|

10. AMENDMENT TO DEVELOPMENT CHARGE BY-LAW 2007-66 MONAHAN DRAIN

STORMWATER MANAGEMENT FACILITY Modification Au Règlement

municipal no 2007-66 sur les redevances d'aménagement visant

l'installation de drainage Monahan et l'installation de gestion des eaux

pluvialeS |

Committee Recommendations

That Council approve:

1.

An amendment to the

Development Charges By-Law 2007-66 adopted on February 14, 2007 to reflect

changes in the area-specific stormwater non‑residential rates resulting

from changes to the Area Specific Development Charges Background Study dated

March 7, 2008, as recommended by Planning and Environment Committee on

January 22, 2008; and

2. The Background Study attached as Document 2,

inclusive of the revised area-specific development charge growth projections

and non‑residential rates for the Monahan Drain area.

Recommandations du comité

Que le Conseil approuve :

1.

Une modification au Règlement

municipal no 2007-66 sur les redevances d’aménagement adopté le 14 février 2007

afin de refléter les changements des taux non résidentiels relatifs aux eaux

pluviales de secteurs distincts qui ont été causés par les changements de

l’Étude de base sur les redevances d’aménagement de secteurs distincts

effectuée le 7 mars 2008, comme il a été recommandé par le Comité de

l’urbanisme et de l’environnement le 22 janvier 2008; et

2. L’Étude de base présentée en

pièce jointe 2, qui tient compte des nouvelles prévisions de croissance

relatives aux redevances d’aménagement de secteurs distincts et des taux non résidentiels

du secteur de l’installation de drainage Monahan.

Documentation

1. Deputy City Manager’s report (Planning

Transit and the Environment) dated 23 April 2008 (ACS2008-PTE-PLA-0060).

Report to/Rapport au :

Corporate Services and Economic Development

Committee

Comité des services organisationnels et du développement économique

and Council / et au Conseil

23 April 2008 / le 23 avril 2008

Submitted by/Soumis par : Nancy Schepers,

Deputy City Manager/Directrice municipale

adjointe,

Planning, Transit and the

Environment/Urbanisme, Transport en commun et Environnement

Contact Person/Personne ressource : Michael Wildman, A/Manager,

Infrastructure Approvals Division

Planning

Branch/Direction de l'urbanisme

(613) 580-2424

x 27811, Mike.Wildman@ottawa.ca

REPORT RECOMMENDATIONS

That the Corporate Services and Economic Development Committee

recommend Council approve:

1.

An amendment to the

Development Charges By-Law 2007-66 adopted on February 14, 2007 to reflect

changes in the area-specific stormwater non‑residential rates resulting

from changes to the Area Specific Development Charges Background Study dated

March 7, 2008, as recommended by Planning and Environment Committee on

January 22, 2008; and

2.

The Background

Study attached as Document 2, inclusive of the revised area-specific

development charge growth projections and non‑residential rates for the

Monahan Drain area.

RECOMMANDATIONS DU RAPPORT

Que le Comité des

services organisationnels et du développement économique recommande au Conseil

d'approuver :

1.

Une modification au Règlement

municipal no 2007-66 sur les redevances d’aménagement adopté le 14 février 2007

afin de refléter les changements des taux non résidentiels relatifs aux eaux

pluviales de secteurs distincts qui ont été causés par les changements de

l’Étude de base sur les redevances d’aménagement de secteurs distincts

effectuée le 7 mars 2008, comme il a été recommandé par le Comité de

l’urbanisme et de l’environnement le 22 janvier 2008; et

2.

L’Étude de base présentée en pièce

jointe 2, qui tient compte des nouvelles prévisions de croissance relatives aux

redevances d’aménagement de secteurs distincts et des taux non résidentiels du

secteur de l’installation de drainage Monahan.

