Report to/Rapport au :

Corporate Services and

Economic Development Committee

Comité des services organisationnels

et du développement économique

and Council / et au Conseil

4 January 2008 / le 4 janvier 2008

Submitted by/Soumis par: Nancy Schepers, Deputy City Manager /

Directrice municipal adjointe

Planning, Transit and the Environment /

Urbanisme, Transport en commun et Environment

Contact

Person/Personne ressource : Rob

Mackay, Acting Director/Directeur intérimaire, Economic and

Environmental Sustainability/

Viabilité économique et de la

durabilité de l’environnement

(613) 580-2424 x22632, Rob.Mackay@ottawa.ca

|

SUBJECT: |

|

|

|

|

|

OBJET : |

INTENTION DE

DÉSIGNER LA ZONE |

REPORT

RECOMMENDATIONS

That the Corporate

Services and Economic Development Committee recommend Council:

1. Designate the area described by Document 1 as a Business Improvement Area (BIA) under Section 204 of the Ontario Municipal Act, 2001;

2. Authorize and

direct the City Clerk to send out a notice of Council's intention to pass a

by-law designating the area, as defined in Document 1, as a Business

Improvement Area, in accordance with Section 210 of the Ontario Municipal Act, 2001;

3. Authorize and direct the City Solicitor

to:

(i) Prepare

a by-law to designate the area as a Business Improvement Area, as described in

Document 1, to be named the "Glebe Business Improvement Area";

(ii) Prepare

a by-law to establish the Board of Management of the Business Improvement Area,

to be named the "Glebe Business Improvement Area Board of

Management"; and

4. Enact the two aforementioned by-laws in accordance with section 204 of the Ontario Municipal Act, 2001, subject to the City Clerk reporting favourably on the results of the intention to pass a by-law designating the area referred to in Recommendation (2).

RECOMMANDATIONS DU

RAPPORT

Que le Comité des

services organisationnels et du développement économique recommande au

Conseil :

1. de désigner le secteur décrit dans le document 1 ci-joint comme zone

d’amélioration commerciale (ZAC) en vertu de l’article 204 de la Loi de 2001

sur les municipalités;

2. de permettre et de prescrire au greffier de la Ville de publier un avis

de l’intention du Conseil d’adopter un règlement municipal désignant le

secteur, défini dans le document 1 ci-joint, comme zone d’amélioration

commerciale, conformément à l’article 210 de la Loi de 2001 sur les

municipalités;

3. de permettre et de prescrire au chef du contentieux :

(i) de rédiger le texte

d’un règlement municipal désignant le secteur décrit dans le document 1

ci-joint comme la « Zone d’amélioration commerciale de Glebe »;

(ii) de rédiger le texte

d’un règlement municipal créant le « Conseil d’administration de la Zone

d’amélioration commerciale de Glebe »; et

4. d’adopter les deux règlements municipaux susmentionnés en vertu de

l’article 204 de la Loi de 2001 sur les municipalités, sous réserve d’un

rapport favorable de la part du greffier de la Ville sur les réactions

suscitées par l’avis, mentionné dans la recommandation 2, de l’intention

d’adopter un règlement municipal désignant le secteur.

BACKGROUND

A Business Improvement Area (BIA) is an association

of property owners and businesses within a specified geographic area who join

together, with official approval of the City under Section 204 of the Ontario Municipal Act 2001, in a

self-help program aimed at stimulating local business. BIAs are funded by a special levy paid by

property owners and tenants within the designated area. This money is used in an ongoing effort to

draw more prospective customers to the BIA by improving the attractiveness of

the area and promoting it as a good place to shop, obtain services, visit and

do business.

Once a BIA is approved by City

Council, every business within its boundaries automatically becomes a member.

There are no exceptions, under the principle that all who benefit should be

required to bear their fair share of the cost of the program. While a BIA arises from the retail and

professional activities of a main street or commercial area, it has a profound

effect on the surrounding area. It serves as an economic and social anchor,

helping to stabilize, revitalize, and enhance the local community.

There are now more than 230 BIAs in

place across Ontario. They vary in size from less than 60 businesses and

property owners to more than 2000. The

BIA concept has also spread beyond the boundaries of Ontario. More than 1500

communities have adopted the concept across the United States and in most

provinces in Canada. The City of Ottawa

currently has 13 BIAs that represent over 3400 businesses.

