Report to/Rapport au :

Finance and Economic Development Committee

Comité des finances et du développement économique

and Council / et au Conseil

27 September 2011 / le 27 septembre 2011

Submitted by/Soumis par : Kent Kirkpatrick, City Manager/Directeur municipal

Contact Person/Personne ressource : Gordon MacNair, Director, Real Estate Partnership and Development Office/Directeur, Partenariats et Développement en immobilier

(613) 580-2424 x21217, Gordon.MacNair@ottawa.ca

REPORT RECOMMENDATIONS

That the Financial and Economic Development Committee recommend that Council approve:

- The Lease of 29,768 square feet of office space on the 1st and 2nd floor of the building municipally known as 80 Aberdeen Street from 80 Aberdeen Office Limited Partnership for a term of five (5) years commencing 1 December 2011 and terminating 30 November 2016 for a total estimated consideration, including operating costs, realty taxes and parking, of $5,297,758 plus HST;

- The Sublease of 29,768 square feet of office space on the 1st and 2nd floor of the building municipally known as 80 Aberdeen Street to Ottawa Centre for Regional Innovation (OCRI) for a term of five (5) years commencing 1 December 2011 and terminating 30 November 2016 for a total estimated term revenue of $3,122,313 plus HST with the balance of lease payments over the term covered by the City of Ottawa;

- The Sublease of 16,732 square feet of office space on the 2nd floor of the building municipal known as 2625 Queensview Drive by the City from Ottawa Centre for Regional Innovation for a term of nine (9) years commencing 1 December 2011 and terminating on 30 November 2020 for a total estimated consideration, including operating costs, and realty taxes of $4,572,643 plus HST.

RECOMMANDATIONS DU RAPPORT

Que le Comité des finances et du développement économique recommande au Conseil d’approuver ce qui suit :

- La location de bureaux d’une superficie de 29 768 pieds carrés aux 1er et 2e étages de l’immeuble portant l’adresse municipale 80, rue Aberdeen, auprès de la société 80 Aberdeen Office Limited Partnership pour une période de cinq (5) ans débutant le 1er décembre 2011 et prenant fin le 30 novembre 2016, moyennant la somme estimative, y compris les coûts de fonctionnement, les taxes foncières et le stationnement, de 5 297 758 $, TVH non comprise;

- La sous-location de bureaux d’une superficie de 29 768 pieds carrés aux 1er et 2e étages de l’immeuble portant l’adresse municipale 80, rue Aberdeen, au Centre de recherche et d’innovation d’Ottawa (OCRI) pour une période de cinq (5) ans débutant le 1er décembre 2011 et prenant fin le 30 novembre 2016, pour des recettes totales de 3 122 313 $, TVH non comprise, sur l’ensemble de la période, le solde du paiement de location étant couvert par la ville d’Ottawa;

- La sous-location par la Ville de bureaux d’une superficie de 16 732 pieds carrés au 2e étage de l’immeuble portant l’adresse municipale 2625, promenade Queensview, auprès du Centre de recherche et d’innovation d’Ottawa pour une période de neuf (9) ans débutant le 1er décembre 2011 et prenant fin le 30 novembre 2020, moyennant la somme estimative totale, y compris les coûts de fonctionnement et les taxes foncières, de 4 572 643 $, TVH non comprise.

EXECUTIVE SUMMARY

In 2010 and 2011 Council approved the delivery of improved and expanded economic development services that encourage entrepreneurial culture and economic development results through both the economic development strategy 'Partnerships for Prosperity' and the Economic Strategy Implementation Plan. Both reports highlighted that innovation and entrepreneurship are key pillars for economic development.

In order to facilitate delivery of the improved and expanded economic development services the City of Ottawa will be entering into a lease for 29,768 square feet of space on the 1st and 2nd floors at 80 Aberdeen Street. The entire leased space will then be sublet to the Ottawa Centre for Regional Innovation (OCRI). OCRI will then sublet various portions of the space to groups promoting and providing economic development services such as; the Entrepreneurship Centre (EC), the Regional Innovation Centre (RIC), the new Business Incubation Centre (BIC) and others.

