|

7. Brownfields rehabilitation grant application - Demande de subvention pour la remise en valeur des FRICHES

industrielLEs - société d’aménagement de Beechwood sud - |

Committee RecommendationS

That Council:

1. Approve the Brownfields Rehabilitation Grant Application

submitted by South Beechwood Development Corporation, owner of the property at

100 Landry Street, for a Brownfields Rehabilitation Grant not to exceed $1,231,625,

payable to South Beechwood Development

Corporation over a maximum of ten (10) years, subject to the establishment of,

and in accordance with, the terms and conditions of the Brownfields

Rehabilitation Grant Agreement;

2. Direct staff to enter

into a Brownfields Rehabilitation Grant Agreement with South Beechwood

Development Corporation establishing the terms and conditions governing the

payment of the Brownfields Rehabilitation Grant, for, and redevelopment of, 100

Landry Street, satisfactory to the Deputy City Manager, Planning, Transit and

the Environment, the City Solicitor and the City Treasurer; and

3. Resolve to exempt the

proposed redevelopment at 100 Landry Street by South Beechwood Development

Corporation from paying future development charges up to a maximum of

$2,555,000, under Section 7(t) of the Development Charges By-law 298-2004, and

under the Guideline for the Development Charge Reduction Program due to Site

Contamination, approved by Council March 28, 2007.

RecommandationS du comité

Que le

Conseil :

1. donne son aval à la

demande de subvention pour la remise en valeur des friches industrielles

présentée par la Société d’aménagement de Beechwood-Sud, propriétaire du 100,

rue Landry, que cette demande ne dépasse pas 1 231 625 $ et qu’elle

soit versée à la Société d’aménagement de Beechwood-Sud pendant au plus dix

(10) ans, sous réserve de la mise en œuvre des modalités de l’entente sur

la subvention pour la remise en valeur des friches industrielles et

conformément à celles‑ci;

2. confie au personnel la tâche de

conclure avec la Société d’aménagement de Beechwood-Sud une entente de

subvention pour la remise en valeur des friches industrielles, dans laquelle

seront stipulées les modalités du versement de la subvention pour la remise en

valeur des friches industrielles, en vue de la remise en valeur du 100, rue

Landry, à la satisfaction de la directrice municipale adjointe, Urbanisme,

Transport en commun et Environnement, du chef du Contentieux et de la

trésorière municipale;

3. veille à dispenser la Société

d’aménagement de Beechwood-Sud du versement de redevances d’aménagement

ultérieures dans le réaménagement proposé au 100, rue Landry, jusqu’à

concurrence de 2 555 000 $, en vertu de l’article 7t) du

Règlement sur les redevances d’aménagement 2004‑298 et des lignes

directrices du Programme de dispense des redevances d’aménagement en cas de

contamination, avalisées par le Conseil le 28 mars 2007.

Documentation

1. Deputy City Manager's report (Planning,

Transit and the Environment) dated 27 September 2007 (ACS2007-PTE-POL-0043).

2. Extract of Draft Minute, 2 October 2007 (follows the French version of this report, and available in English only).

DocumentS

1. Rapport du Directrice municipal adjointe

(Transport en commun et Environnement) daté le 27 septembre 2007

(ACS2007-PTE-POL-0043).

2. Extrait de l’ébauche du procès-verbal,

le 2 octobre 2007 (suit la version française de ce rapport, et disponible en

anglais seulement).

Report

to/Rapport au :

Corporate Services and Economic Development Committee

Comité des services organisationnels

et du développement économique

and Council / et au Conseil

27 September 2007 / le 27 septembre 2007

Submitted by/Soumis par : Nancy Schepers,

Deputy City Manager / Directrice municipale

adjointe,

Planning, Transit and the Environment / Transport en commun et

Environnement

Contact

Person/Personne ressource : Rob Mackay, A/Director Director / Directeur par

intérim, Economic and Environmental Sustainablity / Direction de la viabilité

économique et de la durabilité de l’environnement, (613) 580-2424, 22632

Rob.Mackay@ottawa.ca

REPORT RECOMMENDATIONS

That the Corporate Services and Economic Development Committee

recommend Council:

1.