The Economic Development Division

has been working with the Glebe Business Group to establish a Glebe BIA that

includes the high profile Queensway and Bank Street commercial corridors:

between Lyon street and Queen Elizabeth Driveway along Chamberlain avenue,

Isabella Street and Pretoria Avenue; and between the Queensway and Queen

Elizabeth Driveway along the Bank Street corridor, including properties on

intersecting streets and Lansdowne Park (Document 1). The committee is comprised of business operators and owners in

the described area. The members have

been actively promoting the area and exploring the idea of establishing a BIA

for over a year.

Economic Development staff have

participated in public meetings, providing details on the process of

establishing a BIA and on the support programs offered to BIAs by the City.

Councillor Clive Doucet, the local Councillor for the area, has been very

supportive of the initiatives of the Steering Committee and is a strong

advocate for the creation of a BIA.

The Glebe Business Group has

submitted a letter (Document 2) to the City Clerk's office confirming that they

have successfully undertaken the public consultation process recommended by the

City, and are formally requesting that City Council adopt a by-law to establish

a BIA. Pursuant to the Ontario Municipal Act, 2001, Section

210, the next step in the process is a requirement that Council authorize the

City Clerk to send out a notice of intention to designate the area as a BIA to

all property owners in the affected area (Document 3). The property owner then must within 30 days

after the notice is mailed give a copy of the notice to each tenant of the

property to which the notice relates who is required to pay all or part of the

taxes on the property.

For the purpose of defeating the

by-law, the municipality’s period for receiving sufficient objections is 60

days from the latest day of mailing of the notice by the municipality. Under

Section 210 of the Ontario Municipal Act,

2001 Council cannot pass a proposed BIA by-law if the municipality receives

written objections by at least one-third of the persons entitled to notice who

are responsible for at least one-third of the tax on property in the proposed

BIA.

As a result of recent Bill 130

amendments to the Municipal Act, 2001, BIAs are now "local boards" of

the municipality. As part of these amendments, the municipality may vary

traditional BIA provisions in the Municipal Act, 2001 to meet the requirements

of local BIAs. The municipality may also establish codes of conduct to ensure

accountability and transparency for its local boards. Staff will continue to

advise existing and new BIAs on future measures undertaken pursuant to these

amendments, including the application of accountability and transparency

policies to BIAs.

DISCUSSION

While well known to, and patronized by the Glebe and

Ottawa South communities, the Glebe business district has not maximized its

potential as a commercial destination within the greater Ottawa area through

collective marketing, promotions and special events. Unlike most main - street and commercial business districts in

Ottawa, the Glebe has not established a Business Improvement Area and Board of

Management. The Glebe business district

therefore does not have the ability to levy area business properties and

tenancies to support joint marketing or beautification initiatives or advocacy

efforts and related staff resources.

Nor has it been represented on civic matters by a formal organization

and dedicated staff.

Accordingly, the Glebe business

district has not been included in cross-promotional tools supported by City and

collective BIA funding, such as the Ottawa BIAs brochure, City website listings

and proposed e-commerce strategies.

And, it has not had formal, dedicated representation on such key issues

as the pending Bank Street reconstruction work and potential streetscape

enhancements.

In order to maximize the potential

of the Glebe business district, the Glebe Business Group (GBG) now wishes to

establish a BIA and Board of Management and a levy to retain supporting staff

and undertake collective advocacy, marketing and improvement initiatives. The proposed Glebe BIA Board of Management

will retain an Executive Director and identify priority business strategies and

establish related Board and working committees to address those

priorities. The BIA will work closely

with its members, the Glebe Community Association, the Capital Ward Councillor,

City of Ottawa staff and various organizations to address priority matters in a

proactive, strategic and collaborative fashion.

It is anticipated that the

priorities of the Glebe BIA will be as follows:

·

in the

short term: matters of advocacy, particularly related to the Bank Street

reconstruction, Lansdowne Park design competition, parking management, branding

and positioning of the BIA district, seasonal decorations, and inclusion of the

BIA within joint Ottawa BIA initiatives and tools, such as the Graffiti

taskforce and Ottawa BIAs brochure, web listings and promotions;

·

in the

mid term: district-specific marketing, special promotions and events,

collaboration/strategic alliances with other agencies, such as Lansdowne Park,

Ottawa Tourism, the Ottawa Business Advisory Committee and the Ottawa Chamber

of Commerce; and

·

in the

longer term, visitor/tourism oriented marketing and strategic initiatives, such

as the revitalization of Lansdowne Park.

The establishment of the Glebe BIA

and Board of Management will enable Glebe businesses to maximize their level of

representation respecting key issues and initiatives, develop core marketing

tools such as a website and website listings, leverage physical and service

improvements, elevate the profile of the business district and attract more

consumers/visitors and businesses.