OCRI’s relocation to 80 Aberdeen Street has led to an opportunity for the City whereby the City will sublet 16,732 square feet from OCRI on the 2nd floor at 2625 Queensview Drive. This space will be occupied by OC Transpo during the renovation of their building at 1500 St. Laurent Drive for most of the term of the sublet and the City will pursue a use by an internal client or an external tenant for the remainder of the sublet term.

The report sets out the details of the Lease of 80 Aberdeen, the Sublease of 80 Aberdeen as well as the Sublease of 2625 Queensview Drive and costs and recoveries for each.

RÉSUMÉ

En 2010 et 2011, le Conseil a approuvé la prestation de services élargis de développement économique améliorés, qui encourageaient la culture entrepreneuriale et les résultats en matière de développement économique, grâce à la « Stratégie des partenariats pour la prospérité » et au plan de mise en œuvre de la stratégie économique. Les deux rapports insistaient sur le fait que l’innovation et l’esprit d’entreprise sont les piliers du développement économique.

Afin de faciliter la prestation de services élargis de développement économique améliorés, la Ville d’Ottawa va louer un espace de 29 768 pieds carrés sur deux étages au 80, rue Aberdeen. La totalité de l’espace loué sera ensuite sous-loué au Centre de recherche et d'innovation d'Ottawa. À son tour, le Centre de recherche et d'innovation d'Ottawa sous-louera diverses parties de cet espace à des groupes qui font soit la promotion de services de développement économique ou en fournissent eux-mêmes comme le Centre d'entrepreneuriat, le centre d'innovation régional, le nouveau Business Incubation Centre (BIC) et d’autres.

Le déménagement du Centre de recherche et d'innovation d'Ottawa au 80, rue Aberdeen, permet par ailleurs à la Ville de sous-louer un espace de 16 732 pieds carrés du Centre de recherche et d'innovation d'Ottawa, situé au 2625, chemin Queensview. Cet espace sera occupé par OC Transpo durant la rénovation de son immeuble au 1500, boul. St. Laurent, pour la plus grande partie de la durée de la sous-location. La ville cherchera un client interne ou un locataire externe pour le reste du bail.

Le rapport présente le détail du bail au 80, rue Aberdeen, de la sous-location au 80, rue Aberdeen, ainsi que de la sous-location au 2625, chemin Queensview et des coûts et récupération de coûts pour chacun.

BACKGROUND

City Council approved the delivery of improved and expanded economic development services that encourage entrepreneurial culture and economic development results through both the economic development strategy 'Partnerships for Prosperity' (ACS2010-ICS-CSS-0011; 14 July 2010) and the Economic Strategy Implementation Plan (ACS2011-ICS-CSS-0007; 13 July 2011).

Both of these reports highlighted that innovation and entrepreneurship are key pillars for economic development. A specific key strategic action identified in the implementation plan is to "enhance the existing Entrepreneurship Centre (EC) and the existing Regional Innovation Centre (RIC), and have them co-locate with a new Business Incubation Centre (BIC)". Incubation services and space targeted to fledgling Ottawa companies will encourage start-ups and help achieve a higher rate of success.

The Economic Development Branch (EDB) identified the building at 80 Aberdeen Street as an ideal site for the co-location of EC, RIC and the new BIC. Real Estate Partnerships and Development Office (REPDO) was tasked with negotiating a lease to accommodate these users. Concurrent to these negotiations, EDB became aware that the Ottawa Centre for Regional Innovation (OCRI) were dissatisfied with the space they are occupying at 2625 Queensview Drive. EDB recognized that there was value in combining all the groups in one location and tasked REPDO with investigating the real estate options and assess the cost implications.

The co-location of innovation and economic development services is advantageous from both an efficiency and an impact perspective. A one-stop business service centre housing the RIC, a new BIC, the EC, Invest Ottawa, as well as provincial, federal, and local support agencies such as the Ontario Centres of Excellence (OCE), The National Research Council-Industrial Research Assistance Program (NCR-IRAP), OCRI, and others builds a critical mass of business and economic development support. This will highlight the priority Ottawa gives to this sector and will draw local, national and international interest in Ottawa as a magnet for entrepreneurial and investment attraction activities. The co-location of RIC, BIC and Invest Ottawa (IO) with OCRI permits OCRI to be directly engaged and manage the space requirements of start-up businesses.

