|

6. DISPOSITION OF 2007 OPERATING SURPLUS / DEFICIT UTILISATION DE L’EXCÉDENT OU DU DÉFICIT DE FONCTIONNEMENT DE 2007 |

Committee RecommendationS

That, as part of the finalization of 2007 operations, Council approve the following transfers to/from reserve funds:

1.

That

in accordance with the various reserve fund by-laws, the $5,945,000 surplus

within the City Wide tax supported operations be transferred to the following

reserve funds:

a) the surplus attributable to Social Housing of $22,000 be transferred to the Social Housing Reserve Fund in accordance with By-Law 2003-237;

b) the surplus attributable to Solid Waste Rate operations of $5,022,000 be transferred to the Solid Waste Rate Reserve fund in accordance with By-Law 2005-556; and

c) the remaining surplus of $901,000 be transferred to the City Wide Capital Reserve Fund;

2.

That the $340,000

surplus in the Ottawa Public Library be transferred to the OPL Capital Reserve

Fund in accordance with By-Law 2003-310;

3.

That the $2,187,000

deficit in the Transit Operating Fund be funded by a transfer from the Transit

Capital Reserve Fund in accordance with By-Law 2003-361;

4. That the $4,391,000 deficit in the Ottawa Police Services be

funded by a transfer from the City Wide Capital Reserve Fund;

5. That the surplus within the rate supported

operations be transferred to the following reserve funds:

a)

The

surplus attributable to Water operations of $2,939,000 be transferred to the

Water Capital Reserve Fund in accordance with By-Law 2003-141; and

b)

The

surplus attributable to the Wastewater operations of $3,327,000 be transferred

to the Wastewater Capital Reserve Fund in accordance with By-Law 2003-141;

and

6. That the $5,856,000 residual Best Start one-time funding be

transferred to the Childcare Capital Reserve Fund in accordance with By-Law

2004-328.

RecommandationS du comité

Dans le cadre de la mise au point

des opérations pour 2007, que le Conseil approuve les transferts suivants aux

fonds de réserve ou en provenance de ceux‑ci :

1.

Que conformément aux différents

règlements sur les fonds de réserves, l’excédent de 5 945 000 $

découlant des opérations financées par les taxes et impôts soit transféré aux

fonds de réserve suivants:

a)

transfert

de l’excédent de 22 000 $ attribuable au logement social au fonds de

réserve du logement social conformément au Règlement municipal 2003‑237;

b)

transfert

de l’excédent de 5 022 000 $ attribuable aux opérations liées

aux déchets solides au fonds de réserve pour gestion des déchets solides

conformément au Règlement municipal 2005‑556; et

c)

transfert

du solde de 901 000 $ au fonds de réserve panmunicipal;

2.

Transfert de l’excédent de

340 000 $ de la Bibliothèque publique d’Ottawa au fonds de réserve

pour immobilisations de la BPO conformément au Règlement municipal 2003‑310;

3.

Transfert de

2 187 000 $ du fonds de réserve destiné au financement du

transport en commun au fonds d’administration générale du transport en commun,

afin de compenser le déficit conformément au Règlement municipal 2003‑361;

4.

Transfert de

4 391 000 $ du fonds de réserve pour immobilisations de la Ville

au Service de police d’Ottawa, afin de compenser le déficit;

5.

Transfert de l’excédent du fonds de

fonctionnement provenant des tarifs aux fonds de réserve suivants :

a)

transfert

du surplus de 2 939 000 $ du fonds d’exploitation de l’eau au

fonds de réserve du service d’eau conformément au Règlement municipal 2003‑141;

et

b)

transfert

de l’excédent de 3 327 000 $ du fonds d’exploitation des eaux

usées au fonds de réserve des eaux usées, conformément au Règlement municipal

2003‑141; et

6.

Transfert de l’excédent de 5 856 000

$ du fonds unique Meilleur départ au fonds de réserve alloué à la garde

d’enfants in accordance with By-Law 2004-328 conformément au Règlement

municipal 2004-328.

Documentation

1. City Treasurer’s report dated 7 April 2008

(ACS2008-CMR-FIN-0014).

2. Extract of Draft Minutes, 15 April 2008.

Corporate Services and

Economic Development Committee

Comité des services organisationnels et du développement économique

and Council / et au Conseil

7 April 2008 / le 7 avril 2008

City Treasurer/Tresorièr municipal

Contact Person/Personne ressource : Wayne Martin, Manager, Accounting and

Reporting

Financial

Services/Services financiers

(613) 580-2424

x25183, Wayne.Martin@Ottawa.ca

SUBJECT:

|

|

|

|

|

OBJET :

|

UTILISATION DE L’EXCÉDENT OU DU DÉFICIT DE FONCTIONNEMENT DE 2007 |

That, as part of the finalization of 2007 operations, the Corporate Services and Economic Development Committee recommend Council approve the following transfers to/from reserve funds:

1. That in accordance with the various

reserve fund by-laws, the $5,945,000 surplus within the City Wide tax supported

operations be transferred to the following reserve funds:

a) the surplus attributable to Social Housing of $22,000 be transferred to the Social Housing Reserve Fund in accordance with By-Law 2003-237;

b) the surplus attributable to Solid Waste Rate operations of $5,022,000 be transferred to the Solid Waste Rate Reserve fund in accordance with By-Law 2005-556; and

c) the remaining surplus of $901,000 be transferred to the City Wide Capital Reserve Fund;

2. That the $340,000 surplus in the Ottawa Public Library be

transferred to the OPL Capital Reserve Fund in accordance with By-Law 2003-310;

3. That the $2,187,000 deficit in the Transit Operating Fund be

funded by a transfer from the Transit Capital Reserve Fund in accordance with

By-Law 2003-361;

4. That the $4,391,000 deficit in the Ottawa Police Services be

funded by a transfer from the City Wide Capital Reserve Fund;

5. That the surplus within the rate supported

operations be transferred to the following reserve funds:

a)

The

surplus attributable to Water operations of $2,939,000 be transferred to the

Water Capital Reserve Fund in accordance with By-Law 2003-141; and

b)

The

surplus attributable to the Wastewater operations of $3,327,000 be transferred

to the Wastewater Capital Reserve Fund in accordance with By-Law 2003-141;

and

6. That the $5,856,000 residual Best Start one-time funding be

transferred to the Childcare Capital Reserve Fund in accordance with By-Law

2004-328.