Approve the

Brownfields Rehabilitation Grant Application submitted by South Beechwood

Development Corporation, owner of the property at 100 Landry Street, for a

Brownfields Rehabilitation Grant not to exceed $1,231,625, payable to South Beechwood Development

Corporation over a maximum of ten (10) years, subject to the establishment of,

and in accordance with, the terms and conditions of the Brownfields

Rehabilitation Grant Agreement;

2.

Direct staff to enter into a Brownfields Rehabilitation

Grant Agreement with South Beechwood Development Corporation establishing the

terms and conditions governing the payment of the Brownfields Rehabilitation

Grant, for, and redevelopment of, 100 Landry Street, satisfactory to the Deputy

City Manager, Planning, Transit and the Environment, the City Solicitor and the

City Treasurer; and

3.

Resolve to exempt the proposed redevelopment at 100

Landry Street by South Beechwood Development Corporation from paying future

development charges up to a maximum of $2,555,000, under Section 7(t) of the

Development Charges By-law 298-2004, and under the Guideline for the

Development Charge Reduction Program due to Site Contamination, approved by

Council March 28, 2007.

RECOMMANDATIONS DU RAPPORT

Que le Comité des services organisationnels et du développement économique recommande au Conseil de :

1. donner son aval à la demande de subvention pour la remise en valeur des friches industrielles présentée par la Société d’aménagement de Beechwood-Sud, propriétaire du 100, rue Landry, que cette demande ne dépasse pas 1 231 625 $ et qu’elle soit versée à la Société d’aménagement de Beechwood-Sud pendant au plus dix (10) ans, sous réserve de la mise en œuvre des modalités de l’entente sur la subvention pour la remise en valeur des friches industrielles et conformément à celles‑ci;

2.

confier au personnel la tâche de

conclure avec la Société d’aménagement de Beechwood-Sud une entente de

subvention pour la remise en valeur des friches industrielles, dans laquelle

seront stipulées les modalités du versement de la subvention pour la remise en

valeur des friches industrielles, en vue de la remise en valeur du 100, rue

Landry, à la satisfaction de la directrice municipale adjointe, Urbanisme,

Transport en commun et Environnement, du chef du Contentieux et de la

trésorière municipale;

3.

veiller à dispenser la Société

d’aménagement de Beechwood-Sud du versement de redevances d’aménagement

ultérieures dans le réaménagement proposé au 100, rue Landry, jusqu’à

concurrence de 2 555 000 $, en vertu de l’article 7t) du

Règlement sur les redevances d’aménagement 2004‑298 et des lignes

directrices du Programme de dispense des redevances d’aménagement en cas de

contamination, avalisées par le Conseil le 28 mars 2007.

BACKGROUND

On April 25, 2007 City Council adopted the Brownfields Redevelopment Community Improvement Plan (CIP). Brownfields are abandoned, vacant, or underutilized commercial and industrial properties where past actions have resulted in actual or perceived environmental contamination and/or derelict or deteriorated buildings. The Brownfields Redevelopment CIP contains a comprehensive framework of incentive programs including the Rehabilitation Grant Program and the Building Permit Fee Grant Program.

South Beechwood Development Corporation has filed an application for a Brownfields Rehabilitation Grant for the clean-up of 100 Landry Street, a 3.91-hectare property that is currently vacant. The property was formerly occupied by a steel fabrication and distribution industry (Dominion Bridge Company Ltd.).

The Dominion Bridge Company Ltd. operated at this location from 1909 to 1970. The site received fill material for the construction of spur lines and general site grading. The fill material (as determined by Golder Associates Ltd, Phase II Environment Site Assessment) was impacted with elevated concentrations of metals and trace amounts of hydrocarbon and polycyclic aromatic hydrocarbons. The impacted fill is located over the entire surface of the site and extends to a depth of between one and two metres below ground surface.

The site qualifies as an eligible "brownfield" under the City's Brownfields CIP.

The purpose of this report is to bring the Rehabilitation Grant application for 100 Landry Street before Committee and Council for approval.

DISCUSSION

The Rehabilitation Grant Program is a tax-increment based grant funded through the tax increase that results from redevelopment of the property.

Grants will equal 50 per cent of the City portion of the increase in property taxes that results from the redevelopment, payable annually for up to 10 years, or up to the time when the total grant payments equal the total eligible costs, whichever comes first. The City will only pay the annual grant after property taxes have been paid in full each year.