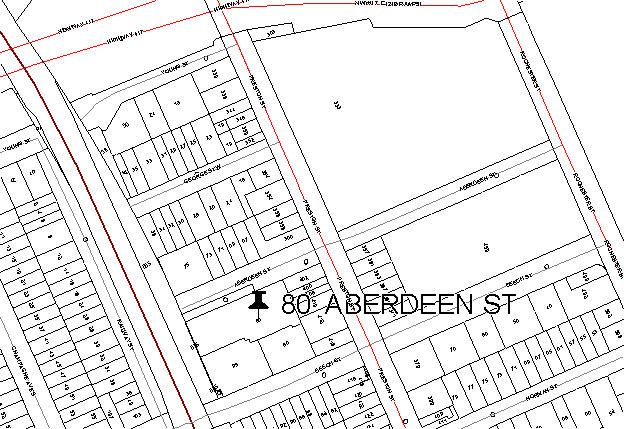

Best practice research and local interviews have confirmed that the ideal locations in Ottawa are the Byward Market (no large suites are available), Westboro (no large suites are available) and the Preston Street area South of the Queensway. The building at 80 Aberdeen Street is located in the Preston Street area and is a modern structure with high ceilings and was the former location for both Hummingbird and OpenText. The site is a 6-minute walk to the Carling Avenue O-Station and is approximately equal distance to both Carleton University and the University of Ottawa. Preston Street is in close proximity to multiple restaurants and coffee shops. The building is adjacent to a bicycling path and both suites have showers for cycle commuters. There is sufficient space to accommodate all the potential users, including OCRI, on the two floors totalling 29,768 square feet, (see map of location attached as Document 5).

The EDB operational plan is for the City to lease the required space at 80 Aberdeen Street to accommodate all the users, relocate OCRI from Queensview Drive to Aberdeen Street and have OCRI manage the space to facilitate a one-stop business centre to enhance business development.

DISCUSSION

CITY Lease - 80 Aberdeen Street

Under direction of the EDB, REPDO entered into negotiations with the Landlord, 80 Aberdeen Office Limited Partnership. A lease agreement has been developed and reviewed by Legal Services to acquire 29,768 square feet of office space on the 1st and 2nd floors at 80 Aberdeen Street, for a five (5) year term commencing 1 December 2011 and terminating 30 November 2016. The total estimated gross rent, including operating costs, realty taxes and parking is $5,290,425 plus a one-time allowance for the purchase of existing office furniture and equipment based on a 10% depreciated value of the appraised value of $73,330, which amounts to $7,330 plus HST. The total consideration includes base rent in the amount of $18 per square foot as well as operating costs, realty taxes, parking fees and furniture and equipment purchase estimated over the term. A detailed breakdown of the total estimated consideration of $5,297,758 plus HST is outlined in Document 1 and Document 2.

The rents are considered at market value per review of independent rental information from the Altus InSite data as well as independent confirmation from real estate professionals. The Lease includes the following provisions:

· the City has the right to renew this Lease for two (2) further terms of five (5) years each upon providing the Landlord with six (6) months written notice. The annual rent for each of the renewal terms will be market value at the time of renewal;

· the City has a Fixturing Term during which no rent will be paid and terminating on 30 November 2011;

· the City is entitled to a maximum of twenty-four (24) designated parking spaces at a cost of $100 plus HST per spot/per month.

The 1st and 2nd floors are furnished and equipped with various office items including a telephone system and the Lease provides that the City will purchase the furniture and equipment at a rate of ten (10%) percent of the appraised value. The City retained an appraisal firm who have appraised the furniture and equipment at a total appraised value of $73,330; therefore the cost to the City will be $7,330 plus HST. This has been included in the first year operating costs. While 80 Aberdeen Street is almost in a “move-in” condition, slight fit-up costs may also be incurred to modify spaces to meet the needs of the City and its subtenants (e.g. space configuration, audio-visual equipment, etc.). The City’s EDB has $100,000 for fit-up costs in its 2011 budget.