BACKGROUND

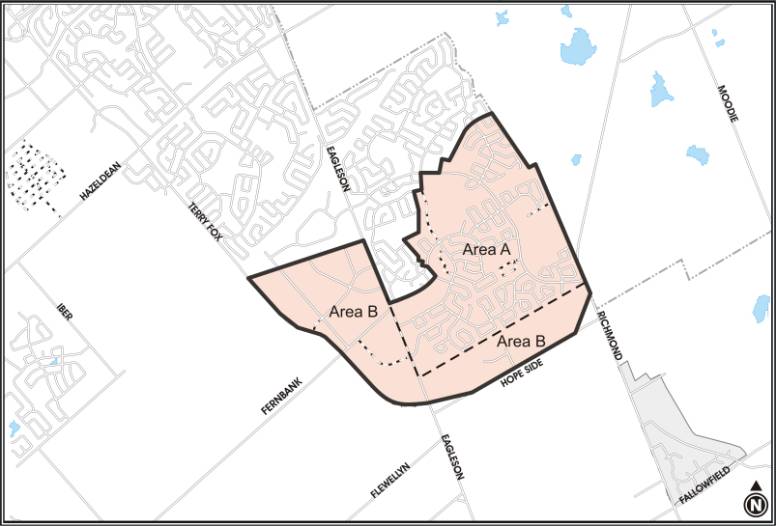

The Monahan Drain Constructed Wetland Stormwater Management Pond (hereinafter called “Monahan Drain”) is located at the southern limit of Kanata and is bounded by Terry Fox Drive to the west, Hope Side Road to the south, and the Bridlewood community to the east. Document 1 includes a map of the Monahan Drain storm development charge area. In 2004, the City engaged in a comprehensive development charge review, for which 15 Area Specific Development Charge (DC) By‑Laws were enacted. From this review, the Monahan Drain Area Specific Development Charge By‑Law 2004-307 was established with project costs incorporating the outstanding debt payments and a DC reserve fund deficit, both originating from the former City of Kanata.

In 2007, Council approved an amendment to the Monahan Drain DC By-Law, currently By-Law 2007-66 as enacted, to reflect the changes in land use according to the Official Plan. The amendment included updated growth projections and updated costs for the design and construction of the stormwater pond to reflect current construction costs and design changes (costs also included the existing reserve fund balance and debt repayments) With the updated total project costs, the effective DC rates increased substantially. The rise was due to unforeseen increases in capital cost estimates required for the expansion of the stormwater area in the City’s 2004 DC Background Study.

As a consequence of the increased rates, Urbandale Corporation, and Cavanaugh Construction appealed By-Law 2007-66 to the Ontario Municipal Board (OMB). Urbandale advanced the argument that they should not be subject to the higher rates since much of their land holdings are subject to registered plans for which agreements of purchase and sale have already been signed. Urbandale also advanced the argument that they should not have to pay for stormwater works for the benefit of the lands west of Eagleson Road. Claridge Homes, another developer in the area, had been granted party status in the appeals as well.

City staff held several meetings with the appellants to review possible options to amend the DC rates and a consensus was reached in January 2008. A report (ACS2008‑CMR‑LEG-0003) was brought to Planning and Environment Committee for a proposed amendment to the Monahan Drain storm DCs, which Council and recently the OMB approved.

The amendment divides the Monahan Drain storm development and charge area into two distinct areas. As illustrated in Document 1, and pursuant to the amendment, Area A includes lands held primarily by Urbandale, east of Eagleson Road. Area A will be subject to the lower DC charges imposed under the former Kanata By-Law 140-00 and subject to indexing. Area B includes the balance of the lands west of Eagleson Road and the undeveloped lands north of Hope Side Road. For Area B, the current rates imposed under By-Law 2007-66 will remain in place. The table below summarizes the residential rates recently approved by the OMB.

|

|

AREA A |

AREA B |

||

|

OMB approved |

Indexed to April 1,

20 |

OMB approved |

Indexed to April 1, 2008 |

|

|

Single/Semi- detached |

$1,701 |

$1,880 |

$2,373 |

$2,624 |

|

Row/Townhouse |

$1,239 |

$1,370 |

$1,895 |

$2,095 |

|

Stacked row/ Apartment |

$842 |

$931 |

$842 |

$931 |

With the established residential rates in place as per above, the resulting non-residential rate would have been higher than the current rate under By-Law 2007-66. According to the Development Charges Act, the OMB does not have authority to increase DC rates on an appeal, and as such, a revision to the background study and By-Law was necessary.