The environmental site assessment, remediation, and risk management cost components of an approved Rehabilitation Grant may be applied against development charges payable, subject to Council approval. The maximum reduction of development charges is 50 per cent of these cost components.

The Building Permit Fee Grant Program provides an additional incentive in the form of a grant equivalent to 30 per cent of building permit fees paid on a project that has been approved for a Rehabilitation Grant. This grant is paid as a component of the Rehabilitation Grant.

The Landry Grant Application

The required documents that are to be submitted to the City as part of a Rehabilitation Grant application are described in Document 2. Staff has reviewed the submissions and deemed the application to be complete.

Proposed Remediation/Risk Management

The remediation approach for the site was to develop site-specific risk based criteria for portions of the site and to remediate other portions of the site to generic criteria in accordance with Part XV.1 of the Environmental Protection Act, and regulations and standards established thereunder.

The impacts at the site are confined to the soil matrix and therefore contaminated soil will be excavated from the site for off-site disposal at a Ministry of the Environment (MOE) licensed landfill facility. All of the contaminated material on the site classifies as solid non-hazardous waste. Golder Associates estimate that the amount of contaminated material to be removed from the site is approximately 95,000 tonnes. The Ministry of the Environment have accepted the proposed approach to site remediation, risk assessment and risk management.

Proposed Redevelopment Scheme

The City approved the site plan control application for this property on October 24, 2006. It involves three apartment towers: two twenty-storey apartment buildings and one nine-storey building with 193 seniors apartments. It also includes 60 low-rise apartment (stacked townhouses) units and 76 townhouses.

Rehabilitation Grant-Eligible

Costs

Under the Brownfields Rehabilitation Grant program guide the applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. Staff has reviewed the submissions and has determined that the total costs eligible for a Brownfields Rehabilitation Grant are $7,573,250 of which $5,110,000 are the costs eligible for reduction in development charges due to site contamination. A breakdown of the eligible costs is shown in Document 3.

Calculating the Rehabilitation Grant and Development Charge Reduction

Because the Ottawa Brownfields CIP specifies that the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings, the cap on eligible costs is $3,786,625.

Based on the formulas contained within the approved CIP, the reduction in development charges is $2,555,000 and the Rehabilitation Grant is $1,231,625. The detailed calculations are shown in Document 4.

For the purposes of estimating the highest future municipal tax increment and the earliest estimated grant pay-out period it has been assumed for illustrative purposes that all of the first phase would be completed within three years. The first phase is to include most of the development. The second phase is the completion of one of the apartment buildings. The detailed assumptions and the calculations are shown in Document 5. If the building program were to proceed at this pace the rehabilitation grant pay-out could end in three years.

The actual development may see elements of each of the components completed over a longer period and therefore the actual grant payment will depend on the pace at which development occurs. The program period is a maximum of 10 years from the first payment or until all eligible costs have been paid by the annual grant, whichever comes first.

Over the years, there have been several proposals for the redevelopment of 100 Landry Street; none of which came to fruition because of the significant financial barriers to overcome in implementing any type of project on this site.

Benefits to the

Community

Economic Benefits

The overall economic impact of the proposed development is estimated at $100 million in construction value spread over 136 town and stacked townhouses, 385 apartments and a 193-unit retirement residence. Both significant direct and indirect economic benefits to the local economy will be realized during the remediation and construction period through payroll, purchased material supplies and services and equipment rentals on a development project of this magnitude. The economic benefits would span over the estimated three to five year construction period. It is estimated that during the construction period approximately 800 person years of direct employment and 1,400 person years of indirect employment would be created by this project.

After construction and phased occupancy there would be an injection of new local spending on goods and services in the nearby Beechwood Village, and to neighbourhoods beyond (such as along Montreal Road and in the Central Area) by the over 700 new households (1,200 persons) representing various incomes, lifestyles and purchasing requirements.

Over $172 million in new residential assessment would be added to the property tax assessment roll at full development. Staff estimates that over $1 million per year in increased municipal property taxes, net of the Brownfields Rehabilitation Grant, can be expected at full development. This is a significant increase over the current municipal taxes of $22,000 per year.

The project will earn the City over $2.54 million in present value dollars of development charges, other development fees, and building permit fees.