Commiting to a lease under these general terms, as per Recommendation 1 of this report, is the initial step in creating the one-stop business centre.

OCRI Sublease - 80 Aberdeen Street

The City has the option to sublet some or all of the 1st and 2nd floors at 80 Aberdeen Street with written approval from the Landlord, which approval has been received. The City will sublet the entire 29,768 square feet to OCRI to manage the space and facilitate a one-stop business centre.

Negotiations with OCRI have resulted in an agreement with the Landlord wherein the City will sublet to OCRI the entire 29,768 square feet, being the 1st and 2nd floors at 80 Aberdeen Street under the same terms and conditions as contained in the City’s Lease with the Landlord (Head Lease) except as it relates to rents to be paid. The estimated rent recovery from OCRI will be a gross amount including operating costs, realty taxes and parking in the amount of $3,122,313 plus HST over the term. A detailed explanation of the sublease payments is shown in Document 2. The completion of the sublease to OCRI, under these terms and conditions, is set out under Recommendation 2 of this Report.

The rent differential between the City lease and the OCRI sublease is $2,175,445 plus HST over the term. The City will be responsible for the shortfall under the head lease. The EDB budget has the capacity to fund the shortfall as part of the financial support approved in the Economic Development strategy implementation plan. This strategy has identified funds for lease accommodation to support a one-stop business service centre housing the RIC, the new BIC, the EC and Invest Ottawa.

OCRI will be responsible to manage and sublet various square foot blocks to other economic development companies and organizations as well as the incubator businesses. The rents from the incubator business centre will be collected and accounted for under a management agreement with OCRI. The lease rate charged back to the incubator businesses will be determined by the City and will be on a cost recovery basis. The business plan is to remit incubator rents back to the City to offset the identified $2,175,445 sublease rent shortfall. It is difficult to project the offsetting revenue given vacancy and bad debt. However, the EDB anticipates the City will recover approximately 60% of the sublease rental shortfall or approximately $1,300,000 over the 5-year term. The estimated short fall in rent, after considering the offset recoveries from incubator businesses, is $875,445 over the term of the OCRI sublease.

CITY Sublease - 2625 Queensview Drive

In order to attain the synergies of co-locating OCRI with the incubators and various other economic development organizations, OCRI will need to relocate from 2625 Queensview Drive. To facilitate this relocation the City will sublet OCRI’s current office space totalling 16,732 square feet. Negotiations are under way with the Landlord of 2625 Queensview Drive to complete the Sublease. The Landlord has agreed in principle to the sublet.

Committing to the OCRI Lease for the remaining nine (9) years of the term, commencing 1 December 2011 and terminating 30 November 2020 is set out in Recommendation 3 of this Report. The lease rate was recently negotiated and is considered to be at market. Under the terms of the sublease, the City will be responsible for an estimated rent, including operating costs and realty taxes, for the remaining nine (9) years of the term of $4,572,643 plus HST. There is no budget identified to carry this cost. For a detailed breakdown of the estimated total consideration refer to Document 3.

The 16,732 square feet will be placed into the City real estate inventory managed by REPDO. REPDO will examine strategies to mitigate the unfunded $4,572,643 plus HST rent obligation. A review of corporate needs identified a short term office requirement for OC Transpo of +/- 15,000 square feet for a term of three (3) years as swing space required during the renovation of their building at 1500 St. Laurent Boulevard. REPDO had been tasked by OC Transpo to find suitable office space in the private sector. There is no office space in the City inventory to accommodate this need, and should Council approve the recommendations of this report, the entire OCRI space will be allocated to OC Transpo for a term of three (3) years commencing 1 December 2011 and ending 30 November 2014. A budget is identified by OC Transpo for this temporary relocation and will be applied to the sublease. A total consideration for the three (3) year term is $1,402,973 plus HST. For a detailed breakdown of these rental payments, refer to Document 4. The occupancy of OC Transpo will mitigate 30% of the City’s unfunded financial risk created by subleasing the OCRI space. Once OC Transpo has vacated the premises, REPDO will seek to mitigate the remaining risk by subletting the space to another City Department if there is an identified need with budget approval, or to a third party for the remainder of the term.

