Report to/Rapport au:

Finance and Economic Development Committee

Comité des finances et du développement économique

and Council / et au Conseil

28 March 2011 / le 28 mars 2011

Submitted by/Soumis par : Marian Simulik, City Treasurer/Trésorière municipale

Contact Person/Personne ressource : Mona Monkman, Deputy City Treasurer- Corporate Finance/ Trésorière municipale adjoint - Finances municipales

Finance Department/Service des finances

613-580-2424 ext./poste 41723, Mona.Monkman@ottawa.ca

|

Ref N°: ACS2011-CMR-FIN-0021 |

SUBJECT: |

DISPOSITION OF 2010 TAX SUPPORTED OPERATING Surplus/ DEFICIT |

|

|

|

OBJET : |

RÈGLEMENT DE L’EXCÉDENT / DU DÉFICIT DE 2010 DES OPÉRATIONS FINANCÉES PAR LES RECETTES FISCALES |

REPORT RECOMMENDATIONS

That the Finance and Economic Development Committee recommend Council approve the following transfers from/to reserve funds:

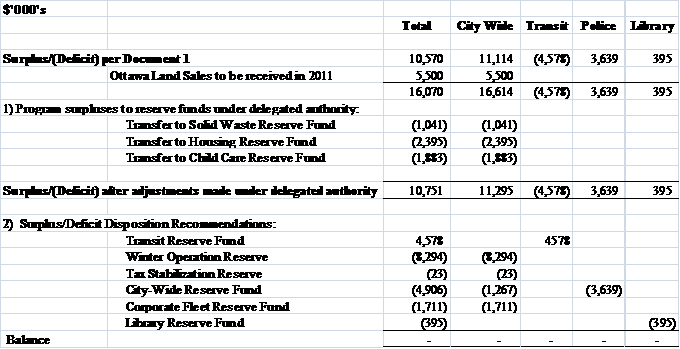

1. That the deficit of $4.6 million in transit be funded by a transfer from the Transit Capital Reserve Fund;

2. That the $5.5 million in 2010 budgeted land sales from the Ottawa Lands Development Corporation be funded from 2011 land sale proceeds; and

3. That the surplus in tax supported operations be disposed of as follows:

a) a transfer of $8.3 million to the Winter Operations Reserve

b) a transfer of $0.023 million to the Tax Stabilization Reserve

c) a transfer of $1.7 million to the Corporate Fleet Reserve Fund

d) a transfer of $4.9 million to the City-Wide Reserve Fund

e) a transfer of $0.395 million to the Library Reserve Fund

RECOMMANDATIONS DU RAPPORT

Que le Comité des finances et du développement économique recommande au Conseil d’approuver les transferts suivants en provenance ou à destination des fonds de réserve :

- Pour financer le déficit de 4,6 millions de dollars pour le transport en commun grâce à un transfert du Fonds de réserve pour immobilisations du transport en commun;

- Pour combler le déficit des ventes budgétées en 2010 pour la Société d’aménagement de terrains d’Ottawa, un transfert de 5,5 millions de dollars sur le produit des ventes de terrains en 2011; et

- Pour utiliser de la manière suivante l’excédent des opérations financées par les recettes fiscales :

- un transfert de 8,3 millions de dollars au Fonds de réserve des opérations hivernales

- un transfert de 0,023 million de dollars au Fonds de réserve de stabilisation du taux d’imposition

- un transfert de 1,7 million de dollars au Fonds de réserve pour immobilisations du Parc automobile

- un transfert de 4,9 millions de dollars au Fonds général de réserve

- un transfert de 0,395 million de dollars au Fonds de réserve de la Bibliothèque

BACKGROUND

As part of the finalization of 2010 operations, and in conjunction with the preparation of the financial statements it is necessary to obtain Council approval of the disposition and funding of any operating surplus or deficit. This report provides an analysis of the final results of the 2010 tax supported operations.

The 2010 Rate supported water and wastewater program results are discussed in a separate report to the Environment Committee.

DISCUSSION

Year-end Results

The City ended the year with a surplus of $16 million for tax support programs, external boards and agencies. This represents less than 1 percent of the 2010 budgeted operating expenditures. These year-end results include an $8.3 million surplus in Winter Maintenance operations and a $6 million surplus in solid waste operations.

Document 1 presents a summary of the year-end operating results by committee. It also summarizes the results by “business area”. For some services such as transit and police the final year-end position includes both operating results and the impacts of changes in certain taxation related revenues and expenditures that are allocated to those services as they have their own tax rate. These are referred to as the results by “business area”.