DISCUSSION

Under the OMB imposed residential rates, an alternative method in determining the non-residential DC rates was required. The City’s basic principles according to the DC Background Study could not be employed in this case. One underlying principle is to allocate the total costs of the stormwater infrastructure on a proportionate basis by hectare area for residential and non-residential development. The allocated costs to residential lands are then distributed accordingly by the number of housing units to arrive at a residential DC rate. Similarly, the costs apportioned towards non-residential lands are distributed based on gross floor area (GFA) to arrive at a charge per GFA. However, since the residential rates had already been established, a reverse approach was required in order to recoup the full capital costs in the Monahan Drain area.

The background study identified that the applicable residential rates for Area B would be as follows:

|

Indexed to April 1, 2008 |

|

|

Single/Semi-detached |

$2,095 |

|

Row/Townhouse |

$1,674 |

|

Stacked row/ Apartment |

$741 |

However, the stormwater works within Area B are being constructed by the landowners pursuant to a front-ending agreement between the landowners and the City. To ensure recovery of the costs of the stormwater works, the landowners indicated to the City, prior to the earlier report to Committee and Council this year, that it is their preference that the residential rates established in By-law 2007-66 continue to apply to Area B. While the imposition of these rates could theoretically provide for an over-recovery by the City, as stated in the January report, there is uncertainty as to whether reimbursement has been made for a past property acquisition by the former City of Kanata for the Monahan Stormwater Facility. In addition, the remaining debentures issued for the past construction of the stormwater facility mature in 2011. To the extent that not all of the development in the drainage area has occurred by then, there will be further carrying costs incurred by the City not accounted for in the estimate of costs in the background study.

With respect to the non-residential rates, several options were reviewed for the area specific non-residential rates for Areas A and B. One option considered was to establish a blended non-residential rate for both Area A and B. The table below summarizes the results of the non-residential rates under two scenarios, indexed to April 1, 2008.

|

Area specific rate |

Blended rate |

|

|

Area A |

$10.15 |

$2.65 |

|

Area B |

$2.08 |

Although the area specific rates above would have been the usual approach to consider, under the circumstances, the $10.15 proposed non-residential rate for Area A is excessive, and is therefore not recommended, as it represents a fourfold increase over the City’s estimated average. It should be noted that when the drainage area is reduced in size, as is the case for the Area A lands, the effective DC rates increase because of the lower growth potential. This practice is in contrast to another principle employed by the City in establishing DCs, and that is to strategically size the drainage area to yield realistic DC rates. Due to the alternative approach used in obtaining the non-residential rate, it is recommended that a blended rate of $2.65 be used, which is in line with the estimated averages in other storm DC areas.

CONSULTATION

According to the Development Charges Act, 1997, an amendment to the Development Charge By-Law requires public consultation. The public meeting will be held at the Corporate Services and Economic Development Committee meeting of May 6, 2008. Notice will be given in the Citizen and Le Droit on April 11 and 18, 2008. Copies of the amendment to the Monahan Drain Area W-1 Background Study information will be made available on April 11, 2008. Staff have also met with the appellants to By-law 2007-66.

FINANCIAL IMPLICATIONS

Total project costs for the Monahan Drain benefiting area of $8,260,735 will be recovered through stormwater DCs levied in accordance with the rates proposed in the DC Background Study as noted in Document 2. Project costs include $790,710 debt and $1,108,900 reserve fund deficit balances, both incurred prior to the City’s amalgamation. For the $6,361,125 capital cost to design, construct, and acquire land for the stormwater infrastructure, a Front-Ending Agreement is in place with TCK Co-Tenancy and Claridge Homes (Eagleson) Inc.

SUPPORTING DOCUMENTATION

Document 1: Map of Monahan Drain Stormwater Drainage Area

Document 2: Background Study Update March 7, 2008 Monahan Drain (Area W-1) Amendment to By-Law 2007-66

DISPOSITION

This report will be forwarded to City Council for a decision on May 14, 2008. Following the decision, any amendment to the By-law will be advertised in the Citizen and LeDroit within 20 days pursuant to the Development Charges Act. The public will have 40 days to appeal the amendment to the Ontario Municipal Board. Building Services Division will be informed of the revised rates pending Council approval and the passing of the amendment By-law for administration.