The City has a secondary exit strategy to mitigate the financial risk to the OCRI sublet. The OCRI lease includes an option to terminate the lease anytime during the sixty-seventh (67th) month (June 2016) through to the end of the eighty-fourth (84th) month (February 2018) of the term upon providing the Landlord with nine (9) months written notice. Should REPDO not be able to find an internal user, or a private sector tenant, REPDO will exercise this right of termination. The ability to terminate the lease will reduce the financial risk to the City. The potential exposure time to the City between the time OC Transpo vacates the premises and the date of early termination is 19 months. The City will investigate exploring a short-term sublease with a private party or subletting the space to another City department with an approved need and budget. The anticipated exposure to the City would be limited through the use of mitigation measures to attract a third party. An upside limit of $200,000 for tenant inducements is estimated.

RURAL IMPLICATIONS

There are no rural implications associated with the recommendations of this report.

CONSULTATION

REPDO has consulted with the EDB, Risk Management and Legal Services in negotiations and documentation preparation for the Lease and both Subleases.

EDB has consulted with OCRI, RIC and the EC as subtenants and as sublandlord (on behalf of the City) to the other subtenants. Invest Ottawa, the Ottawa Young Entrepreneurs (OYE), National Research Council - Industrial Research Assistance Program (NRC-IRAP) and OCE have also been consulted as other potential subtenants. The Ontario Ministry of Economic Development and Trade has been consulted (as a co-funder of EC).

COMMENTS BY THE WARD COUNCILLORS

Ward 14 - Somerset - Councillor Diane Holmes - “I concur with the leasing of space at 80 Aberdeen Street for OCRI and other economic development staff. However, once the Entrepreneurship Centre at Ottawa City Hall is vacant, I do not support its leasing to a third party for ‘cost recovery’. There is an urgent need for more public space at City Hall and this high visibility ground level space should be used for our own municipal purposes.”

Ward 7 - Bay - Councillor Mark Taylor - “I have no issue with the proposed recommendation regarding the leased space on Queensview Drive. I understand the greater economic benefit that will be derived City-wide by allowing for the co-location of the economic development agencies. It is also my understanding that the prospects are good that an internal client(s) will be able to make use of the Queensview space within their existing needs set.”

LEGAL IMPLICATIONS

There are no legal impediments to implementing the recommendations in this report.

RISK MANAGEMENT IMPLICATIONS

80 Aberdeen Street

The lease for 29,768 square feet within 80 Aberdeen Street commits the City to a gross lease cost of $5,297,758 plus HST over five (5) years. Should OCRI default on its obligation as the subtenant, the City will be responsible for the lease payments for the remainder of the term.

The risk of OCRI defaulting is considered low, however, it is a single entity, it is responsible for 59% of the total lease cost. The remaining 41% ($2,168,112) represents rent from start-up business, and a mix of provincial, federal, and local support agencies such as the Ontario Centres of Excellence (OCE). The potential for business failures, funding cuts, and vacancy places this revenue at a moderately higher risk. It is anticipated that as high as 40% of the rent will not be recovered, in the worst case scenario, and will be funded from EDB in the amount of $875,445 over the five (5) year term.

2625 Queensview

The Real Estate Partnerships and Development Office (REPDO) is confident that a tenant will be found between the time OC Transpo vacates the premises and the date of early termination which is 19 months. REPDO will consider mitigation measures if necessary to attract a third party tenant. This would be in the form of tenant inducements with an upside limit of $200,000.

Other Implications

The assembly of economic agencies under one roof includes the relocation of the Entrepreneurship Centre (EC) out of 110 Laurier Avenue (City Hall). The EC currently occupies 2,369 square feet and generates revenue to Parks, Buildings, Grounds Operation and Maintenance in the amount of $5,022 plus HST per month. This equates to a gross rent of $25.44 per square foot per annum. Parks, Buildings, Grounds Operation and Maintenance have been notified of the potential loss in revenue.

