|

3. tHE NEW DEVELOPMENT CHARGE BY-LAW - APPROACH AND TIMETABLE NOUVEAU RÈGLEMENT MUNICIPAL SUR LES REDEVANCES

D’EXPLOITATION – DÉMARCHE ET CALENDRIER |

Committee RecommendationS

That

Council approve:

1.a) The general principles

underlying the Development Charges Review Study ass outlined in Appendix Document 1 and

detailed in this report. ; and

2. T

b) the

timetable for the Development Charges Study as outlined in Document Appendix 12 and detailed in

this report be received for information.

Recommandations

du comité

Que le Conseil approuve :

1. les principes généraux qui

sous-tendent l’étude sur les redevances d’exploitation, énoncés au

document 1 et décrits en détail dans le présent rapport.

2. le calendrier de réalisation de

l’étude sur les redevances d’exploitation, présenté au document 2 et décrit en

détail dans le présent rapport.

Documentation

1. Development Services Department

General Manager's report dated 14 October 2003 (ACS2003-DEV-POL-0053).

2. Extract of Draft Minutes, 21 October 2003.

Report to/Rapport au :

Corporate Services and Economic Development Committee

Comité des services organisationnels et du

développement économique

and Council / et au Conseil

1421

October 2003 / le 2114 octobre 2003

Submitted by/Soumis par : Ned Lathrop, General

Manager/Directeur général,

Development Services/Services d'aménagement

Contact Person/Personne

ressource : Dennis Jacobs, Director / Directeur

Planning, Environment and Infrastructure

Policy/Politique d'urbanisme, d'environnement et d'infrastructure

(613) 580-2424 x25521, dennis.jacobs@ottawa.ca

|

SUBJECT: |

|

|

|

|

|

OBJET : |

NOUVEAU RÈGLEMENT MUNICIPAL SUR

LES REDEVANCES D’EXPLOITATION – DÉMARCHE ET CALENDRIER |

REPORT RECOMMENDATIONS

That the Corporate Services

and Economic Development Committee recommend Council approve:

1.a) the general principles underlying the

Development Charges Review Study ass outlined in Appendix Document 1 and

detailed in this report. ; and

2. T

b) the

timetable for the Development Charges Study as outlined in Document Appendix 12 and detailed in

this report be received for information.

RECOMMENDATIONS DU RAPPORT

Que le Comité des services organisationnels et du

développement économique recommande au Conseil d’approuver :

1.

les principes généraux qui

sous-tendent l’étude sur les redevances d’exploitation, énoncés au

document 1 et décrits en détail dans le présent rapport.

2.

le calendrier de réalisation de

l’étude sur les redevances d’exploitation, présenté au document 2 et décrit en

détail dans le présent rapport.

BACKGROUND

The Development Charges Act, 1997 came into force and effect on March 1, 1998. According to the Act, when municipalities adopt a development charge bylaw, it must be supported by a Background Report that estimates the amount, type and location of development; includes a calculation for each municipal service included in the development charge (e.g. growth/non-growth split, residential/non-residential split, capacity in existing systems), and an examination, for each service, of the long-term capital and operating costs for the capital infrastructure required and other information that is deemed relevant. Under this legislation, the former Region and former municipalities (except for Ottawa and Vanier) formulated development charge by-laws which came into force mid 1999. The Development Charges Act, 1997 also states that municipalities must update and complete a new background study to determine development charges within a 5-year period of the existing development charge by-law initiation date. Therefore, the City of Ottawa must pass a new development charge by-law(s) by the end of July, 2004. In addition, the amalgamation of the City of Ottawa and recent levels of development have required a reassessment of short and long term growth related capital expenditures. The Ottawa 20/20 Growth Management Strategy has provided a framework for this reassessment and the adoption of the City’s new Official Plan and related Transportation and Infrastructure Master Plans have established a new vision for determining capital priorities.

DISCUSSION

1. ) General Principles

It is important for the Development Charges Review Study to proceed with certain principles established by Council early in the process so that this direction can frame the way in which the new bylaw or bylaws are prepared. The following is a discussion of these general principles.

a1) Capital

costs for growth must be self supporting.