CONSULTATION

The Glebe business district is relatively well

connected and a number of businesses (~60) have worked cooperatively together

through a volunteer association, the Glebe Business Group (GBG) and ad hoc

committees to address common issues and objectives, as required. There is a strong sense among GBG members

that a larger, formal BIA is now required to represent all area business and

property owners, alleviate volunteer fatigue and address such key challenges

and opportunities as the pending Bank Street reconstruction.

As a result, the GBG struck a

Steering Committee to assess options for enhanced business representation and

development. With funding support from

the Economic Development Division, it subsequently retained a consultant to

assess the option of forming a BIA. The

consultant undertook a series of stakeholder interviews to identify key issues

and gauge support for establishing a BIA, determined by-law requirements and

best practices for forming a BIA and undertook a comparative analysis of

existing Ottawa BIAs. A special flyer was prepared and directly distributed to

all GBG members, outlining challenges facing the street, the role of a BIA and

requesting their attendance at a special meeting February 7, 2007 for a

presentation and vote on pursuing formation of a BIA.

The consultant findings and

committee recommendations were presented at the February 7th meeting, along

with comments from a former Executive Director of the ByWard Market BIA and

input from City staff. At the

conclusion of the meeting, the members voted unanimously (35-0) in support of

the following motion: "that a BIA

is the best option to represent the interests of the Glebe, and to move forward

and begin the process of forming a Business Improvement Area in the

Glebe".

The Consultant then undertook

extensive site visits and research and developed a comprehensive database of

Glebe commercial properties and businesses; and proposed parameters for the

BIA, which were endorsed by the Steering Committee. From September to November

2007, a meeting was held with the Ward Councillor, an interview conducted with

the Glebe Report newspaper, a further presentation made to the GBG and a

newsletter and survey mailed to all property owners and distributed to and

discussed with area businesses by Steering Committee members. A final open

house meeting and presentation was held December 11, 2007 in the Glebe.

Direct consultations with and survey

responses from commercial property and business owners in the Glebe, as well as

discussion at the Glebe Business Group and open house meetings indicate that

there is a strong level of support within the Glebe business community for

establishing the Glebe BIA.

Approximately eighty potential members of the proposed Glebe BIA

(commercial property and business owners, some which own multiple properties or

businesses) have confirmed their support for establishing the BIA. The Glebe Community Association also

supports formation of the BIA.

At the October 10th Glebe Business

Group meeting and the December 11th open house meeting, the proposed framework

for the Glebe BIA was presented, including the proposed boundaries,

recommendations for an annual budget of $200,000.00 and action priorities for

the new Board of Management and staff.

Economic Development and Finance

staff have consulted regularly with representatives from the GBG and their

Consultant leading up to their formal request to the City to designate a

BIA. The Steering Committee and Staff

have also consulted with the Capital Ward Councillor who strongly supports the

designation.

FINANCIAL IMPLICATIONS

BIAs are funded by a special levy to commercial and

industrial property owners and their tenants within the designated area based

on the yearly budget requirement submitted by the BIAs Board of Management. The

Financial Services Unit will be responsible for providing resources to the BIA

and will be able to do so through existing resources and efficiencies.