The pending departure of the EC creates an opportunity for REPDO to lease the 2,369 square feet to a third party. There is a risk that a suitable tenant cannot be found. However given the current office rental rates REPDO is confident that lost income can be replaced. Alternatively, the space can be rationalized to reduce current City tenancies in the private sector resulting in a cost avoidance.

CITY STRATEGIC PLAN

The creation of a central one-stop economic development hub is a key element of the City of Ottawa’s long-term economic development strategy. This is the kind of transformation that is required to aggressively compete with other municipalities in North America for the same knowledge-based talent and investment dollars.

TECHNOLOGY IMPLICATIONS

There are no technical implications as a result of the recommendations of this report.

FINANCIAL IMPLICATIONS

80 Aberdeen Lease

This Lease represents a total consideration of $5,290,425 plus HST, plus furniture and equipment costs in the amount of $7,333 plus HST.

Sublease 80 Aberdeen

ORCI Sublease represents revenues of $3,122,313 plus HST. The estimated third party tenancies to be managed by OCRI are $1,300,000 plus HST.

The total estimated net cost to the City is $875,445 plus HST. Funds are available within Economic Development’s operating budget, subject to annual Council approval of the Operating Budget. An increase/decrease in the third-party tenancy revenues would impact available funding for Economic Development program delivery.

In addition, costs to retro-fit the space will be funded from within Economic Development’s 2011 operating budget.

2625 Queensview Drive

This Sublease represents a total consideration of $4,572,643 plus HST over the entire nine (9) year term. The total consideration to the early termination date of 30 June 2016 is $2,139,039 plus HST.

The total consideration to be funded by OC Transpo from over the three (3) year term of their occupancy is $1,402,972 plus HST. For the balance of the lease for the early termination option of 19 months is estimated at $736,000. The City will consider mitigation measures if necessary to attract a third party to eliminate this liability. The potential requirement of tenant inducements is not expected to exceed $200,000.

If required, the $200,000 used as a mitigation measure will be funded from within Economic Development’s operating budget, subject to annual Council approval of the Operating Budget; which would decrease available funding for Economic Development program delivery.

Other

This Lease and the subsequent Subleases represent lost revenue to the Ottawa Carleton Centre - in Buildings, Parks and Grounds (117135-407910) of $5,022 plus HST per month.

SUPPORTING DOCUMENTATION

Document 1 - Breakdown of rental payments for term - 80 Aberdeen Street

Document 2 - Breakdown of EDB subsidy - 80 Aberdeen Street

Document 3 - Breakdown of rental payments for term - 2625 Queensview Drive

Document 4 - Breakdown of rental payments for OC Transpo - 2625 Queensview

Document 5 - Map of area surrounding 80 Aberdeen Street

DISPOSITION

Upon approval the Real Estate Partnerships and Development Office will:

- execute Lease document for 80 Aberdeen Street;

- work with Legal Services and Economic Development Branch to complete and execute the Sublease with OCRI for 80 Aberdeen Street;

- work with Legal Services and Economic Development Branch to complete and execute the Sublease with the Landlord at 2625 Queensview Drive;

- market and lease the 2,369 square feet of space that will become available at 110 Laurier Avenue West;

-

work with OC Transpo on their relocation to 2625 Queensview Drive.

DOCUMENT 1

Breakdown of Lease Payments - 80 Aberdeen Street

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

5 Year total |

|

|

Base Rent |

$ 535,824 |

$ 535,824 |

$ 535,824 |

$ 535,824 |

$ 535,824 |

$ 2,679,120 |

|

Operating Rent |

$ 446,520 |

$ 468,846 |

$ 492,288 |

$ 516,903 |

$ 542,748 |

$ 2,467,305 |

|

Parking |

$ 28,800 |

$ 28,800 |

$ 28,800 |

$ 28,800 |

$ 28,800 |

$ 144,000 |

|

Furniture/Equip |

$ 7,333 |

$ - |

$ - |

$ - |

$ - |

$ 7,333 |

|

$1,018,477 |

$1,033,470 |

$1,056,912 |

$1,081,527 |

$1,107,372 |

$ 5,297,758 |

|

|

HST |

$ 688,709 |

|||||

|

TOTAL |

$ 5,986,466 |

|||||

|

NOTE - Years 2 through 5 include a 5% increase in additional rent for each year |