Document 2 presents a variance discussion analysis of the major results by committee.

The year-end surplus is comparable to previous forecasts, including the forecasts used during the development of the 2011 tax supported operating budget. Where year-end positions differ from amounts previously forecasted, they have been highlighted in the Document 2 discussion on year-end variances.

Disposition of Surplus and Deficit

The total year-end surplus for the tax supported programs, external boards and agencies is $16 million.

Staff are recommending that $5.5 million in budgeted land sales from the Ottawa Lands Development Corporation, which had not occurred prior to year-end, be funded from proceeds from land sales in 2011. This represents a timing difference as these sales had been budgeted in 2010 but are not expected to be confirmed until 2011.

Program surpluses for solid waste, housing, and child care totaling $5.3 million have been transferred to various reserve funds in accordance with the respective reserve by-laws and staff’s delegated authority.

In accordance with the Transit Reserve by-law, it is recommended that a transfer of $4.6 million be made from the Transit Capital Reserve Fund to dispose of the transit deficit.

In accordance with the winter operations reserve by-law, any surplus associated with winter operations must be transferred to the winter operations reserve to the extent that City wide operations is not in an overall deficit. City wide operations were in a surplus position therefore, staff recommends that the winter operations surplus of $8.3 million be transferred to the Winter Operations Reserve.

Council has also approved criteria recommending that any surplus in the Provision for Unforeseen and One-Time Expenditures be transferred to the Tax Stabilization Reserve. Consequently, staff is recommending the transfer of the $23 thousand in unspent funds from this account to the Tax Stabilization Reserve. The annual budget for this provision is $2.8 million.

As part of the 2009 disposition of tax supported operating deficit, the City wide deficit was partially funded from an $11.9 million loan from the Corporate Fleet Reserve Fund as there were insufficient funds in the City Wide capital reserve fund. Council approved the transfer of $11.9 million from the Corporate Fleet reserve fund with the stipulation that the transfer be repaid over a 3 year term starting in 2011. The 2011 budget includes $1 million to repay part of this loan. It is recommended that a portion of City wide operations surplus ($1.7 million) be contributed to the Fleet reserve as part of the repayment towards this loan.

During the past few months, City and Ottawa Police staff have worked together to analyze the capital projects with debt financing approved by the Police Services’s Board with a view to finalizing debt issuance plans for approved capital works. Based on this review staff have identified $7.4 million in debt authority on previously approved capital projects that is not eligible for permanent debt financing. The Police operating surplus of $3.6 million will be transferred to the City Wide Capital Reserve Fund and will be available to help refinance capital projects which are not debt eligible.

In addition to the above, the recommended transfer to the City Wide Reserve fund also includes a surplus of $1.3 million resulting from the final settlement of funding for costs incurred for the H1N1 epidemic.

Year-end Disposition as per Current By-laws /Policies

Continuity of Reserves and Reserve Funds

Document 3 presents a continuity schedule of the City’s reserves and reserve funds. The schedule shows the impact on reserve balances of the recommendations for surplus disposition that are included in this report of $16.0 million together with the $4.5 million disposition of Sinking fund surplus approved separately (Finance and Economic Development Committee March 1, 2011- ACS20011-CMR-FIN0012) for a total surplus of $20.5 million.

Budget Adjustments

During the year, adjustments to budgets are made to better reflect the alignment of budget authority with spending needs. These transfers are made either through the delegated authority given to the City Treasurer or through Council-approved reports. Documents 4 and 5 show the changes in budgets processed throughout the year. Council policy requires the reporting of these transactions for information purposes.

CONSULTATION

The purpose of this report is administrative in nature and therefore no public consultation is required.

LEGAL/RISK MANAGEMENT IMPLICATIONS

The transfers outlined in the recommendations require Council approval. There are no legal or risk management impediments to implementing the recommendation in this Report.

FINANCIAL IMPLICATIONS

Financial implications are outlined in this report.

RURAL IMPLICATIONS

Not applicable.

SUPPORTING DOCUMENTATION

Document 1 – 2010 Operating Results Summary– Tax Supported Programs

Document 2 – Variance Analysis – 2010 Operating Results – Tax Supported Programs

Document 3 – 2011 Continuity of Reserves and Reserve Funds Tax Supported

Document 4 – Budget Adjustments under Delegated Authority

Document 5 - Inter & Intra-departmental Budget Adjustments & Transfers

DISPOSITION

The Finance Department will make the necessary accounting adjustments.