City Strategic Directions

One of the City’s priorities, as a strategic direction, is in planning and growth management. An important objective is to integrate new growth seamlessly with established communities.

In general, residential intensification assists the City’s overall smart-growth urban management objectives by placing less of an emphasis on the expansion of service boundary (into greenfields) and more of an emphasis on the utilization of existing municipal infrastructure investments. The current approved site plan for this property incorporates many sustainable development principles such as the creation of compact built form and parkland space, the strengthening of the link between higher density residential development and public transit, and providing additional housing opportunities within an existing urban community. In general, encouraging residential intensification of brownfield sites such as this former industrial site can also have many positive economic, social, and environmental benefits to the surrounding neighbourhood and local economy.

ENVIRONMENTAL ImPLICATIONS

The

approval of this rehabilitation grant will encourage the redevelopment of this

brownfield property and assist in supporting the growth management principles

of Ottawa 20/20. It will assist in

responsibly managing aspects of the City’s environment as established in the

Environmental Strategy and will ensure that this contaminated site is properly

assessed, remediated and/or risk managed prior to development. Brownfield redevelopment is identified as a

key strategy for promoting reinvestment in existing urban areas and for

reducing the need to expand into greenfield sites. The remediation and redevelopment of brownfield sites assists in

meeting the Environmental Strategy’s goal of “clean air, water and earth”.

CONSULTATION

N/A

FINANCIAL IMPLICATIONS

As per the Brownfields Redevelopment CIP, if this Rehabilitation Grant application is approved the City would provide the owner with a grant equivalent to 50 per cent of the increase in municipal taxes. In this case, the total maximum grant is $1,231,625. The grant payment would be calculated annually and would be paid per year until the total eligible costs are repaid, or a maximum of 10 years, whichever comes first. The annual grant could be paid out at the earliest in approximately three years. At that time the City will begin to collect and retain the full municipal portion of the tax increment.

Under the Rehabilitation Grant program, the

calculation for the annual grant paid by the City to the owner is based on the

increase in taxes generated by the development attributable to the Brownfields

financial incentives program.

The City will retain 15 per cent of the municipal tax increment per year to coincide with the grant period until the total eligible costs are repaid. These monies will be deposited into the Municipal Leadership Account. This account would function as a revolving fund (capital account) to be used to support the Brownfields Redevelopment Strategy. These funds would be used to offer the various grants that are not property tax-based as described in the Strategy and CIP and to cover the FTE costs for Financial Services.

No taxes will be rebated in 2007. As approved

components of this project come forward in 2008 the Revenue Division will

review rebated tax calculations. This and other projects will require a new FTE

for the Revenue Division in Financial Services. The funding for the position required in Financial Services will

come from the Municipal Leadership Account.

The transition guidelines approved and adopted by City Council under the Brownfields CIP allow for consideration of proposals received prior to January 16, 2007 under the previous development charges exemption program. The applicant had applied under these provisions in August 2006. The current development charges by-law permits, where authorized by way of a resolution of Council, an exemption from paying growth-related fees for redevelopment taking place on contaminated lands or so-called brownfield sites. There was no mandatory capping of the financial assistance applicable under this by-law and therefore the maximum development charge reduction would have been 100 per cent of eligible site remediation costs ($5,111,000) or up to the maximum development charges payable which is estimated to be $3,695,000 in development charges not collected for this site if approved under the transition provisions.

Since the applicant has agreed to be considered under the Brownfields Rehabilitation Grant rather than under the transition provisions, the reduction in development charges, if approved, would be $2,555,000. The balance of the estimated development charges for full development of this site will still be due and payable at the time that building permits are issued and is estimated to be $1,140,000.

A development charge discount is a significant economic incentive for promoting brownfield redevelopment and revitalization. The approval of this report may result in a reduction of an estimated $2,555,000 in development charge revenues that will not be payable at the time building permits are issued.

The reduction may not be made up through an increase in fees for other categories (Development Charges Act, 1997, S.O. 1997, c. 27, s. 5(6) para. 3). Any reduction in the Development Charge collections arising from an exemption may result in a shortfall in funding to support growth-related projects. This shortfall will be addressed in the five-year review of the development charge by-law as required by legislation.