Dans le cadre de la mise au point des

opérations pour 2007, que le Comité des services organisationnels et du

développement économique recommande au Conseil d’approuver les transferts

suivants aux fonds de réserve ou en provenance de ceux‑ci :

1. Que

conformément aux différents règlements sur les fonds de réserves, l’excédent de

5 945 000 $ découlant des opérations financées par les taxes et

impôts soit transféré aux fonds de réserve suivants:

a)

transfert

de l’excédent de 22 000 $ attribuable au logement social au fonds de

réserve du logement social conformément au Règlement municipal 2003‑237;

b)

transfert

de l’excédent de 5 022 000 $ attribuable aux opérations liées

aux déchets solides au fonds de réserve pour gestion des déchets solides

conformément au Règlement municipal 2005‑556; et

c)

transfert

du solde de 901 000 $ au fonds de réserve panmunicipal;

2. Transfert

de l’excédent de 340 000 $ de la Bibliothèque publique d’Ottawa au

fonds de réserve pour immobilisations de la BPO conformément au Règlement

municipal 2003‑310;

3. Transfert

de 2 187 000 $ du fonds de réserve destiné au financement du

transport en commun au fonds d’administration générale du transport en commun,

afin de compenser le déficit conformément au Règlement municipal 2003‑361;

4. Transfert

de 4 391 000 $ du fonds de réserve pour immobilisations de la

Ville au Service de police d’Ottawa, afin de compenser le déficit;

5. Transfert

de l’excédent du fonds de fonctionnement provenant des tarifs aux fonds de réserve

suivants :

a) transfert

du surplus de 2 939 000 $ du fonds d’exploitation de l’eau au

fonds de réserve du service d’eau conformément au Règlement municipal 2003‑141;

et

b) transfert

de l’excédent de 3 327 000 $ du fonds d’exploitation des eaux

usées au fonds de réserve des eaux usées, conformément au Règlement municipal

2003‑141; et

6. Transfert

de l’excédent de 5 856 000 $ du fonds unique Meilleur départ au fonds de

réserve alloué à la garde d’enfants in accordance with By-Law 2004-328

conformément au Règlement municipal 2004-328.

In conjunction with the preparation of the audited financial statements it is necessary to obtain Council approval of the disposition of any surplus or deficit that occurred in the prior year. This report provides an analysis of the final results of operations for 2007 and recommendations related to the disposition of the surpluses or deficits, which allows the 2007 operations to be closed.

The City ended the year with a $0.3 million deficit within the tax supported programs. This deficit is the result of:

1. Departmental surplus of $6.0 million,

2. A deficit of $4.5 million by the Ottawa Police Services,

3. A deficit of $1.8 million within the Non-Departmental and Property Tax Accounts.

The following chart summarizes this deficit by fund within the tax supported programs and the disposition of the deficit.

|

|

City |

Ottawa |

|

Ottawa |

|

|

|

Wide |

Library |

Transit |

Police |

Total |

|

|

$000 |

$000 |

$000 |

$000 |

$000 |

|

2007 Operating Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

Departmental |

5,406 |

490 |

144 |

(4,522) |

1,518 |

|

|

|

|

|

|

|

|

Non-Departmental |

(150) |

(2,331) |

131 |

(1,811) |

|

|

|

|

|

|

|

|

|

Total

Surplus/(Deficit) |

5,945 |

340 |

(2,187) |

(4,391) |

(293)

|

|

Disposition |

|

|

|

|

|

|

Transfers To/(From) Reserve Funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

City Wide Capital |

901 |

|

|

(4,391) |

(3,490) |

|

Library |

|

340 |

|

|

340 |

|

Social Housing |

22 |

|

|

|

22 |

|

Solid Waste Capital |

5,022 |

|

|

|

5,022 |

|

Transit Capital |

|

|

(2,187) |

|

(2,187) |

|

|

5,945 |

340 |

(2,187) |

(4,391) |

(293) |

The department specific areas of the City’s Tax Supported Operating Budget had a surplus of $6.0 million. This was achieved primarily due to savings in compensation of $9.0 million and higher than budgeted Solid Waste related revenues of $3.5 million, which was offset by the unachieved corporate efficiency savings target of $5.6 million.

The City’s 2007 adopted Operating Budget provided for an efficiency savings target of $14.3 million of which $1.1 million in savings were realized on a permanent basis. As outlined in the September 30th Operating Status report, interim measures were implemented to manage and achieve a significant portion of the remaining corporate efficiency target on a one time basis.