The main principle outlined in the City’s Long Range Financial Plan is that growth must pay for itself to the extent allowed by legislation and not be subsidized from the tax base. This refers only to the growth portion of projects. Where new construction or improvements to existing facilities are caused by growth pressures but also serve existing development, this non-growth portion of the project must be funded by tax/rate related revenue. Council must consider limiting growth where the growth/non-growth components are not affordable.

The

City will collect development charges for all growth-related major

infrastructure items and all growth-related local infrastructure will be

provided and paid for directly by developers. This breakdown between local and

major projects will be different than that found in the previous development

charge by-laws prior to amalgamation.

This was done to reduce the overall number of projects by including only

those that serve a wider area and to facilitate the development process.

Given that the

new development charge bylaw must be adopted prior to August 3, 2003 or the

City will lose the authority to collect any charges, phasing in

of the charges in a new bylaw will not be considered.

b2) Implement Ottawa 20/20 Directions.

The structure of the development charge bylaw(s) will provide an implementation tool for the Ottawa 20/20 principles such as the encouragement of compact development, use of existing infrastructure, encouragement of mixed use development, and concentration of rural growth in villages.

c3) Build on the methodolgy from previous

bylaws.

In 1999, new development

charge bylaws were adopted by the Region and all former municipalities in

response to the Development Charges Act, 1997.

Considerable work and discussion with the stakeholder community took

place at that time. The process and

methodology followed by the former Region in preparing its development charge

background report and bylaw has provided a good foundation for this update. The harmonization of both what were formerly

upper and lower tier services from a variety of municipalities does necessitate

a review of service levels. Upon adoption of new City of Ottawa engineering

standards, any adjustments will be

incorporated into project calculations. Therefore, the approach for this

development charge review is to continue what has been both established and

found acceptable practice by the stakeholder community and to focus change upon

those elements for which there is a compelling reason to move in a new

direction. In these instances, best

practice from other municipalities will be investigated as part of the change

process.

d4) Pursue

a rate structure that reflects the servicing characteristics and geography of

Ottawa.

i) Implement city-wide charges for those

service areas that are appropriately funded by all new development .

Some growth-related services provide benefit throughout the Ottawa service area. These often provide benefit to the entire Ottawa area from a single location (sewage treatment) or the growth-related benefit cannot be assigned to a specific geographic location (tranist). Other examples are: city-wide parks, water purification, major road network, major recreation facilities (e.g. a new Sportsplex). The growth component of these facilities should be cost-shared at the same rate in one part of the city as another.

ii) Implement specific large area rates for

services that can be assigned to general geographic distribution areas.

Wherever possible and reasonable, charges should be amalgamated to a higher geographic area to spread the cost over the area of development being served; to reduce administrative error and cost; to increase stakeholder community understanding; to avoid penalizing deveopment unnecessarily for particular geographic features; and to maintain some consistency between charges for growth-related municipal services and taxing and user fee practices.

With fewer area-specific charges, the City is better able to determine its servicing priorities; to use funding more flexibly within service accounts; to better respond to factors impacting municipal decisions; and to be more strategic in its service provision. Monies collected for services in relation to development charges cannot be used for another purpose. Therefore care must be taken in the definition of areas. If areas are defined too finely, it may remove users of the service from the requirement to pay (those locating outside of the defined area). For example, with a recreation facility, if the area of users is too narrowly defined, future users from other growth areas would not be required to pay even though they are users of the facility. Narrowly-defined areas can lead to a reduction in flexibility for the municipality as monies collected can only be spent for the specific services in the specific area. In addition, it would reduce the city's ability to determine its servicing priorities. In effect, individual developers would determine the priority of the infrastructure that gets built. With the definition of specific areas at an appropriate level, these concerns can be greatly mitigated.

Therefore, to implement the

general direction of the Official Plan and to reflect principles of equity, most

services should be assessed with a

large area approach. For this study, it

is proposed that two scenarios be prepared for most services. These would include one scenario based upon

four areas: inside the Greenbelt,

outside the Greenbelt (combining East, South and West), rural and Kanata West.

A second scenario would be based on six areas: inside the Greenbelt, four areas

outside the Greenbelt - East, South, West, Kanata West and rural. Services that can be geographically-referenced

to support a large area-specific charge structure include: roads, sewers,

watermains, fire stations, police stations, most parkland development, branch

libraries, most recreational services below a city-wide level.