Funds are available for mail-out

costs within the existing 2008 Economic Development Division budget

SUPPORTING DOCUMENTATION

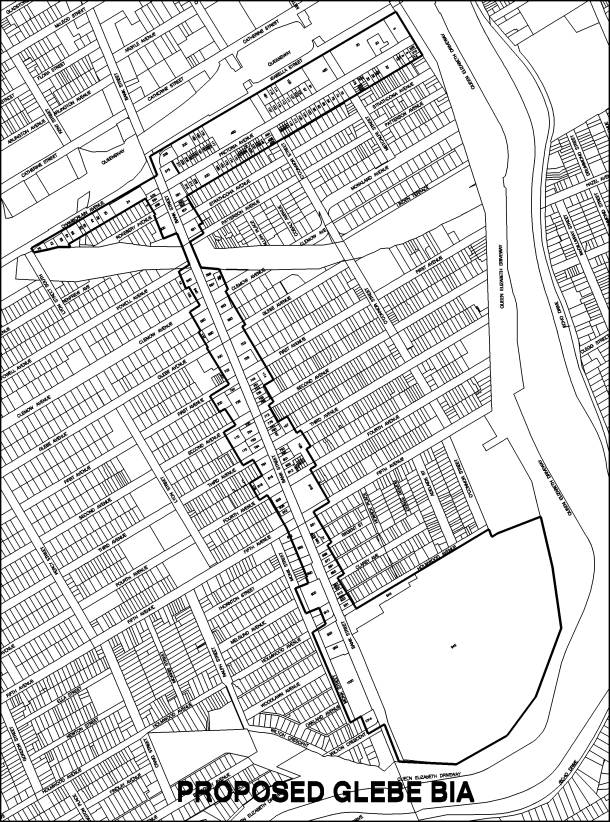

Document 1 Proposed

Glebe BIA boundaries

Document 2 Letter from Glebe Business Group to City Clerk

Document 3 Letter from City Clerk to Property Owners

DISPOSITION

City Clerk's Branch will forward notices to affected

property owners as provided for in the Ontario

Municipal Act, 2001.

Legal Services Branch will prepare a

by-law to designate the area as a Business Improvement Area, as described in

Document 1, in accordance with Sections 204 and 209 of the Ontario Municipal Act, 2001, and place the aforementioned by-law on

the Orders of the Day, subject to the responses to the aforementioned

notices. Economic Development staff

will report back on the results of the circulation, and whether the expansion

was successful.

DOCUMENT 1

PROPOSED GLEBE BIA

BOUNDARIES

DOCUMENT 2

LETTER FROM GLEBE

BUSINESS GROUP TO CITY CLERK

December 17, 2007

City Clerk's Branch

City Manager's Office

City Of Ottawa

110 Laurier Avenue West

Ottawa, Ontario K1P 1J1

Attention: Pierre

Pagé, City Clerk

Dear Mr. Pagé,

Re: Request to Form a Glebe BIA

Please accept this letter as a formal

request to designate a Business Improvement Area (BIA) and establish a BIA

Board of Management for the Glebe under section 204. (1) of the Municipal Act,

2001.

This formal request for a BIA is

the result of a year of preparations and consultations with hundreds of Glebe

commercial property and business interests through direct discussions, general

and focus meetings, written material (including newsletters, a comprehensive

survey and promotional poster) and interviews with the Glebe Report community

newspaper. The Councillor for Capital

Ward and the Glebe Community Association are also very supportive of a

establishing a Glebe BIA. The overall

conclusion from these consultations was to proceed formally with an application

to designate the BIA.

The framework for discussions

with potential Glebe BIA members included addressing the proposed BIA

boundaries, annual budget and priorities for action. The proposed boundaries capture the high profile Queensway and Bank

Street commercial corridors in the Glebe and their connection to the major

attractions and activities of the Rideau Canal and Lansdowne Park. The boundary extends west-east from Lyon

Street along Chamberlain Avenue, Isabella Street and Pretoria Avenue to Queen

Elizabeth Driveway/the Rideau Canal; and north-south from the Queensway along

Bank Street to the Bank Street Canal Bridge, including commercial properties

along side streets and Lansdowne Park.

The annual budget recommended for the Glebe BIA is $200,000.00. This is lower than the budgets of comparable established BIAs in Ottawa (such as Westboro and Preston Street BIAs) but was viewed as sufficient to address the initial staffing requirements and action priorities of a new Glebe BIA.

…2

The recommended action priorities for the Glebe BIA for the short term include: matters of advocacy, particularly related to the pending major reconstruction of Bank Street and the Lansdowne Park Design Competition; parking management; branding and positioning of the Glebe business district; seasonal decorations; and inclusion of the BIA within joint Ottawa BIA initiatives, such as the anti-graffiti program and Ottawa BIAs brochure, web listings and promotions.

Priorities for the longer term include: niche market development; special promotions and events; collaboration, such as with Lansdowne Park, Ottawa Tourism, the Ottawa Business Advisory Committee and Ottawa Chamber of Commerce; visitor/tourism oriented marketing; advancement of strategic initiatives such as the redevelopment of Lansdowne Park; and new business attraction.

The establishment of the Glebe

BIA and Board of Management will enable Glebe business interests to maximize

their level of representation respecting key issues and initiatives, develop

core marketing tools, leverage physical and service improvements, elevate the

profile of the business district and attract more consumers/visitors and

businesses to this distinct commercial district. A Glebe BIA will also help to maintain and improve on the quality

of life in the overall Glebe community.

On behalf of the Steering

Committee, I would request that you process this BIA application immediately

and keep the committee apprised at key points, as the application follows its

course to completion. Your assistance

with this important business development initiative is greatly appreciated.