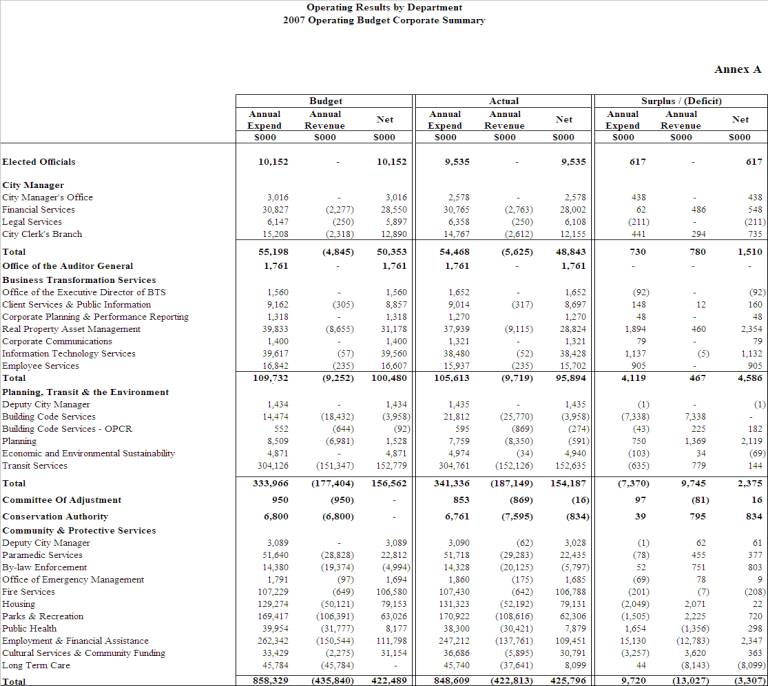

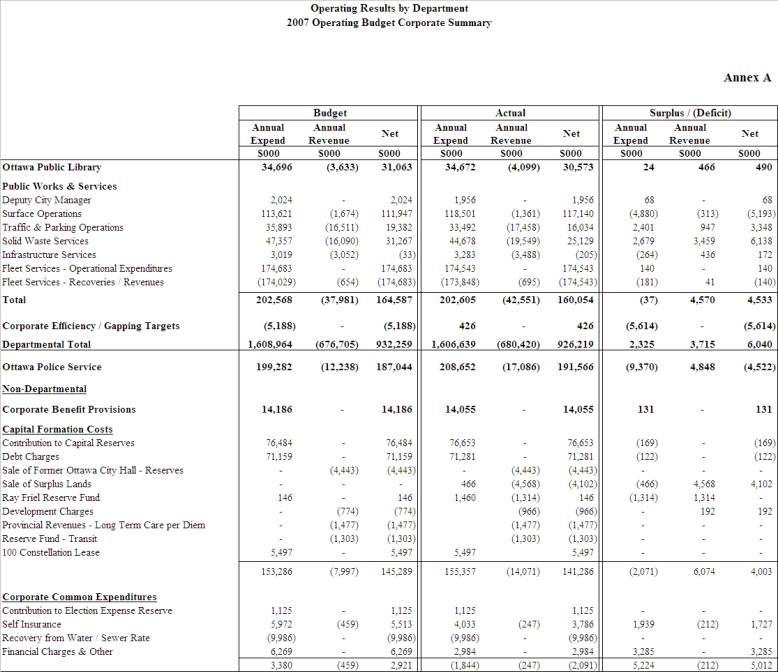

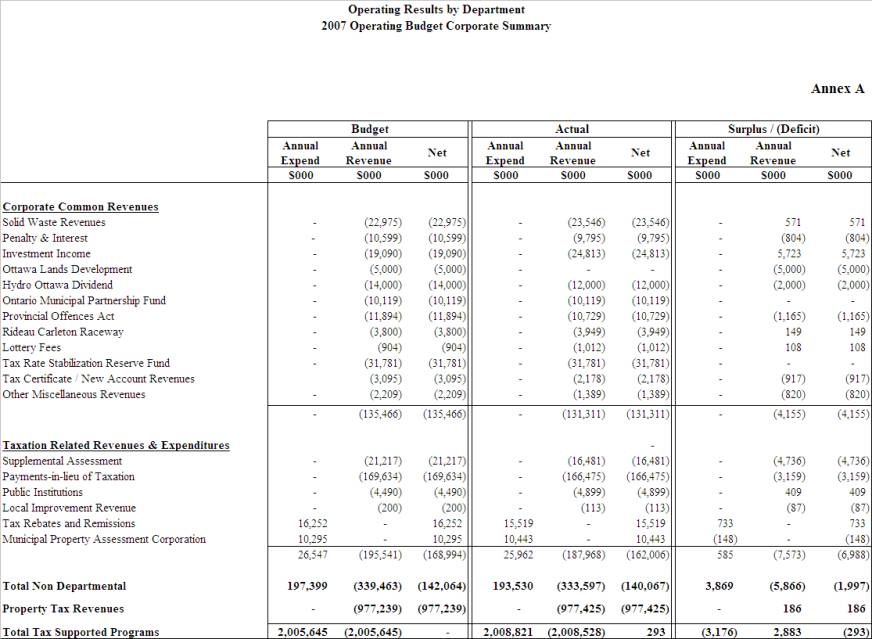

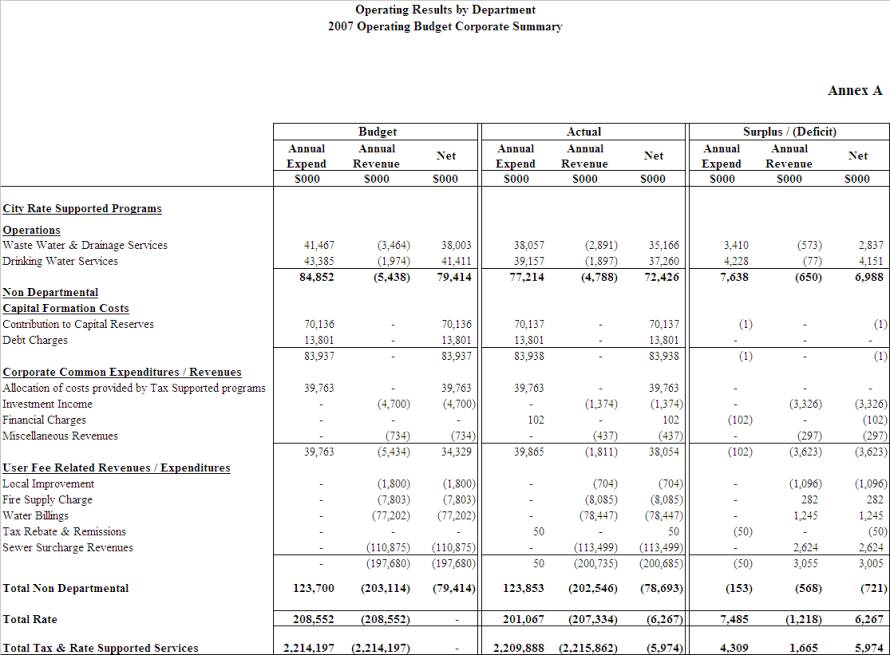

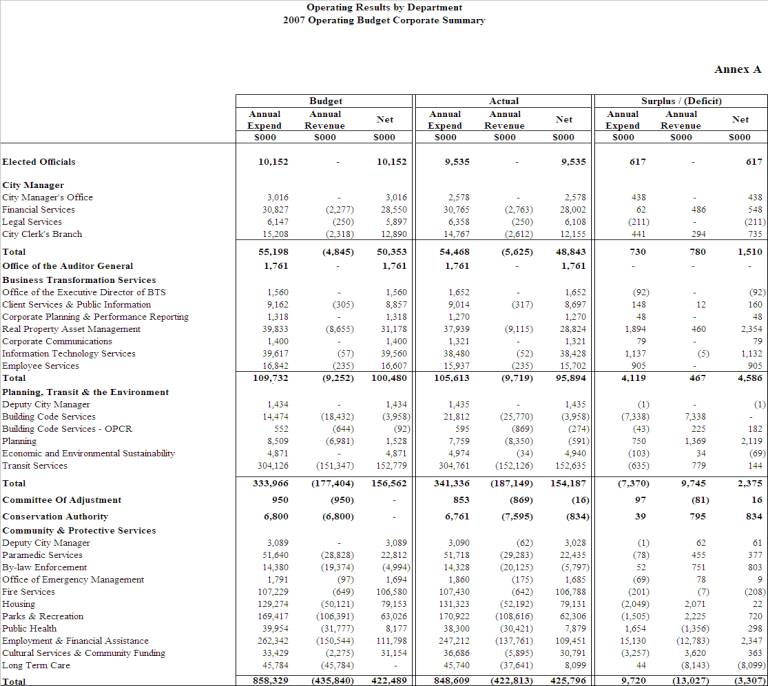

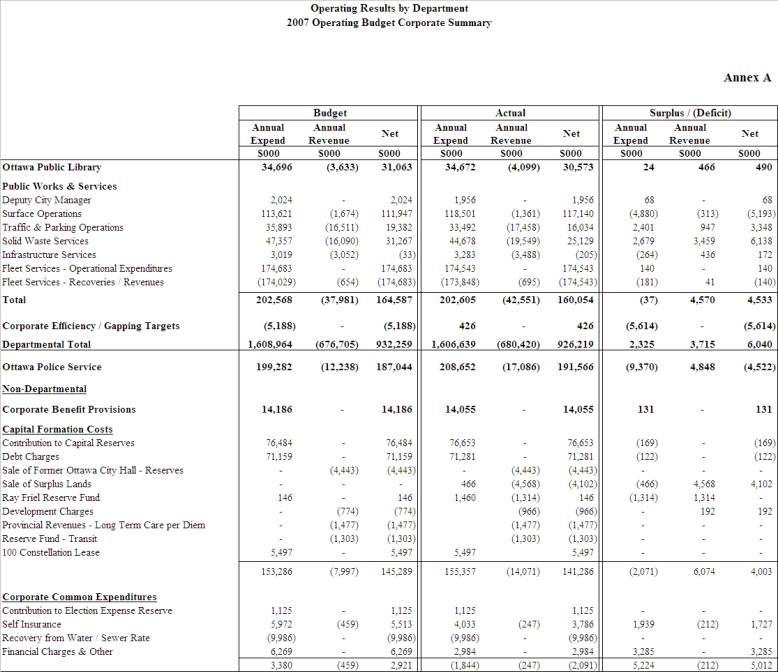