||||||

DOCUMENT 2

Breakdown of Subsidy by Economic Development Branch - 80 Aberdeen Street

|

Lease Year |

Estimated Lease Costs |

OCRI plus OCE Lease Payment |

Subsidy by Economic Development Branch |

Less estimated BIC revenue |

TOTAL estimated to be paid by EDB |

|

1 |

$1,011,144 |

$596,774 |

$414,370 |

||

|

2 |

$1,033,470 |

$609,937 |

$423,533 |

||

|

3 |

$1,056,912 |

$623,769 |

$433,143 |

||

|

4 |

$1,081,527 |

$638,292 |

$443,235 |

||

|

5 |

$1,107,372 |

$653,541 |

$453,831 |

||

|

$5,297,758 |

$3,122,313 |

$2,175,445 |

-$ 1,300,000 |

$ 875,445 |

|

|

HST |

$688,709 |

$405,901 |

$282,808 |

||

|

TOTAL |

$5,986,466 |

$3,528,214 |

$2,458,253 |

DOCUMENT 3

Breakdown of lease payments - 2625 Queensview Drive

|

Nine Year Term only |

||||||||||||||||||

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

TOTAL TERM |

|

|||||||

|

Base Rent |

$18,126 |

$209,150 |

$209,150 |

$217,516 |

$217,516 |

$230,065 |

$230,065 |

$230,065 |

$242,614 |

$242,614 |

$2,046,881 |

|

||||||

|

Operating Rent |

$12,702 |

$160,050 |

$168,052 |

$176,455 |

$185,278 |

$194,542 |

$204,269 |

$214,482 |

$225,206 |

$236,467 |

$1,777,503 |

|

||||||

|

Realty Taxes |

$5,912 |

$73,072 |

$75,264 |

$77,522 |

$79,848 |

$82,243 |

$84,710 |

$87,252 |

$89,869 |

$92,565 |

$748,258 |

|

||||||

|

$36,741 |

$442,272 |

$452,467 |

$471,493 |

$482,642 |

$506,850 |

$519,044 |

$531,799 |

$557,690 |

$571,646 |

$4,572,643 |

|

|||||||

|

HST |

$594,444 |

|

||||||||||||||||

|

TOTAL |

$5,167,086 |

|

||||||||||||||||

|

NOTES |

|

|||||||||||||||||

|

Operating costs are currently $9.11/sf and have been estimated for Years 2 to 10 using a 5% increase per annum |

|

|||||||||||||||||

|

Realty Taxes are currently $4.24/sf and have been estimated for Years 2 to 10 using a 3% increase per annum |

|

|||||||||||||||||

DOCUMENT 4

Breakdown of rental payments for OC Transpo - 2625 Queensview Drive

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

|||||

|

2010-2011 |

2011-2012 |

2012-2013 |

2013-2014 |

|||||

|

Base Rent |

$18,126 |

$209,150 |

$209,150 |

$217,516 |

||||

|

Operating Rent |

$12,702 |

$160,050 |

$168,052 |

$176,455 |

||||

|

Realty Taxes |

$5,912 |

$73,072 |

$75,264 |

$77,522 |

||||

|

$36,741 |

$442,272 |

$452,467 |

$471,493 |

$1,402,972 |

||||

|

HST |

$182,386 |

|||||||

|

TOTAL |

$1,585,359 |

|||||||

|

NOTES |

||||||||

|

Operating costs are currently $9.11/sf and have been estimated for Years 2 to 10 using a 5% increase per annum |

||||||||

|

Realty Taxes are currently $4.24/sf and have been estimated for Years 2 to 10 using a 3% increase per annum |

||||||||

DOCUMENT 5

Map of Area surrounding 80 Aberdeen Street