Sincerely yours,

Greg Best

Greg Best

Chair, Glebe BIA Formation Steering Committee

Glebe Business Group

c.c. Clive Doucet, Councillor, Capital Ward

Darrell Cox, Economic Development Consultant

Liam McGahern, Chair, Glebe Business Group

Members, Glebe BIA Formation Steering Committee

Catherine Lindquist, Lindquist & Anderson

Robert Brocklebank, Glebe Community Association

DOCUMENT 3

LETTER FROM CITY

CLERK TO PROPERTY OWNERS

Dear Property Owner:

Re: NOTICE OF INTENTION

Intention to Designate

the Boundaries of the Glebe Business Improvement Area (BIA)

In accordance with Section 204 of the Ontario

Municipal Act, 2001 hereinafter referred to as “the Act”, the Glebe

Business Group has requested

the City of Ottawa designate the boundaries of the BIA as outlined in the map

attached as Attachment 1.

A BIA is a tool to develop and undertake promotional programs and/or streetscape beautification for the business area. These programs are financed through a special levy, which is applied to all commercial and industrial property owners in the area who usually pass the cost on to business tenants. For more information on the Glebe BIA request, please contact Greg Best, Chair, Glebe BIA Formation Steering Committee, Glebe Business Group TO BE CONFIRMED.

The request to designate the

boundaries of the B.I.A. under the provisions of the Act was subsequently

approved by City Council at its meeting held January 23, 2008. In

this regard, attached are Sections 209 and 210 of the Act (Attachment 2).

You will note Section 210 (2), outlines

obligations of landlords to provide copies within specific timeframes. This

notice is being sent by registered mail on January 25, 2008. Therefore please note that the dates

referred to in the Act will be: Section 210 (2) (a) February 24, 2008,

and Section 210 (3) (a) March 25, 2008.

Yours truly,

original signed by

P.G. Pagé

City Clerk

City of Ottawa

110 Laurier Avenue West

Ottawa, ON K1P 1J1

Attachment 1 - Proposed Glebe Business

Improvement Area boundary

Attachment 2 - Ontario

Municipal Act, 2001

Changes to boundary

209. The

municipality may alter the boundaries of an improvement area and the board of

management for that improvement area is continued as the board of management

for the altered area. 2001, c. 25, s. 209.

Notice

210. (1) Before

passing a by-law under subsection 204 (1), clause 208 (2) (b), subsection 208

(3) or section 209, notice of the proposed by-law shall be sent by prepaid mail

to the board of management of the improvement area, if any, and to every person

who, on the last returned assessment roll, is assessed for rateable property

that is in a prescribed business property class which is located,

(a) Where the improvement area already exists,

in the improvement area and in any geographic area the proposed by-law would

add to the improvement area; and

(b) Where a new improvement area would be

created by the proposed by-law, in the proposed improvement area. 2001,

c. 25, s. 210 (1).

When notice received

(2) A person who receives a notice under

subsection (1) shall, within 30 days after the notice is mailed,

(a) Give a copy of the notice to each tenant of

the property to which the notice relates who is required to pay all or part of

the taxes on the property; and

(b) Give the clerk of the municipality a list

of every tenant described in clause (a) and the share of the taxes that each

tenant is required to pay and the share that the person is required to pay.

2001, c. 25, s. 210 (2).

Objections

(3) A municipality shall not pass a by-law

referred to in subsection (1) if,

(a) Written objections are received by the

clerk of the municipality within 60 days after the last day of mailing of the

notices;

(b) The objections have been signed by at least

one-third of the total number of persons entitled to notice under subsection

(1) and under clause (2) (a); and

(c) The objectors are responsible for,

(i) In the case of a proposed addition to an

existing improvement area,

(A) At least one-third of the taxes levied for

purposes of the general local municipality levy on rateable property in all

prescribed business property classes in the improvement area, or

(B) At least one-third of the taxes levied for

purposes of the general local municipality levy on rateable property in all

prescribed business property classes in the geographic area the proposed by-law

would add to the existing improvement area, or

(ii) in all other cases, at least one-third of

the taxes levied for purposes of the general local municipality levy on

rateable property in all prescribed business property classes in the

improvement area. 2001, c. 25, s. 210 (3).

Withdrawal of objections

(4) If sufficient objections are withdrawn

in writing within the 60-day period referred to in clause (3) (a) so that the

conditions set out in clause (3) (b) or (c) no longer apply, the municipality

may pass the by-law. 2001, c. 25, s. 210 (4).

Determination by clerk

(5) The clerk shall determine whether the

conditions set out in subsection (3) have been met and, if they are, shall

issue a certificate affirming that fact. 2001, c. 25,

s. 210 (5).

Determination final