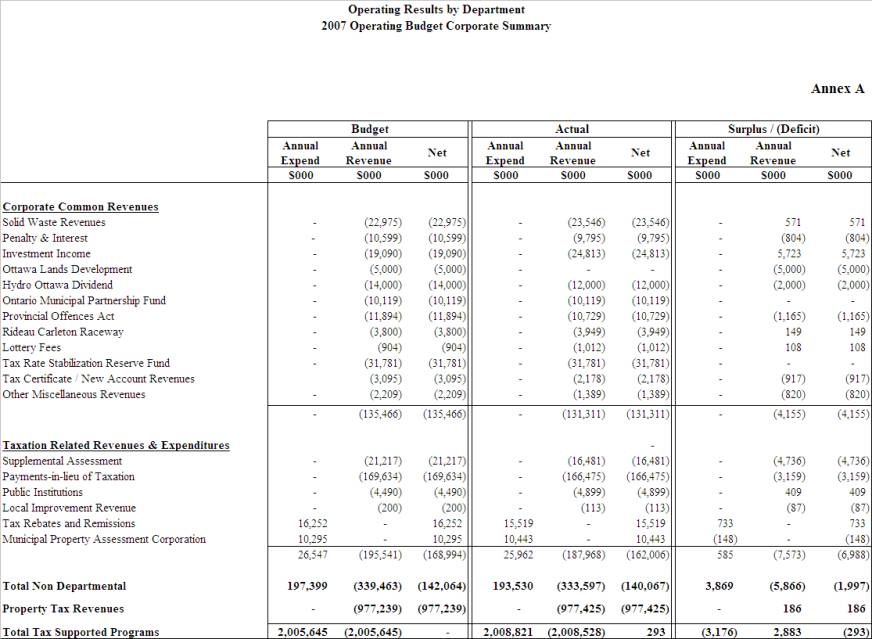

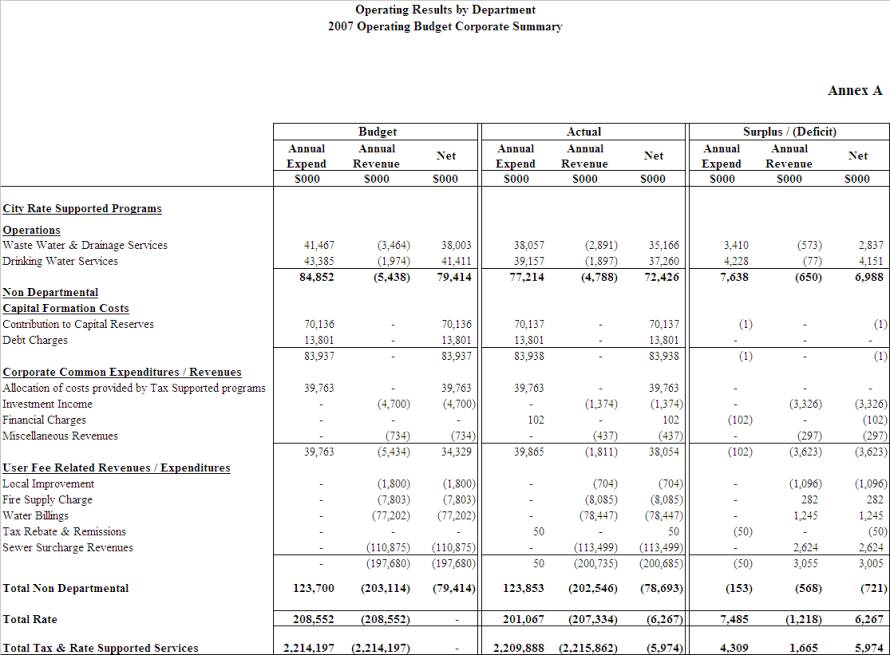

A summary of the 2007 Operating Results by department is attached to this report as Annex A. An explanation of the major variances by department is provided in Annex B.