The Official Plan and

exisitng by-laws provide that particular portions of the city are not within

the service area for some municipal services.

As a result, people outside of the defined areas have not shared in the

cost of providing such services. This

is applicable to sanitary sewer and water services and this practice would be

continued.

iii) Implement specific

area rates for services that clearly benefit only a definable client group

Some growth-related

servicing projects are required solely for the benefit of a localized and

definable service area, for example, the construction of a storm water

management pond that provides a service to specific lands not previously

serviced. Such costs can be segregated

and allocated to specific benefiting areas.

This practice would be continued where a clear case can be made that it

is the most equitable practice.

e5) Discontinue non-statutory exemptions that

are not considered to warrant a tax-based subsidy.

Development charges can only

be based upon expected costs of defined growth-related municipal services. Where charges for categories of uses are

exempted or reduced, other categories of uses cannot be asked to make up the

difference. Some other means of funding

the services (other than grants and subsidies which are subtracted prior to assessing

a development charge) must be found.

The approach with regard to existing exemptions from the 1999 bylaws is

that, although legislated exemptions must continue, non-statutory exemptions

and/or reductions will be discontinued unless they carry out one or more of the

directions of the Ottawa 20/20 Plan and

they are considered sufficiently desirable (e.g. non-profit housing) to warrant

a tax-based subsidy.

f6) Continue to use the Infrastructure

Development Charges Price Index

In March 2003, Council

adopted a Statistics Canada Infrastructure Development Charges Price Index to

replace the use of the Statistics Canada Construction Price Index that is

legislated by the Development Charges Act, 1997. The new index was considered

to better reflect the growth-related costs for Ottawa. It would seem reasonable to continue to use

this index with the new bylaw.