Map of Monahan Drain Stormwater Drainage Area DOCUMENT

1

DOCUMENT 2

BACKGROUND STUDY UPDATE

MARCH 7, 2008

MONAHAN DRAIN (AREA W-1) AMENDMENT TO BY-LAW 2007-66

BACKGROUND

STUDY UPDATE

MARCH 7,

2008

MONAHAN DRAIN (AREA W-1)

AMENDMENT TO BY-LAW 2007-66

Prepared by Angela Taylor

Coordinator, Forecasting and Budgets

Infrastructure Approvals Division

Planning Branch

Planning, Transit and the Environment Department

Project

Description

Monahan Drain,

Charge Area W-1

The Monahan Drain Constructed Wetland Stormwater Management Pond (hereinafter called “Monahan Drain”) is located at the southern limit of Kanata and is bounded by Terry Fox Drive to the west, Hope Side Road to the south, and the community of Bridlewood to the east. The project is within the W-1 benefitting charge area and is identified as drawing number STM2 of the report entitled “City of Ottawa: Development Charges Study Drawings-Volume 2, dated February 12, 2004”, prepared by Stantec Consulting Ltd. See Figure 1 for an illustration of the area.

Background

In February 2007, Council approved an amendment to the area specific Monahan Drain Development Charge By-Law 2007-66 as a result of an Official Plan amendment to update housing and commercial densities as well as update costs. Effectively, the development charge (DC) rates increased fourfold for residential and almost threefold for non-residential. This was due to an unforeseen increase in the capital cost estimates required for the expansion of the stormwater area in the City’s 2004 DC Background Study. As a consequence of the increase, Urbandale Corporation, and Cavanagh Construction appealed the amendment to the Ontario Municipal Board (OMB) on the basis that Urbandale has held land in the area prior to the City’s amalgamation. Claridge Homes was granted party status in the appeals as well. These lands currently have registered plans containing lots for which agreements of purchase and sale have been signed and therefore, it was Urbandale’s view that they should not be subject to the increased charges.

City staff worked with the appellants to reach a consensus, the result of which was presented to and approved by Council in January 2008. The amendment imposed the residential portion of DC rates, which the OMB subsequently approved. With the newly imposed DCs, the non-residential rates would have been higher than those currently in effect. According to the Development Charges Act, the OMB does not have authority to increase DC rates on an appeal, and as such, an amendment to the background study is required to revise the non-residential rates.

Residential Development Charge Rates Established

The amendment that set the residential DCs divides the Monahan Drain lands into two separate areas A and B, as shown in Figure 1. Area A lands are mostly held by Urbandale, while Area B represents the balance of the lands for the drainage area. According to the amendment, Area A residential rates will be subject to the lower rates pursuant to the former Kanata By-Law 140-00, and subject to annual indexing, while the residential rates imposed by By-Law 2007-66 will remain in place for Area B. The following table summarizes the imposed residential rates, which were approved by the OMB.

|

|

AREA A |

AREA B |

||

|

OMB approved |

Indexed to April 1, 2007 |

OMB approved |

Indexed to April 1, 2007 |

|

|

Single/Semi- detached |

$1,701 |

$1,801 |

$2,373 |

$2,513 |

|

Row/Townhouse |

$1,239 |

$1,312 |

$1,895 |

$2,007 |

|

Stacked row/ Apartment |

$842 |

$892 |

$842 |

$892 |

Revised By-Law 2007-66 (Appendix 1)

During this review, staff discovered that a revision to By-Law 2007-66 was necessary to properly allocate the residential and non-residential costs. Tables found in Appendix 1 contain the revised DC rates using the same growth projections and capital costs as per the current By-Law. This revision effectively lowers the residential rates. As a consequence, and pursuant to the Development Charges Act, several builders will be entitled to an estimated refund of $93,000 from the overpayment of DC rates for building permits obtained subsequent to the passing of the current DC By-Law 2007-66 in February 2007. The $93,000 will be reflected as an increase to the reserve fund deficit under the different scenarios noted below.

Options to Non-Residential Development Charge

Calculations

With the newly set residential rates, the City explored several options to determine the non-residential rates. The options are presented for discussion along with the recommendation proposed by the City. Table 1 summarizes the DC rates of the various options for comparative purposes.

Option 1: Rates for One Drainage Area (Appendix 2)

Option 1 is included

for comparison only.