SUPPORTING DOCUMENTATION

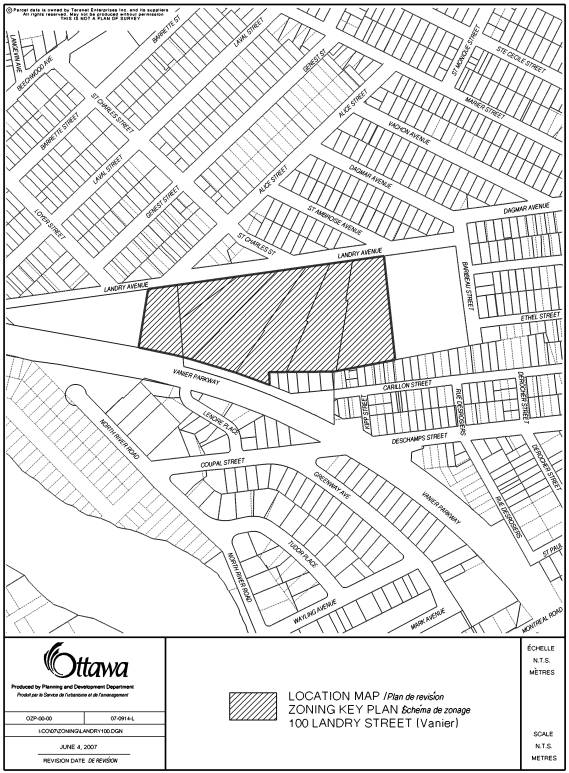

Document 1 General

Location Map

Document 2 Rehabilitation

Grant Application Requirements

Document 3 Rehabilitation

Grant-Eligible Costs

Document 4 Calculating the Rehabilitation Grant and Development Charge Reduction

Document 5 Estimated Future City Property Tax Increment and Annual Municipal Grant Payable

DISPOSITION

Legal Services Branch, to prepare the Brownfields Rehabilitation Grant Agreement.

Planning, Transit and the Environment Department, Building Code Services Branch will be notified that the properties are not required to pay development charges at the time of building permit issuance up to the amount of $2,555,000 in development charges that would normally have been paid. Development Charges however will be payable after this amount is reached at the time of building permit issuance as per the applicable Development Charge fee schedule.

Planning, Transit and the Environment Department and City Manager’s Office, Financial Services Branch to develop a general administrative approach to implement the Brownfields Redevelopment financial incentive program and more specifically for this application.

Planning, Transit and the Environment Department to monitor the performance of this grant application and prepare a status report on this application as part of an annual Brownfields Redevelopment monitoring report to Council.

Planning, Transit and the Environment Department to notify the owner/applicant (Neil Malhotra, South Beechwood Development Corporation, 2001-210 Gladstone Avenue, Ottawa, ON K2P OY6); and solicitor (C. Warren Stroud, 486 Gladstone Avenue, Ottawa, ON K1R 5N8) of Council’s decision.

A Brownfields Rehabilitation Grant program guide was prepared as part of the administration of the Brownfields financial incentives program. This program guide provides the detailed requirements to an applicant in order to file a complete application with the City for consideration of financial assistance under this grant program. The applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. The following documents are required:

- All environmental studies (Phase I ESA, Phase II ESA, Remedial Action Plan and Risk Assessment);

- Detailed work plan and cost estimate prepared by a qualified person (as defined by the Environmental Protection Act and Ontario Regulation 153/04, as amended, for all eligible environmental remediation and risk assessment/risk management works;

- A cost estimate provided by a bona fide contractor for eligible rehabilitation/redevelopment costs;

- A set of detailed architectural/design and /or construction drawings; and

- An estimated post-project assessment value prepared by a private sector property tax consultant.

The applicant (registered owner) or agent acting on behalf of the registered owner is required to fully complete the application including all required signatures and complete the sworn declaration.

