|

13. DEFERRAL OF DEVELOPMENT CHARGES FOR HABITAT FOR HUMANITY

REPORT des REDEVANCES d’aménagement pour habitat pour l’humanité

|

COMMITTEE RECOMMENDATION

That Council approve one time funding of

$19,306 from the Development Charge Reserve Fund to offset development charges Habitat paid last year

on their development at 859-861 Pinecrest and delegate authority to the Director of Housing to enter into Municipal

Housing Project Facilities Agreement with Habitat for Humanity to allow for and

secure the deferral of Development Charges in the amount totalling $38,612 for

the development charges associated with the four Habitat homes at 859-861

Pinecrest and 855-857 Pinecrest.

RECOMMENDATION DU COMITÉ

Que le Conseil approuve

un financement unique de 19 306 $ à partir de la réserve des redevances

d'aménagement pour contrebalancer les redevances d'aménagement qu'Habitat pour

l'humanité a payé l'an passé pour le projet d'aménagement des 859 et 861,

chemin Pinecrest; et d’autoriser le directeur, Logement à

participer à un accord sur les immobilisations domiciliaires municipales avec

Habitat pour l’humanité afin de permettre et de garantir le report des

redevances d’aménagement totalisant 38 612 $ et concernant les quatre maisons

d’Habitat situées aux 859 et 861 Pinecrest et aux 855 et 857 Pinecrest.

DOCUMENTATION

1. Community

and Protective Services, Deputy City Manager’s report dated

27 March 2006

(ACS2006-CPS-HOU-0005).

Report

to/Rapport au :

Corporate Services and Economic Development Committee

Comité des services organisationnels

et du développement économique

27 March 2006 / le 27 mars 2006

Submitted by/Soumis par : Steve Kanellakos, Deputy City Manager/Directeur

municipal adjoint,

Community and Protective Services/Services communautaires et de

protection

Contact

Person/Personne ressource : Janet Kreda, Housing Developer

Housing/Logement

(613) 580-2424 x, Janet.Kreda@ottawa.ca

|

|

Ref N°: ACS2006-CPS-HOU-0005

|

|

SUBJECT:

|

DEFERRAL OF DEVELOPMENT CHARGES FOR

HABITAT FOR HUMANITY

|

|

|

|

|

OBJET :

|

REPORT des REDEVANCES d’aménagement pour habitat pour l’humanité

|

REPORT RECOMMENDATION

That Corporate Services and Economic Development Committee recommend

that Council approve one time funding of $19,306 from the Development Charge

Reserve Fund to offset development

charges Habitat paid last year on their development at 859-861 Pinecrest and delegate

authority to the Director of Housing to

enter into Municipal Housing Project Facilities Agreement with Habitat for

Humanity to allow for and secure the deferral of Development Charges in the

amount totalling $38,612 for the development charges associated with the four

Habitat homes at 859-861 Pinecrest and 855-857 Pinecrest.

RECOMMANDATION DU

RAPPORT

Le Comité des services

organisationnels et du développement économique recommande au Conseil d'approuver un financement unique de 19 306 $ à

partir de la réserve des redevances d'aménagement pour contrebalancer les

redevances d'aménagement qu'Habitat pour l'humanité a payé l'an passé pour le

projet d'aménagement des 859 et 861, chemin Pinecrest; et d’autoriser le directeur, Logement à participer à un accord sur les

immobilisations domiciliaires municipales avec Habitat pour l’humanité afin de

permettre et de garantir le report des redevances d’aménagement totalisant 38

612 $ et concernant les quatre maisons d’Habitat situées aux 859 et 861

Pinecrest et aux 855 et 857 Pinecrest.

BACKGROUND

City

Council on October 13, 2004, in considering Amendments to the City Council Approved

Official Plan to modify policies related to affordable housing, provided

direction to staff to im plement various planning incentives and direct

supports to promote and encourage the achievement of the Official Plan

policies. Habitat for Humanity is a

charitable organization that develops housing for families who are at or below

the Low Income Cut-Off or LICO as established by Statistics Canada. Habitat recently developed a duplex at

859-861 Pinecrest and they are in the process of building two more units at

855-857 Pinecrest. They are seeking

relief from development charges on these two properties.