The Ottawa Police Service (OPS)

incurred a net operating deficit of $4,522,000 in 2007, representing 2.4% of

the net 2007 OPS budget. There are

several components making up the 2007 year-end position. There was a surplus of $200,000 for ongoing

police operations. There were two

unique one-time issues constituting major components of the deficit, namely the

implementation of the Job Evaluation Plan and the cost of providing policing

for the Stanley Cup Playoffs totaling $3.3 million. Revenue and expenditure pressures added a

further $1.4 million to the deficit.

Further details regarding the variances are outlined in Annex B.

The deficit within the non-departmental accounts was the result of lower than planned supplementary taxes and payments in lieu of taxes, offset by higher than planned investment income attributable to the tax support funds.

The City ended the year with a $6.3 million surplus within the rate supported programs. This surplus is the result of:

1. Departmental surplus of $7.0 million,

2. A deficit of $0.7 million within the Non-Departmental accounts.

The following chart summarizes this deficit by fund within the rate supported programs and the disposition of the surplus.

|

|

Drinking |

Waste |

|

|

|

Water |

Water

|

Total |

|

|

$000 |

$000 |

$000 |

|

2007 Operating Results |

|

|

|

|

|

|

|

|

|

Departmental |

2,837 |

6,988 |

|

|

|

|

|

|

|

Non-Departmental |

(1,211) |

490 |

(721) |

|

Total

Surplus |

2,940 |

3,327 |

6,267 |

|

|

|

|

|

|

Disposition |

|

|

|

|

Transfer To/(From) Reserve Funds |

|

|

|

|

2,940 |

|

2,940 |

|

|

Wastewater Capital |

|

3,327 |

3,327 |

|

|

2,940 |

3,327 |

6,267 |

Within the

department specific areas of the City’s Rate Supported Operating Budget a

surplus of $7.0 million was achieved primarily due to savings in compensation

of $2.9 million. The deficit within the

non-departmental accounts was $0.7 million and was the result of lower than

budgeted investment income offset by higher water and sewer rates revenues.

Specific details on this surplus are provided within the Rate Supported Program

section of Annex B.

In 2005, the federal government of the day announced a major expansion to childcare programs and provided funding to the provinces for this initiative. The Province then allocated $33 million to the City of Ottawa to be spent over three years. Initial funding in the amount of $7.2 million was received in December of 2005 and deferred until program implementation in 2006. The 2006 federal election brought about a change in government and the major expansion to childcare was cancelled. The Province, without on going funding from the federal government, cancelled the $33M program for Ottawa and notified the City that funds remaining from the $7.2 million initial investment could be used as one-time unconditional funding.

It is recommended as per By-law 2004-328 that the remaining $5.9 million in deferred revenue be transferred to the Childcare Reserve Fund.

The purpose of this report is administrative in nature and therefore no public consultation is required. All Departments were consulted in the preparation of this report.

The disposition of the 2007 surpluses and deficits as recommended in this report will reduce the projected 2008 year-end balance in the combined tax supported reserve funds below the $50 million target level as established by Council. After incorporating the 2008 contributions to the reserve funds and the drawdowns to fund capital projects along with funding a portion of the net operating requirements of the Public Health program, a balance of $42.7 million is projected at year-end. As directed by Council, the funding of the net operating requirements of the Public Health program is to be on a one-time basis in 2008, with the expectation that the Province will upload these costs in 2009.

As

a result of surpluses in each of the rate supported programs (Water, Sewer and

Solid Waste), the 2008 year-end reserve fund balances are projected to be $36.9

million. Council's target level for the

rate supported capital reserve funds is $20 million, which encompasses only the

water and sewer reserve funds. These

two reserve funds are projected to have a year-end balance of

$32.3 million.

Details

of the tax and rate supported capital reserve funds are included in Annex

C.

Annex A - 2007 Operating Results by Department

Annex B - Variance Analysis - 2007 Operating Results

Annex C - Reserve Fund Projections

The Financial Service Branch will make the necessary accounting adjustments.

ANNEX B

A variance analysis has been provided only for those departmental areas under the control of the administration and therefore do not include the Elected Officials or the Office of the Auditor General. Variance analysis has only been provided for those branches where there is significant difference between the Net Budget and Net Actual.

The surplus in the City Manager’s Office of $438,000 results from savings against planned expenditures within the Rural Affairs Office.

The surplus in City Clerk’s Branch of $735,000 is a combination of expenditure savings resulting from increased recoveries and a revenue surplus. The expenditure savings of $440,000 is primarily attributed to increased cost recovery for printing and mail services. The revenue surplus results from increased Heritage Grant funding and Vital Stats revenue.

The deficit in the Executive Director's Office of $92,000 is primarily attributed to severance payments that were partially offset by savings due to vacancies.

The surplus in Employee Services of $905,000 is attributed primarily to the delayed start of both the CIPP and CUPE 503 updates to the Job Evaluation Plans and less than planned expenditures in health & safety activities, corporate training and services provided through the Employee Assistance Program.

The surplus in Real Property & Asset Management Branch of $2,354,000 resulted from a combination of savings in expenditures and increased revenues. Expenditure savings were primarily attributed to less than planned spending in natural gas and hydro, compensation savings as a result of the hiring freeze and increased recoveries resulting from the use of internal trade staff. The increased revenues are associated with events held at Lansdowne Park.