The costs eligible for a Brownfields Rehabilitation Grant for 100 Landry Street are estimated as follows:

|

|

Eligible Costs

|

Actual/Estimated Cost |

|

1 |

Environmental studies |

$131,000[1] |

|

2 |

Environmental Remediation |

$4,250,000 |

|

3 |

Placing Clean fill and grading |

$275,000 |

|

4 |

Installing enviro/engineering controls as specified in work plan/risk assessment |

$300,000 |

|

5 |

Monitoring, maintaining, operating engineering works as specified in work plan/risk assessment |

$150,000 |

|

6 |

Environmental Insurance Premiums |

$4,000 |

|

|

Total Costs eligible for DC

reduction due to site contamination |

$5,110,000 |

|

7 |

Cost of Project Feasibility Study |

$10,000 |

|

8 |

30 per cent of the estimated Building Permit Fee to be paid[2] |

$400,000 |

|

9 |

Upgrading on-site infrastructure including water services, sanitary sewers and stormwater management facilities |

$1,456,000 |

|

10 |

Constructing/upgrading off-site infrastructure where required to permit remediation, rehabilitation of the property |

$597,250 |

|

|

Total Costs Eligible for a

Rehabilitation Grant |

$7,573,250 |

From the above, the total costs eligible for a Brownfields Rehabilitation Grant are $7,573,250, of which $5,110,000 is the costs eligible for reduction in development charges due to site contamination.[3]

DOCUMENT 4

CALCULATING THE REHABILITATION GRANT AND

DEVELOPMENT CHARGE REDUCTION

The Ottawa Brownfields CIP specifies that, the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings.

|

1 |

Total eligible Costs-

from Document 3 |

$7,573,250 |

|

2 |

Total capping at 50 per

cent of line 1 |

$3,786,625 |

|

3 |

Estimated Development

Charges (DC) |

$3,695,000 |

|

4 |

Total costs eligible for

DC reduction from Document 3 –total of items 1to 6 |

$5,110,000 |

|

5 |

Capping at 50 per cent of

line 4-development charge reduction* |

$2,555,000 |

|

6 |

Development charge

payable is reduced by the amount in line 5 (line 3-line 5)** |

$1,140,000 |

|

7 |

Eligible cost cap is

reduced by DC reduction (line 2-line

5) |

$1,231,625 |

|

8 |

Total Rehabilitation Grant Payable |

$1,231,625 |

* The maximum reduction of development charges is 50 per cent of the cost components of line 4 if the site is located in the priority area. The site is located just over 400 metres from Montreal Road, which is a “Transit Priority Corridor” and “Future Rapid Transit Corridor”. This location would qualify as being in the priority area under the Brownfields CIP and therefore is eligible for the 50 per cent maximum reduction.

The development charge reduction is $2,555,000 (line 5

above).

The development charge payable is $1,140,00 (line 6

above).

**The environmental site assessment, remediation and risk management cost components of an approved Rehabilitation Grant may be applied against development charges payable, subject to Council approval.

The total Rehabilitation Grant

payable is $1, 231,625 (line 8 above).

DOCUMENT 5

ESTIMATED

FUTURE CITY PROPERTY TAX INCREMENT AND

ANNUAL MUNICIPAL GRANT PAYABLE

Pre-Project Property Tax Rates and Property Taxes

Current Value Assessment (2007) on the property at 100 Landry is $1,283,000, classed as Multi-Residential (MT). Current property taxes are approximately $25,802.33 broken down as follows:

Table 1

|

Municipal Property Tax portion |

$22,415.21 |

|

Education Property Tax Portion |

$3,387.12 |

|

Tax Cap Adjustment |

0 |

Total Pre-Project Property Taxes |

$25,802.33 |

Property taxes are paid in full.

Based on the post-project assessment valuation prepared by Deloitte & Touche LLP[4], as submitted as part of the application, it has been estimated that once the entire project is complete, the property including all buildings will have a post- project assessment value of approximately $173,101,000 (2007$).

The breakdown is as follows:

|

76 townhomes (freehold)[5] |

$25,152,000 |

|

60 stacked townhomes (condo)[6] |

$13,644,000 |

|

Condo building 195 units[7] |

$54,390,000 |

|

Condo building 190 units |

$52,915,000 |

|

Retirement Residence 193 units[8] |

$27,000,000 |

|

TOTAL

post construction assessment value |

$173,101,000 |

A large project of this

nature will see development occurring in phases dependent on market

conditions. The applicant has indicated

that the first phase of the project would commence later this year and could

take 2 to 3 years to complete. The

first phase is to include the 76 townhomes, 60 stacked townhomes, one apartment

of 195 units and the 193-unit retirement residence. The second phase is the completion of the 190-unit apartment

building.