Option 1 is essentially an updated version of the current By-Law. It incorporates current growth projections, as well as revised debt and reserve fund deficit balances. With no change to the capital cost to design, construct, and acquire land, the new project costs are then allocated in accordance to the existing background study method of establishing DCs. Appendix 2 provides the detailed calculations as well as the updated growth projections of Areas A and B in Table 5 that will be used for all other options.

Option 2: Area A and B Rates Under the Traditional

Method (Appendix 3)

Option 2 establishes residential and non-residential rates separately

for each area to illustrate an option that was considered during the appeals

process.

According to the amended residential rates, two distinct areas A and B are defined. Costs allocated to the Area A lands held primarily by Urbandale include the debt and the reserve fund deficit, since these costs were incurred prior to amalgamation.

Costs in Area B include the capital costs to design, construct, and acquire land for the stormwater management facility. Appendix 3 contains tables for the detailed cost allocations and DC calculations for each respective area, also employing the City’s existing background study methodology for stormwater DCs.

While the resulting rates for Option 2 are in line with the City DCs, Area A rates are higher than the current By-Law and this was not considered an acceptable option to Urbandale.

Option 3: Separate Area A and B Non-Residential Rates

(Appendix 4)

Due to the imposed residential rates set in accordance with the recent OMB Board Order, a reverse approach was necessary to establish the non-residential rates. Appendix 4 includes tables illustrating the detailed calculations. For this approach, the estimated revenues generated from the residential portion were obtained by applying the residential DC rates to the total units for each area. The estimated revenues generated then reduced the total project costs allocated to each respective area, and the remaining balance was apportioned to the non-residential rate.

For Area A, this approach yields an excessively high non-residential rate of $9.72 per gross floor area (GFA), a fourfold increase over the City’s estimated average rate, whereas the $1.99 per GFA rate for Area B is in line with the average rates. Given the divided land areas that Urbandale endorsed, this option was viewed as the logical approach to consider. However, the unreasonably high rate in Area A renders this option unsuitable because it is based on a smaller drainage area, which yields lower growth potential.

It should be noted that the conventional method employed by the City to establish the DC rates would have been preferred. The conventional method is based on defined drainage areas, which are strategically sized to ensure equitable DC rates. Option 3 demonstrates the evident inequity and complexity that results from a deviation from the sound principles contained in the City’s 2004 comprehensive DC By-Law.

Proposed Option

4: Blended Non-Residential Rate

(Appendix 4)

Option 4 applies the same approach as Option 3, with the exception that the balance of the costs, after netting the estimated residential revenues from both Areas A and B are combined. The balance of costs is then allocated to the non-residential portion, and when these costs are applied to the total GFA of both Area A and B, a blended rate is obtained. Table 13 of Appendix 4 provides the details. The resulting blended rate of $2.54 is in line with the City’s estimated average rate and is the recommended non-residential rate.

Relevant

Studies/ By-Laws

· Bridlewood Trails Stormwater Management Report, dated February 27, 2006, revised September 13, 2006, prepared by Novatech Engineering Consultants Ltd.

· Monahan Drain Constructed Wetlands Phase 2, Final Design Report, dated March 30, 2006, prepared by Novatech Engineering Consultants Ltd.

· City of Ottawa By-Law No. 2004-307, being a by-law for the imposition of development charges for the Monahan Drain Stormwater Facility (Area W-1) and the amending By-Law 2007-66.

· Former City of Kanata Development Charges Background Study Re: The Monahan Drain Constructed Wetlands Project and an additional amendment to By-Law No. 144-99 re the definition of non-residential uses, September 20, 2000.

· Former City of Kanata By-Law No. 140-00 being a by-law to provide for the imposition of area specific development charges for the Monahan Drain Constructed Wetlands Project.

· City of Ottawa Report to Corporate Services and Economic Development Committee and Council ACS2007-PTE-APR-0002 – “Amendment to Development Charges By-Law 2004-307 Monahan Drain and Front-Ending Agreement Stormwater Management Facility Area 2”.

· City of Ottawa Report to Planning and Environment Committee and Council ACS2008-CMR-LEG-0003 – “Monahan Drain Stormwater Development Charge”.

Other Approvals

· Ministry of Environment Certificate of Approval for the entire Monahan Drain Area 1 and Area 2 was issued in July of 1994, certificate number 3-1383-93-946.