The surplus in Building Services Branch of approximately $10,400,000 resulted from higher than expected revenues relating to building permit fees of $7,300,000, unspent compensation due vacant positions of $2,300,000 and savings in the purchase of services of approximately $800,000. This surplus has been contributed to the various Building Services Reserve Funds as required under the Building Code Statute Amendment Act and Ontario Regulation 305/3.

The surplus of $182,000 in the Building Services Branch - Other Permits and Compliance Reporting is attributed to higher than expected revenues of $225,000 and compensation savings of $38,000. This surplus was partially offset by greater expenditures in Material and Services $81,000.

The surplus of $2,100,000 in the Planning Infrastructure Approvals Branch is attributed to savings due to vacant positions of $235,000, savings in materials and services of $465,000 and higher then expected revenues of $1,400,000.

The surplus in By-Law & Regulatory Services of $803,000 is attributed to savings in compensation of approximately $52,000 and an increase in revenue of approximately $751,000 mainly as a result of increased parking fines, taxi licences and portable sign permits.

The deficit in Long Term Care of $8,099,000 resulted from a shortfall in Provincial revenue. As part of the 2007 budget Council approved an increase in provincial revenue to the level prescribed by the legislated cost sharing formula, an additional $8,500,000. Council directed that staff correspond with the Province to address the gap, to date negotiations have been unsuccessful resulting in the deficit.

The Surface Operations Branch ended the year with a deficit of $5,193,000. The Winter Control Program was overspent by $7,223,000 as a result of extensive winter storms. November and December both set snowfall records with 60 cm and 121 cm of snow accumulation, respectively. A single storm on December 16 delivered 37 cm of snow in a 24-hour period – the largest single day accumulation ever in December. These months were exceptional not only in snow accumulation, but also in frequency of winter storm events. November and December brought 11 and 18 winter events, respectively, some extending over multiple days. The number, volume of accumulation and intensity of the snowstorms resulted in significant snow plowing and removal and other winter control activities occurring. Extensive snow removal began earlier than normal and without benefit of the typical “warm spells” that reduce demand for removal.

However, non-winter control road maintenance activities in Road Hard Surface, Right of Way, Sidewalks and Pathways and Structures were under spent by $1,322,000 partially as a result of the November winter events shifting the work force and fleet resources off these activities; Parks and sports fields maintenance operations were under spent $687,000 due to favourable weather conditions which resulted in less requirement for contracted resources to supplement city resources and less requirement for materials for maintenance operations; Technical Operations and Research support had savings of $283,000 as the unit was undergoing extensive restructuring and hiring throughout the year; and Forestry Operation had minor savings of $51,000. Revenues were under achieved by $313,000 due to base revenue.

The Traffic and Parking Operations Branch ended the year with a net surplus of $3.3 million. The net surplus was realized through a number of issues, which the main areas are noted below. Adjustments have been made in the 2008 Budget and also further adjustments will be taken to recognize productivity efficiencies on an ongoing basis in 2008 and 2009 based on 2007 results.

Expenditure savings were realized through one time deferrals of $400,000 for Hydro Ottawa pole attachment fees, $200,000 for CNR/Rail Term charges for the Fallowfield and Merivale railway crossing maintenance and $400,000 for parts and supplies due to the current Pay & Display review. Higher staff turnover resulted in one-time savings of $285,000, while discretionary spending restrictions resulted in savings of $311,000. Lower market rates for energy charges saved $357,000 for street lighting and signals. Increased capital recoveries and other net items of $47,000. Additional revenue of $1.3 million due to Right Of Way permits volume and new legislation that granted authority to charge the Gas Utilities road cut permits.

The Solid Waste Service Branch ended the year with a surplus of $6,138,000. Staff vacancies due to delays in filling newly approved positions and the Branch reorganization in 2007 resulted in savings of $982,000. The reduction of City residential waste received at the Carp Road landfill resulted in savings of $1,200,000 in tipping fee costs, which were partially offset by increased leachate hauling costs of $180,000 and vehicle rental costs of $220,000. Savings in internal costs are mainly due to reduced Fleet costs of $1,121,000. Restrictions in the volume of waste accepted at the Carp Road Landfill resulted in additional volumes of waste accepted at Trail Road, thus generating additional revenues of $2,463,000. Recyclable materials market prices exceeded expectations for additional revenues of 1.0 million.

The surplus for Infrastructure Services Branch of $172,000 is attributed to higher than expected revenues relating to engineering fees of $630,000, sewer permit connection fees of $84,000 and savings due to vacant positions of approximately $162,000. These savings were offset by the over expenditures in the allowance for doubtful accounts of $384,000 and revenue shortfalls in Municipal Access Agreements of $320,000.

OTTAWA POLICE SERVICES

The Ottawa Police Services ended the year with a deficit of $4,522,000. There was a surplus of $200,000 in direct policing operations. Although direct and on-going police operations experienced financial pressures from compensation gapping, overtime, and fuel prices, these were more than offset by surpluses achieved through efficiencies in fleet maintenance, court overtime, and the impact of a discretionary spending freeze imposed by Chief’s Order.

The deficit is attributed to $2,700,000 for a one-time compensation settlement for the Civilian Job Evaluation program approved by the Police Services Board and the related one-time retroactivity payments for the years 1999 to 2007. While funds were set aside each year since 1999, the final results of the program and the resultant payouts were not finalized until 2007, and the provision was not sufficient. The balance resulted from an expenditure of $600,000 for one-time special policing event, namely, the safety and security costs arising from the Stanley Cup Playoffs, and $1,400,000 from non-operational accounts including workers’ compensation matters (WSIB), insurance settlement claims and false alarm revenue. The 2008 budget base issue has been adjusted for all of these items.

The surplus of approximately $4,100,000 is mainly from net proceeds from the sale of surplus land, other than the Ottawa Lands Development.

In 2007 the self-insured component of insurable losses of the City was $1,700,000 less than the budgeted provision while in 2006 the insurable losses had exceeded the budget provision by $2,800,000. The 2007 Operating Budget had been increased by $1,100,000 to address the 2006 deficit. The provision for Financial Charges, which consists of short-term interest costs associated with the daily cash management of City funds along with the costs for placing and servicing the long-term debt for the capital program, were under spent by $3.3 million.