For the purposes of

estimating the future municipal tax increment and the estimated pay-out period

it has been assumed that all of the above components of the first phase would

be completed within three years. The actual

development may see elements of each of the components completed after this

period but the table below would indicate the situation if the site were to

develop quickly.

It is important to note that

the tax increment is an estimate and provides guidance on the order of

magnitude of the highest possible payment under the assumption of all buildings

being completed, reassessed and taxes levied and paid in the three-year period.

The administration of the

grant program would require that any grants to be paid be based on actual

Municipal Property Assessment Corporation (MPAC) property assessment (including

any resolution of appeals) of improved properties. The prevailing tax rate would be applied and only after taxes are

paid in full for one year and only when the City is satisfied that all terms

and conditions have been met as specified in the legal agreement between the

City and the applicant would a tax rebate be issued. This rebate would be capped at 50 per cent of the municipal share

of the increase in property taxes over the pre-project municipal property taxes

paid.

The program period is a

maximum of 10 years from the first payment or until all eligible costs have

been paid by the annual grant, whichever comes first.

Annual Post-Project Property Tax Rates and Municipal Property Taxes- Phase I

|

Dwelling Type |

Estimated assessment |

Municipal tax rate * |

Estimated Municipal Tax |

|

76 townhomes |

$25,152,000 |

0.9307% |

$234,089 |

|

60-stacked townhomes |

$13,644,000 |

0.9307% |

$126,984 |

|

Apartment- 195 units |

$54,390,000 |

0.9307% |

$506,207 |

|

Retirement Home |

$27,000,000 |

0.9307% |

$251,289 |

|

TOTAL |

$120,186,000 |

|

$1,118,569 |

*Tax Class NT (New Multi Residential) and RT (Residential). Both classes have the same tax rates for 2007.

Estimated future Municipal

Tax Increment = Estimated future municipal tax minus pre-project municipal

share of taxes (2007). That is $1,118,569 (from Table 2) - $22,415 (from

Table 1) = $1,096,154

Once the future municipal tax increment has been determined based on the 50 per cent grant factor (as set by Council in the CIP) the annual grant could be $548,077. The possible payment schedule is shown in the following table.

Table 3 Rehabilitation Grant Schedule

Year

|

MunicipalTax Increment ($) |

Grant Factor |

Municipal Grant ($) |

Cumulative Total ($) |

|

1 |

$1,096,154 |

50% |

$548,077 |

$548,077 |

|

2 |

$1,096,154 |

50% |

$548,077 |

$1,096,154 |

|

3 |

$1,096,154 |

50% |

$135,471 |

$1,231,625 |

In the administration of this grant each row would be calculated every year based on the new assessment, tax rate, taxes paid and actual municipal tax increment to establish the actual grant payment. If the first phase of the development were to be completed within three years the grant pay-out would end in three years. The actual payment schedule will likely extend beyond this period but in no case beyond 10 years from the first payment.

Table 4 Estimated Municipal Property Tax Changes – if only Phase I built

|

Year |

Existing Taxes |

New Taxes |

Municipal Tax Increment |

50% Grant |

15% to BMLRF* |

Revenue |

|

1 |

$22,415 |

$1,118,569 |

$1,096,154 |

$548,077 |

$82,211 |

$465,866 |

|

2 |

$22,415 |

$1,118,569 |

$1,096,154 |

$548,077 |

$82,211 |

$465,866 |

|

3 |

$22,415 |

$1,118,569 |

$1,096,154 |

$135,471 |

$20,320 |

$940,363 |

|

4 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

5 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

6 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

7 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

8 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

9 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

10 |

$22,415 |

$1,118,569 |

$1,096,154 |

|

|

$1,096,154 |

|

TOTAL |

$224,150 |

$11,118,

56 9 |

$10,096,154 |

$1,231,625 |

$184,742 |

$9,545,173 |

*BMLRF-Brownfields Municipal Leadership Revolving

Fund

|

New municipal property tax portion (tax increment) for years one through 10 |

$10,096,154 |

|

Rehabilitation Grant value for years one through three |

$1,231,625 |

|

Contribution to BMLRF based on tax increment for years one through three |

$184,742 |

|

Net new municipal portion of

property taxes for years one through 10 |

$9,545,173 |