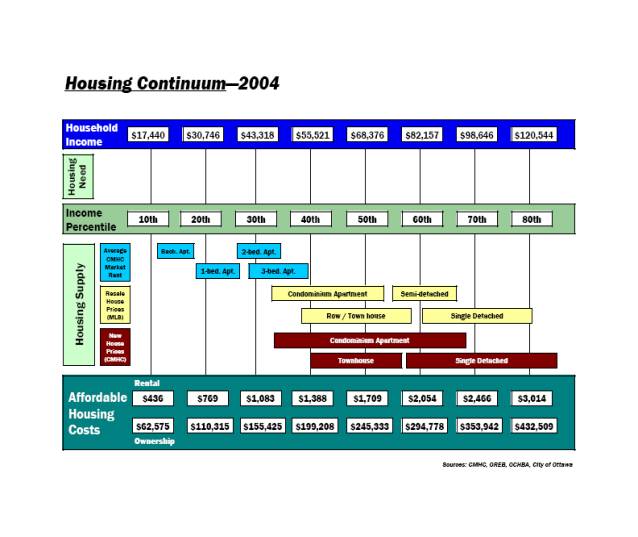

The

housing meets the Official Plan definition of "affordable" in that

the household will not pay more than 30% of

income on the mortgage payment, and the household income is at or below

the 40th income percentile.

Attached in Document 1,please find the most recently published LICO's

from 2004, and Document 2, Housing Continuum by Household Income Percentiles

2004. Habitat holds a first and second

mortgage on the home and arranges an affordable payment schedule with the buyer

to ensure that the mortgage payment is no more than 30% of household

income. The organization also retains

the right of first refusal, if the home is sold before the mortgages are paid

off.

Under the current Development Charge By-law

(By-law 2004-298) as adopted by Council on July 14, 2004, the exemption for

affordable housing extends only to units that are owned by non-profit or

charitable housing organizations. It

does not extend to units that are developed by a non-profit and subsequently

sold to private individuals, because private individuals are not

"non-profit" or charitable entities.

The

Legal Department advises that it may be possible to revise the Development Charges

By-law to allow non-profit organizations such as Habitat for Humanity to be

exempt from DC’s, providing there are mechanisms in place to ensure the

benefits are used to support the organizations mandate for long term

affordability of the home.

Since

the option to exempt DC’s is not currently available, the proposed alternative

is to enter into a Municpal Housing Project Facilities Agreement to defer the

payment of development charges until such time as the benefited home is sold. At that time, the value of the deferred

development charges would be repaid by the vendor to the City as part of the

sales process. This requires that

Habitat enter into a Municipal Capital Facilities Agreement with the City for each

benefited unit, and that the value of the deferred fees plus interest would be

secured as a second mortgage in favour of the City. Staff propose that the interest rate for the deferred fees be the

rate used by City staff to determine the annual affordable housing costs for

the purposes of the Official Plan affordable housing targets. This is similar to the agreement reached for

the development at 138 Somerset/St. John's Church. (ACS2005-PGM-APR-0129), approved June l8, 2005.

The

term of the Municpal Housing Project Facilities Agreement is 20 years. The Development Charges would be repayable

to the City when:

1. The property is sold for fair market value

and no longer meets the Official Plan definition of affordable.

2. The Habitat mortgages are paid in full

within the 20 yr term of MHPFA, and the occupant family income exceeds the 40th

income percentile, or subsequent affordable housing threshold as decided by

Council.

If

neither of the above conditions occur prior to the expiry of the MHPFA, the

Development Charges will be forgiven at the end of the 20 year MHPFA, and the

mortgage on title in favour of the City will be removed.

CONSULTATION

The

report has been circulated to Planning and Growth Management, Legal and

Finance. No public consultation has

been conducted with respect to this request for assistance. The request and recommended response is

consistent with current program practice.

FINANCIAL IMPLICATIONS

Approval

of this report will result in a total refund of $19,306 from the Development Charge

Reserve Fund to offset the development charges Habitat paid last year on their

development at 859-861 Pinecrest. In

addition, approval of this report will result in the deferral of $38,612

($19,306 in development charges related to the development at 859-861 Pinecrest

and $19,306 in development charges currently due for 855-857 Pinecrest). Over the life of this program, the overall

financial implication is minimal, as it is expected these properties will be sold

at fair market value by the end of the 20 year MHPFA and the deferred

development charges will be repaid to the City.

For

2006, there is no current budget identified to fund this initiative.

Subject to Council approval, one time funding from the $19,306 from the

Development Charge Reserve Fund is recommended to address this requirement in

2006. As part of the 2007 budget, the

Community and Protective Services Department will bring forward a budget

pressure identifying the funding requirement.

The

tax increase forecast for 2007 as presented in the 2006 Draft Budget Summary

document was projected to be 8.1%.

All additional requirements approved by Council that have a 2007 budget

implication will be summarized and presented in the City’s quarterly status

reports.

SUPPORTING DOCUMENTATION

Document

1: Low Income Cut-Offs 2004

Document

2: Housing Continuum and Household Income Percentiles 2004

DISPOSITION

A

project specific Municipal Housing Project Facilities By-law will be brought

forward to Council.

Upon

approval by Council, the Housing Branch will execute a Municipal Capital

Facilities Agreement with Habitat for Humanity as per the terms identified in

this report.

Corporate

Services, Financial Services Branch to prepare the payment and adjust accounts

accordingly.