The deficit of approximately $4,155,000 was due to a number of factors. The Ottawa Lands Development had a $5,000,000 deficit as no properties were sold in 2007. There was a shortfall of $2,000,000 in the Hydro Ottawa dividend as a lower amount was declared relative to the City’s base budget provision.

Provincial Offence Act revenue had a deficit of approximately $1,165,000. The revenue projection was increased in 2007 by $1,200,000 over the 2006 base budget to $11,900,000. The 2008 Budget has been maintained at this level as these revenues are expected to increase in 2008.

Other revenues shortfalls accounted for were approximately $1,713,000.

Offsetting these deficits was a surplus of $5,723,000 in the investment income attributed to the tax supported operations of the City. The total investment income attributed to the operating funds increased by $392,000 in 2007 as the rate of return increased from 4.40 % in 2006 to 4.59% in 2007.

In the 3rd Quarter Forecast, supplementary taxation revenues were expected to be $6,000,000 lower than budget. This was due to delays in the delivery of the supplementary assessment roll by the Municipal Property Assessment Corporation (MPAC). As a result of the Ontario Ombudsman’s report, MPAC has been directed to implement a new computer system. However, implementation problems resulted in delays in adding properties to the tax roll and thereby reduced the supplementary taxation revenues for all municipalities in Ontario. MPAC was able to provide a supplementary assessment roll late in 2007, which resulted in supplementary taxes being only $4,700,000 lower than budget.

The 3rd Quarter forecast had projected that the City would achieve the revenues as budgeted for 2007 on the Payment in lieu of Taxes (PILT) account on the basis that valuation disputes with the Federal government would be resolved before year-end. There will however be a shortfall of $3.2 million in this account due to that fact that these valuation disputes have not yet been resolved, combined with the sale of two federal government properties.

Wastewater and Drainage Services ended the year with an operational surplus of $2,836,000. Savings in compensation costs of $1,130,000 were mainly due to staff vacancies, and the delay in implementing the new Drainage on Private Property Program. Savings of $2,750,000 in purchased services, materials and fixed assets were mainly due to a combination of competitive pricing on collection system maintenance contracts, a one‑time multi year QST recovery for the bio-solids disposal costs, and deferred maintenance. The delay in commissioning the Waste Management facilities at the water purification plants also resulted in lower costs but these were offset by lower recoveries of $900,000 from Water. Finally, lower Fleet costs resulted in savings of $173,000.

The deficit in revenues is mainly due to decreased volumes of liquid hauled waste accepted at the Robert O. Pickard Centre.

Drinking Water Services ended the year with an operational surplus of $4,151,000. Savings of $1,817,000 were achieved in compensation. Deferred maintenance, lower than anticipated production levels and the delay of the commissioning of the Waste Management facilities at the water purification plants, resulted in various savings in purchased services and materials of $2,227,000 and $900,000 in sewer surcharge costs. Finally, Fleet costs were $104,000 lower than budgeted.

Revenues were lower than budgeted by $77,000 due to lower than anticipated volume of external cost recovery work performed by City crews.

The 2007 Budget anticipated a consumption drop experienced in 2006 as the result of water conservations measures and seasonal variations. 2007 actual consumption and revenue was 1.6% higher than planned due to the growth in the number of accounts.

The rate supported programs share of the City's investment income was $3,200,000 lower than planned. The rate supported programs earn investment income primarily on their unexpended capital program funds. The unexpended capital funds were $123.2 million at the end of 2003 and had decreased to $25.4 million by the end of 2007. This reduction has occurred as a result of the increased use of debt to finance capital projects and the delay in debt issuance which has required greater use of unexpanded capital funds

Annex C

DISPOSITION OF 2007 OPERATING SURPLUS / DEFICIT

UTILISATION DE L’EXCÉDENT OU DU DÉFICIT DE FONCTIONNEMENT DE 2007

ACS2008-CMR-FIN-0014 city-wide / À l’Échelle de la ville

Ms. M. Simulik,

City Treasurer, spoke to a PowerPoint presentation, which served to provide

Committee with an overview of the report.

A copy of her presentation is held on file with the City Clerk.

Responding to questions from Councillor Bloess with respect to the Ottawa Police Service’s (OPS) deficit, Ms. Simulik believed their budget increase for this year was somewhere in the order of 10% and she confirmed that the deficit outlined in the report represented an additional 2.5% increase. Based on notes provided by OPS staff, she explained that $2.7M of the deficit was related to a one-time compensation settlement related to job evaluation. She acknowledged that they may have been able to forecast some of this deficit at budget time, though they had probably identified the current year’s costs. However, she noted this cost related to a retro-activity going back to 1999, which would likely have been difficult to estimate.

In reply to a comment from Councillor Wilkinson, Councillor McRae indicated she would be happy to raise this issue with the Ottawa Police Services Board, noting that she had raised it with their Finance and Audit Committee. Furthermore, she advised the Chief of Police had agreed to undergo a review of overtime and that he was very fiscally conscientious.

Councillor Wilkinson referenced the last paragraph at page 57 of the agenda package, which indicated the City’s investment income related to rate supported programs was $3.2M lower than planned and she wondered if this was because reserves were depleted. Ms. Simulik indicated this related to water and wastewater and she explained there were no interest earnings on their works in progress because they had been debt financing. She advised that staff was trying to remedy the situation by moving to rebalance the two reserves. Furthermore, she submitted that with the water rates recently approved by Council, there should be a change in this interest income line in 2008.

Responding to a question from Councillor Wilkinson with respect to reserves, Ms. Simulik explained that, based on the current policy, each year when staff came forward with the draft capital budget, it started with a $50M capital reserve, which Council could draw from.

In response to follow-up questions, the Treasurer noted the forecasted position changed dramatically, depending on Provincial announcements, closing capital works, and so on. She noted that the quarterly status reports provided Council with the forecasted position of the capital reserves.

