paid under each grant program.

SUPPORTING DOCUMENTATION

Document 1 St. Joseph Boulevard CIP Project Area Draft By-law

Document 2 St. Joseph Boulevard CIP Adoption Draft By-law

Document 3 St. Joseph Boulevard CIP (distributed separately and on file with City Clerk)

Document 4 Sample

CIP Grant Payment Calculations

DISPOSITION

Infrastructure Services and Community

Sustainability Department to prepare implementing by-laws and forward to Legal

Services Branch.

Legal Services to forward implementing by-laws to City Council.

Infrastructure Services and Community

Sustainability Department to implement the Community Improvement Plan.

Infrastructure Services and Community Sustainability Department to prepare an annual Community Improvement Plan grant monitoring report to Council.

DOCUMENT 1

ST. JOSEPH BOULEVARD CIP PROJECT AREA DRAFT BY-LAW

BY-LAW NO. 2009 - ____

A

by-law of the City of Ottawa to

designate a part of the area covered by the Official Plan for the City of

Ottawa as the St. Joseph Boulevard Community Improvement Project Area.

WHEREAS pursuant to Section 28 of the Planning Act, R.S.O. 1990. c. P.13, City Council may designate the whole or any part of an area covered by an Official Plan as a community improvement project area;

AND WHEREAS the 2003 St. Joseph Boulevard Corridor Study approved by Council directed the implementation of a Community Improvement Plan for St. Joseph Boulevard;

AND WHEREAS on ________,

2009 Planning and Environment Committee recommended the designation of part of

the area covered by the Official Plan to be a community improvement project

area;

AND WHEREAS on ________, 2009, City Council carried the recommendations of Planning and Environment Committee;

THEREFORE the Council of the City of Ottawa enacts as follows:

1. The following area is designated as the St. Joseph Boulevard Community Improvement Project Area:

(1) the land illustrated on Schedule “A” to this by-law is hereby designated as a community improvement project area.

2. This by-law shall come into force in accordance with the provisions of the Planning Act, R.S.O. 1990, c.P.13, as amended.

ENACTED AND PASSED this __ day of ________, 2009.

CITY CLERK MAYOR

DOCUMENT 2

ST. JOSEPH BOULEVARD CIP ADOPTION DRAFT BY-LAW

BY-LAW NO. 2009 -

_______

A by-law of the City of Ottawa to adopt the St. Joseph Boulevard Community Improvement Plan.

WHEREAS pursuant to Section 28 of the Planning Act, R.S.O. 1990.

c. P.13,

City Council may, where

it has passed a by-law designating the whole or any part of an area covered by

an Official Plan as a community improvement project area, adopt a plan as a

community improvement plan for the community improvement project area;

AND WHEREAS Council has convened public meetings to consider the

adoption

of the St. Joseph

Boulevard Community Improvement Plan;

AND WHEREAS on __________, 2009 Planning and Environment Committee

recommended the

adoption of the St. Joseph Boulevard Community Improvement Plan;

AND WHEREAS on

_________, 2009 City Council carried the recommendations

of Planning and

Environment Committee;

THEREFORE the Council of the City of Ottawa enacts as follows:

1. Attachment 1, being the St. Joseph

Boulevard Community Improvement Plan is hereby adopted.

2. This by-law shall come into force in

accordance with the provisions of the

Planning Act, R.S.O. 1990, c.P.13, as amended.

ENACTED AND PASSED this ____th day of ________, 2009.

CITY CLERK MAYOR

SAMPLE CIP

GRANT PAYMENT CALCULATIONS DOCUMENT 4

|

Development

Type

|

New Retail Store |

Office Expansion |

Multi-Unit Residential (Affordable Housing) |

|

Feasibility

Study Grant Program |

Maximum

grant = $2,500 |

Maximum

grant = $2,500 |

Maximum

grant = $5,000 |

|

Planning Application Fee

Grant Program |

Zoning

By-law Amendment: $6,200 Site

Plan Approval: $4,796

$10,996 $10,996 x 25% = $2,749 max. grant |

Minor

Variance: $880 $880

x 25% = $220 max. grant |

Site

Plan Approval: $15,646 Plan

of Condominium: $10,360

$26,006 Upset

grant amount = $10,000 |

|

Development

Incentive

Grant And

Building

Permit Fee Grant Program |

Total

Eligible Costs $1,792,830 (construction,

permit fees, etc.) Increase

in Assessment: $843,000 Municipal

Tax Increment: $16,848 Maximum

annual grant payment is 70% of tax increment = $11,794 Total

grant over 10 years = $117,940 |

Total

Eligible Costs $140,000 (construction,

permit fees, etc.) Increase

in Assessment: $21,790 Municipal

Tax Increment: $3,114 Maximum

annual grant payment is 70% of tax increment = $2,179 Total

grant over 10 years = $21,790 |

Total

Eligible Costs $2,846,000 (construction,

permit fees, etc.) Increase

in Assessment: $742,480 Municipal

Tax Increment: $87,351 Maximum

annual grant payment is 85% of tax increment = $74,248 Total

grant over 10 years = $742,480 |

|

Totals

|

Feasibility

Study Grant $2,500 Planning

Fee Grant $2,749 Dev.

Incentive Grant $117,940 Overall Total Grant $123,189

|

Feasibility

Study Grant $2,500 Planning

Fee Grant $ 220 Dev.

Incentive Grant $21,790 Overall Total Grant $24,510

|

Feasibility

Study Grant $5,000 Planning

Fee Grant $10,000 Dev.

Incentive Grant $742,480 Overall Total Grant $757,480

|

|

Notes |

Dev.

Incentive Grant amount will fluctuate annually with changes in municipal

taxes. All

examples are under the overall maximum grant amount of the lower of 70% / 85%

of Eligible Costs and $1,000,000 All

examples would be paid over a ten-year period. |

||