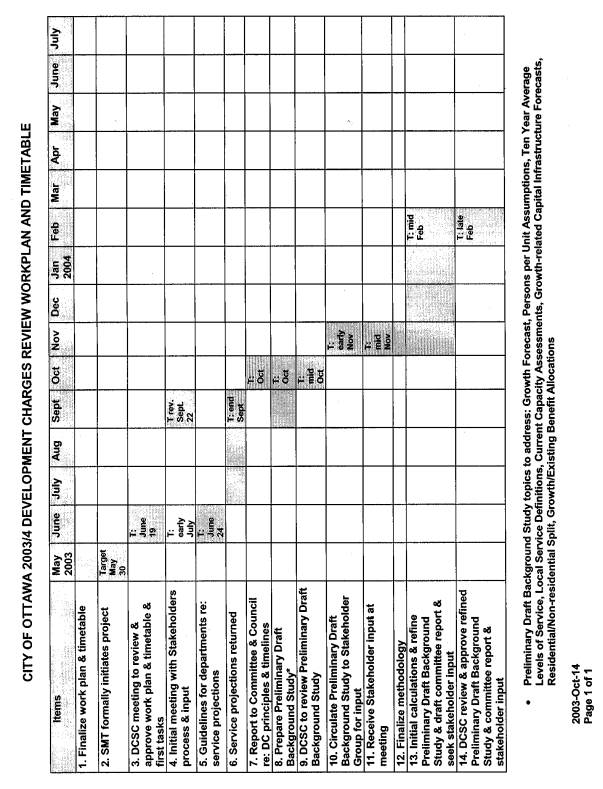

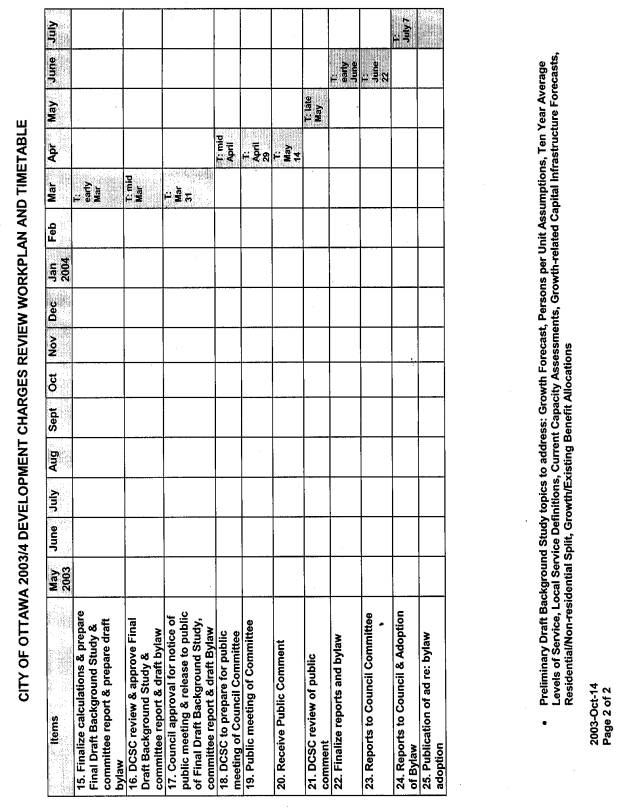

2. ab) Timetable

for the Development Charges Review Study

Work

related to the new Development Charges Review Study has commenced. The project is

lead by

Development Services and a team from Corporate Services and involves the

efforts of most departments. Consulting services have also been retained for

specific areas of work. A Steering

Committee has been established for the project, consisting of managers and

directors from many areas of the Corporation.

This Committee is intended to ensure that there is corporate-wide

understanding and concurrence with the developmeng charges review process and timelines

and to review and approve of documents as they are prepared for Senior

Management, Committee and Council consideration. A Stakeholders' Group has been

formed to provide input into the process and feedback at key stages of the

review. A milestone work plan and

timetable for the Development Charges Review is attached in AppendixDocument 21 for information.

The critical points in the Review include: the timing of the adoption of the new bylaw, the formal public consultation process that will take place in the spring of 2004 and the preparation of the information for the public consultation process. Departments are currently preparing a list of projects that will be required to meet the needs of the population, household, employment and GFA projections for the next 10 years and, for hard infrastructure, for the lifespan of the Official Plan or build-out.

CONSULTATION

Before passing a

development charge by-law, Council is required to hold at least one public

meeting to review the draft Development Charges Background Report, Council report

and Development Charges Bylaw. The timelines of the Development Charges Review

Study work plan foresees this meeting to be held at the Corporate Services and

Economic Development Committee at the end of April 2004.. A minimum of 20 days notice of the meeting(s)

is required and the proposed by-law and background study are to be made

available to the public at least two weeks prior to the meeting.

Public notice

may be given by publication in a newspaper with sufficiently general

circulation.

Any person who

attends a meeting may make representations relating to the proposed

by-law. If a proposed by-law is changed

following a meeting, Council shall determine whether a further meeting is

necessary. Such a determination is

final and not subject to review by a court or the Ontario Municipal Board

Prior to the formal public consultation, a Development Charges Stakeholders’ Group has been established. The Stakeholders’ Group is comprised of interested representatives of the residential and non-residential development community, OCHBA and BOMA, citizen groups and the Greater Ottawa Chamber of Commerce. The Stakeholders’ Group is intended to provide an informal forum for input, liaison and feedback at key stages of the preparation of the Development Charges bylaw. Input into the general principles outlined in this report was solicited at the first meeting of the Stakeholders’ Group. The Group will be informed of the direction of Council with regard to these general principles.

FINANCIAL IMPLICATIONS

N/A

SUPPORTING DOCUMENTATION

Documentttachment 21 – Development Charges

Review Study Timeline of Work Plan

DISPOSITION

City staff to carry out the direction of Council with regards to the preparation of the Development Charges Review Study.

Document

1

DEVELOPMENT CHARGES PRINCIPLES Document 1

Development

Charges Review Study general principles

1) Capital costs for growth

must be self-supporting.

2) Implement Ottawa 20/20

Directions.

3) Build on the methodology

from previous bylaws.

4) Pursue

a rate structure that reflects the servicing characteristics and geography

of Ottawa.

4 - i) Implement

city-wide charges for those service areas that are appropriately funded by all

new development.

4 - ii) Implement

specific large area rates for services that can be assigned to general

geographic distribution areas.

4 - iii) Implement

specific area rates for services that clearly benefit only a definable client

group.

5) Discontinue

non-statutory exemptions that are not considered to warrant a tax-based

subsidy.

6) Continue to use the

Infrastructure Development Charges Price Index.

DEVELOPMENT CHARGES REVIEW STUDY

TIMELINE OF WORK PLAN Document 21