Councillor Cullen referenced the news received earlier in the week with respect to a higher than expected dividend from Hydro Ottawa and he wondered what would happen to that $2M. Ms. Simulik maintained the current report dealt with the 2007 fiscal year, during which there was a $14M expected dividend from Hydro Ottawa but the City received $12M from them. She noted this year, the budget retained the anticipated Hydro dividend at $14M and, based on the recent announcement from Hydro Ottawa, it appeared the City would instead receive $16.375M in 2008. She submitted that without Council direction, the money would flow to that account and would be part of the total surplus / deficit position for 2008. Therefore, it would either offset deficits in other areas or flow to surplus, which would then be contributed towards the City-wide tax reserve.

Responding to questions from Councillor Cullen with respect to delays in the delivery of the supplementary assessment roll by the Municipal Property Assessment Corporation (MPAC), Ms. Simulik confirmed there was a shortfall for 2007. With respect to whether the growth would show up in 2008, she indicated staff expected it would, though this growth could be tempered by other factors at play in the larger economy. She acknowledged that as a result of the aforementioned delays, the City was out-of-pocket, as were all municipalities across Ontario.

In response to a final question from Councillor Cullen with respect to a $2.3M surplus in Planning, Transit and the Environment for compensation due to vacant positions, Ms. Simulik indicated this related to the Building Services Branch’s difficulty in getting building inspectors. She believed they had implemented some new programs to try to get building inspectors through Algonquin College. However, she noted that under the legislation, this unspent money went into reserve for the Branch’s use to implement new technology or to offset years where building permits declined and the Director still had to deal with prior years’ issues. Ms. N. Schepers, Deputy City Manager of Planning, Transit and the Environment, confirmed this was a focus for the department and, although she could not guarantee all positions would be filled, she assured members that it continued to be a very high priority for the Building Services Branch as well as other areas of the department.

Responding to questions from Councillor Hunter with respect to the issue of the supplementary tax increase revenue being below budget and having an effect on the Transit portion of the levy but not on the other portions in the same amount, Ms. Simulik explained because Transit did not have a lot of works in progress funded from Transit cash, that Branch did not get the same share of the interest income and as a result, this put them in a deficit position on their non-departmental. She added, this related to the fact that so much of Transit’s capital works were funded either from debt, Provincial gas tax, or other sources. Because of the way Transit projects were funded, Ms. Simulik indicated she would expect this to continue in the future.

In response to follow-up questions from Councillor Hunter with respect to MPAC, Ms. Simulik confirmed there were no freebies. She noted the statute of limitations allowed the City to tax for the current year as well as the two previous years. Therefore, when MPAC did put new properties onto the assessment rolls, the City would issue tax bills for the current year as well as the previous, or the two previous, as the case may be.

Speaking to the OPS deficit, Councillor Hunter indicated his interpretation was that the Police Service had been under-estimating its costs by an average of $700,000 per year for the past seven or eight years. They had not been putting money aside for what should have been expected for job evaluation changes and as a result, the City-wide reserve was taking a big hit this year. Ms. Simulik felt this was a fairly good summary of what had happened in the past. She noted that since 2002, the City-wide reserve had funded approximately $6M worth of deficits within the Police budget. Furthermore, she remarked that during this same period, there were only two years where the OPS had operating surpluses and in one of those years, they got Council to agree to put the surplus back into their own reserve instead of contributing it to the City-wide reserve. She indicated she was uncertain as to why they were unable to estimate their job evaluation costs in 2007. However, she was certain that it had been built into their 2008 budget.

Councillor Hunter referenced the $5M surplus for Solid Waste capital and he wondered about the possibility of adjusting the flat rate down a bit per household. Ms. Simulik explained the surplus related primarily to tipping fees. She reminded members of circumstances with respect to commercial waste coming to an Ottawa landfill site and residential waste going to Moose Creek. She noted this was a situation that would continue for another two years. Furthermore, she recalled that Solid Waste staff had come forward to talk about additional capital works needed to accommodate the commercial waste. Therefore, she submitted that the Branch would be looking to use some of the surplus.

Councillor Desroches noted Council’s target for the rate supported capital reserve funds was $20M and the fact that, as a result of surpluses, the reserve fund balances were projected to be over $30M. He wondered why the City would not use the money to either offset a rate increase or other purposes. Ms. Simulik reminded Committee that the rate supported capital program relied heavily on debt. Therefore, in order to avoid an exponential rate increase, the “extra” would either be applied to debt or it would be used in the 2009 capital program to reduce that year’s requirement. She advised this would be factored into reports coming forward this year.

At this juncture, Committee voted on the report recommendations.

That, as part

of the finalization of 2007 operations, the Corporate Services and Economic

Development Committee recommend Council approve the following transfers to/from

reserve funds:

1. That in accordance with the various reserve

fund by-laws, the $5,945,000 surplus within the City Wide tax supported

operations be transferred to the following reserve funds:

a) the surplus attributable to Social Housing of $22,000 be transferred to the Social Housing Reserve Fund in accordance with By-Law 2003-237;

b) the surplus attributable to Solid Waste Rate operations of $5,022,000 be transferred to the Solid Waste Rate Reserve fund in accordance with By-Law 2005-556; and

c) the remaining surplus of $901,000 be transferred to the City Wide Capital Reserve Fund;

2. That the $340,000 surplus in the Ottawa

Public Library be transferred to the OPL Capital Reserve Fund in accordance

with By-Law 2003-310;

3. That the $2,187,000 deficit in the Transit

Operating Fund be funded by a transfer from the Transit Capital Reserve Fund in

accordance with By-Law 2003-361;

4. That the

$4,391,000 deficit in the Ottawa Police Services be funded by a transfer from

the City Wide Capital Reserve Fund;

5. That

the surplus within the rate supported operations be transferred to the

following reserve funds:

a) The surplus attributable to Water

operations of $2,939,000 be transferred to the Water Capital Reserve Fund in

accordance with By-Law 2003-141; and

b) The surplus attributable to the Wastewater

operations of $3,327,000 be transferred to the Wastewater Capital Reserve Fund

in accordance with By-Law 2003-141; and

6. That the

$5,856,000 residual Best Start one-time funding be transferred to the Childcare

Capital Reserve Fund in accordance with By-Law 2004-328.

CARRIED